With US stock indexes looking top-heavy, long-term investment moneys could be looking for the next commodity complex sector to ride higher in 2026.

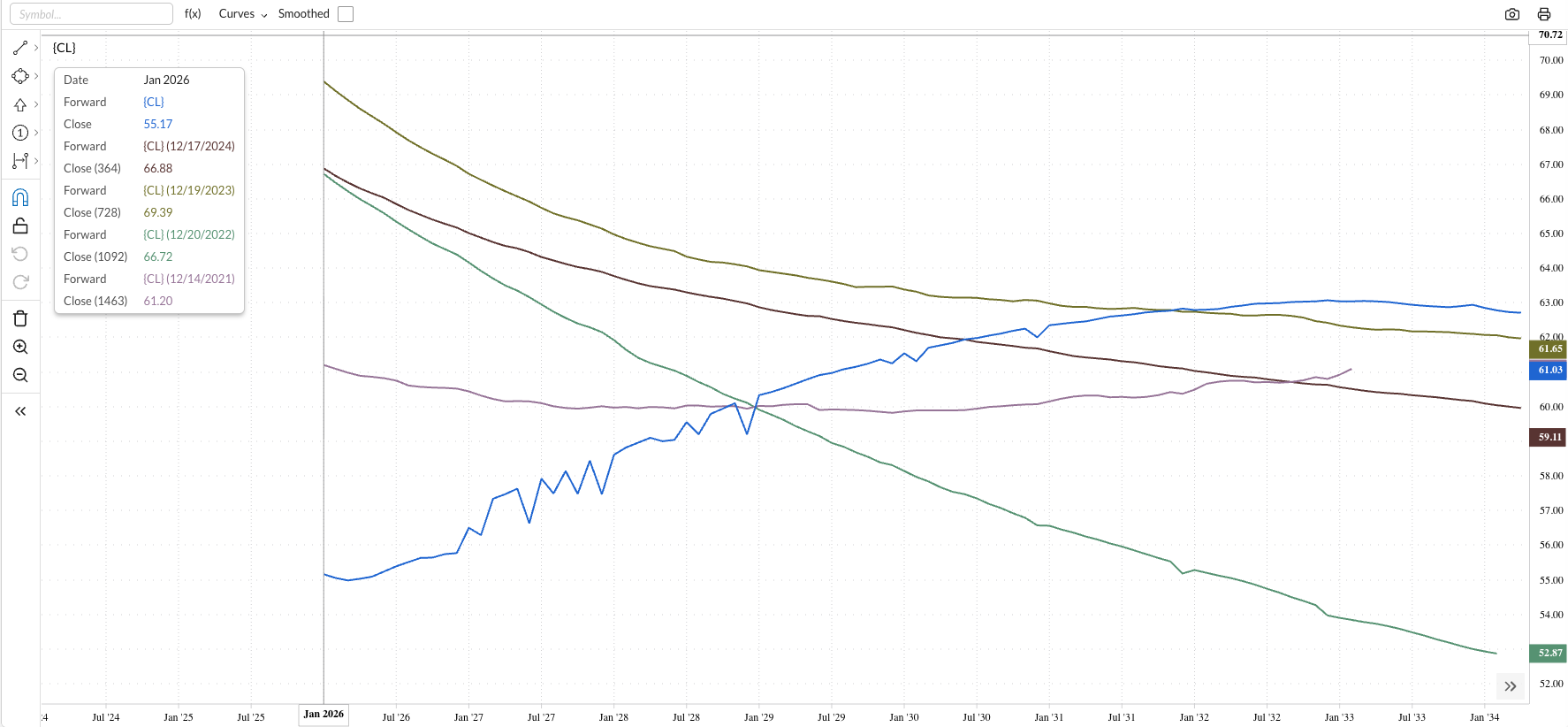

Despite WTI crude oil's backwardated forward curve the last number of years, investment money has been coming out of crude oil as much of the world looks at green technology.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.Based on the Law of Supply and Demand, and the spot-month WTI price falling to nearly 5-year lows, investors could wait to see what develops in crude oil.

As we approach the end of 2025, much of the chatter amongst talking heads on financial television has to do with investment money rolling out of equities and into other market sectors. I’ve been tracking the commodity complex as an investment arena rather than a casino for nearly four decades, looking for what sector might attract the next wave of investment money. As I’ve talked about before, the decision by investors tends to come down to long-term fundamentals. In some sectors, Grains and Softs in particular, this usually means long-term weather patterns. In other sectors, let’s clump Energies and Livestock together for now, it has to do with trends of physical supplies. What about the 3 rate cuts seen this past year, with the US president expected to lower rates at will in 2026? Will this spark a strong rally in commodities based on a collapsing US dollar? Not necessarily.

For today, though, I want to focus on the Energies sector, WTI crude oil in particular, as a possible gusher for investors next year. (Cue The Ballad of Jed Clampett)

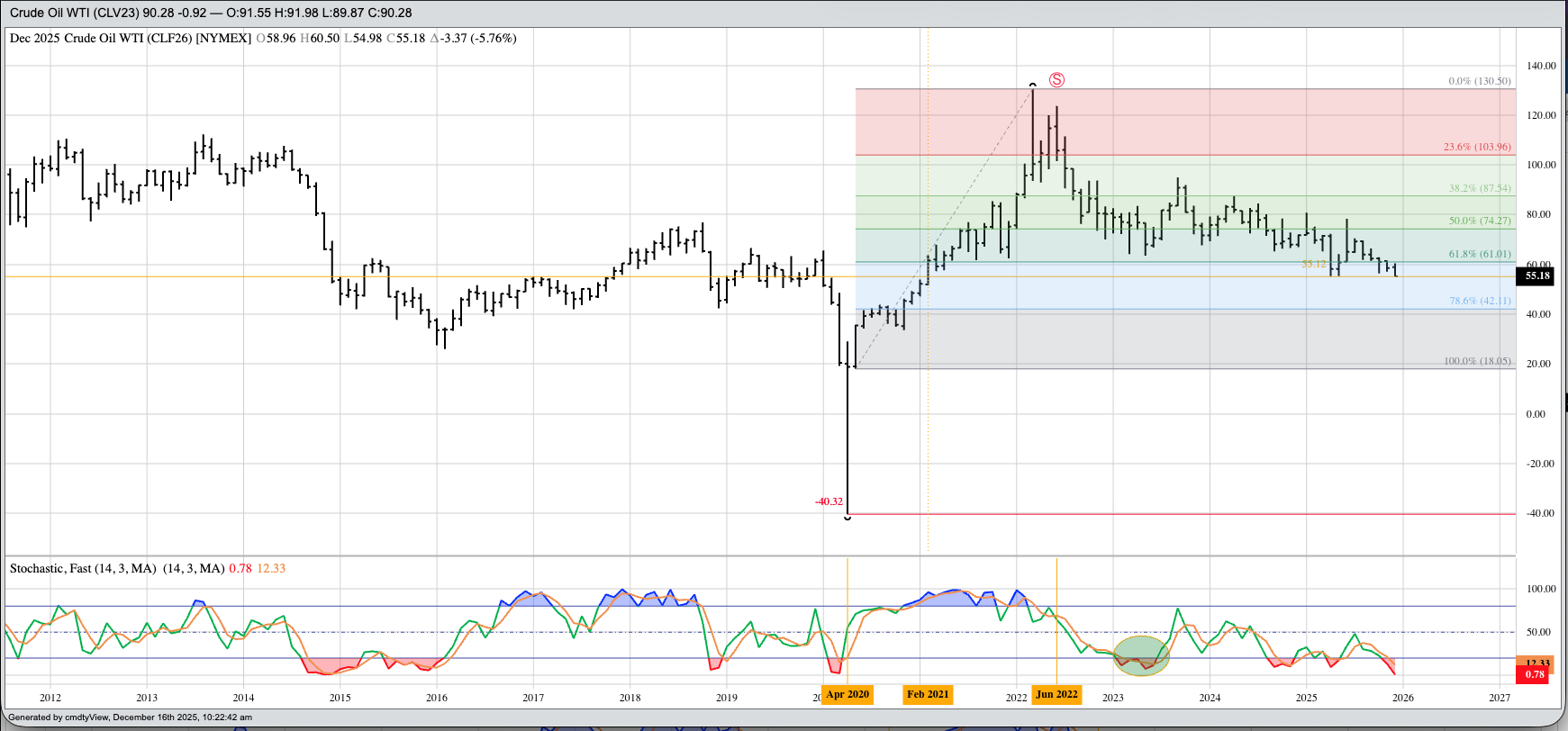

The long-term continuous monthly price chart for WTI crude oil can be interpreted as both bullish (technically) and bearish (fundamentally). Though I have my doubts about the usefulness of complicated technical analysis these days, let’s start with some simple analysis. The spot-month contract spiked $130.50 per barrel immediately after Russia’s illegal invasion of its neighbour and sovereign nation Ukraine. The US Biden administration moved to reduce the effects of the invasion by releasing barrels from the Strategic Petroleum Reserve, as well as increasing US crude oil production in an attempt to stabilize global markets. Following an early spring selloff and seasonal rally to a June 2022 high of $123.68, the spot-month contract completed a bearish 2-month reversal, sending the market into a major (long-term) downtrend it still finds itself in 3.5 years later.

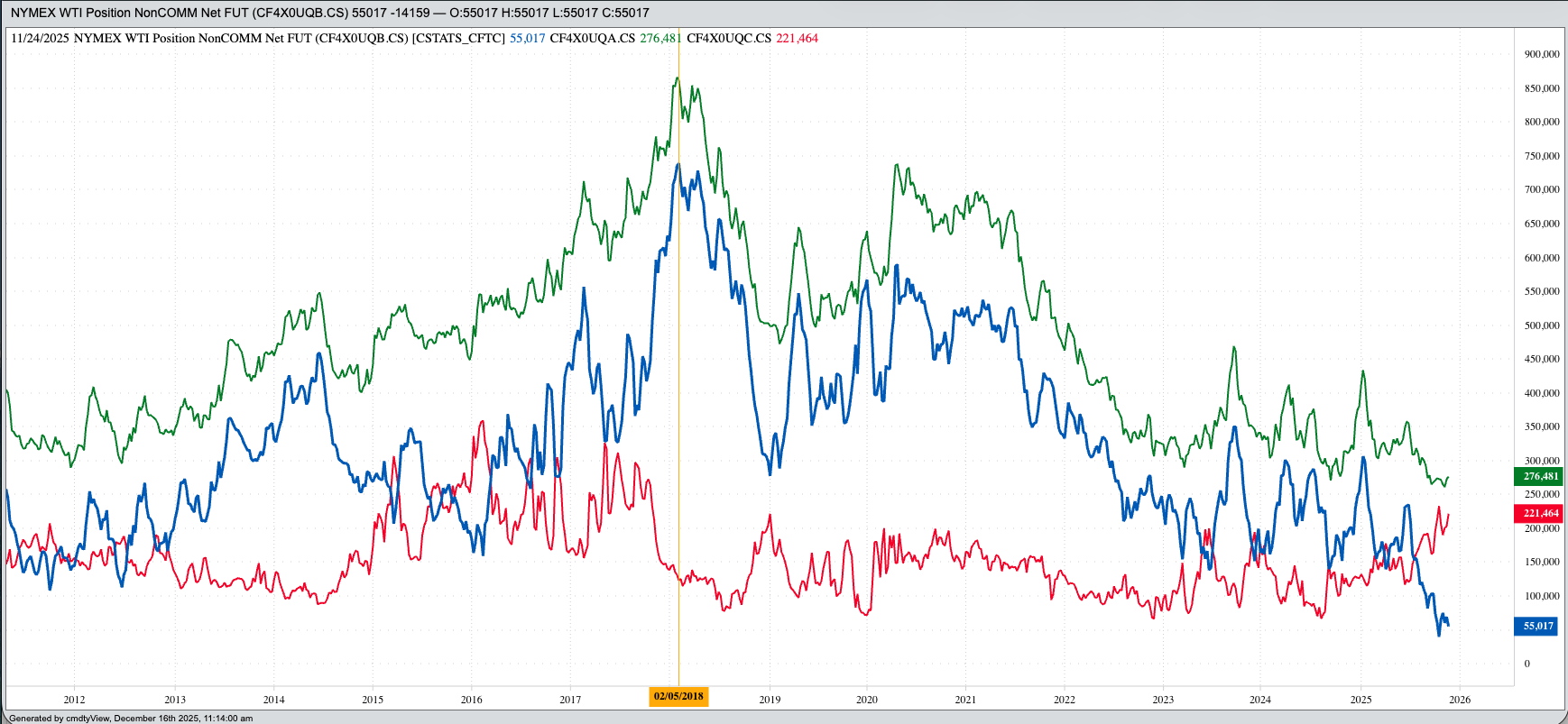

A look at the CFTC Commitments of Traders report (legacy, futures only) numbers gives us a good indication as to why the major trend remains down. The net-long futures position peaked at 739,097 contracts back in early February 2018. Surprisingly enough, this position did not change a great deal during the early days of Russia’s invasion, with the chart showing investment traders continued selling. This activity has not let up, with the net-long position being trimmed to only 39,800 contracts in late October 2025. As of this writing (December 2025), the spot-month contract (CLF26) has fallen below $55 for the first times since February 2021. From a technical point of view, again, WTI could be viewed as oversold with monthly stochastics well below 20% and a possible buying opportunity, but is it undervalued?

Here's where the fundamental picture gets a bit murky. Based on the economic Law of Supply and Demand, the very fact the spot price is at an almost 5-year low tells us supplies outweigh demand by more than what has been seen during that same time period. That is not bullish, but it fits with what all the “experts” are saying about a global oil glut as the rest of the world moves forward with green technology and electric vehicles (see also the trend in silver (SIY00) as an industrial metal) while the current US administration views “green” as a 4-letter word (don’t ask me) and is taking steps to make sure US drives burn as much gasoline (but not ethanol) as possible.

On the other hand, WTI crude oil’s forward curve has been in backwardation (inverted) for years, only in late 2025 showing a contango (carry) starting with the May 2026 contract. Historically, a market with a forward curve in backwardation was known to have a tight supply and demand situation, with the stronger the inverse the tighter supplies were in relation to demand. Therefore, if we viewed WTI crude oil’s real fundamental situation as bullish, despite what the “experts” say and spot price show, and we apply Newsom’s Market Rule #6 (Fundamentals win in the end), then we would likely come to the conclusion the market is indeed a good long-term buy and good be one of the more explosive opportunities this coming year.

But I’m not there yet. For whatever reason, funds did not move to get in line with fundamentals over the past number of years, and they were rewarded. Now that the fundamental picture is less bullish – again, the forward curve is showing a contango beyond May 2026 – there would be less incentive for long-term investors to buy. The other question, one that keeps me up at night, is if we are starting to lose futures spreads and forward curves as a read on real supply and demand. There are getting to be more examples of this as algorithm-driven trade increases its control over futures markets. If we’ve lost forward curves and spreads, we are left with spot-price alone, and we all know that can be skewed and/or manipulated by one action or social media post from one person at any time. (The latest occurring overnight through early Wednesday morning, just as I posted this piece.)

The bottom line is I do not see WTI crude oil as the next big investment opportunity. Things could change, of course, but that hasn’t happened in nearly four years.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart