The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how marine transportation stocks fared in Q2, starting with Genco (NYSE: GNK).

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

The 5 marine transportation stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 5.3%.

While some marine transportation stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

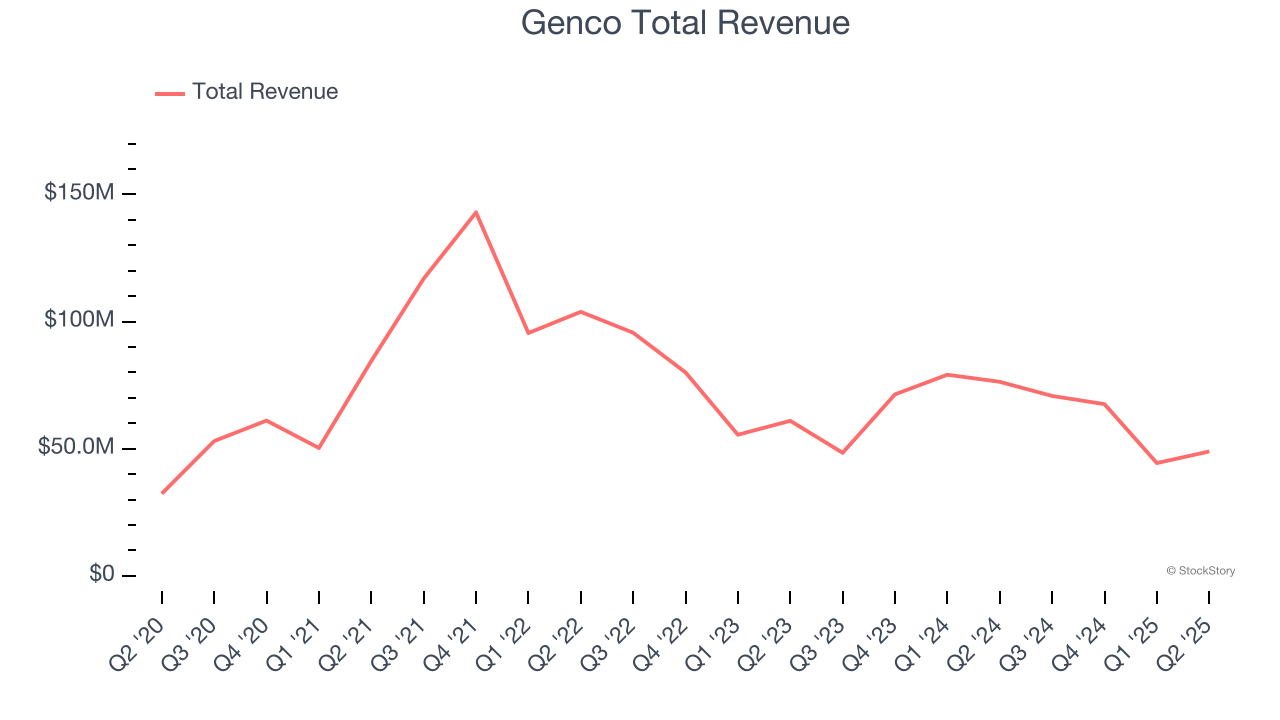

Weakest Q2: Genco (NYSE: GNK)

Headquartered in NYC, Genco (NYSE: GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

Genco reported revenues of $48.91 million, down 35.9% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates and a slight miss of analysts’ EBITDA estimates.

John C. Wobensmith, Chief Executive Officer, commented, “We continue to execute on our differentiated value strategy, as we position the Company to return capital to shareholders and expand our earnings power through drybulk market cycles. Declaration of our Q2 dividend marks our 24th consecutive dividend, representing the longest uninterrupted dividend period among our drybulk peer group. Including Q2, total dividends to shareholders will amount to $6.915 per share, or approximately 41% of our current share price.”

Genco delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 4.2% since reporting and currently trades at $16.02.

Read our full report on Genco here, it’s free for active Edge members.

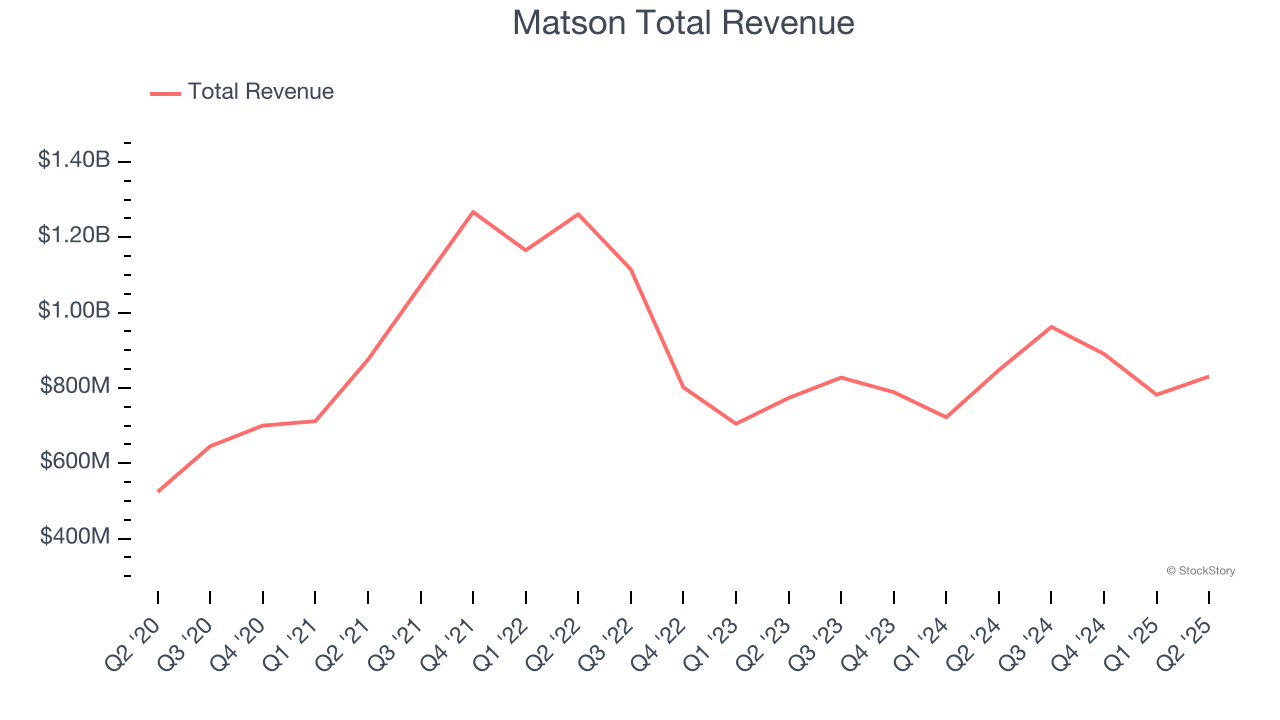

Best Q2: Matson (NYSE: MATX)

Founded by a Swedish orphan, Matson (NYSE: MATX) is a provider of ocean transportation and logistics services.

Matson reported revenues of $830.5 million, down 2% year on year, outperforming analysts’ expectations by 2.6%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 12.8% since reporting. It currently trades at $93.22.

Is now the time to buy Matson? Access our full analysis of the earnings results here, it’s free for active Edge members.

Kirby (NYSE: KEX)

Transporting goods along all U.S. coasts, Kirby (NYSE: KEX) provides inland and coastal marine transportation services.

Kirby reported revenues of $855.5 million, up 3.8% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a mixed quarter.

As expected, the stock is down 27.7% since the results and currently trades at $86.87.

Read our full analysis of Kirby’s results here.

Scorpio Tankers (NYSE: STNG)

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Scorpio Tankers reported revenues of $222.8 million, down 40.4% year on year. This result beat analysts’ expectations by 1.7%. It was a stunning quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Scorpio Tankers had the slowest revenue growth among its peers. The stock is up 32.4% since reporting and currently trades at $59.75.

Read our full, actionable report on Scorpio Tankers here, it’s free for active Edge members.

Pangaea (NASDAQ: PANL)

Established in 1996, Pangaea Logistics (NASDAQ: PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Pangaea reported revenues of $156.7 million, up 19.2% year on year. This print surpassed analysts’ expectations by 21.2%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ revenue estimates and EPS in line with analysts’ estimates.

Pangaea delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 1.9% since reporting and currently trades at $4.92.

Read our full, actionable report on Pangaea here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.