Chicken Soup for the Soul Entertainment, Inc. (CSSE), a video streaming company, is struggling with mounting losses. Although management projects an increase in revenue and cash flow this year, along with potential scaling of operations and debt reduction, the short-term prospects for regaining profitability remain uncertain.

Shares of the company have lost 64.1% since the start of the year and 28.4% over the past month. However, Chairman & CEO William Rouhana recently purchased 74% more of shares of the company, indicating some level of internal confidence. But to make an informed decision, let’s look at some of the key metrics.

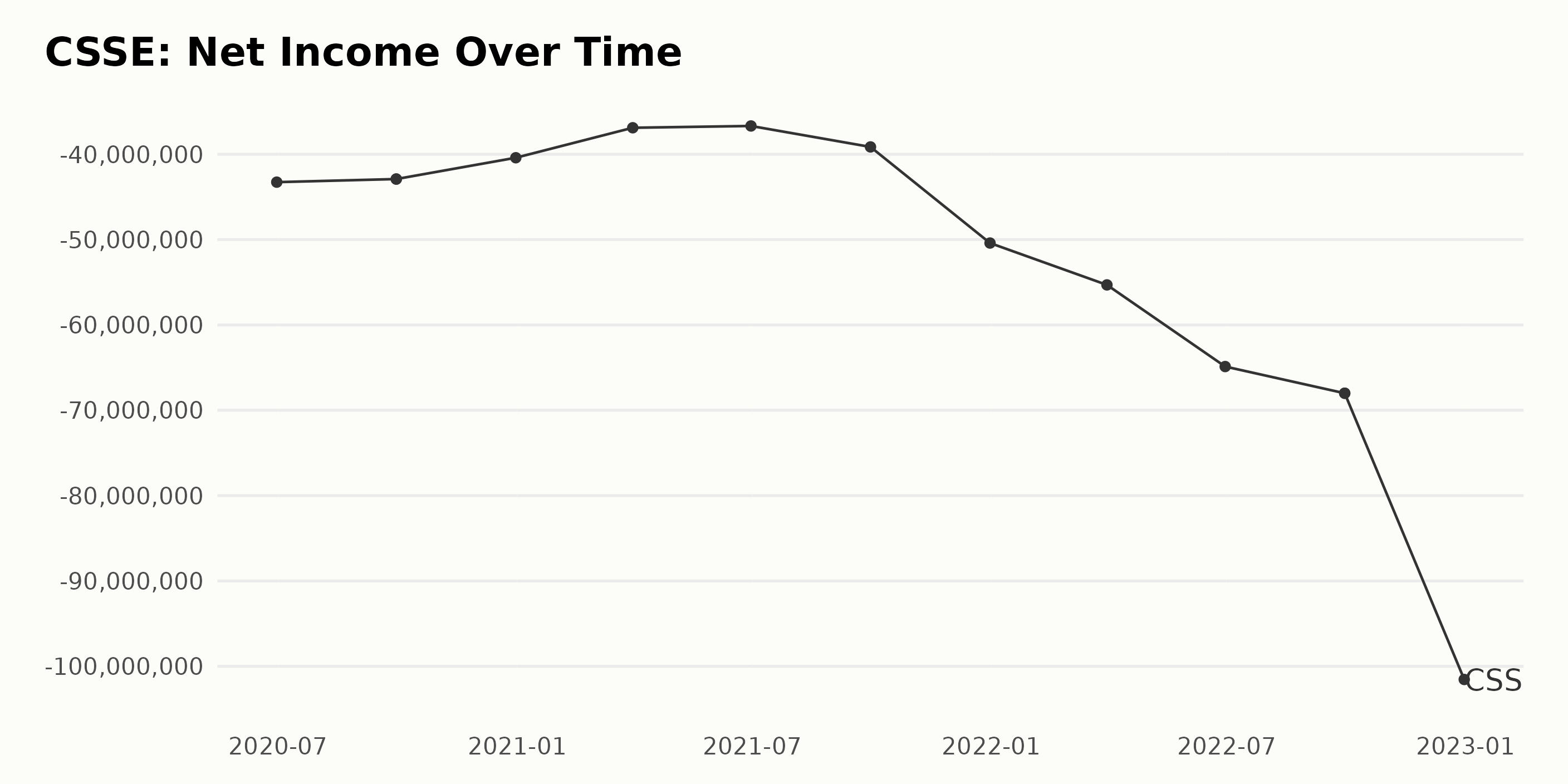

Tracking Chicken Soup for the Soul Entertainment Inc. (CSSE) Net Income & Margin Trends

The net income of CSSE has been generally decreasing over the past couple of years and was most recently reported at negative $101.5 million on December 31, 2022. Compared to the first report on June 30, 2020 (negative $43.3 million), the net income has decreased by 136%, exhibiting a steep decline. There have been some fluctuations in the net income since then, with the amount increasing up to negative $36.7 million on June 30, 2021, before decreasing again.

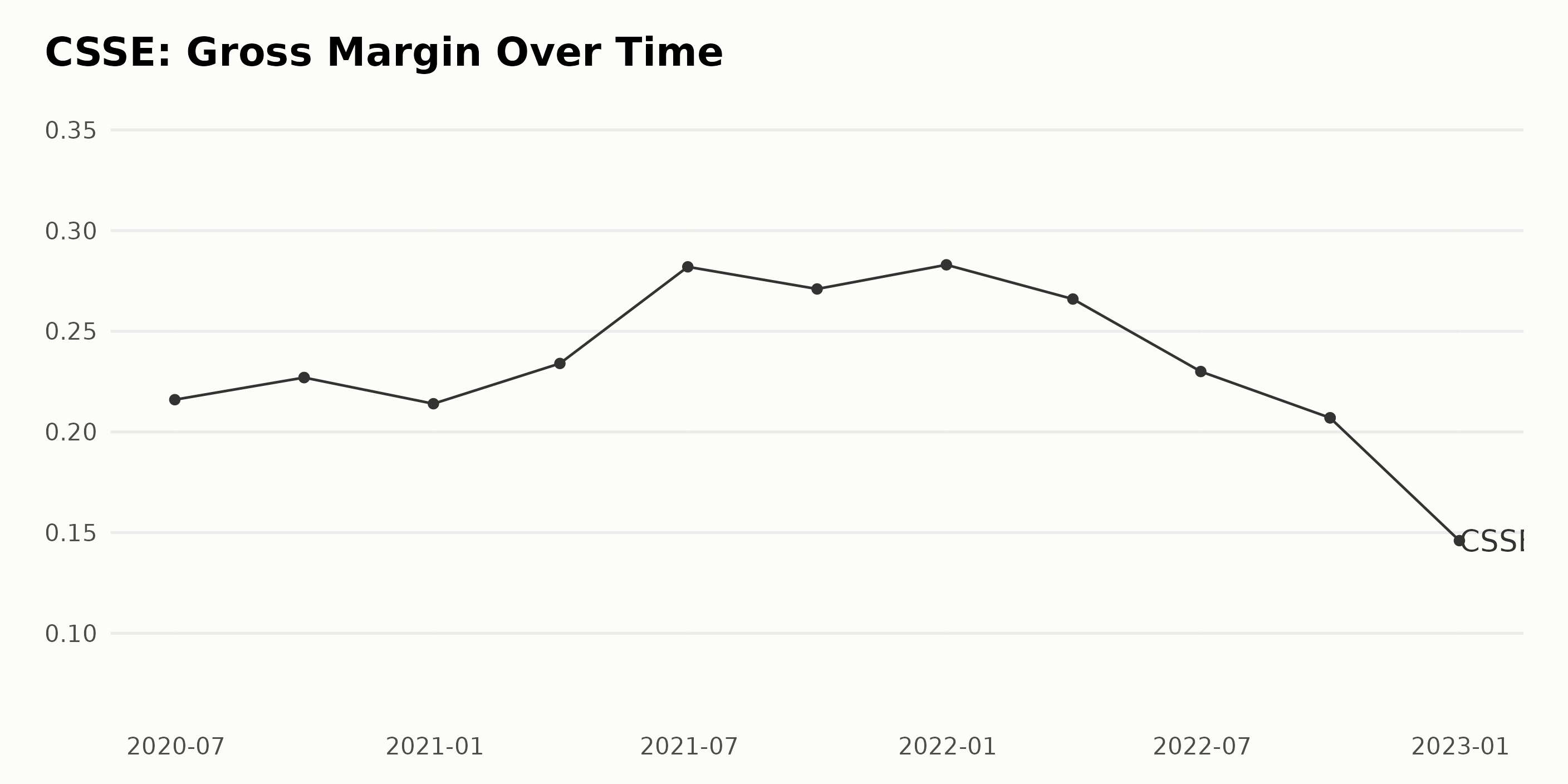

The CSSE’s gross margin has shown a gradual increasing trend — from 21.6% on June 30, 2020 to 28.3% as of December 31, 2022. This growth rate can be calculated by measuring the last value from the first value, which yields a 30% increase. Fluctuations have been seen in this series of data, mainly at an interval of 3 months, reaching the highest value of 28.3% in December 2021 and the lowest point of 14.6% in December 2022.

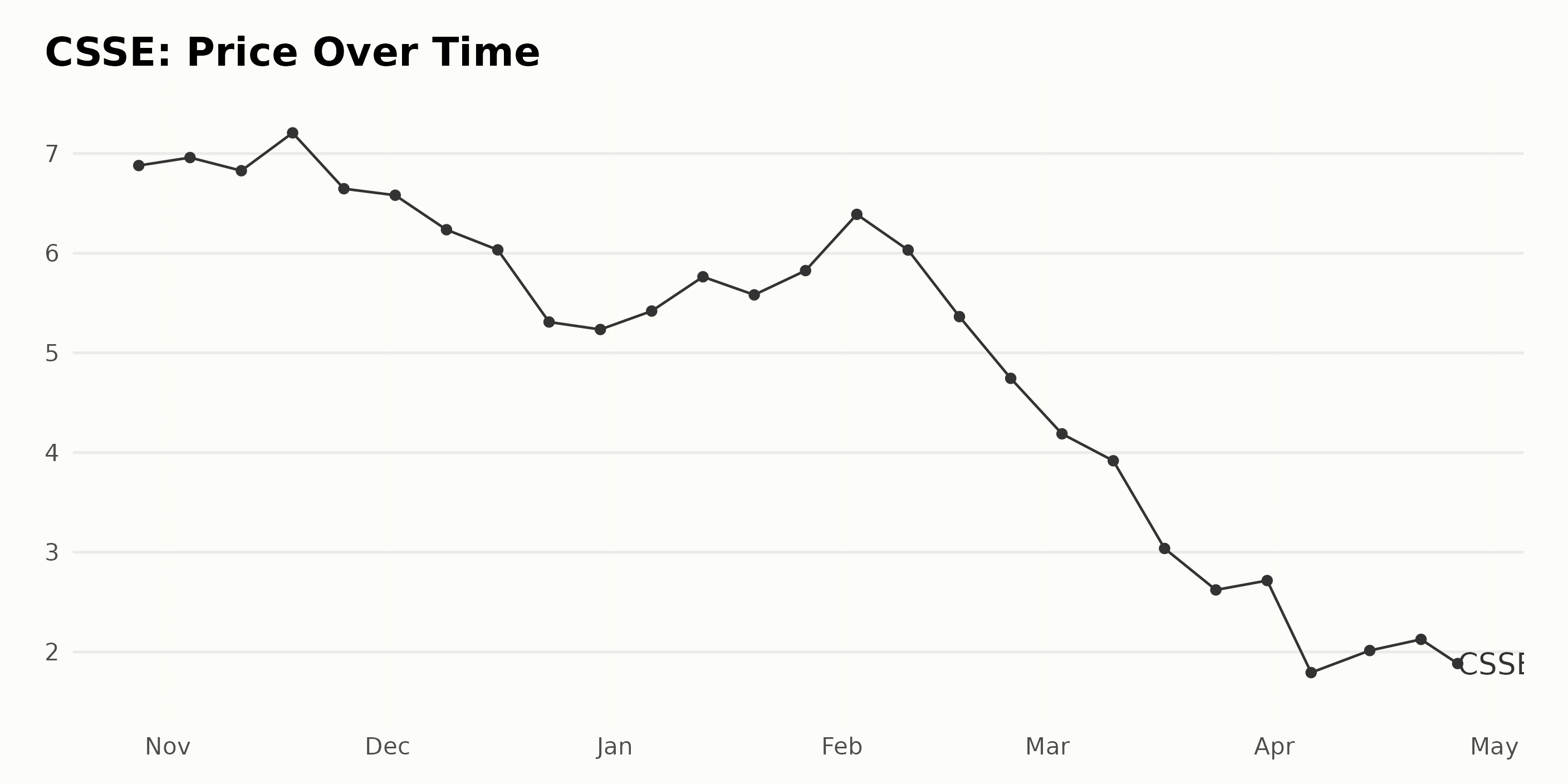

CSSE Stock Prices Plunge 73% Over 6 Months

The trend of CSSE stock prices is decreasing. The stock price has decreased from a high of $6.88 on October 28, 2022, to a low of $1.8775 on April 25, 2023, a decrease of over 73%. The rate of decrease in the share prices has been accelerating since January 2023. Here is a chart of CSSE’s price over the past 180 days.

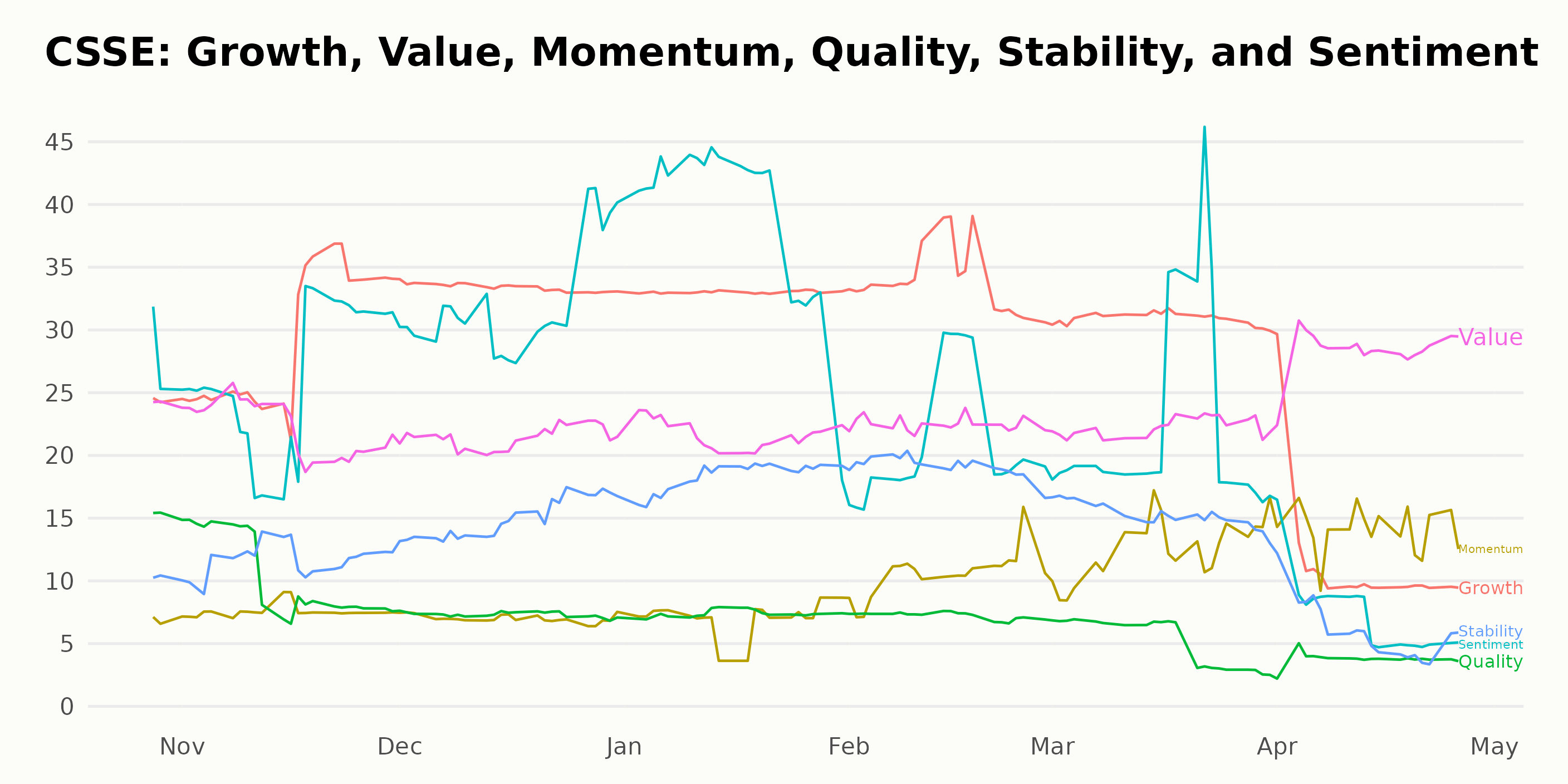

CSSE POWR Ratings: Analyzing Growth, Sentiment & Value

CSSE has an overall rating of F, translating to a Strong Sell in our POWR Ratings system. It is ranked last among the 14 stocks in the Entertainment - Media Producers category as of April 25, 2023.

It also has an F grade for Quality and a D for Growth, Momentum, Stability, and Sentiment.

Stock to Consider Instead of Chicken Soup for the Soul Entertainment, Inc. (CSSE)

In the Entertainment - Media Producers sector, Vivendi (VIVHY), with better POWR Ratings, may be worth considering.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

CSSE shares were trading at $1.86 per share on Wednesday morning, up $0.02 (+1.09%). Year-to-date, CSSE has declined -63.67%, versus a 6.36% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Investment Alert: Steer Clear of This Media Stock to Avoid Disaster This Week appeared first on StockNews.com