For investors more inclined to take risks, there are intriguing opportunities in the aerospace and defense sector, particularly in stocks trading under $5. Penny stocks, known for their heightened risk and volatility, can also present substantial rewards if they perform well.

Given the significance of the aerospace and defense industry, it's worth considering a list of five aerospace and defense stocks under $5 for a potential investment or to conduct thorough due diligence.

The sector is currently of heightened relevance due to the ongoing conflicts and rising tensions, such as those in Israel and Gaza. These events underscore the importance of defense capabilities and the need for advanced aerospace technology, making investments in this sector particularly pertinent, given the increased global focus on security and preparedness.

Byrna Technologies (NASDAQ: BYRN)

Byrna Technologies is a non-lethal defense tech company offering various non-lethal solutions for law enforcement and personal security. Their products include handheld security devices, projectiles, and related accessories, available to consumers through e-commerce and retail stores. They also serve the professional security market with training programs.

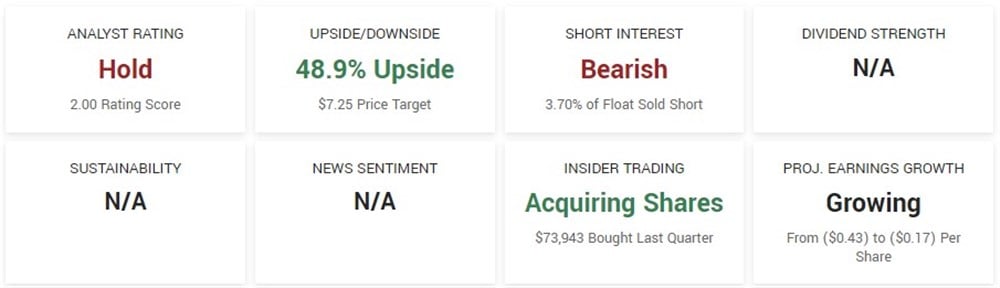

Shares of BYRN have steadily fallen lower this year, down almost 38% year-to-date (YTD). However, in the previous month, the stock staged an impressive reversal, surging close to 86% on increased volume. The stock has a consensus rating of Hold and a price target of $7.25, which sees almost 50% upside, based on two analyst ratings.

ParaZero Technologies (NASDAQ: PRZO)

ParaZero Technologies is an aerospace company specializing in autonomous parachute safety systems for commercial drones. They design, manufacture, and distribute their products worldwide, including the United States, Israel, Canada, Europe, and other regions.

The company priced its IPO of 1.95 million shares at $4 per share in July. After experiencing a brief surge higher in October, fueled by a rise in volume after the company announced an Australian regulator approved the first commercial drone flights in populated areas using its Parazero safety systems, the stock has settled back near the low end of its 52-week range.

Redwire (NYSE: RDW)

Redwire is a space infrastructure company operating globally. They provide essential space solutions and components for solar power, in-space manufacturing, avionics, sensors, and more. Their product range includes antennas, data modules, and robotics software. They also offer space domain awareness, digital spacecraft technology, and support for low-earth orbit commercialization.

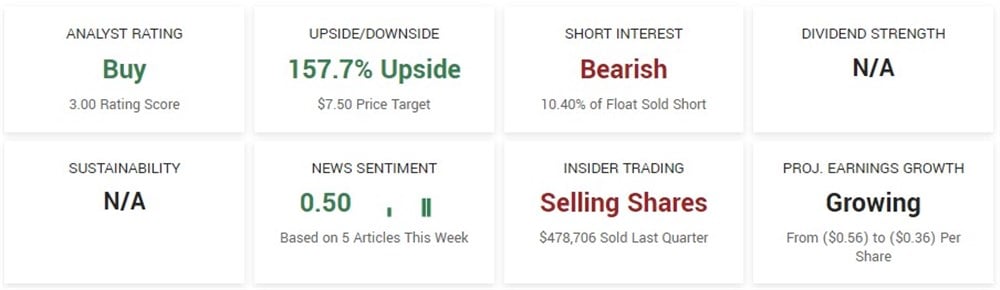

Three analysts cover the stock, and RDW has a consensus Buy rating. The consensus analyst price target for RDW is $7.50. Impressively, that price target predicts over 157% upside.

Terran Orbital (NYSE: LLAP)

Terran Orbital, headquartered in Boca Raton, Florida, manufactures satellites for the U.S. aerospace and defense industry. They provide comprehensive satellite solutions and operate a constellation of earth observation satellites with synthetic aperture radar capabilities.

LLAP, which has a $163 million market cap, is covered by five analysts and has a consensus rating of Moderate Buy. Incredibly, the small-cap aerospace and defense stock has a consensus price target that predicts over 600% upside at $7.34.

CPI Aerostructures (NYSE: CVU)

CPI Aerostructures specializes in manufacturing structural aircraft parts for fixed-wing aircraft and helicopters, serving commercial and defense markets. They offer aerosystems, and parts for maintenance and act as subcontractors for defense and commercial contractors, including the U.S. Department of Defense.

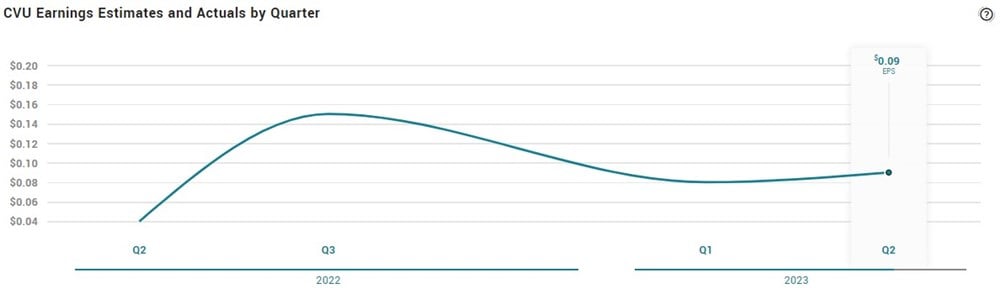

The company last reported its quarterly earnings on August 21, 2023, with earnings per share (EPS) of $0.09 and revenue of $20.55 million for the quarter. The company has a trailing twelve-month EPS of $0.87 and a P/E of 3.4. The company is expected to next report earnings on Monday, November 20, 2023.