As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the it services & other tech industry, including Amdocs (NASDAQ: DOX) and its peers.

The IT and tech services subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products like switches and firewalls as well as implementation services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

The 20 it services & other tech stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

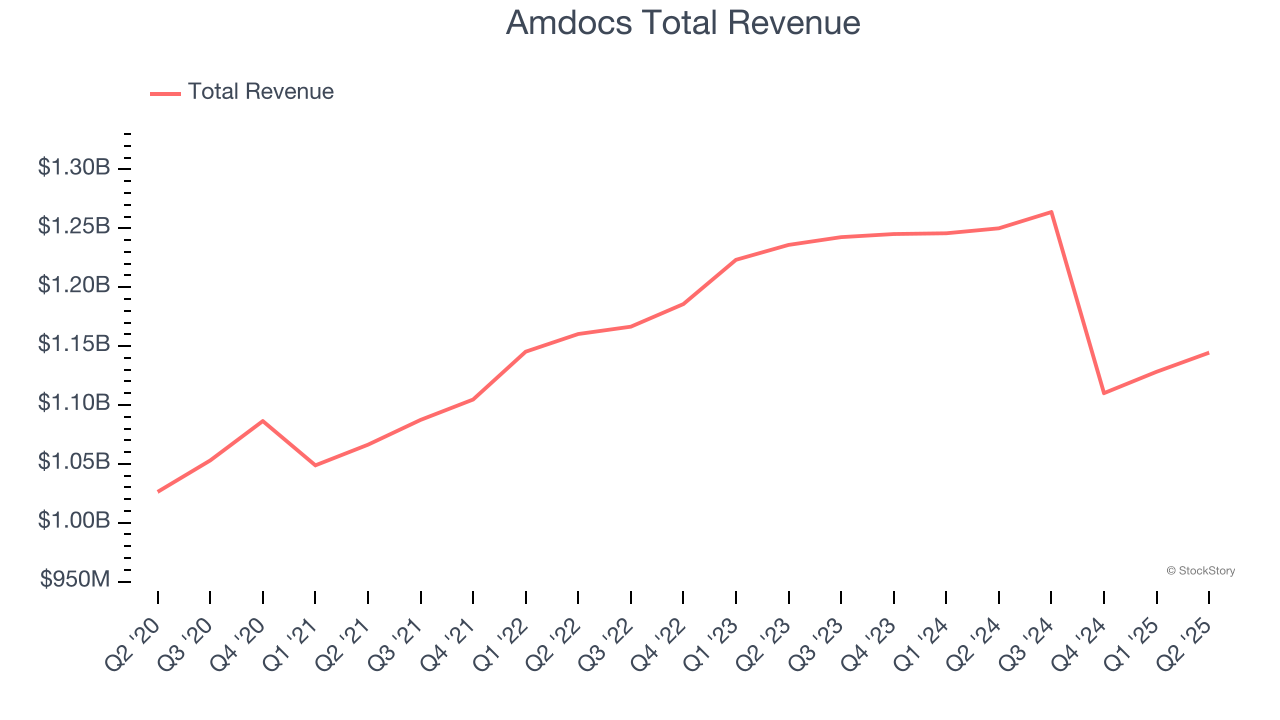

Amdocs (NASDAQ: DOX)

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ: DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Amdocs reported revenues of $1.14 billion, down 8.4% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ full-year EPS guidance estimates but backlog in line with analysts’ estimates.

"Amdocs achieved solid financial results and important business milestones in Q3 as we continued to support the strategic business imperatives of our customers with our innovative cloud, digital and AI-based solutions." said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Unsurprisingly, the stock is down 3.9% since reporting and currently trades at $81.28.

Is now the time to buy Amdocs? Access our full analysis of the earnings results here, it’s free.

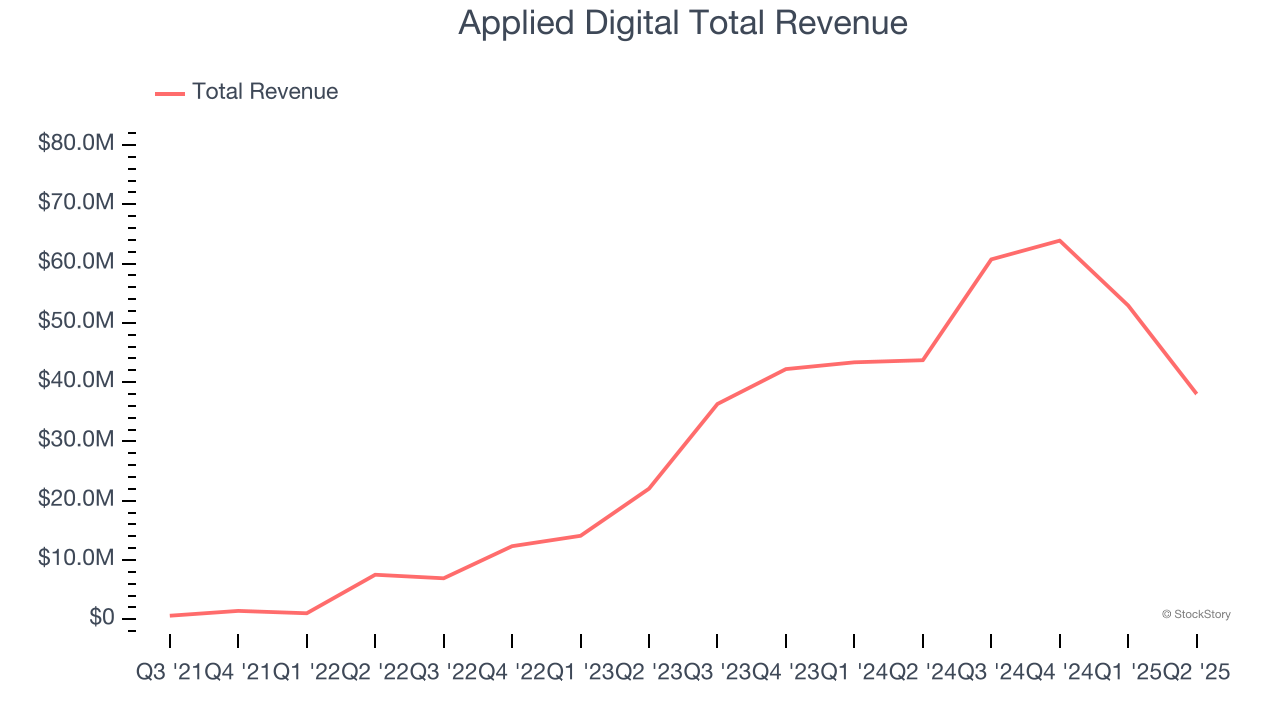

Best Q2: Applied Digital (NASDAQ: APLD)

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ: APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Applied Digital reported revenues of $38.01 million, down 13% year on year, in line with analysts’ expectations. The business had a very strong quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 117% since reporting. It currently trades at $21.78.

Is now the time to buy Applied Digital? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Xerox (NASDAQ: XRX)

Pioneering the modern office copier and inventing technologies like Ethernet and the laser printer, Xerox (NASDAQ: XRX) provides document management systems, printing technology, and workplace solutions to businesses of all sizes across the globe.

Xerox reported revenues of $1.58 billion, flat year on year, exceeding analysts’ expectations by 1.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 28.9% since the results and currently trades at $3.71.

Read our full analysis of Xerox’s results here.

Cisco (NASDAQ: CSCO)

Founded in 1984 by a husband and wife team who wanted computers at Stanford to talk to computers at UC Berkeley, Cisco (NASDAQ: CSCO) designs and sells networking equipment, security solutions, and collaboration tools that help businesses connect their systems and secure their digital operations.

Cisco reported revenues of $14.67 billion, up 7.6% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a narrow beat of analysts’ EPS guidance for next quarter estimates but billings in line with analysts’ estimates.

The stock is down 4.4% since reporting and currently trades at $67.22.

Read our full, actionable report on Cisco here, it’s free.

Super Micro (NASDAQ: SMCI)

Founded in Silicon Valley in 1993 and known for its modular "building block" approach to server design, Super Micro Computer (NASDAQ: SMCI) designs and manufactures high-performance, energy-efficient server and storage systems for data centers, cloud computing, AI, and edge computing applications.

Super Micro reported revenues of $5.76 billion, up 7.5% year on year. This number lagged analysts' expectations by 4.2%. Overall, it was a slower quarter as it also logged a significant miss of analysts’ operating income estimates.

Super Micro delivered the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is down 20.4% since reporting and currently trades at $45.59.

Read our full, actionable report on Super Micro here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.