Blackstone trades at $158.06 per share and has stayed right on track with the overall market, gaining 21.1% over the last six months. At the same time, the S&P 500 has returned 22.9%.

Is now the time to buy BX? Find out in our full research report, it’s free for active Edge members.

Why Do Investors Watch BX Stock?

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE: BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

Three Positive Attributes:

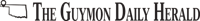

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Luckily, Blackstone’s revenue grew at an impressive 17.9% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

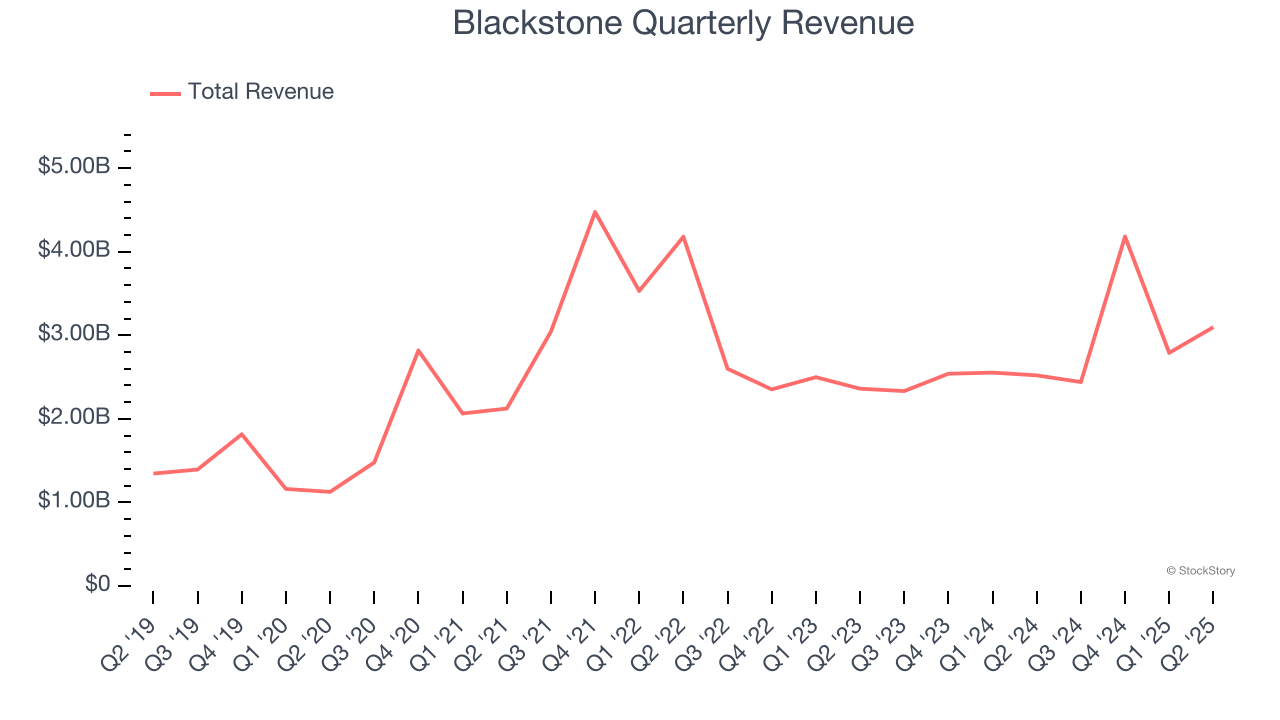

2. Fee-Related Earnings Jumped Higher

Topline performance tells part of the story, but sustainable profitability is the real measure of success. In the asset management space, fee-related earnings isolate the consistent profits from ongoing fee-based operations, filtering out the volatility of performance fees and investment income. This gives us a clear view of the company’s recurring earnings potential.

Blackstone’s annual fee-related earnings growth over the last five years was 23.4%, a top-notch result.

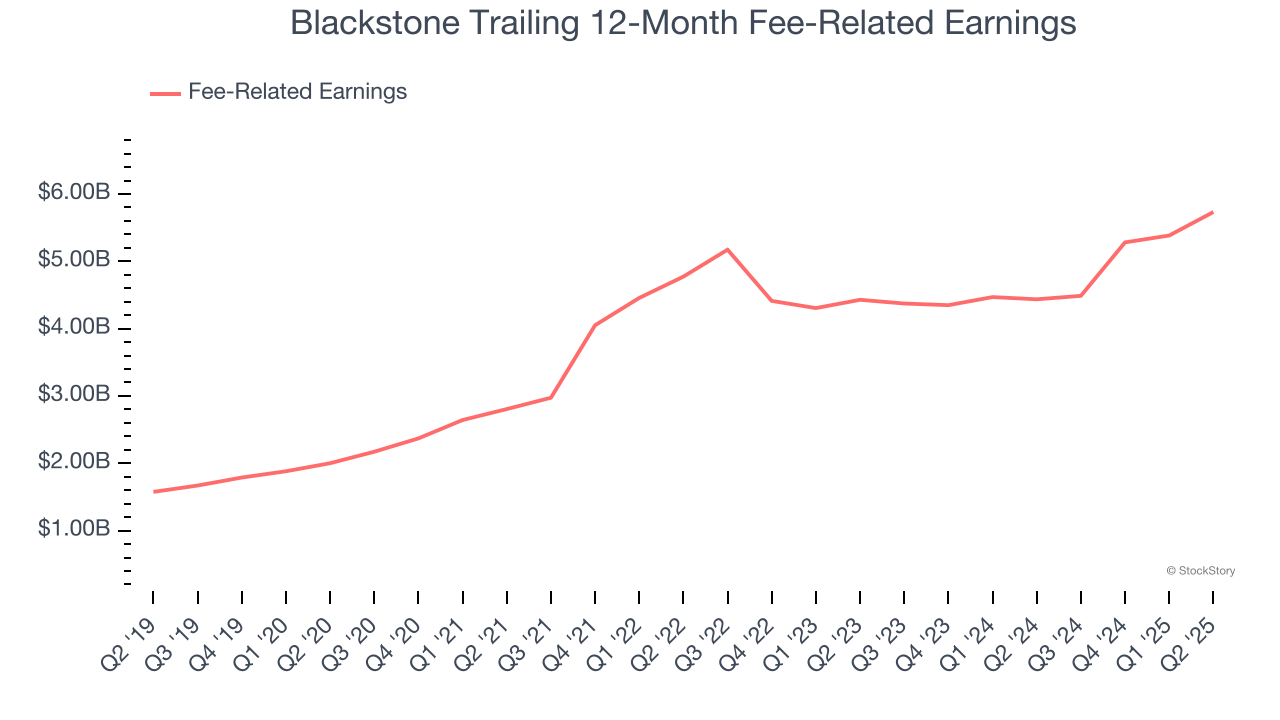

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Blackstone’s EPS grew at a remarkable 19.9% compounded annual growth rate over the last five years, higher than its 17.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Blackstone possesses several positive attributes, but at $158.06 per share (or 27.6× forward P/E), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.