iShares 7-10 Year Treasury Bond ETF (NQ:IEF)

All News about iShares 7-10 Year Treasury Bond ETF

Weekly Market Pulse: Good News Is Good News ↗

January 13, 2025

Via Talk Markets

Financial Conditions Tighten In Response To Recent Data ↗

January 10, 2025

Via Talk Markets

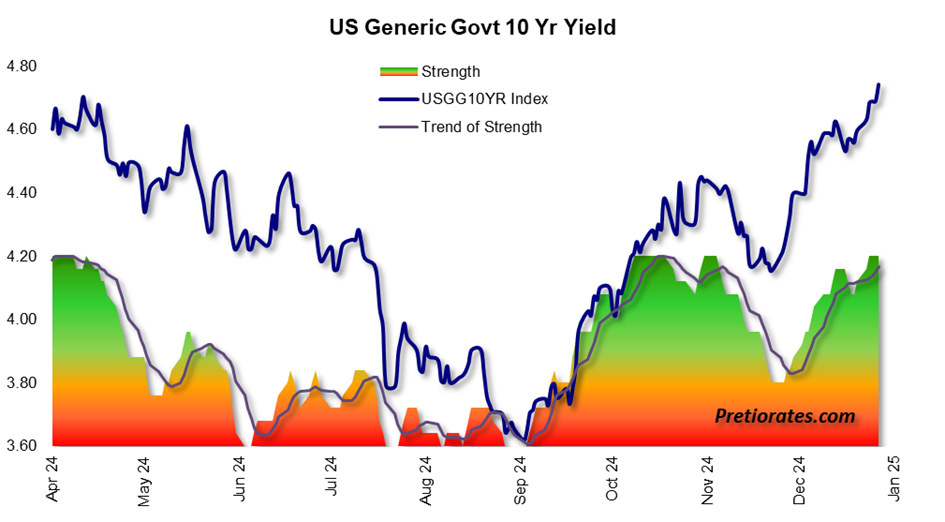

This One Chart Tells Us What 2025 Will Look Like ↗

January 09, 2025

Via Talk Markets

Debt Collapse Starting, Gold Boom On The Horizon ↗

January 09, 2025

Via Talk Markets

Via Talk Markets

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.