Canopy Growth Corporation (CGC) struggles with declining revenues and widening losses. The Canadian cannabis producer saw a 28% year-over-year revenue drop in the last reported quarter, primarily due to heightened competition in the domestic adult-use cannabis market and a decrease in its U.S. CBD operations. With investors worried about its prospects, the stock has slumped substantially over the past year, currently trading under $2.

CGC is attempting to reverse its fortunes with cost control efforts, exiting some international markets, shutting down stores, and divesting retail businesses. Moreover, earlier this year, CGC announced it is transitioning its Canadian business to an asset-light model and significantly reducing the overall size of its organization.

While the increasing number of states legalizing cannabis has been encouraging, full legalization still lacks support in Congress. Thus, the road to profitability and growth for the company may be bumpy.

Here are some of CGC’s key metrics that indicate a bleak prospect for the stock.

CGC’s Revenue, Net Income, Gross Margin & Analyst Price Target

Overall, CGC’s net income has experienced a significant decline from negative $146.77 million on June 30, 2020, to a record low of negative $314.12 million on December 31, 2022. The downward trend observed during this period was punctuated by brief periods of growth, such as the $195.35 million increase recorded from September 30, 2020, to December 31, 2020.

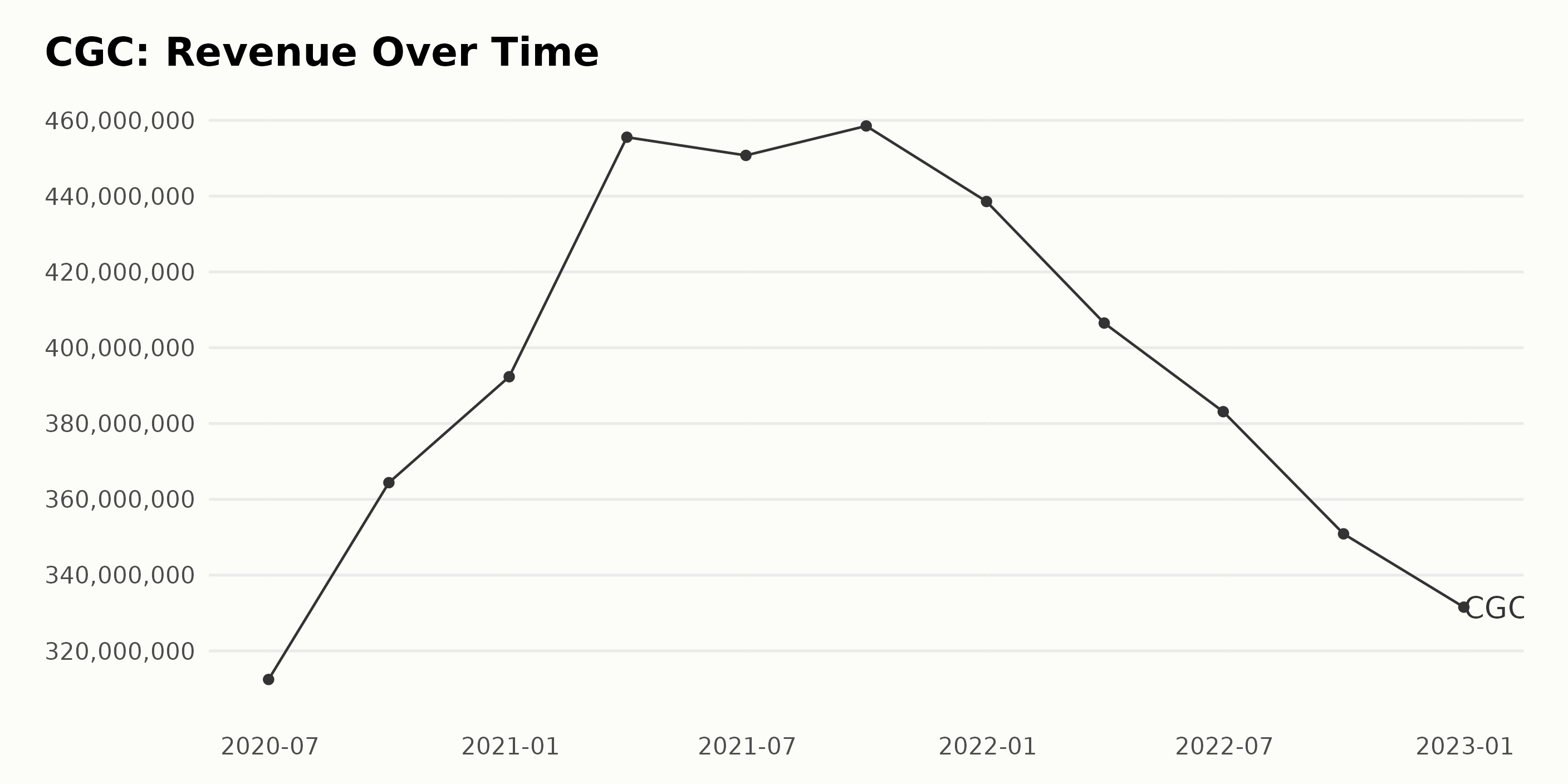

CGC’s revenue has experienced fluctuations over the past two years, with a small decrease in growth from June 2020 to March 2021. Despite this, CGC still reported a growth rate of 44.8% from $312.47 million (June 2020) to $451.05 million (September 2021). However, revenue has seen a drastic decrease since March 2021, dropping to $331.55 million (December 2022), which is a 24.7% decrease from the September 2021 value.

CGC’s gross margin has experienced fluctuating trends over the past several years, ranging from negative 32.3% in June 2020 to negative 45.0% in June 2022. CGC’s gross margin growth rate from June 2020 to June 2022 was negative 41.1%.

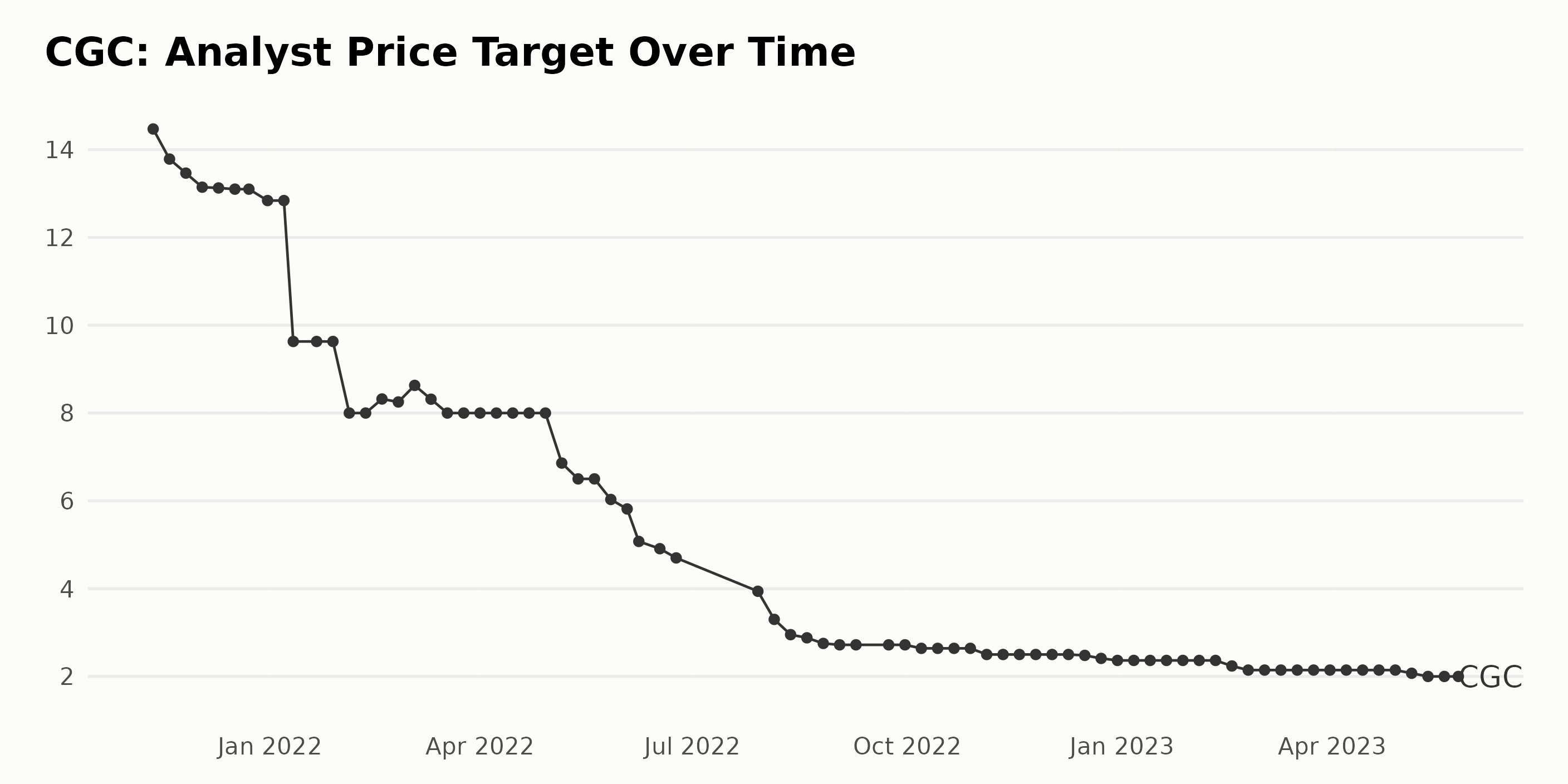

The Analyst Price Target for CGC fluctuated significantly over the past two years. From November 2021 to May 2023, the price target dropped from $14.47 to $2.00, a decrease of 86%. Most recently, the price target has stabilized and remained at $2.00 since May.

CGC Stock Prices Decreased Over 180 Days

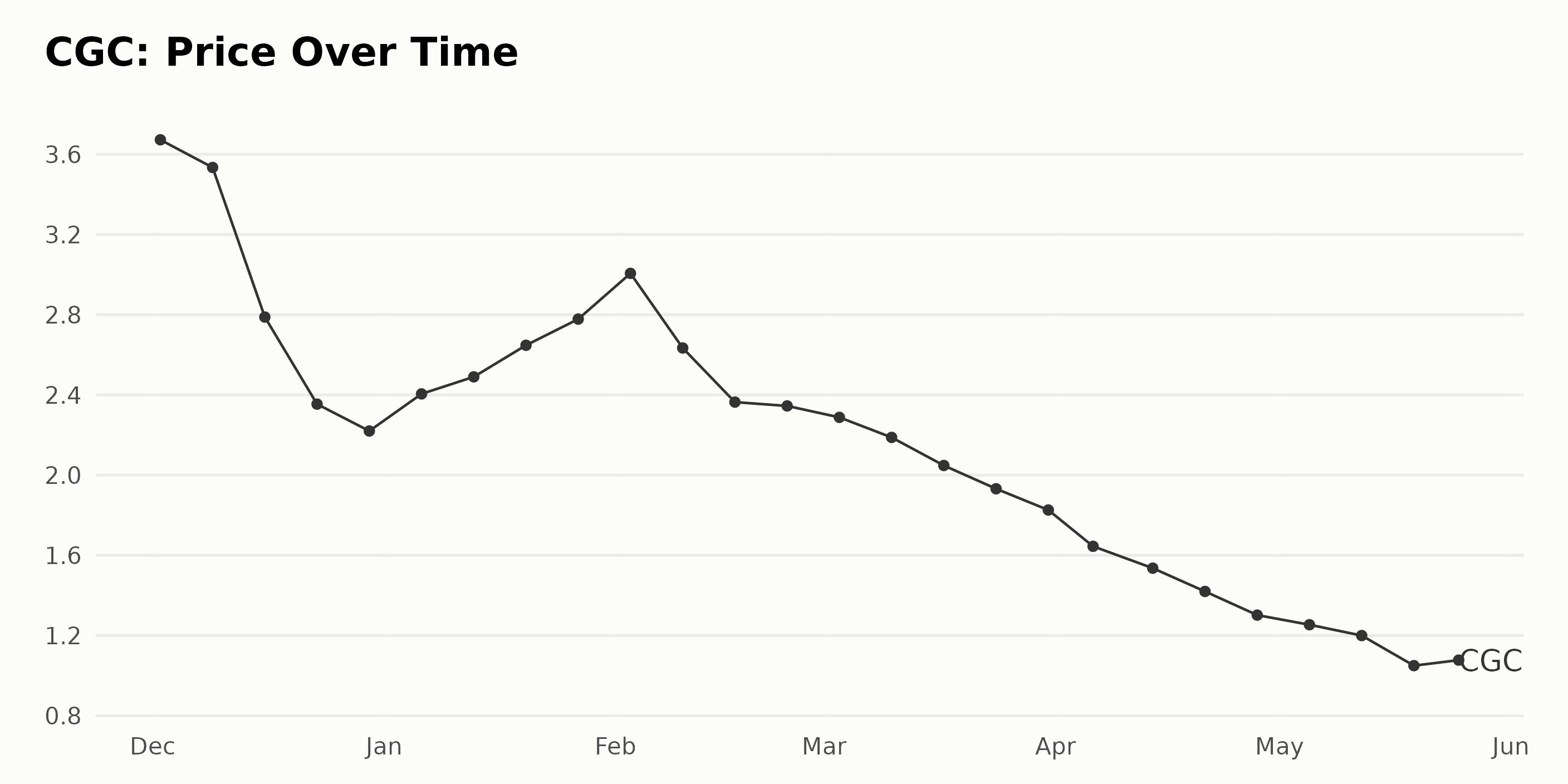

CGC’s shares have been on a downtrend. The share price started from $3.67 on December 02, 2022, and decreased to $1.05 on May 24, 2023. The rate of decrease appears to be gradually increasing towards the end of the time period. Here is a chart of CGC’s price over the past 180 days.

Unfavorable POWR Ratings

CGC has an overall D rating, equating to a Sell in our POWR Ratings system. It is ranked #154 out of 166 stocks in the Medical - Pharmaceuticals industry.

It has an F grade for Momentum and Sentiment and a D for Value and Stability.

Stocks to Consider Instead of Canopy Growth Corporation (CGC)

Other stocks in the Medical - Pharmaceuticals sector that may be worth considering are Novo Nordisk A/S (NVO), Astellas Pharma Inc. (ALPMY), and AbbVie Inc. (ABBV) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

CGC shares were trading at $0.93 per share on Thursday afternoon, down $0.12 (-11.72%). Year-to-date, CGC has declined -59.74%, versus a 8.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Canopy Growth (CGC) a Buy Under $2? appeared first on StockNews.com