Content production and distribution company Sphere Entertainment (NYSE:SPHR) reported Q3 CY2024 results exceeding the market’s revenue expectations, with sales up 93.1% year on year to $227.9 million. Its GAAP loss of $2.95 per share was 1,613% below analysts’ consensus estimates.

Is now the time to buy Sphere Entertainment? Find out by accessing our full research report, it’s free.

Sphere Entertainment (SPHR) Q3 CY2024 Highlights:

- In October, the Company and the Department of Culture and Tourism – Abu Dhabi ("DCT Abu Dhabi") announced plans to make Abu Dhabi the next Sphere location under a franchise model

- Revenue: $227.9 million vs analyst estimates of $222 million (2.7% beat)

- Operating Profit: -$117.6 million vs analyst estimates of -$94.0 million ($23.6 million miss)

- Gross Margin (GAAP): 38.7%, up from 28.4% in the same quarter last year

- Operating Margin: -51.6%, up from -59.1% in the same quarter last year

- EBITDA Margin: -87.5%, down from -47.1% in the same quarter last year

- Market Capitalization: $1.58 billion

Executive Chairman and CEO James L. Dolan said, "The vision for Sphere has always included a global network of venues, and our recently announced plans for a second Sphere in Abu Dhabi mark a significant milestone toward that goal. We are confident in the opportunities ahead for Sphere and believe we are well-positioned to drive long-term shareholder value. "

Company Overview

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE:SPHR) hosts live entertainment events and distributes content across various media platforms.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

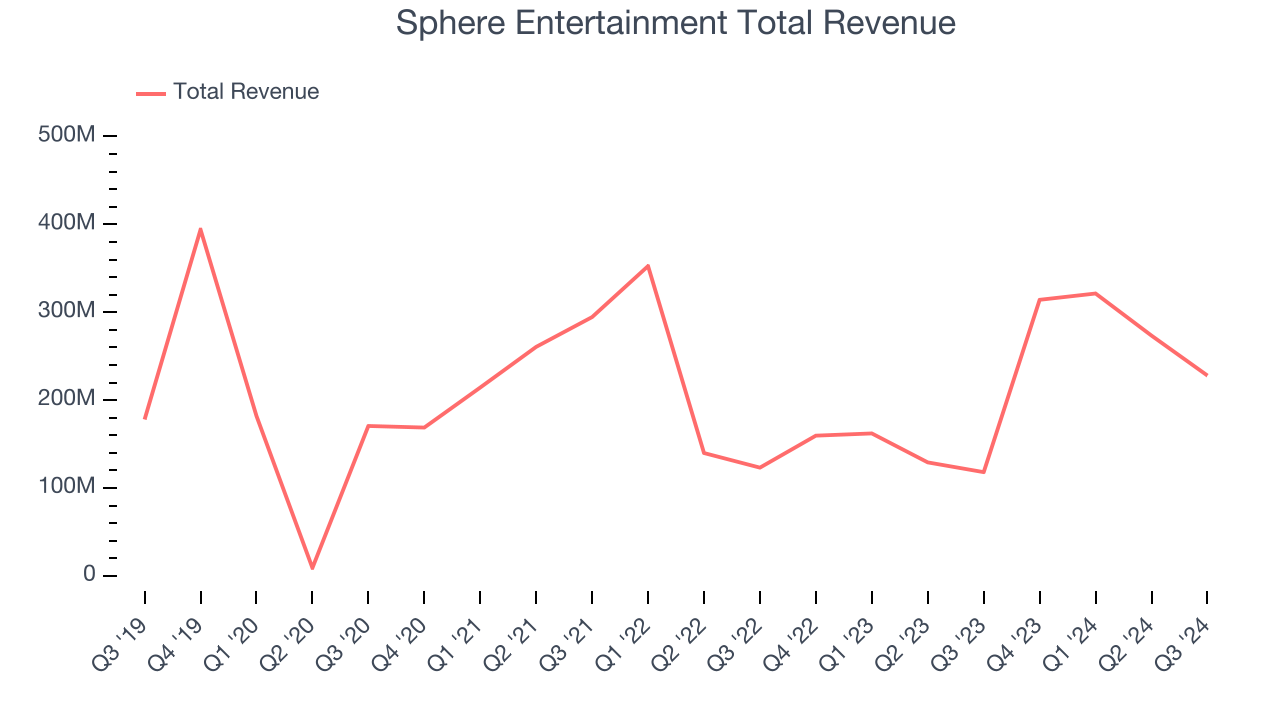

Sales Growth

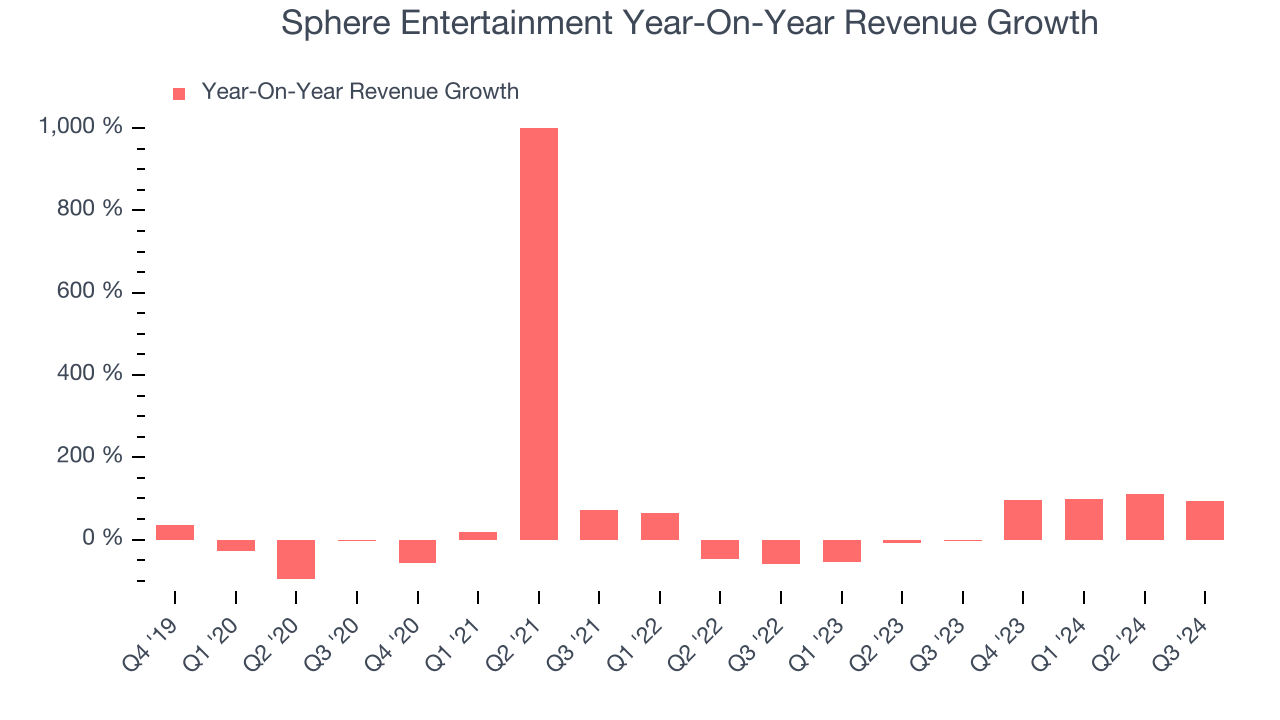

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Sphere Entertainment grew its sales at a sluggish 4% compounded annual growth rate. This shows it couldn’t expand in any major way, a sign of lacking business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Sphere Entertainment’s annualized revenue growth of 15.6% over the last two years is above its five-year trend, suggesting some bright spots. Note that COVID hurt Sphere Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Sphere and MSG Networks, which are 55.8% and 44.2% of revenue. Over the last two years, Sphere Entertainment’s Sphere revenue (live events and advertising) averaged 12,923% year-on-year growth. On the other hand, its MSG Networks revenue (content distribution) averaged 7.6% declines.

This quarter, Sphere Entertainment reported magnificent year-on-year revenue growth of 93.1%, and its $227.9 million of revenue beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

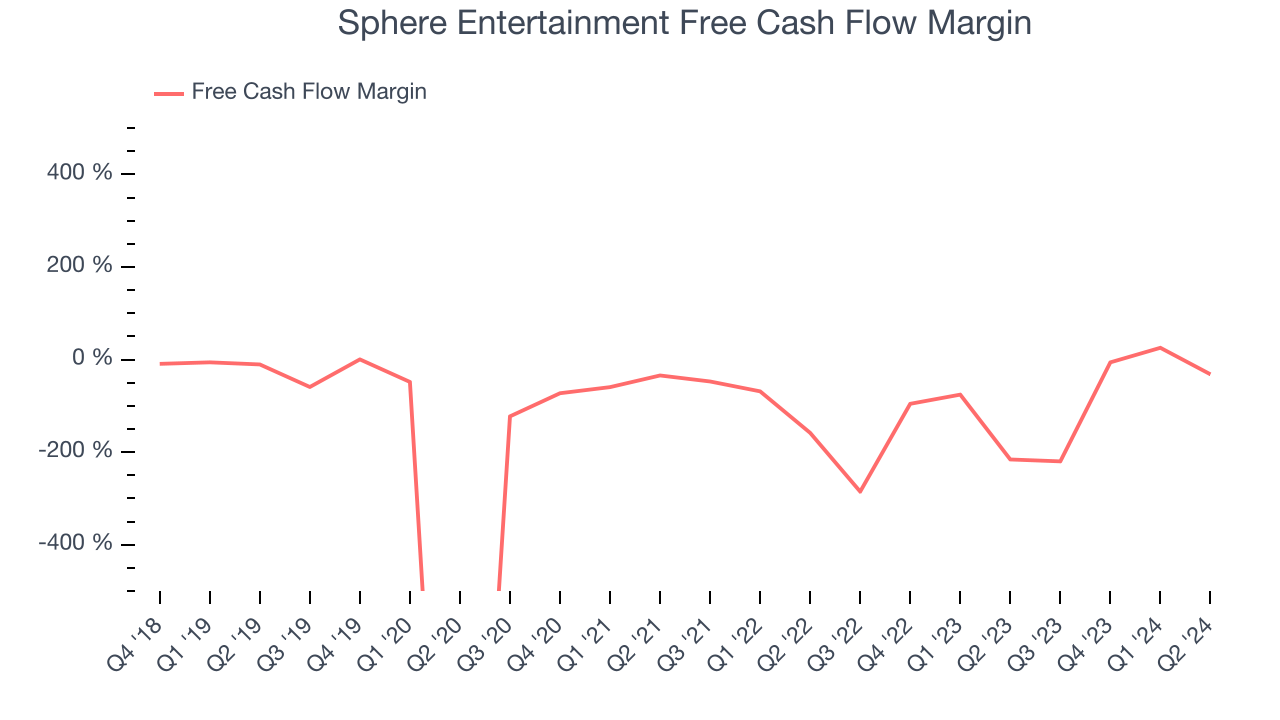

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Sphere Entertainment’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 56.7%, meaning it lit $56.75 of cash on fire for every $100 in revenue.

The company’s cash burn increased from $259.6 million of lost cash in the same quarter last year.

Key Takeaways from Sphere Entertainment’s Q3 Results

It was good to see Sphere Entertainment beat analysts’ revenue expectations this quarter. On the other hand, its operating profit missed by a wide margin. The company also announced the next Sphere location in Abu Dhabi, which will operate under a franchise model. Overall, this was a weaker quarter despite the excitement of the Abu Dhabi announcement. The stock traded down 5.8% to $41.53 immediately following the results.

Sphere Entertainment underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.