It's been a tough first 7 months to the year for most high-tech and growth stocks and the semiconductor industry is no exception. Looking at the iShares Semiconductor ETF (NASDAQ: SOXX) it's clear that a major correction is underway and there is a downtrend in place that will take some breaking. To set the scene, coming into the start of this month its shares were down a full 40% from where they started the year.

It's been a tough first 7 months to the year for most high-tech and growth stocks and the semiconductor industry is no exception. Looking at the iShares Semiconductor ETF (NASDAQ: SOXX) it's clear that a major correction is underway and there is a downtrend in place that will take some breaking. To set the scene, coming into the start of this month its shares were down a full 40% from where they started the year. For context, the same ETF had rallied more than 200% from the depths of the pandemic sell-off through last year, but a fearful combination of rising inflation, increasing recession risk and a global supply glut have proved too much and forced shares lower. For those of us who have managed to avoid most of the damage, it’s still difficult to support a bull thesis in the short term. But there is a growing argument to start thinking about the long-term potential that some of these semiconductor stocks have. In this two-part series, we take a look at two of the more well-known names and see if they’re worth adding to your watchlist.

Advanced Micro Devices (NASDAQ: AMD)

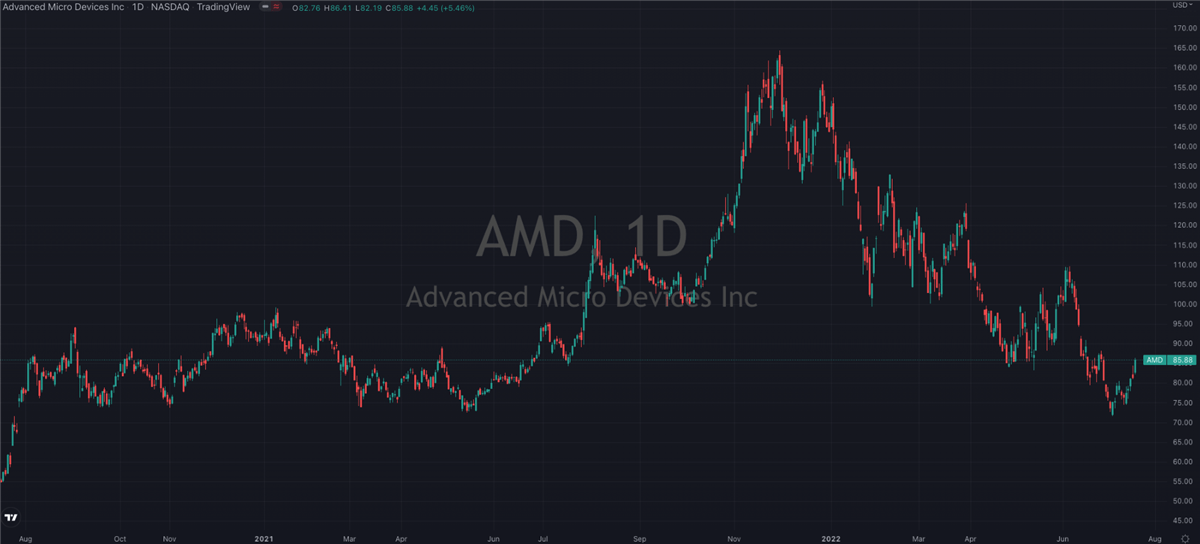

Unsurprisingly, AMD shares outpaced the broader ETF in the selling that was seen during the first half of this year. Though they’ve managed to rally through the past fortnight, they’re still down close to 50% from their December highs. This is indicative of just how spooked investors are with regards to the global chip market and what a combination of soaring inflation and too much supply might mean to it.

Even with the 50% haircut that shares have experienced this year, the team over at KeyBanc Capital Markets are looking for more blood. Last week they lowered their estimates on several semiconductor names, AMD included. Analyst John Vinh noted that after looking at the supply chain, the firm's findings were "mixed, but mostly negative," as it was disrupted by the China lockdowns and weak consumer demand hurt sales of PCs, smartphones and internet-enabled products”. Additionally, the analyst said that easing lead times suggest a correction is "looming" sometime in the second half of the year.

But even though his comments urge caution, he only trimmed his price target to $130 which is still a long way north of the $85 that shares closed at last night. It has to be said that it’s a unique market environment where caution is urged on a stock that at the same time is thought to have upside of 50%.

Bullish Comments

If KeyBanc can be accused of considering the glass to be half empty, the team over at Wedbush are the opposite, and fresh comments from analyst Matt Bryson yesterday should have many investors sitting up and taking notice. In an interview with CNBC he said that he fancied AMD as the most likely near-term winner in the semiconductor space, beating out competitors like NVIDIA (NASDAQ: NVDA) and Intel (NASDAQ: INTC).

He sees AMD continuing to gain share from Intel in both the key categories of servers and PCs, adding "I don't really see that dynamic changing until late '24/'25." His peers at BMO Capital Markets made similar comments last week as part of their upgrade to AMD shares. BMO analyst Ambrish Srivastava raised his rating to outperform from market perform and bumped the price target to $115 from $100, noting that even though there are some "near-term headwinds," the company has transformed itself.

In a note to clients, he wrote that "there is no going back for customers to the old days of when AMD's share would be capped", adding that they see "continued momentum from our work around the industry, and see AMD's server share continuing to expand."

Considering shares are trading at the same level where they spent much of 2020, there’s a lot to like about the risk/reward profile at AMD today. There are undoubtedly near-term headwinds that must be navigated, but you have to be thinking most of the downside is already baked into the share price at this point. That leaves a ton of room for upside surprises in the coming quarters, and if you have a long enough time horizon you just can’t help liking AMD a lot down here.

Stay tuned for Part Two