Atkore has gotten torched over the last six months - since June 2024, its stock price has dropped 36.1% to $83.21 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Atkore, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.Even with the cheaper entry price, we're swiping left on Atkore for now. Here are three reasons why ATKR doesn't excite us and a stock we'd rather own.

Why Is Atkore Not Exciting?

Protecting the things that power our world, Atkore (NYSE:ATKR) designs and manufactures electrical safety products.

1. Core Business Falling Behind as Demand Declines

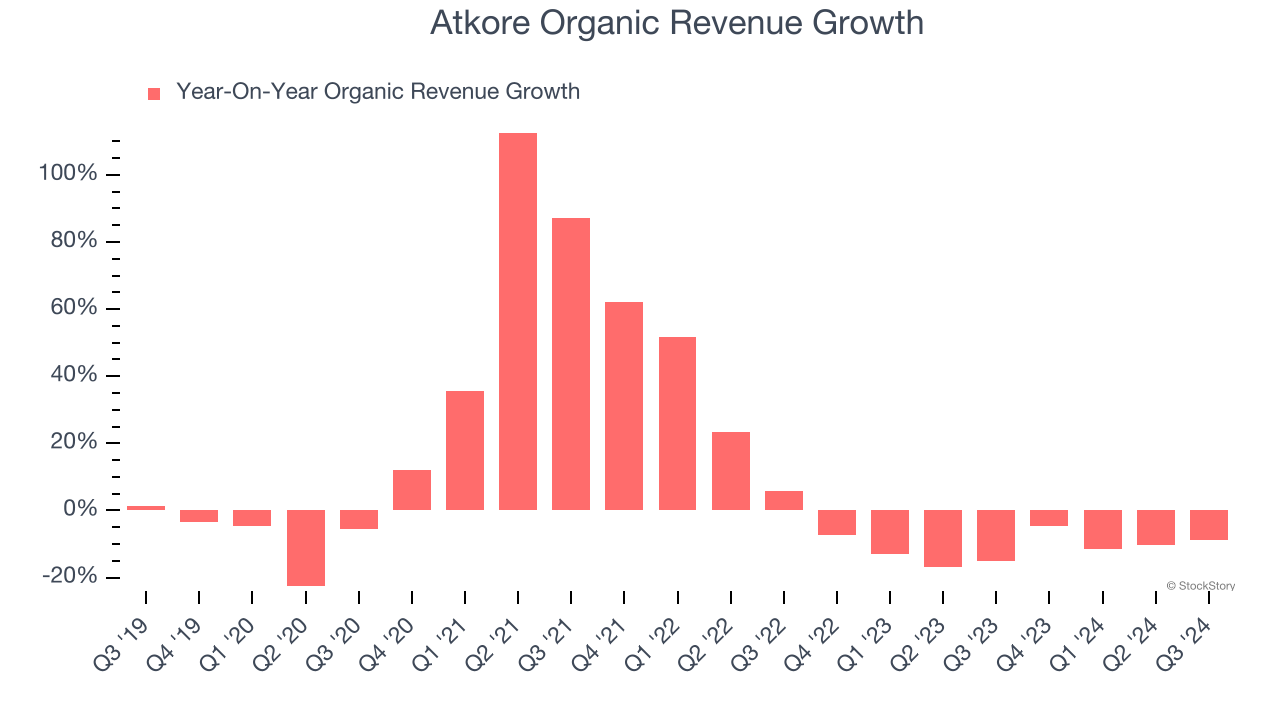

Investors interested in Electrical Systems companies should track organic revenue in addition to reported revenue. This metric gives visibility into Atkore’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Atkore’s organic revenue averaged 10.9% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Atkore might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Took a Dip Over the Last Two Years

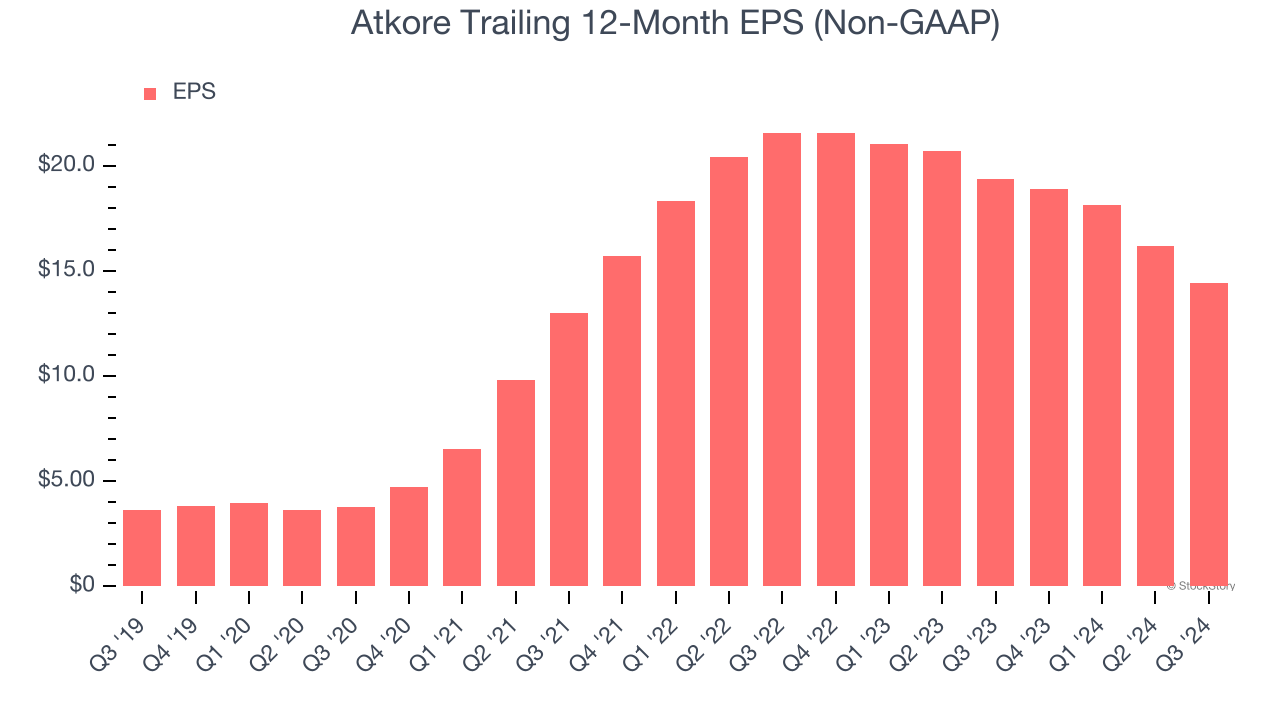

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Atkore, its EPS declined by more than its revenue over the last two years, dropping 18.2%. This tells us the company struggled to adjust to shrinking demand.

3. New Investments Fail to Bear Fruit as ROIC Declines

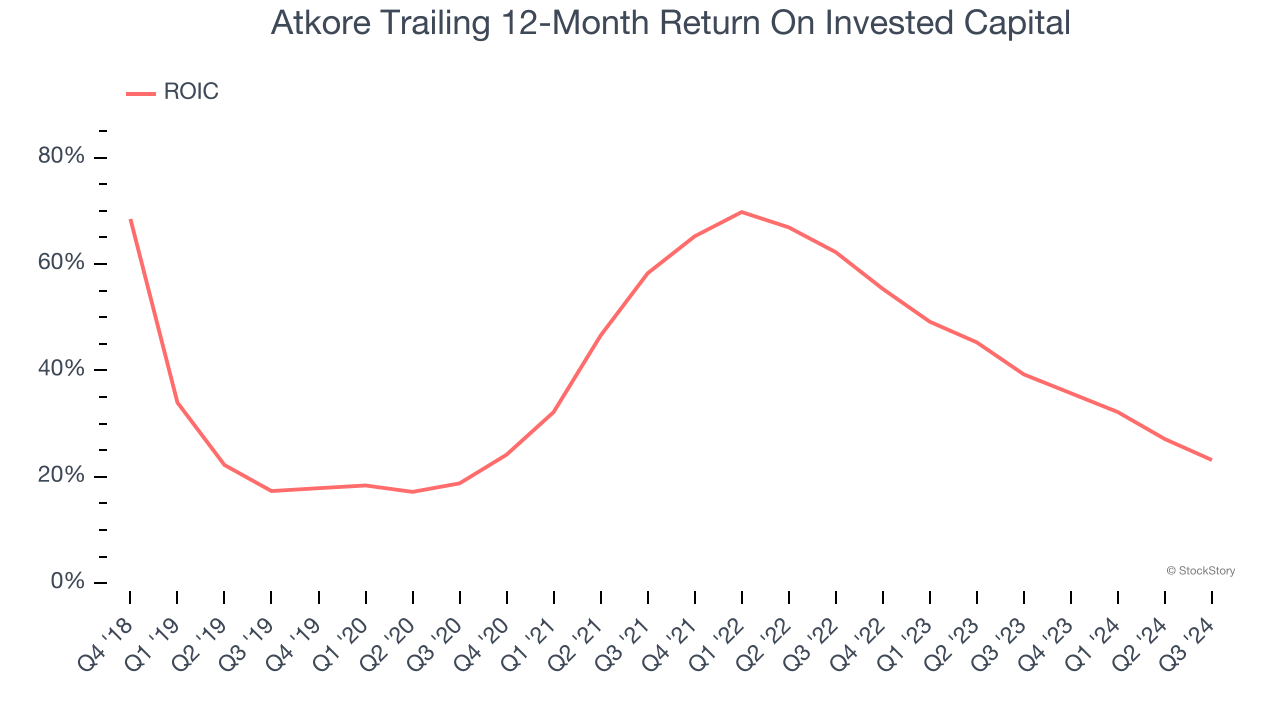

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Atkore’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Atkore isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 7.2× forward price-to-earnings (or $83.21 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at Chipotle, which surprisingly still has a long runway for growth.

Stocks We Would Buy Instead of Atkore

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.