iRobot (IRBT) shares soared as much as 70% this morning following reports the White House is considering sweeping initiatives to accelerate the domestic robotics industry.

According to Politico, Howard Lutnick – the U.S. Secretary of Commerce – has held meetings with top executives at robotics firms and is “all in” on supporting the industry’s development.

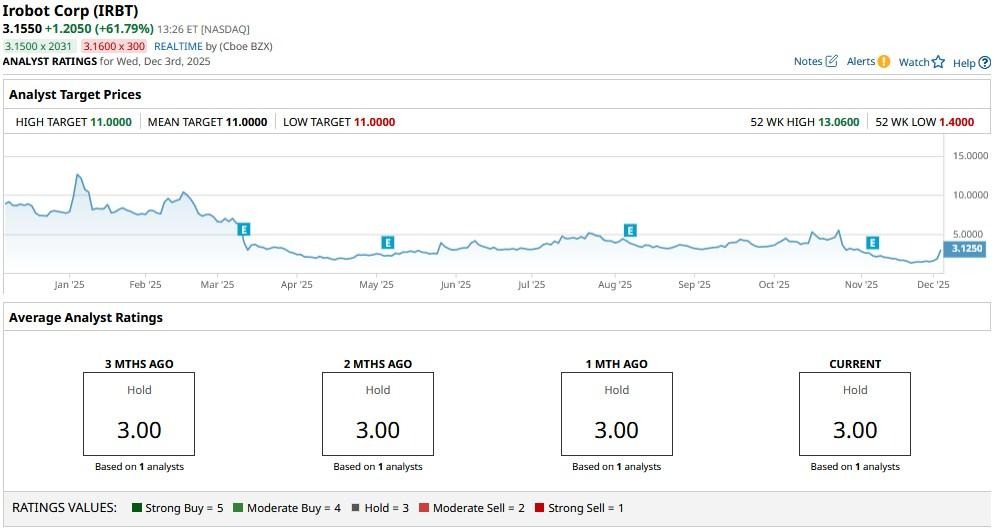

Despite today’s rally, iRobot stock remains down some 70% versus its high set in early January.

Why iRobot Stock Soared Following the Politico Report

Federal support for robotics could prove transformative for iRobot, which has struggled to regain investor confidence in recent years.

A government-led initiative would validate the significance of the robotics industry, potentially unlocking subsidies, tax incentives, and research and development (R&D) funding.

For iRobot, whose consumer robotics business faces stiff competition, such support could provide breathing room to innovate and expand.

The surge in IRBT shares today reflects investor belief that policy tailwinds will help this Nasdaq-listed firm reposition itself as a key player in America’s robotics future.

Why IRBT Shares Remain Super Unattractive to Own

Despite the prospect of government support, investors must tread with caution in iRobot shares as the company’s financials remain in disarray.

With declining revenue, shrinking margins, limited cash reserves, and competitive pressures, IRBT appears unfavorably positioned to gain market share in 2026.

Plus, it’s fair to assume that President Donald Trump’s administration will prioritize industrial robotics, sidelining iRobot’s consumer-focused products.

More importantly, IRBT remains a penny stock (trading decisively below the $5 threshold), which means it faces heightened volatility and limited institutional interest.

On Wednesday, iRobot failed to break above its 100-day moving average (MA) as well, reinforcing that the broader downward momentum remains intact.

In short, IRBT’s elevated risk profile undermines long-term confidence in its future prospects.

Wall Street Isn’t Really Interested in Covering iRobot

Another major red flag on iRobot stock is the absence of Wall Street coverage.

According to Barchart, IRBT shares currently receive coverage from only one analyst, suggesting investors are on their own when it comes to interpreting financials and assessing risks tied to the Roomba maker.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Cathie Wood Is Selling Palantir Stock. Should You?

- Netflix Stock Breaks Below 20-Day Moving Average Amid Selloff. Should You Buy the Dip?

- Michael Burry Says Tesla Is ‘Ridiculously Overvalued.’ Should You Ditch TSLA Stock Here?

- Why Is Michael Burry So Bullish on Lululemon Stock? And Should You Be, Too?