NVIDIA Corporation’s (NVDA) rise has been extraordinary. Once a small graphics chip maker, it now powers data centers, artificial intelligence (AI) systems, and next-gen vehicles, becoming one of Wall Street’s most influential technology leaders. But the AI chip stock’s story has felt like a rocket ride with a few sharp air pockets along the way.

Not long ago, NVDA briefly touched the rarefied $5 trillion market-cap club, powered by blistering revenue growth and near-total dominance of the AI chip market. Then came the pullback. The stock cooled as whispers of an AI bubble grew louder, and investors questioned how long this breakneck infrastructure spending could last. For a company this big, even perfection can feel priced in.

But as 2026 approaches, analyst Dan Ives and his team foresee a tech world – and its investors – caught between excitement and anxiety. The AI revolution hints at a once-in-a-generation leap forward, yet the trillions required to fuel it naturally raise questions. Still, that scale of investment also signals a fourth industrial revolution taking shape, with the U.S. firmly setting the pace.

The analyst believes this crossroads makes 2026 an inflection year. With tech stocks projected to rise by over 20%, Nvidia’s dominance, expanding demand drivers, and potential China access underpin a bullish $275 case. With that setup, let’s get into the details.

About NVIDIA Stock

Santa Clara-based Nvidia hardly needs an introduction. Once celebrated as the king of gaming graphics, it quietly reinvented itself as the backbone of modern computing. Its GPUs now power data centers, AI, robotics, and immersive digital worlds. The CUDA software platform locked developers into a powerful ecosystem, turning Nvidia into an industry standard rather than a supplier. With a market capitalization of nearly $4.4 trillion, Jensen Huang’s company has become the engine of the AI economy.

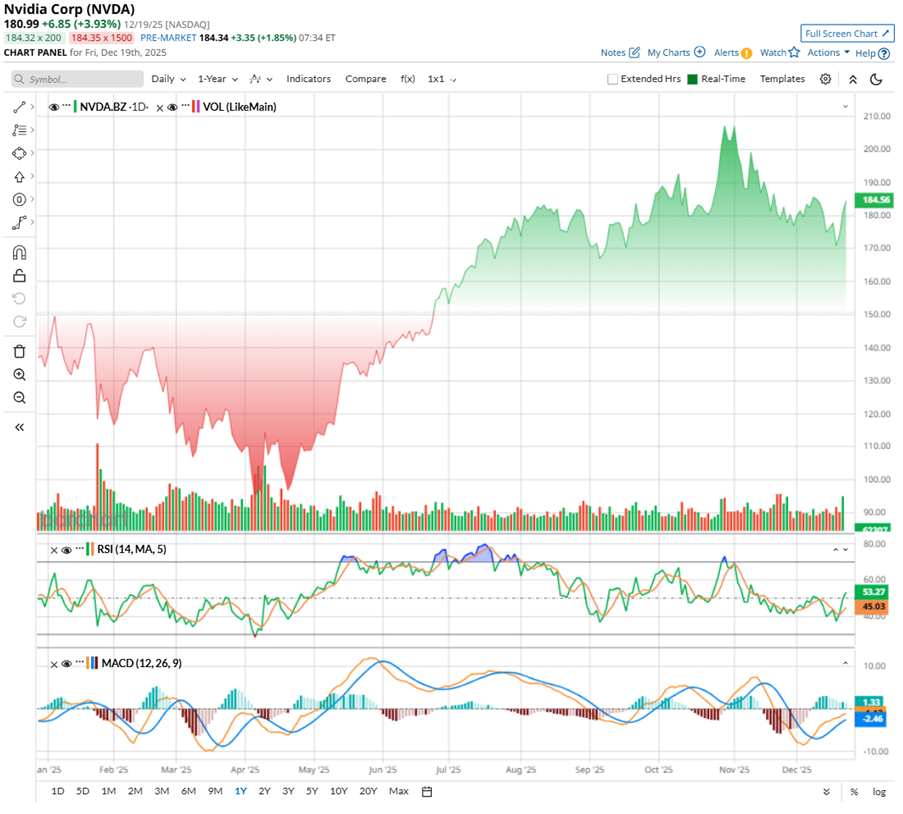

That dominance has translated into a turbulent but rewarding stock journey. Shares of the AI chip maker have surged throughout the year, pausing only to catch breath. Despite a recent pullback, the stock remains up strongly, reflecting investors balancing long-term confidence with short-term caution. After rising to the high of $212.19 on Oct. 29, NVDA retreated about 15.5%, yet it still commands a powerful uptrend across longer horizons, up 36.8% year-to-date (YTD) and soaring 27.7% over the past six months alone.

The chart shows momentum cooling, not collapsing. The 14-day Relative Strength Index (RSI), which pushed beyond the overheated 80 zone during October’s euphoric high, has eased back to around 52. That reset signals excess optimism being worked off, allowing the stock to stabilize rather than unravel. Volume has normalized alongside price, reinforcing the sense of consolidation rather than distribution.

The MACD oscillator remains bullish. The MACD line remains above its signal line, confirming that the broader trend still favors buyers. Although the histogram has narrowed, suggesting slower acceleration, downside pressure remains contained. In practical terms, the bulls are still in control, even if they have eased off the throttle.

Nvidia’s valuation may look expensive at first glance, with the stock trading around 41.09 times forward adjusted earnings, well above most peers. Still, it sits below its own historical average, which adds some perspective. For a company delivering strong double-digit earnings growth and holding enviable margins, that premium feels more justified.

Importantly, Nvidia’s forward PEG ratio of about 1.03x is below both the sector average and its long-term median, suggesting the valuation, while elevated, is still supported by real growth rather than hype.

Nvidia Beats Q3 Projections

Nvidia’s third-quarter update felt more like another chapter in its AI-driven ascent. On Nov. 19, the stock climbed nearly 3% as the company delivered results that comfortably cleared Wall Street’s bar and paired them with upbeat guidance. Revenue surged 62.5% year-over-year (YOY) to $57.01 billion, outpacing expectations, while adjusted earnings climbed 60.5% to $1.30 a share, reminding investors that scale has not slowed Nvidia’s momentum.

At the heart of the story was the data center business, still the company’s growth engine. Sales there jumped 66% annually to $51.2 billion, powered by insatiable AI demand. Networking added its own spark, with revenue soaring 162% to $8.2 billion as NVLink, InfiniBand, and Spectrum-X Ethernet gained traction. Gaming remained steady, posting 30% growth, while automotive quietly advanced with a 32% annual rise.

Management’s tone was just as confident. CFO Colette Kress cited Blackwell Ultra as the top-selling chip, while CEO Jensen Huang noted cloud GPUs are effectively sold out. Addressing concerns about an AI bubble, CEO Huang struck a confident tone on the earnings call. He emphasized that Nvidia is not just another accelerator vendor, but a full-stack platform spanning pre-training, post-training, and inference. Backed by over two decades of investment in CUDA-X, the company also leads in scientific computing, engineering simulations, computer graphics, and advanced data processing, giving Nvidia a breadth few competitors can match. With the management guiding Q4 revenue to about $65 billion, +/-2%, Nvidia’s growth narrative looks firmly intact.

Meanwhile, analysts tracking Nvidia forecast its Q4 fiscal 2026 revenue to be $65.6 billion, and EPS is anticipated to grow 69.4% YOY to $1.44. For the full fiscal 2026, the bottom line is projected to increase 50.5% annually to $4.41 per share before rising by another 54% to $6.79 in fiscal 2027.

What Do Analysts Expect for Nvidia Stock?

Dan Ives views the technology sector as entering a decisive phase ahead of 2026. In Wedbush’s top technology outlook, he expects the sector to rise more than 20% as AI investments move deeper across software, semiconductors, and infrastructure. Strategic developments, including a potential AI partnership between Apple (AAPL) and Google (GOOG) (GOOGL) reinforce the scale of this transition. For Nvidia, Ives remains particularly confident.

He sees Nvidia as the world’s leading AI chip provider, with demand drivers still underappreciated by the market and added upside from improving access to China. In Wedbush’s view, 2026 represents an inflection point for the AI buildout, and Nvidia stands out as a primary beneficiary. Ives’ $275 price target suggests NVDA could rally by as much as 51.9%.

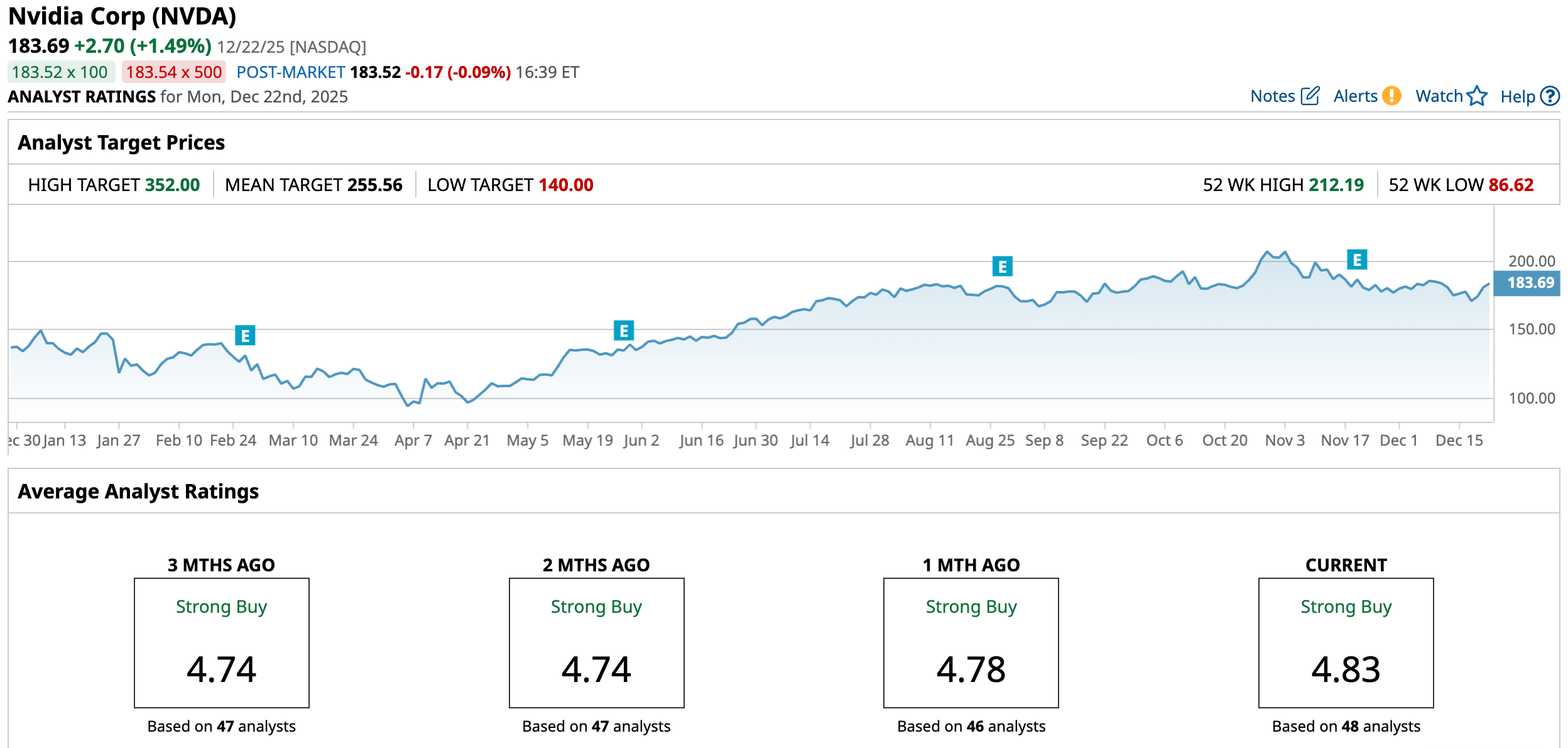

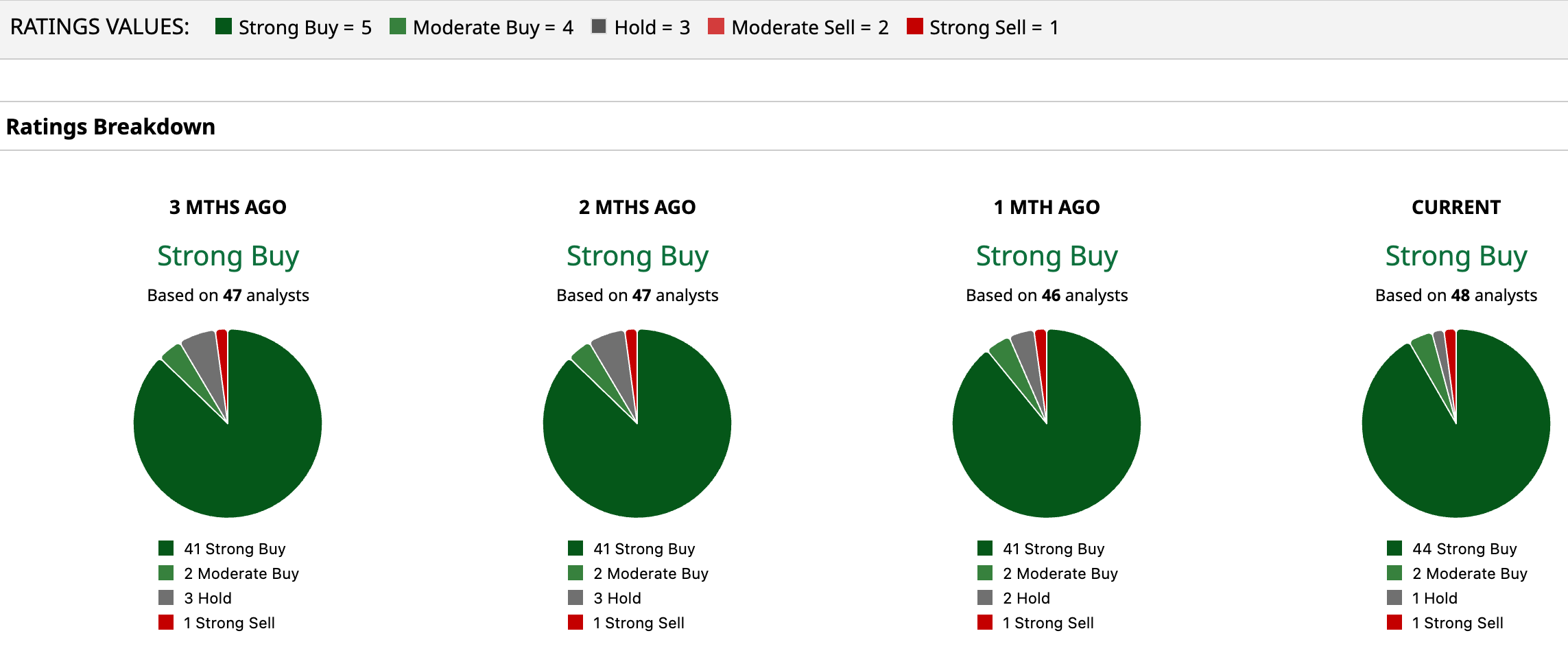

Overall, analysts are bullish about NVDA’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 48 analysts covering the stock, 44 advise a “Strong Buy,” while two suggest “Moderate Buy,” one advises a “Hold,” and only one suggests a “Strong Sell.”

The average analyst price target for NVDA is $255.56, indicating potential upside of 39.13%. Evercore ISI’s Street-high target price of $352 suggests that the stock could rally as much as 91.63% from here.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart