The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how life sciences tools & services stocks fared in Q3, starting with 10x Genomics (NASDAQ: TXG).

The life sciences tools and services sector supports biotech and pharmaceutical R&D and commercialization by providing lab equipment, data analytics, and clinical trial services. These companies benefit from recurring revenue and high margins on specialized products. Looking ahead, the sector is supported by tailwinds like advancements in genomics, personalized medicine, and the use of AI in drug discovery. However, the persistent challenge is dependence on the R&D budgets of large pharmaceutical companies and the volatility of smaller biotech firms. Future headwinds include uncertain research funding and pricing pressures from cost-conscious customers.

The 21 life sciences tools & services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 1% below.

Thankfully, share prices of the companies have been resilient as they are up 9.2% on average since the latest earnings results.

Best Q3: 10x Genomics (NASDAQ: TXG)

Founded in 2012 by scientists seeking to overcome limitations in traditional biological research methods, 10x Genomics (NASDAQ: TXG) develops instruments, consumables, and software that enable researchers to analyze biological systems at single-cell resolution and spatial context.

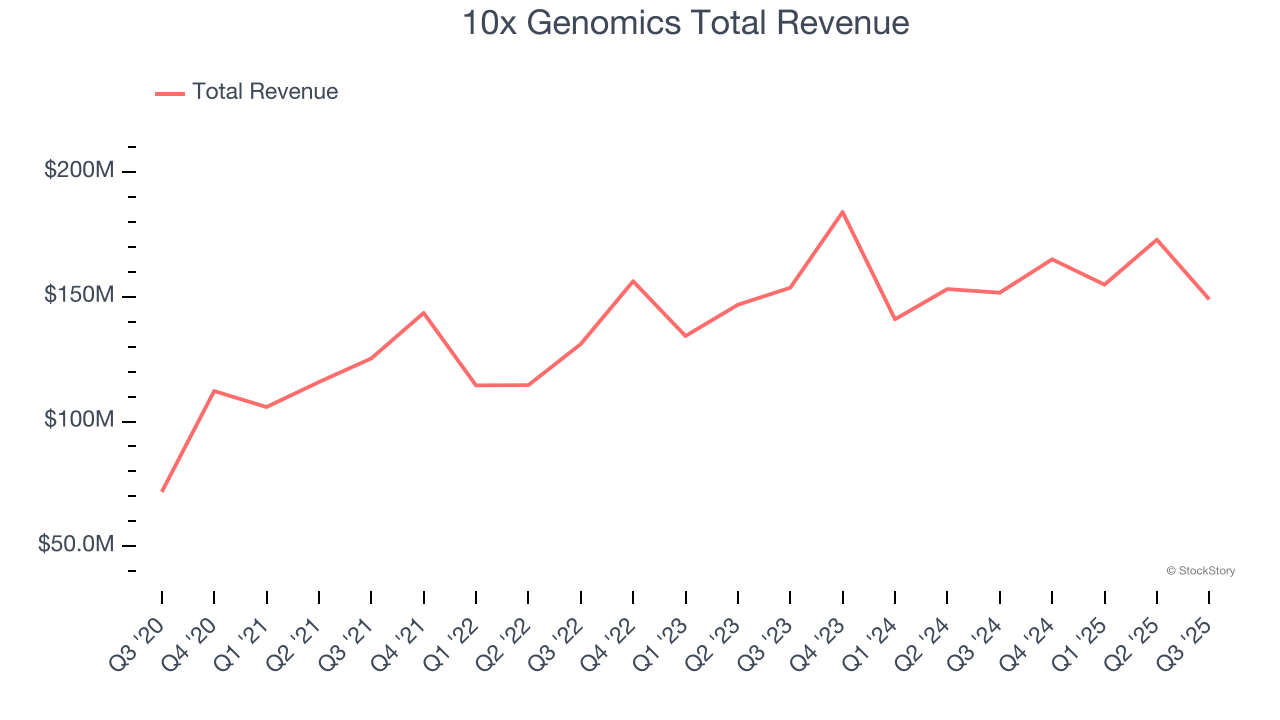

10x Genomics reported revenues of $149 million, down 1.7% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

"Our team delivered a solid third quarter, and we continue to see notable enthusiasm for our single cell and spatial products," said Serge Saxonov, Co-founder and CEO of 10x Genomics.

Interestingly, the stock is up 37% since reporting and currently trades at $17.81.

Is now the time to buy 10x Genomics? Access our full analysis of the earnings results here, it’s free for active Edge members.

Sotera Health Company (NASDAQ: SHC)

With a critical role in ensuring the safety of millions of patients worldwide, Sotera Health (NASDAQGS:SHC) provides sterilization services, lab testing, and advisory services to ensure medical devices, pharmaceuticals, and food products are safe for use.

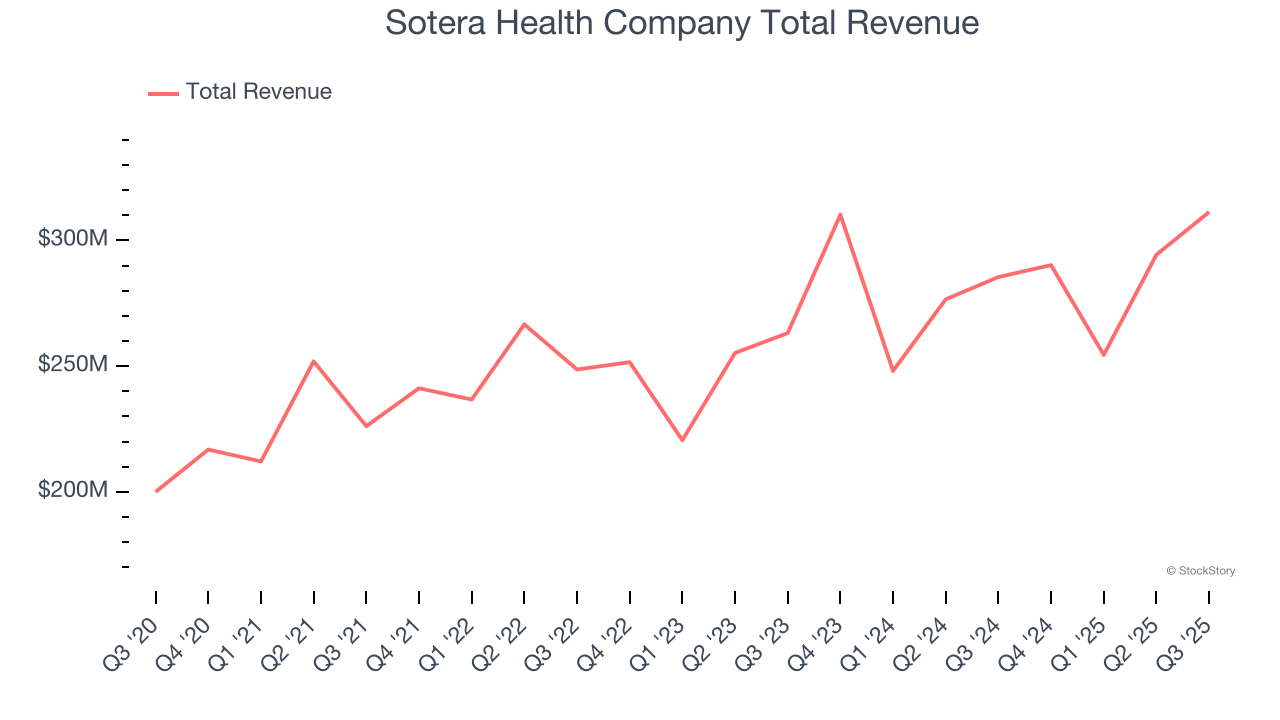

Sotera Health Company reported revenues of $311.3 million, up 9.1% year on year, outperforming analysts’ expectations by 2.6%. The business had an exceptional quarter with a solid beat of analysts’ full-year EPS guidance and organic revenue estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $16.75.

Is now the time to buy Sotera Health Company? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Avantor (NYSE: AVTR)

With roots dating back to 1904 and embedded in virtually every stage of scientific research and production, Avantor (NYSE: AVTR) provides mission-critical products, materials, and services to customers in biopharma, healthcare, education, and advanced technology industries.

Avantor reported revenues of $1.62 billion, down 5.3% year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted a slight miss of analysts’ revenue estimates and a miss of analysts’ organic revenue estimates.

Avantor delivered the slowest revenue growth in the group. As expected, the stock is down 26.9% since the results and currently trades at $11.02.

Read our full analysis of Avantor’s results here.

Charles River Laboratories (NYSE: CRL)

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE: CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

Charles River Laboratories reported revenues of $1.00 billion, flat year on year. This number surpassed analysts’ expectations by 1.1%. It was a satisfactory quarter as it also produced a narrow beat of analysts’ organic revenue estimates.

The stock is up 3.3% since reporting and currently trades at $183.71.

Agilent (NYSE: A)

Originally spun off from Hewlett-Packard in 1999 as its measurement and analytical division, Agilent Technologies (NYSE: A) provides analytical instruments, software, services, and consumables for laboratory workflows in life sciences, diagnostics, and applied chemical markets.

Agilent reported revenues of $1.86 billion, up 9.4% year on year. This print beat analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ organic revenue estimates and a narrow beat of analysts’ revenue estimates.

The stock is down 5.9% since reporting and currently trades at $144.76.

Read our full, actionable report on Agilent here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.