HA Sustainable Infrastructure Capital has been treading water for the past six months, recording a small return of 4.4% while holding steady at $30.52. The stock also fell short of the S&P 500’s 18.6% gain during that period.

Is there a buying opportunity in HA Sustainable Infrastructure Capital, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is HA Sustainable Infrastructure Capital Not Exciting?

We don't have much confidence in HA Sustainable Infrastructure Capital. Here are three reasons there are better opportunities than HASI and a stock we'd rather own.

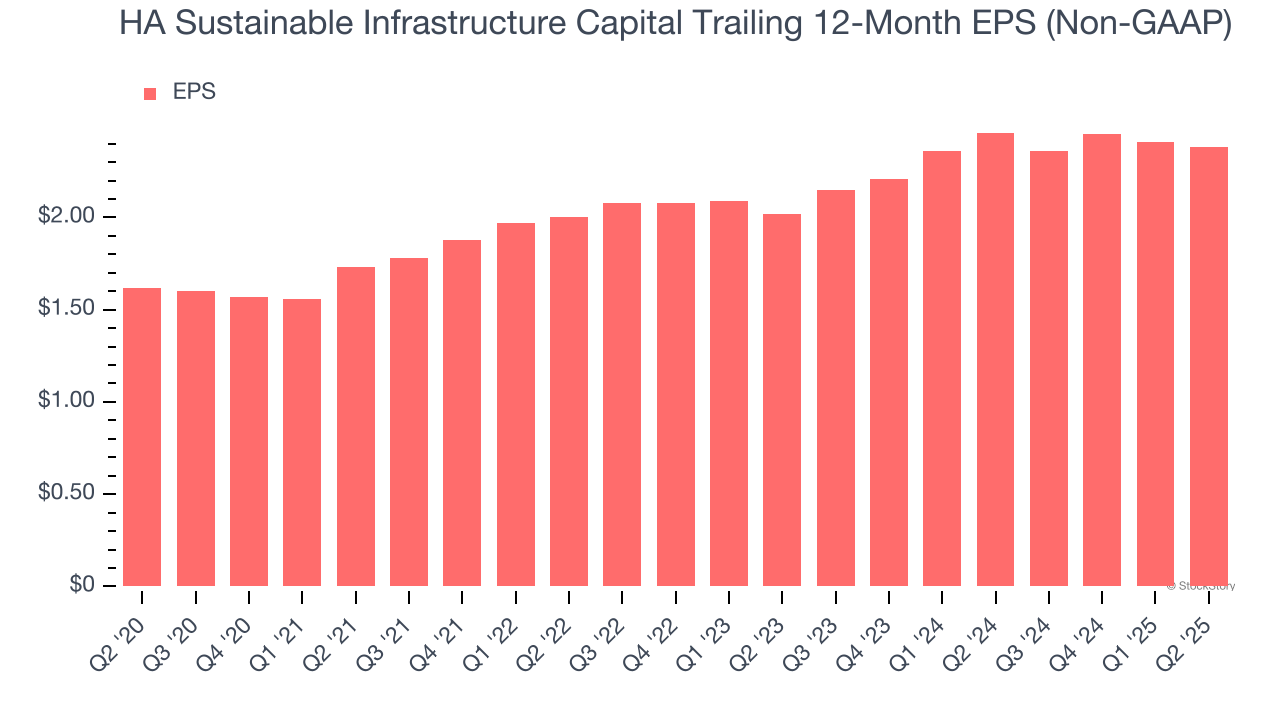

1. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

HA Sustainable Infrastructure Capital’s EPS grew at an unimpressive 8% compounded annual growth rate over the last five years, lower than its 22.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

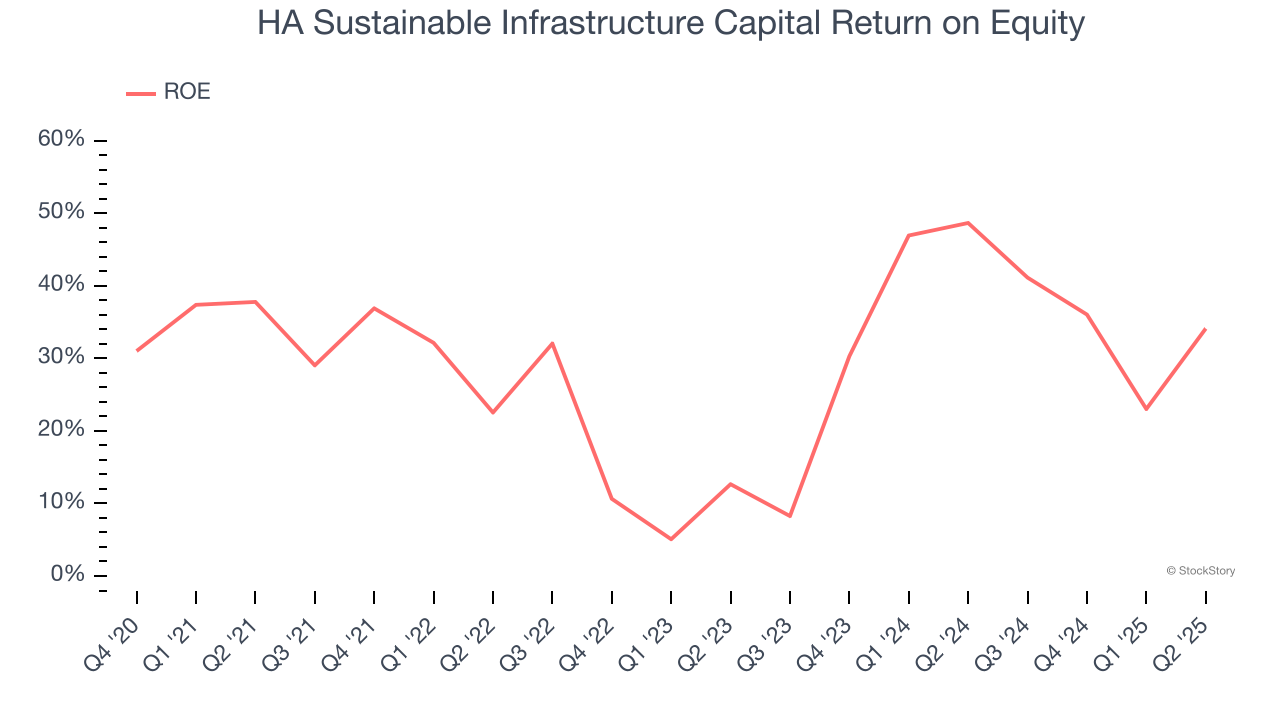

2. Previous Growth Initiatives Haven’t Impressed

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, HA Sustainable Infrastructure Capital has averaged an ROE of 7.8%, uninspiring for a company operating in a sector where the average shakes out around 10%.

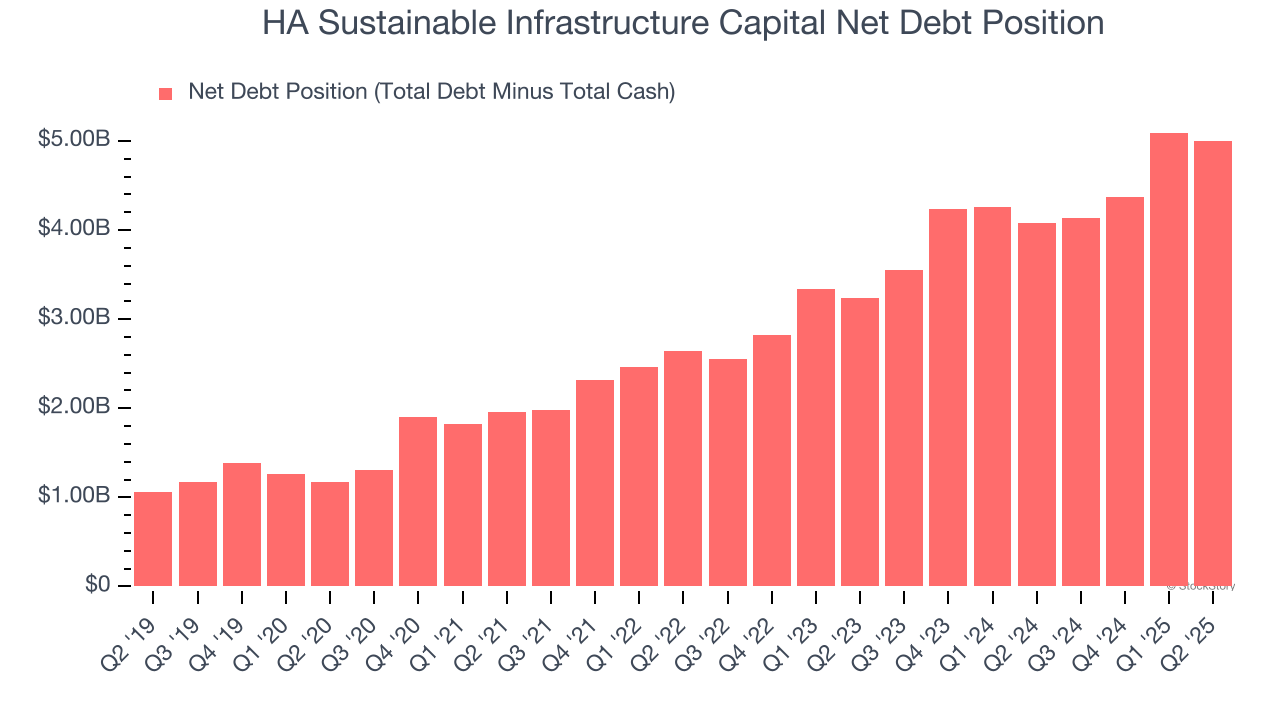

3. High Debt Levels Increase Risk

HA Sustainable Infrastructure Capital reported $86.51 million of cash and $5.08 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $73.08 million of EBITDA over the last 12 months, we view HA Sustainable Infrastructure Capital’s 68.4× net-debt-to-EBITDA ratio as inadequate. The company’s lacking profits relative to its borrowings give it little breathing room, raising red flags.

Final Judgment

HA Sustainable Infrastructure Capital isn’t a terrible business, but it doesn’t pass our bar. With its shares trailing the market in recent months, the stock trades at 10.9× forward P/E (or $30.52 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.