Beauty and waxing service franchise European Wax Center (NASDAQ: EWCZ) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 2.2% year on year to $54.19 million. The company expects the full year’s revenue to be around $207 million, close to analysts’ estimates. Its GAAP profit of $0.09 per share was significantly above analysts’ consensus estimates.

Is now the time to buy European Wax Center? Find out by accessing our full research report, it’s free for active Edge members.

European Wax Center (EWCZ) Q3 CY2025 Highlights:

- Revenue: $54.19 million vs analyst estimates of $52.75 million (2.2% year-on-year decline, 2.7% beat)

- EPS (GAAP): $0.09 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $20.17 million vs analyst estimates of $15.66 million (37.2% margin, 28.8% beat)

- The company reconfirmed its revenue guidance for the full year of $207 million at the midpoint

- EBITDA guidance for the full year is $70 million at the midpoint, below analyst estimates of $71.06 million

- Operating Margin: 25.6%, up from 17.1% in the same quarter last year

- Free Cash Flow Margin: 30.4%, up from 26.6% in the same quarter last year

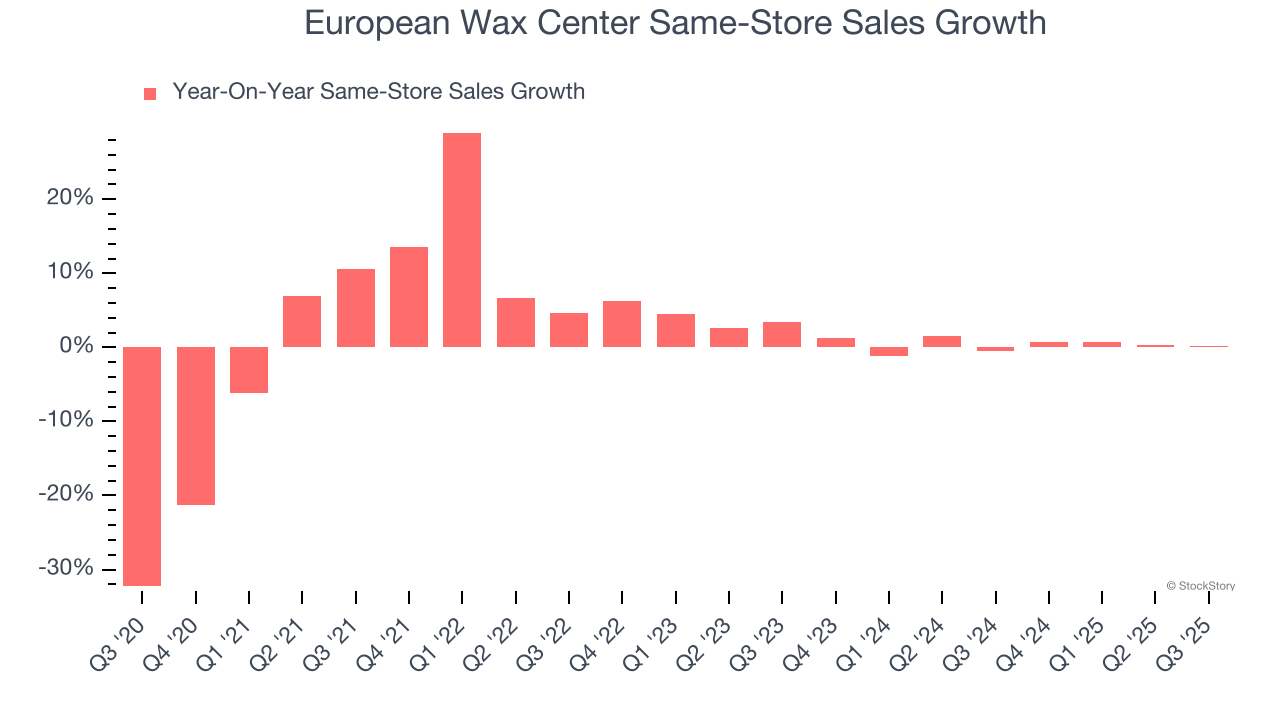

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $158.3 million

Chris Morris, Chairman and CEO of European Wax Center, Inc., stated: “European Wax Center delivered a solid third quarter performance as we continued to strengthen the fundamentals that power our business model. Our new leadership team is executing with discipline and remains focused on our three strategic priorities: driving sales through traffic growth, improving four-wall profitability for our franchisees, and pursuing disciplined, profitable expansion.”

Company Overview

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

Revenue Growth

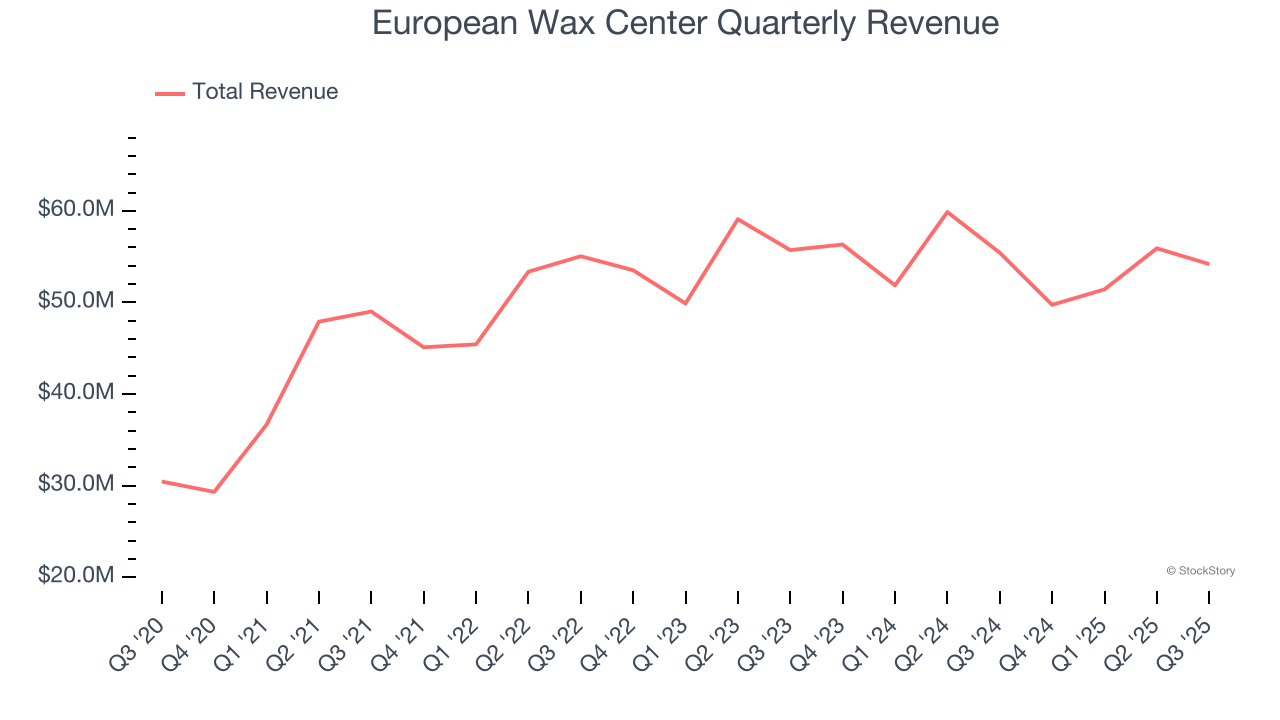

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, European Wax Center grew its sales at a 14.5% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. European Wax Center’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.6% annually. Note that COVID hurt European Wax Center’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center’s same-store sales were flat. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, European Wax Center’s revenue fell by 2.2% year on year to $54.19 million but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

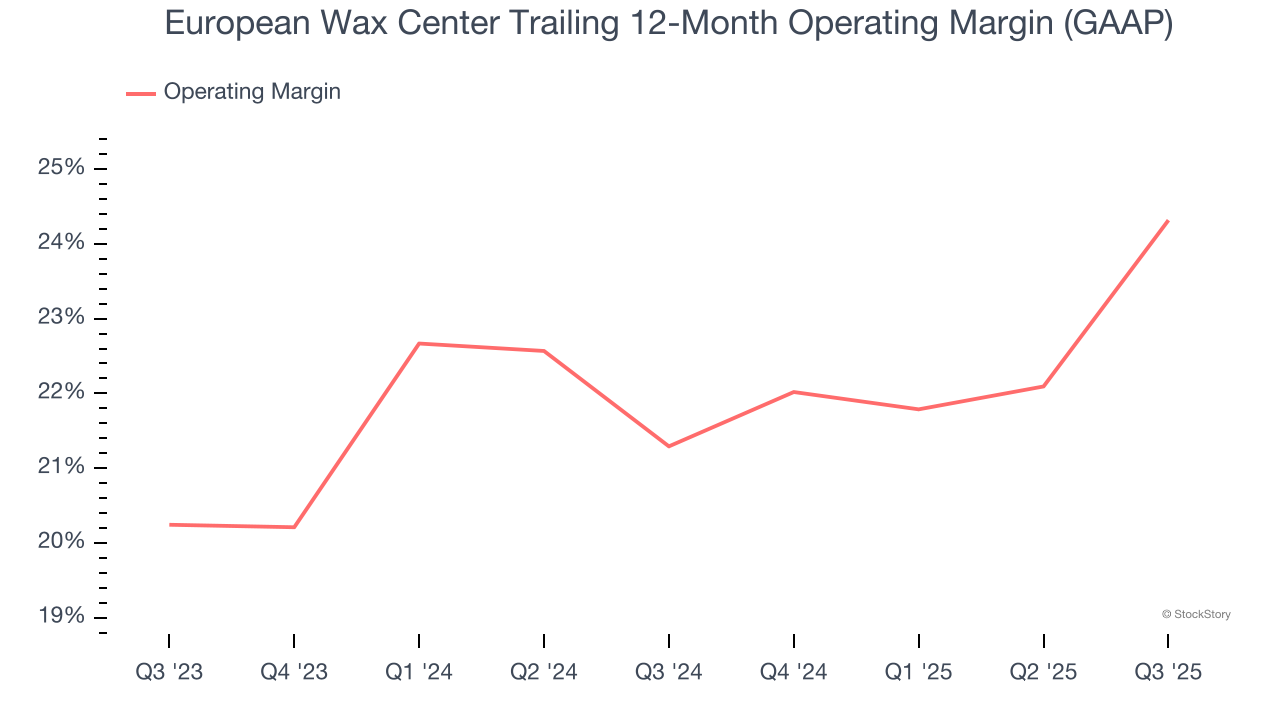

Operating Margin

European Wax Center’s operating margin has risen over the last 12 months and averaged 22.8% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q3, European Wax Center generated an operating margin profit margin of 25.6%, up 8.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

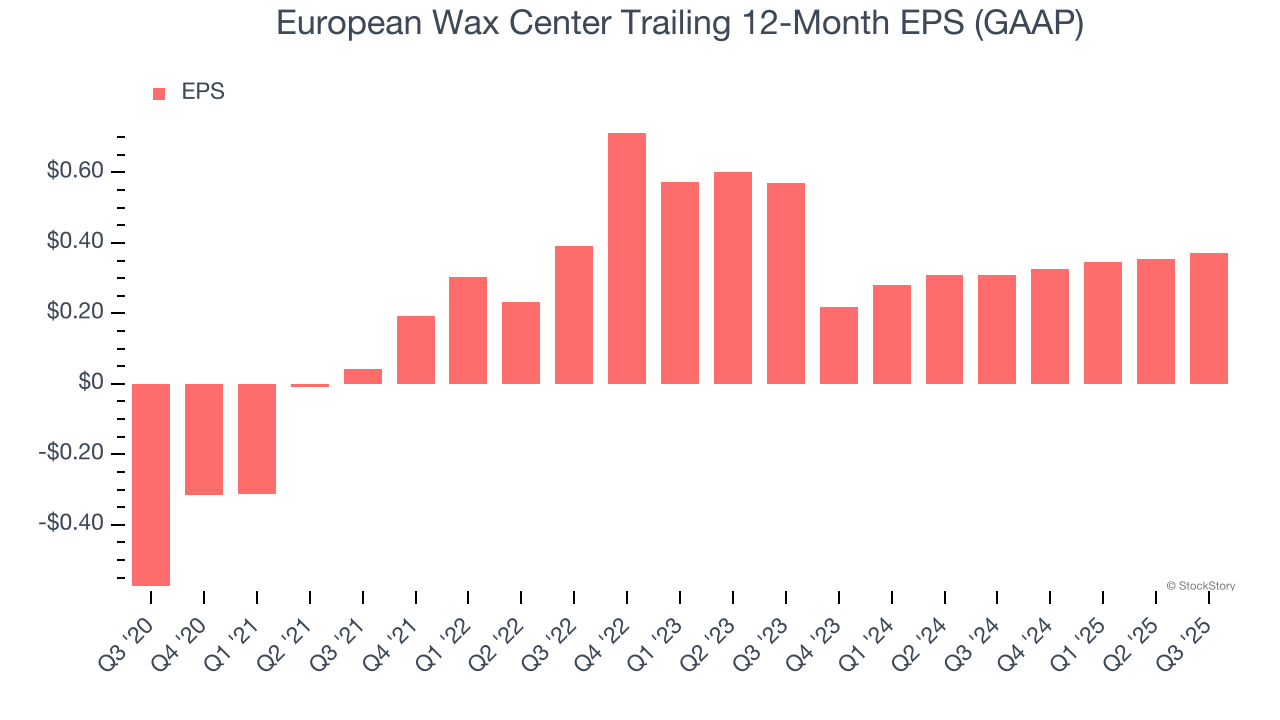

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

European Wax Center’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q3, European Wax Center reported EPS of $0.09, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from European Wax Center’s Q3 Results

It was good to see European Wax Center beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance was in line and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 3.3% to $3.77 immediately after reporting.

European Wax Center put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.