Nearly 500 Practices Cite Escalating Financial Strain, Limited Vendor Support, and Intensifying Consolidation Threats as 2025 Healthcare Landscape Shifts

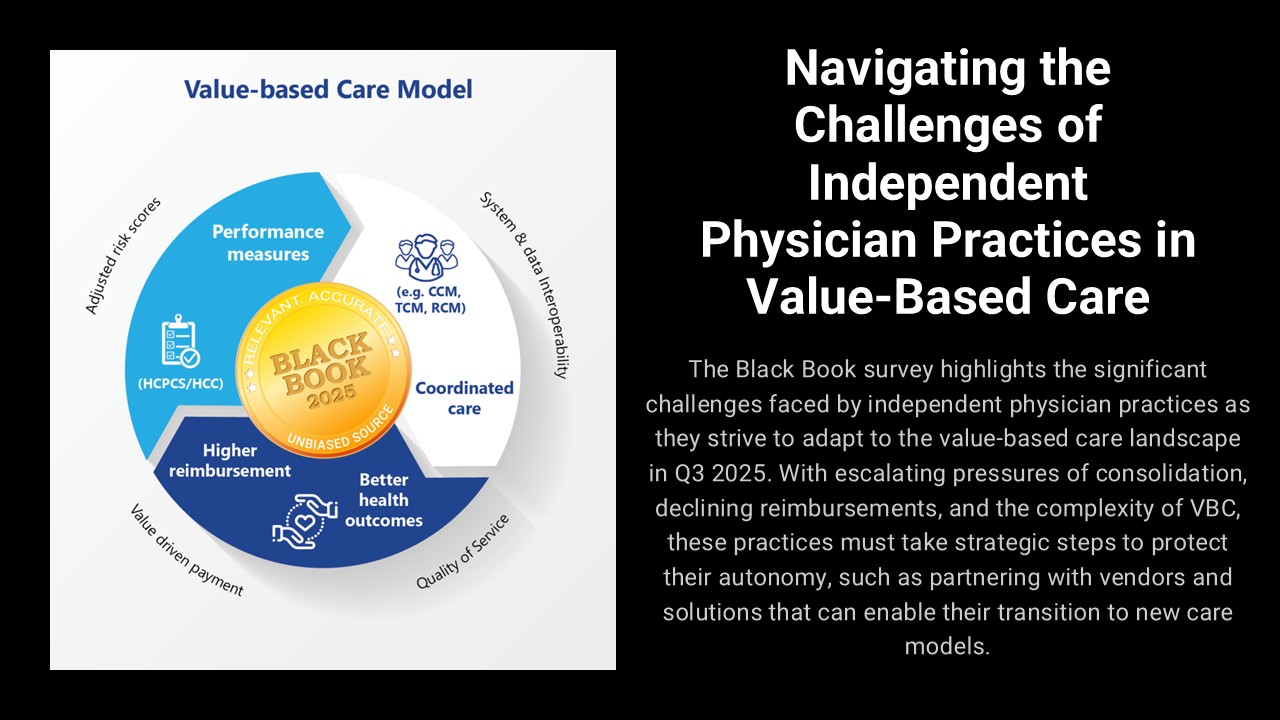

TAMPA, FL / ACCESS Newswire / July 10, 2025 / As the U.S. healthcare system accelerates toward value-based care (VBC) models and consolidation surges in 2025, independent physician practices are fighting for survival. New data from a Q2 Black Book Research poll of 496 practices reveals that 70% do not expect to maintain autonomy beyond the next 18 months without major changes to their operational strategies, partnerships, or financial management.

The study, conducted from March to June 2025, details mounting economic pressures as hospitals, health systems, and private equity-backed entities ramp up acquisition and affiliation activity, and payers expand VBC contracts and reporting requirements. Declining reimbursements, growing administrative complexity, and rapid regulatory changes are pushing many practices to the brink.

Strategic Moves: What Independent Practices Are Trying

Amid these headwinds, physician groups are taking concrete steps to remain viable:

28% have signed new VBC contracts with payers or CMS as of July 1, 2025.

24% have outsourced key administrative and revenue cycle functions to control costs.

16% have joined IPAs, MSOs, or ACOs but retained their independent governance.

5% have directly invested in population health or analytics platforms.

Despite these efforts, 70% of survey respondents worry that such moves will not be enough to preserve independence.

Biggest Threats to Independence in 2025

Asked to identify their greatest challenge, independent practices reported:

71%: Declining reimbursements and unsustainable finances

13%: Regulatory and administrative overload

3%: Technology infrastructure concerns

While technology is not the top-cited barrier, most groups report that current tech solutions are not fully addressing the needs for success in VBC environments.

Vendors Enabling Independent Practice Survival

When naming partners that have made a real difference in supporting their independence and VBC transition, the following vendors were cited most often receiving the highest client satisfaction scores based on the Indpendent Physician Practices IT KPIs below:

Aledade: Provides physician-led ACO and VBC networks, helping independent practices access contracts, actionable data, and in-person support to maximize shared savings.

Privia Health: Delivers technology-enabled physician practice management and population health support, empowering groups to improve performance in VBC models while staying independent.

agilon health: Partners with primary care groups to transition them into risk-based contracting, offering turnkey solutions for VBC success and financial sustainability.

CareAllies: Supports independent practices with practice transformation services, VBC enablement, and care coordination across multiple payers and contracts.

Tebra (Kareo + PatientPop): Equips practices with unified practice management, EHR, billing, and patient engagement solutions tailored to VBC and growth needs.

Elation Health: Offers cloud-based clinical EHR and collaboration tools, making it easier for independent practices to participate in quality programs and deliver coordinated care.

Vytalize Health: Helps practices succeed in Medicare value-based arrangements with technology, care coordination, and financial risk management.

UpStream Healthcare: Provides wraparound clinical, technology, and financial support for primary care groups to thrive in risk-based and VBC arrangements.

Black Book's Six KPIs: Why They Matter in VBC Enablement

Vendors were rated by survey respondents on six key performance indicators, each chosen for their real-world importance to independent practices transitioning to VBC:

Ease of VBC Program Implementation: Reflects how smoothly practices can launch and operate new VBC contracts; critical as cumbersome implementations can disrupt care and finances.

Clinical and Financial Workflow Integration: Assesses how well technology and services align with both care delivery and back-office needs, ensuring efficient operations in a VBC model.

Support for Risk-Based Contracting and Payer Strategy: Measures a vendor's ability to help practices understand, negotiate, and succeed in complex, incentive-driven payment arrangements.

Population Health and Analytics Enablement: Captures a partner's capacity to help practices track, report, and manage outcomes and quality metrics across diverse patient panels.

Practice Autonomy Preservation: Evaluates how effectively a vendor supports operational independence and self-governance, rather than encouraging outright acquisition or control.

Return on Investment and Shared Savings Performance: Quantifies the financial value, showing whether vendor solutions actually improve bottom-line performance in VBC environments.

About Black Book Research

Black Book™ conducts independent, unbiased surveys of healthcare technology users and stakeholders to identify high-performing vendors and services. Since 2010, Black Book has polled over 3.3 million healthcare professionals, providing vendor-agnostic insights into IT and operational performance across hospitals, health plans, and physician organizations. For media inquiries, data licensing, or detailed vendor scorecards, contact research@blackbookmarketresearch.com. Download complimentary industry research at www.blackbookmarketresearch.com.

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

View the original press release on ACCESS Newswire