With a market cap of around $36 billion, Martin Marietta Materials, Inc. (MLM) is a leading natural resource–based building materials company supplying aggregates, cement, concrete, asphalt, and paving services to construction markets across the U.S. and internationally. It also produces magnesia-based chemical products and dolomitic lime used in industries such as steel manufacturing, agriculture, and environmental applications.

Shares of the Raleigh, North Carolina-based company have underperformed the broader market over the past 52 weeks. MLM stock has risen over 2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 10.5%. However, shares of the company have increased 15.6% on a YTD basis, outpacing SPX's 11.2% return.

Looking closer, shares of the seller of granite, limestone, sand and gravel have exceeded the Materials Select Sector SPDR Fund's (XLB) 8.6% dip over the past 52 weeks.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $5.97 and revenue of $1.85 billion, shares of MLM rose nearly 1% on Nov. 4. Martin Marietta raised its full-year adjusted EBITDA forecast to a midpoint of $2.32 billion and reported an 8% increase in aggregates shipments, signaling resilient demand and pricing strength supported by infrastructure spending and data-center-driven construction activity.

For the fiscal year ending in December 2025, analysts expect Martin Marietta's adjusted EPS to dip 44.1% year-over-year at $18.11. The company's earnings surprise history is mixed. It has exceeded the consensus estimates in two of the last four quarters while missing on two other occasions.

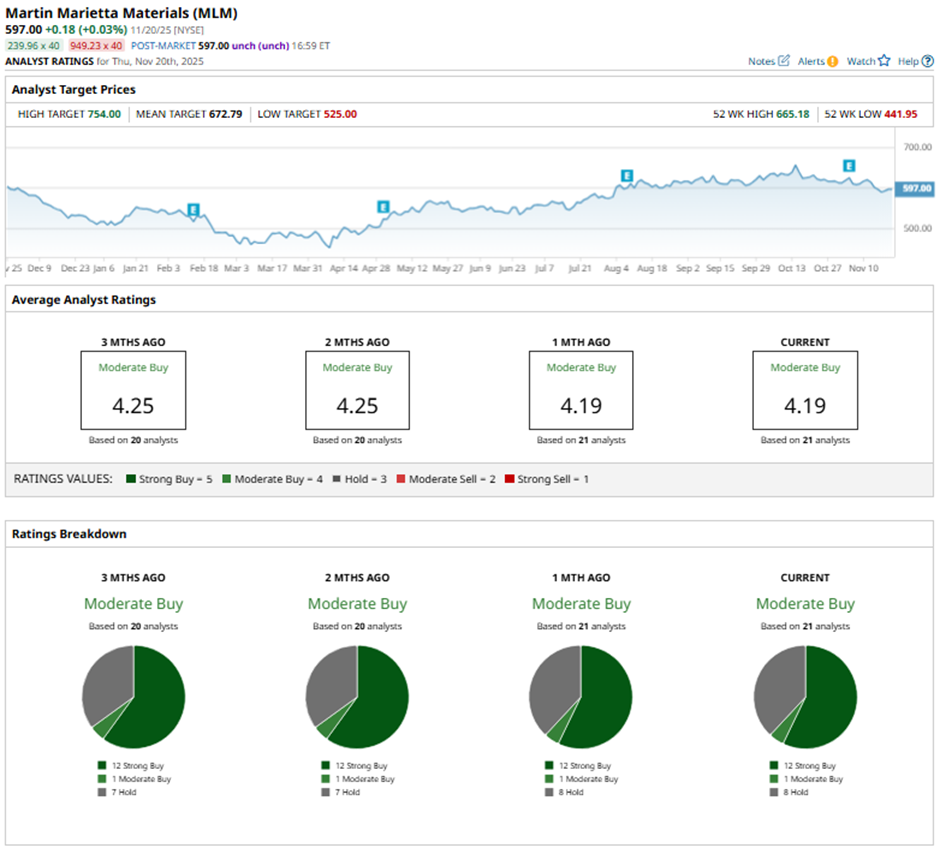

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.”

On Nov. 11, Stifel analyst Brian Brophy raised the price target on Martin Marietta to $681 and maintained a “Buy" rating.

The mean price target of $672.79 represents a 12.7% premium to MLM’s current price levels. The Street-high price target of $754 suggests a 26.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart