After several challenging quarters, Starbucks (SBUX) may finally be showing early signs of revival. In its fourth-quarter fiscal 2025 earnings call, management outlined meaningful progress under the company’s “Back to Starbucks” strategy, its turnaround plan. While results remain mixed in Q4, the company’s momentum in recent months suggests that its comeback story could gain traction heading into 2026.

SBUX stock is down 11% year-to-date (YTD). Is this dip an opportunity to buy Starbucks on the dip?

Return to Growth After Seven Tough Quarters

Starbucks reported a 5% increase in global revenue in the fourth quarter to $9.6 billion, driven by 2% net new company-operated store growth and 1% global comparable store sales growth. The performance marked the company’s first quarter of positive global comps in seven quarters, an encouraging sign for investors who have been waiting for solid signs of a recovery.

North America, which accounts for the majority of Starbucks' revenue, showed a noticeable improvement with flat year-over-year (YoY) comps, as compared to the previous quarter's declines. September was a bright spot, delivering nearly 1% transaction-led comp growth, supported by the rollout of the new Green Apron Service standard across all U.S. stores. It maintained this trend into October, indicating early signs of a rebound.

The international segment was the clear bright spot. In the fourth quarter, revenue rose 9% YoY, hitting a record $2.1 billion, while full-year international sales reached an all-time high of $7.8 billion. Starbucks opened 316 net new international coffeehouses in the quarter and over 900 in fiscal 2025, including high-profile flagship stores in Madrid.

China is Starbucks' second-largest market. It maintained its slow comeback, with 2% comparable sales growth and a 9% increase in transactions. The company's China portfolio surpassed 8,000 stores, and management expressed renewed optimism in the region's long-term growth prospects. Starbucks is looking for strategic alliances in the region, hoping to keep a significant interest while attracting fresh investment funds and sustaining royalty income. Markets in Japan, the U.K., and Mexico also showed renewed strength.

Despite signs of top-line rebound, profitability revealed a different picture. Inflation, rising coffee prices, tariffs, and turnaround-related labor investments all weighed on the operating margin, which fell to 9.4%. Adjusted profits per share (EPS) were $0.52, down 35% YoY, highlighting continuous investments in operational and strategic measures to return the coffee giant to “sustainable, long-term growth.” CEO Brian R. Niccol emphasized, “We expect to grow the top line first, and then earnings will follow.”

The coffee giant took some tough but necessary restructuring moves in the quarter. Starbucks closed 107 stores globally, primarily those that failed to meet profitability or customer experience standards even after potential renovations. While these closures will marginally affect North America's businesses' revenue, management expects them to boost margins and contribute to a better long-term footprint.

Building Momentum Through 2026

Management acknowledged that turnarounds are “difficult to forecast” and not always linear. However, Starbucks is preparing for what it hopes will be a defining year in fiscal 2026. The company has great expectations for the upcoming holiday season, which will feature updated store operations, refreshed marketing, and fan-favorite menu items.

As a gesture of confidence for income, Starbucks also raised its quarterly dividend, marking its 15th consecutive annual increase. Starbucks offers an attractive dividend yield of 2.9%, higher than the consumer discretionary average of 1.89%.

Starbucks faces tough competition on multiple fronts. It has to accelerate its “Back to Starbucks” initiatives (service upgrades, store remodels, and menu innovation) to restore its premium positioning without diluting the brand.

In fiscal 2025, consolidated net revenues increased 3% to $37.2 billion, while adjusted EPS plummeted 36% to $2.13. However, analysts expect SBUX stock to turn in a profit of $2.47 in fiscal 2026, followed by a 3.5% increase in revenue. Revenue and earnings could further increase by 7.1% and 24.9% in fiscal 2027.

What Does Wall Street Say About SBUX Stock?

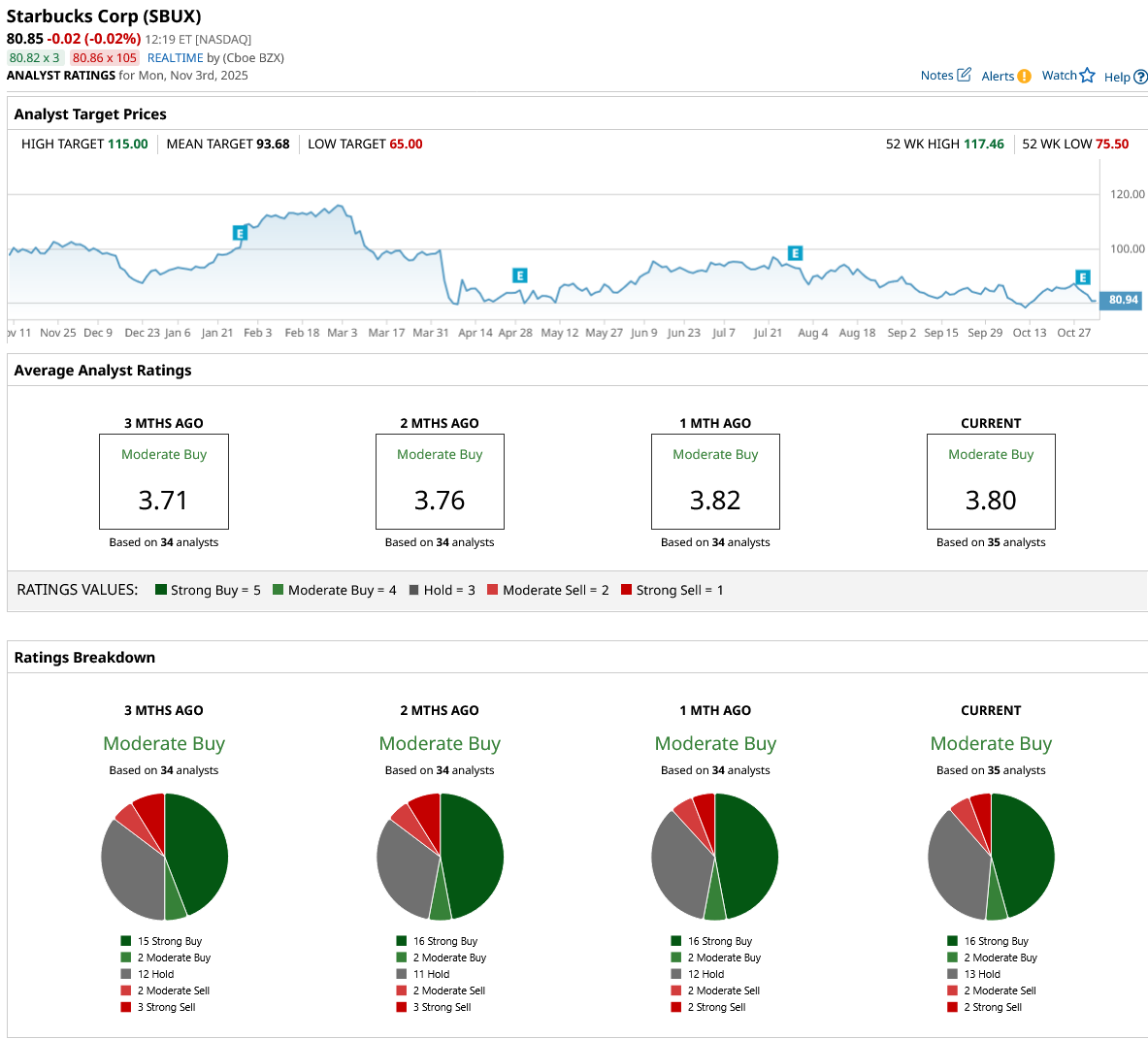

Overall, on Wall Street, SBUX stock is a “Moderate Buy.” Of the 35 analysts covering the stock, 16 rate it a “Strong Buy,” two rate it a “Moderate Buy,” 13 rate it a “Hold,” two say it is a “Moderate Sell,” and two rate it a “Strong Sell.” Based on its average target price of $93.68, SBUX stock has an upside potential of 16% from current levels. However, its high price target of $115 implies the stock can climb 42% over the next 12 months.

The early signs of improvement in Q4 show the coffee giant’s strategy is in place. Now, consistency will determine whether these signs can translate into sustained growth and margin expansion. Investors who trust Starbucks could turn around its story might find this dip an opportunity to grab this consumer stock.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $9.7 Billion Reason to Buy IREN Stock Right Now

- This Analyst Is Warning that a Popular AI Data Center Stock Could Plunge More Than 30% from Here

- Rare Earth Mining Stocks Are Taking Over Wall Street. Here’s 1 ETF to Buy to Profit.

- Athletic Apparel Icon Nike (NKE) Offers an Informational Arbitrage Opportunity