Alphabet (GOOG) (GOOGL) stock has been on fire this year, and even Cathie Wood’s ARK Invest is piling in. Shares recently hit new all-time highs, driven by a wave of AI excitement, from Google’s highly praised Gemini 3 model to reports that Meta may rent Google’s AI chips.

The stock is flirting with a $4 trillion market cap, up roughly 70% year-to-date (YTD). In late November, ARK picked up another chunk of GOOG shares just as the rally accelerated. Recent filings show she bought 174,293 shares worth around $56 million.

Investors are understandably asking, is this a classic case of buying momentum, or is Google worth these lofty prices? Let's try to find out.

What’s Cooking at the Rally

Alphabet has been grabbing a lot of Wall Street attention lately. Google just launched Gemini 3, an advanced AI model that met with rave reviews. Salesforce’s (CRM) Marc Benioff called Gemini 3 a “leap” beyond ChatGPT, saying he’s “not going back” after trying it. Even competitors’ CEOs (OpenAI’s Sam Altman and Nvidia’s (NVDA) Jensen Huang) praised Google’s breakthrough. This buzz convinced many that Google’s AI stack can compete with the best.

At the same time, a report surfaced that Meta is in talks to spend billions on Google’s AI chips for its data centers. So investors think it’s starting to look like Google is stepping into Nvidia’s territory in a big way. Alphabet has agreed to supply its own AI chips, called TPUs, to Meta for use in data centers starting in 2027, with discussions also underway about renting chips through Google Cloud as early as next year.

These chips are built specifically for AI tasks like training and running large models and are designed to work smoothly with tools such as PyTorch and TensorFlow. They may not be as flexible as Nvidia’s chips, but they are cheaper, faster to produce, and ideal for large-scale workloads.

For Meta, the deal lowers costs and reduces dependence on Nvidia. Google creates a new business line and poses a serious challenge to the AI chip giant.

Alphabet Smashes Q3 Earnings Estimate

Alphabet handed investors a blockbuster quarter on Oct. 29, turning in its first-ever $100 billion quarter and plenty of upside to the story.

The company pulled in $102.36 billion in revenue, up about 16% year-over-year and ahead of what analysts had expected. Its core Google Services group, search, Android, YouTube, and related ads, brought in $87.05 billion, rising roughly 14%. Plus, YouTube ad sales jumped to $10.26 billion, an increase of about 15% from a year earlier. Google Cloud was the real standout, climbing 34% to $15.16 billion as the enterprise

Profitability showed enough growth, too. Net income hit $34.98 billion, up about 33%, and diluted EPS came in at $2.85, a jump of roughly 30% that beat street estimates comfortably.

The balance sheet is looking strong as well. Free cash flow for the quarter was $24.5 billion, and Alphabet finished the period with about $98.5 billion in cash and marketable securities.

Management highlighted the scale of its AI rollout. CEO Sundar Pichai said the company’s “full stack” AI push is gaining traction; its Gemini model now processes about seven billion tokens per minute via API and serves roughly 650 million monthly users.

Alphabet told investors it would lift 2025 capital spending to $91 billion to $93 billion to keep up with cloud demand. The company also paid a small quarterly dividend of $0.21 a share, while analysts pencil in full-year 2025 revenue and EPS in line with the strong quarter’s momentum.

What Analysts Are Saying About GOOGL Stock?

Wall Street has been pounding the table on GOOGL stock lately. Goldman Sachs recently boosted its price target to $330 after Q3 results, citing 34% cloud growth and strong search and YouTube performance. Goldman noted Alphabet’s management was very bullish on AI, and they raised their 2026 CapEx forecast in line with Google’s guidance.

Similarly, J.P. Morgan analyst Doug Anmuth lifted his target to $300, reasoning that a favorable antitrust ruling (the DOJ search case) removed an overhang and that Google’s AI investments could drive continued growth. He’s optimistic about double-digit search growth and accelerating YouTube ads and calls Google’s AI positioning (including deals with Meta (META) and OpenAI) a key catalyst. KeyBanc similarly set a $300 target, noting “faster product velocity” in Search, Cloud, and Waymo.

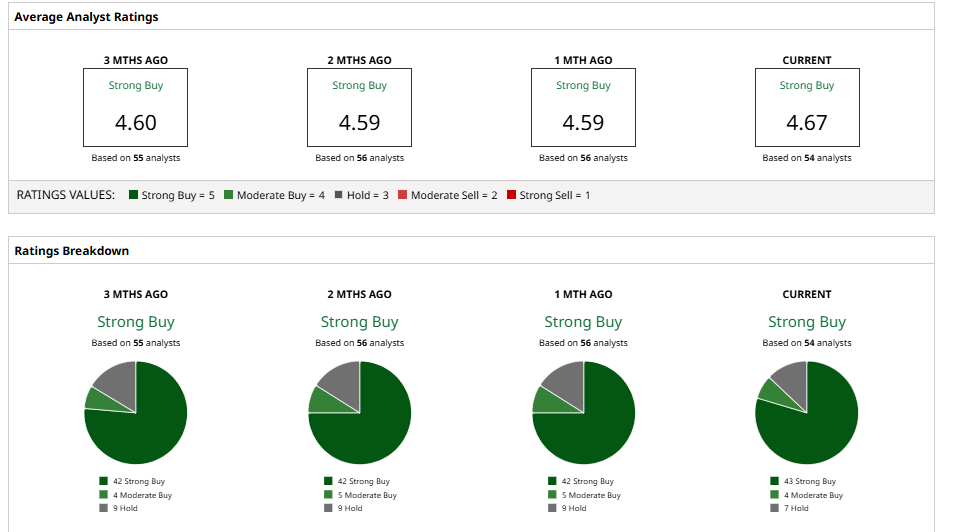

On average, analysts are pretty bullish. The consensus among 54 analysts is “Strong Buy,” with a mean price target of $323.35. That implies around a modest 2.5% upside from the current price.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Heavy Volume in Home Depot Call Options - Investors are Bullish on HD Stock

- Which AI ETF Should You Buy? Perhaps None of Them.

- Cathie Wood Is Buying Up Google Stock at Record Highs. Should You?

- MicroStrategy Is Turning to a U.S. Dollar Reserve Amid Bitcoin Volatility. Should You Buy, Sell, or Hold MSTR Stock Here?