Over the last six months, F&G Annuities & Life’s shares have sunk to $29.58, producing a disappointing 15% loss - a stark contrast to the S&P 500’s 25.5% gain. This might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for FG? Find out in our full research report, it’s free for active Edge members.

Why Is FG a Good Business?

Founded in 1959 and serving approximately 677,000 policyholders who rely on its financial protection products, F&G Annuities & Life (NYSE: FG) provides fixed annuities, life insurance, and pension risk transfer solutions to retail and institutional clients.

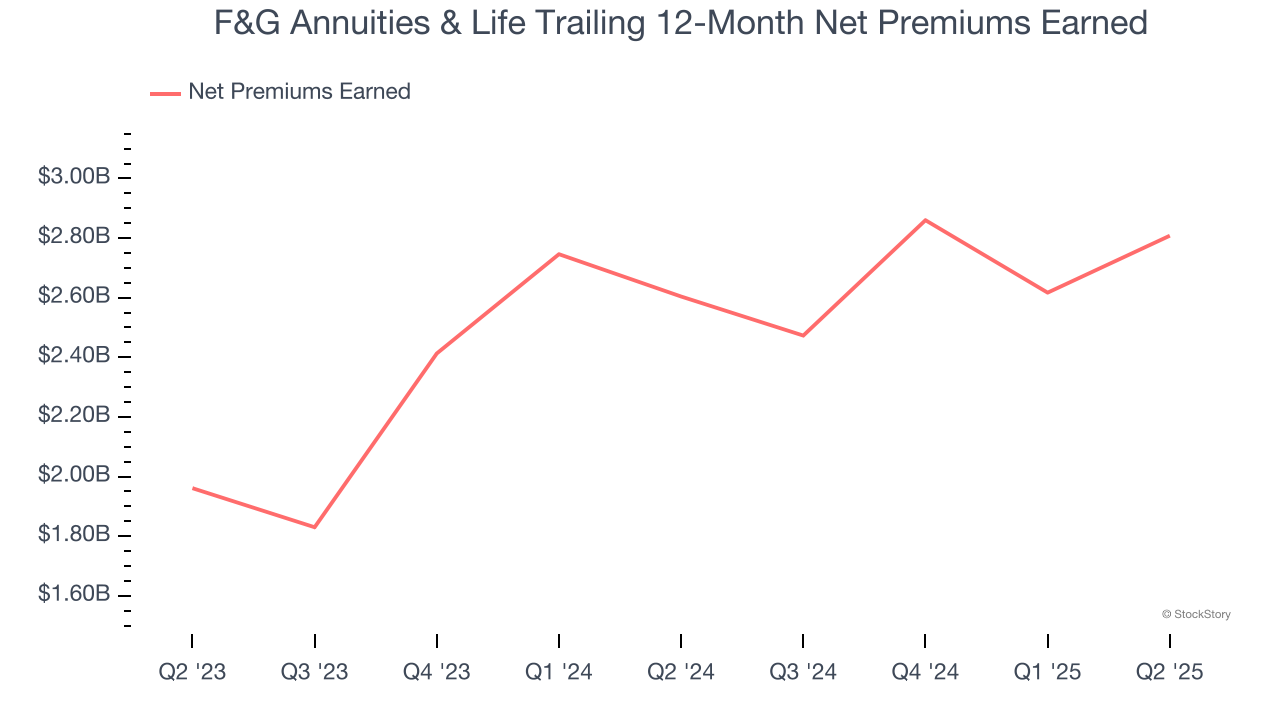

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

F&G Annuities & Life’s net premiums earned has grown at a 19.7% annualized rate over the last two years, much better than the broader insurance industry.

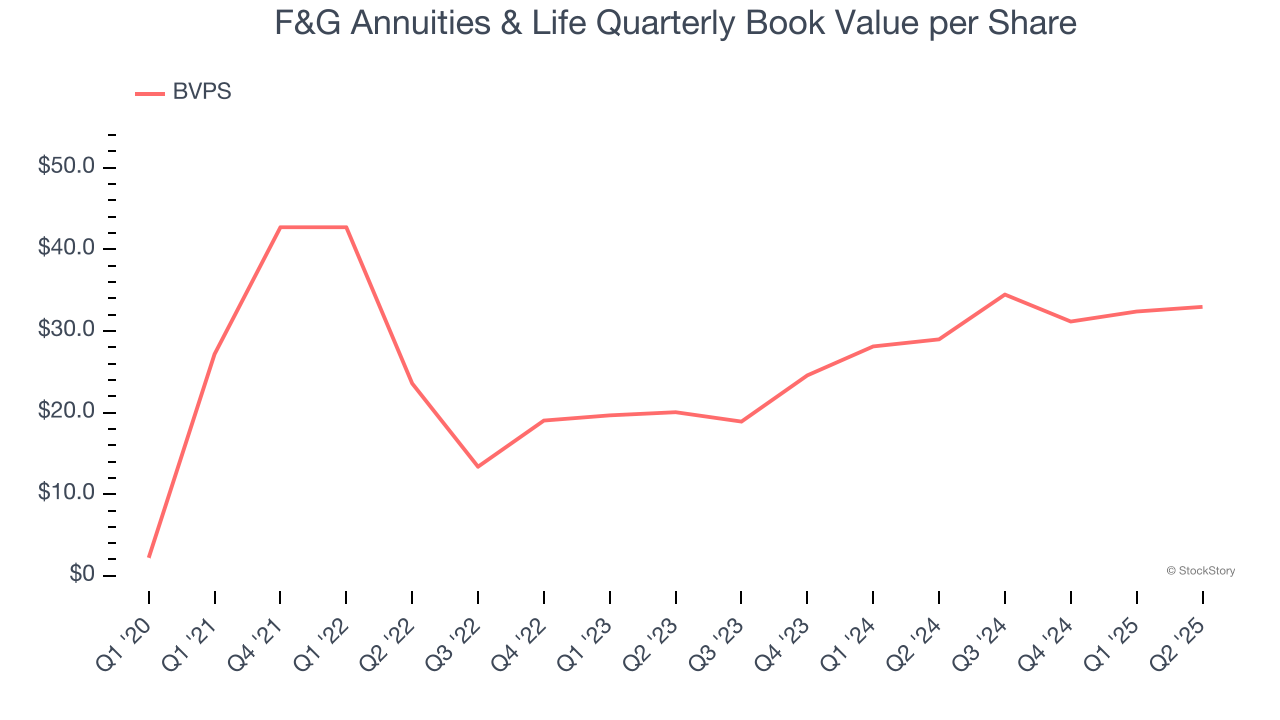

2. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Fortunately for investors, F&G Annuities & Life’s BVPS grew at an incredible 28.2% annual clip over the last two years.

3. Projected BVPS Growth Is Remarkable

An insurer’s book value per share (BVPS) increases when it maintains a profitable pre-tax profit margin and effectively manages its investment portfolio.

Over the next 12 months, Consensus estimates call for F&G Annuities & Life’s BVPS to grow by 48.8% to $45.29, elite growth rate.

Final Judgment

These are just a few reasons why we're bullish on F&G Annuities & Life. With the recent decline, the stock trades at 0.8× forward P/B (or $29.58 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.