- Global Mineral Resource Estimate: 3.4 Million Ounces (@ 1.50 g/t Au) Indicated and 1.7 million Ounces (@ 2.17 g/t) Inferred

- Open-Pit Mineral Resource Estimate: 2.8 Million Ounces (@ 1.45 g/t Au) Indicated and 0.8 Million Ounces (@ 2.32 g/t Au) Inferred

Nighthawk Gold Corp. (“Nighthawk” or the “Company”) (TSX: NHK; OTCQX: MIMZF) is pleased to report an updated Mineral Resource Estimate1 (the “2023 MRE”) on the Colomac Gold Project (the “Project”), located 200 kilometres (“km”) north of Yellowknife, Northwest Territories, Canada (please see Table 1 for the 2023 MRE Summary). The 2023 MRE demonstrates a significant expansion of the open-pit (“OP”) mineralization compared to the estimates reported in 20222 (“2022 Estimate”) and the potential for a future large-scale, OP project within the Company’s District-Scale exploration land package.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230209005475/en/

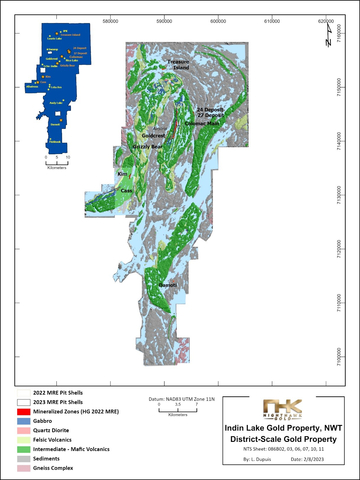

Figure 1 - District-Scale Gold Property Map – Northwest Territories, Canada (Graphic: Business Wire)

Table 1: 2023 MRE Summary1** (Effective date of February 9, 2023). Please review “Notes to Accompany the 2023 MRE” at the end of the news release for additional information.

|

Indicated Mineral Resource |

Inferred Mineral Resource |

||||

Potential mining method |

Tonnes (000s) |

Grade (g/t Au) |

Contained gold ounces |

Tonnes (000s) |

Grade (g/t Au) |

Contained gold ounces |

Open Pit (OP) |

59,846 |

1.45 |

2,804,000 |

10,773 |

2.32 |

802,000 |

Underground (UG) |

10,486 |

1.73 |

584,000 |

13,526 |

2.05 |

889,000 |

Global (OP + UG) |

70,432 |

1.50 |

3,388,000 |

24,299 |

2.17 |

1,691,000 |

**Numbers may not add up due to rounding.

Highlights:

- 36% Increase in the total OP Indicated Mineral Resource estimate ounces and a +5% increase in grade compared to the 2022 Estimate2 (See Table 2);

- 34% Increase in the total OP Inferred Mineral Resource estimate ounces and a 3% decrease in grade compared to the 2022 Estimate2 (See Table 2);

- 26% Increase in the Global Indicated Mineral Resource estimate ounces and a +4% in grade compared to the 2022 Estimate2 (See Table 2);

- 27% Increase in the Global Inferred Mineral Resource estimate ounces and a +3% increase in grade compared to the 2022 Estimate2 (See Table 2); and

- Maiden Colomac Gold Project Preliminary Economic Assessment (“PEA”) scheduled to be completed mid-2023.

Table 2: Comparison between 2023 MRE1** and 2022 Estimate2** – OP and UG Mineralization. Please review “Notes to Accompany the 2023 MRE” at the end of the news release for additional information.

Category |

Tonnes (000 tonnes) |

Grade (g/t Au) |

Contained Gold Ounces |

||||||

2023

|

2022

|

Change |

2023

|

2022

|

Change |

2023

|

2022

|

Change |

|

OP |

|

|

|

|

|

|

|

|

|

Indicated |

59,845 |

46,402 |

29% |

1.45 |

1.38 |

5% |

2,804,000 |

2,062,400 |

36% |

Inferred |

10,773 |

7,831 |

38% |

2.32 |

2.39 |

-3% |

802,000 |

601,000 |

34% |

UG |

|

|

|

|

|

|

|

|

|

Indicated |

10,486 |

11,761 |

-11% |

1.73 |

1.65 |

5% |

584,000 |

624,700 |

-7% |

Inferred |

13,526 |

11,858 |

14% |

2.05 |

1.91 |

7% |

888,000 |

729,500 |

22% |

Global (OP+UG) |

|

|

|

|

|

|

|

|

|

Indicated |

70,432 |

58,163 |

21% |

1.50 |

1.44 |

4% |

3,388,000 |

2,687,100 |

26% |

Inferred |

24,299 |

19,689 |

23% |

2.17 |

2.10 |

3% |

1,691,000 |

1,330,500 |

27% |

**Numbers may not add up due to rounding.

Nighthawk President and CEO Keyvan Salehi, P.Eng. commented: “Our 2023 MRE demonstrates a significant boost in estimated ounces in the Indicated and Inferred categories compared to last year. More importantly, the OP mineralization has reached 2.8 million estimated ounces in the Indicated category and 0.8 million ounces in the Inferred category. The improvement in the estimated OP Indicated grades is noteworthy considering that we utilized a lower cut-off grade for all the deposits compared to the 2022 Estimate.”

“Over the past 2 years, we have increased the estimated OP ounces in the Indicated category by 415% and the Inferred category by 2,470%, while maintaining estimated OP gold grades that are well above the average for OP deposits of projects in advanced development. In addition, a substantial amount of the 2023 MRE tonnes and ounces are in the Indicated category, which we believe provides a higher level of confidence in our estimates.”

“The next major step of our turnaround plan is to deliver a PEA for the Project in mid-2023. Given the size of the OP Mineral Resource estimate ounces, with elevated estimated OP grades, we believe that if the Project is developed, it could have the potential to be a top-tier gold project with respect to size, scale, and economics, located in a mining-friendly jurisdiction.”

“Looking ahead, we are excited about our 2023 exploration plans. We believe there is a massive potential for discovering more gold mineralization across our 930 km2 district-scale property. All our deposits remain open in all directions and show great promise for further expansion in mineral resource ounces.”

2023 MRE1

The 2023 MRE1 benefits from an additional 40 km of drilling information collected in 2022, which targeted areas of higher-grade, near-surface mineralization. The 2023 MRE is comprised of eight (8) deposits (See Table 3 for the 2023 MRE Breakdown by Deposit):

- Four (4) deposits located in the Colomac Centre area: Colomac Main, 24/27, Grizzly Bear, and Goldcrest; and

- Four (4) higher-grade Satellite Deposits located 11 to 28 km from the Colomac Centre: Cass, Kim, Damoti, and Treasure Island

Please refer to Figure 1 for a regional map of the District-Scale Gold Property. Please refer to Figures 2 and 3 for the 2023 MRE section views of the Colomac Main and Cass Deposit, respectively.

The 2023 MRE was generated using various cut-off grades: Between 0.45-0.57 g/t Au for OP mineralization and 1.02-1.66 g/t Au for UG depending on the deposit (please refer to Table 4 for cut-off grades for each deposit). Specific extraction methods are used only to establish reasonable cut-off grades for various portions of the deposits. No PEA, Pre-Feasibility Study or Feasibility Study has been completed to support economic viability and technical feasibility of exploiting any portion of the mineral resources, by any specified mining method. The reasonable prospect for an eventual economical extraction is met by having used reasonable cut-off grades both for OP and UG extraction scenarios and constraining volumes (shapes and optimized pit-shell). Please refer to “Notes to Accompany the 2023 MRE” at the end of the news release for more information on the parameters and assumptions.

Table 3: 2023 MRE1** – Breakdown by Deposit

|

|

Indicated Mineral Resource |

Inferred Mineral Resource |

||||

|

Mining

|

Tonnes

|

Grade

|

Contained

|

Tonnes

|

Grade

|

Contained

|

Colomac Centre |

|||||||

Colomac Main |

OP |

54504 |

1.45 |

2,548,000 |

2,625 |

1.97 |

166,000 |

UG |

8,750 |

1.77 |

498,000 |

10,017 |

1.97 |

634,000 |

|

24/27 |

OP |

1,451 |

1.75 |

82,000 |

15 |

1.51 |

700 |

UG |

514 |

1.55 |

26,000 |

305 |

1.97 |

19,000 |

|

Goldcrest |

OP |

2,849 |

1.36 |

125,000 |

104 |

1.52 |

5,000 |

UG |

659 |

1.49 |

32,000 |

225 |

1.29 |

9,000 |

|

Grizzly Bear |

OP |

1,142 |

1.34 |

49,000 |

11 |

0.69 |

250 |

UG |

563 |

1.54 |

28,000 |

156 |

1.43 |

7,000 |

|

Satellite Deposits |

|||||||

Cass |

OP |

- |

- |

- |

3,983 |

2.36 |

302,000 |

UG |

- |

- |

- |

702 |

2.05 |

46,000 |

|

Kim |

OP |

- |

- |

- |

2,568 |

1.72 |

142,000 |

UG |

- |

- |

- |

662 |

1.88 |

40,000 |

|

Treasure Island |

OP |

- |

- |

- |

962 |

3.86 |

119,000 |

UG |

- |

- |

- |

857 |

3.01 |

83,000 |

|

Damoti |

OP |

- |

- |

- |

505 |

4.13 |

67,000 |

UG |

- |

- |

- |

601 |

2.60 |

50,000 |

|

Global |

OP + UG |

70,432 |

1.50 |

3,388,000 |

24,299 |

2.17 |

1,691,000 |

**Numbers may not add up due to rounding.

Colomac Main Deposit

Mineral Resource estimates at the Colomac Main expanded along strike to the south in Zone 3.5 and in the north at Zone 1.0 compared to the 2022 Estimate2. A significant portion of the UG mineralization at Zone 2.0 was converted to OP. The Colomac Main Deposit remains open in all directions and ongoing structural modeling will support mineralization controls and potential targeting for UG high-grade mineralization. With the successful continuation of mineralization to the south hosted in gabbro and quartz gabbro (compared to quartz diorite), the area to explore has expanded and allowed for potential new discovery. The average depth of the estimated pit-shells is approximately 200 m below surface, with the deepest portion at approximately 450 m below surface in Zone 2.0.

24/27 Deposit

The mineralization at the 24/27 Deposit expanded along strike and at depth compared to the 2022 Estimate2. There was also a meaningful conversion of the OP mineralization from the Inferred to Indicated category, improving the overall confidence level of the 24/27 Deposit Mineral Resource estimation. Successful 2022 drilling along the margins of the 24/27 Deposit suggest the potential expansion of the mineralization along strike and at depth with further drilling. The VTEM survey conducted in late 2022 identified a high conductive zone along the 12 km geological contact that host the 24/27 Deposit. Follow up targeting is being completed during the winter.

Cass Deposit

A very successful 2022 drill program expanded the Cass Deposit mineralization at depth and along strike, adding an auxiliary pit to the west. The estimated OP Inferred Mineral Resource ounces increased 67% compared to the 2022 Estimate2. The new auxiliary pit is located along strike from the Albatross zone (700 m to the west of the Cass Deposit); mineralization was intercepted at Albatross when last drilled in 20213. Strong conductive zones have been identified along the western felsic boundary to the sediments.

Adjustments to the Assumptions and Parameters

The 2023 MRE1 includes a few assumptions and parameters that were adjusted compared to the 2022 Estimate2; please see Table 4 for a Summary of the adjusted assumptions and parameters. The Company and its independent consultants believe that there is potential for a future, large-scale, OP operation at its properties. With additional drill data and a slight increase in the gold price assumption, parameters for the 2023 MRE were adjusted, particularly the OP cut-off grades for each deposit (refer to Notes to Accompany the 2023 MRE for further details).

Table 4: Comparison between 2023 MRE1 and 2022 Estimate2 – Assumptions and Parameters

Category |

Key Assumptions and Parameters |

||

2023 MRE1 |

2022 Estimate2 |

Details |

|

Gold price |

US$1,660/oz |

US$1,600/oz |

Slightly higher gold price assumption compared to the 2022 Estimate (US$1,600/oz) and 2021 Estimate (US$1,650/oz) |

Cut-off grades (g/t Au) |

Colomac Main: OP 0.45; UG 1.02 24/27 & Grizzly Bear: OP 0.46; UG 1.03 Goldcrest: OP 0.45; UG 1.02 Cass & Kim: OP 0.52; UG 1.31 Damoti : OP 0.57; UG 1.66 Treasure Island: OP 0.51; UG 1.50 |

Colomac Main: OP 0.50; UG 1.02 24/27 & Grizzly Bear: OP 0.51; UG 1.02 Goldcrest: OP 0.50; UG 1.02 Cass & Kim: OP 0.58; UG 1.45 Damoti: OP 0.63; UG 1.83 Treasure Island: OP 0.56; UG 1.66 |

Nighthawk opted for a lower cut-off grade to provide a larger amount of mineralized blocks and allow for more flexibility for future potential mine planning |

Maiden PEA and 2023 Exploration Program

The Company has commenced work on a conceptual mine plan, infrastructure, processing and economics for the Colomac Gold Project. The maiden PEA for the Colomac Gold Project is scheduled to be completed in mid-2023. Nighthawk believes that, given the size and scale of the 2023 MRE, the Project (if developed) could have the potential to be a robust, large-scale, gold operation. The Company is also finalizing its 2023 Exploration Program and will provide details soon.

Technical Information

Nighthawk has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. Drill core samples were transported in security-sealed bags for analyses at ALS Global Assay Laboratory in Vancouver, BC (“ALS Global”). ALS Global is an ISO/IEC 17025 accredited laboratory. Pulp and metallics assaying for gold were conducted on the entire pulverized sample.

As part of its QA/QC program, Nighthawk inserts external gold standards (low to high-grade) and blanks every 20 samples in addition to the standards, blanks, and pulp duplicates inserted by ALS Global.

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 (as defined below) in support of the 2023 MRE1 will be filed on SEDAR (www.sedar.com) before March 25, 2023. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the 2023 MRE1. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Technical information related to the 2023 MRE1 contained in this news release has been reviewed and approved by Marina Iund, M.Sc., P.Geo., Carl Pelletier, P.Geo., and Simon Boudreau, P.Eng. of InnovExplo, who are Independent and Qualified Persons as defined by NI 43-101, with the ability and authority to verify the authenticity and validity of this data.

John McBride, MSc., P.Geo., Vice President of Exploration for Nighthawk, who is the “Qualified Person” as defined by NI 43-101 for this project, has reviewed and approved of the technical disclosure contained in this news release.

About Nighthawk Gold Corp.

Nighthawk is a Canadian-based gold exploration company with 100% ownership of more than 930 km2 of district-scale land position within the Indin Lake Greenstone Gold Belt, located approximately 200 km north of Yellowknife, Northwest Territories, Canada. The Colomac Gold Project currently has a Mineral Resource Estimate1 of approximately 70.3 million tonnes grading 1.50 g/t Au for 3.39 million ounces in the Indicated category and approximately 24.3 million tonnes grading 2.10 g/t Au for 1.64 million ounces in the Inferred category. Nighthawk’s experienced management team, with a track record of successfully advancing projects and operating mines, is working towards demonstrating the economic viability of its assets and rapidly advancing its projects towards a development decision.

Notes to Accompany the 2023 MRE1

- The independent and qualified persons for the mineral resource estimate, as defined by NI 43-101, are Marina Iund, P.Geo., Carl Pelletier, P.Geo. and Simon Boudreau, P.Eng. all from InnovExplo Inc., and the effective date is February 9, 2023.

- Mineral Resources are not Mineral Reserves, as they do not have demonstrated economic viability. The Mineral Resource Estimate follows current CIM definitions and guidelines.

- The results are presented undiluted and are considered to have reasonable prospects of economic viability.

- The estimate encompasses eight (8) gold deposits (Cass, Colomac Main, Damoti, Goldcrest, Grizzly Bear, Kim, Treasure Island, 24/27), subdivided into 115 individual zones (6 for Cass, 6 for Colomac Main, 38 for Damoti, 3 for Goldcrest, 4 for Grizzly Bear, 1 for Kim, 45 for Treasure Island, 12 for 24/27) using the grade of the adjacent material when assayed or a value of zero when not assayed. Five (5) low-grade envelopes were created: 1 for Colomac Main (quartz diorite dyke) and 4 for Damoti (BIF).

- High-grade capping supported by statistical analysis was done on raw assay data before compositing and established on a per-zone basis varying from 15 to 100 g/t Au for mineralized zones and 15 to 20 g/t Au for the envelopes.

- The estimate was completed using sub-block model in Leapfrog Edge 2022.1, except Goldcrest (estimated using sub-block model in GEOVIA Surpac 2021) and Damoti (estimated using percent block model in Gemcom).

- Grade interpolation was performed with the Inverse Distance Cubed (“ID3”)method on 1.5 m composites for the Colomac Main, Goldcrest and Grizzly Bear deposits, with the Inverse Distance Squared (“ID2”) method on 1 m composites for the Cass and Treasure Island deposits, with the ID3 method on 1 m composites for the Kim deposit, with the ID2 method on 1.5 m composites for the 24/27 deposits, and with the Ordinary Kriging (“OK”) method on 1.0 m composites for the Damoti deposit.

- A density of value of 3.2 g/cm3 (Damoti), 3.0 g/cm3 (Cass), 2.95 g/cm3 (Kim), 2.7 g/cm3 (Colomac Main, Goldcrest, Grizzly Bear, Treasure Island and 24/27) and 2.00 g/cm3 (overburden) was assigned.

- The Mineral Resource Estimate is classified as Indicated and Inferred. For the Cass, Colomac Main, Goldcrest and Grizzly Bear, Kim, Treasure Island, 27/27 Deposits, the Inferred category is defined with a minimum of two (2) drill holes within the areas where the drill spacing is less than 75 m and shows reasonable geological and grade continuity. The Indicated mineral resource category is defined with a minimum of tree (3) drill holes within the areas where the drill spacing is less than 50 m. For the Damoti Deposit, the Inferred category is defined with a minimum of two (2) drill holes within the areas where the drill spacing is less than 60 m and shows reasonable geological and grade continuity. Clipping boundaries were used for classification based on those criteria.

- The Mineral Resource Estimate is locally pit-constrained with a bedrock slope angle of 50° and an overburden slope angle of 30°. It is reported at rounded cut-off grade ranges of 0.45 to 0.57 g/t Au (OP), 1.02 to 1.50 g/t Au (UG bulk) and 1.66 g/t Au (Damoti - UG selective). The cut-off grades were calculated using the following parameters: mining cost = CA$3.25/t to CA$ 73.00/t; processing cost = CA$21.00/t; G&A = CA$6.00/t; refining costs = CA$5.00/oz; selling costs = CA$ 5.00/oz to CA$54.80/oz; gold price = US$1,660.00/oz; USD:CAD exchange rate = 1.33; and mill recovery = 97.0%. The cut-off grades should be re-evaluated in light of future prevailing market conditions (metal prices, exchange rates, mining costs etc.).

- The number of metric tonnes was rounded to the nearest thousand, following the recommendations in NI 43-101 and any discrepancies in the totals are due to rounding effects. The metal contents are presented in troy ounces (tonnes x grade / 31.10348).

- The authors are not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, or marketing issues, or any other relevant issue not reported in the Technical Report, that could materially affect the Mineral Resource Estimate.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, information with respect to the Company’s Mineral Resource Estimates, the potential extractability of the OP/pit-constrained and UG mineralization, the potential expansion of Mineral Resource Estimates, the potential for higher-grade assay results, the potential of the Project to be a ‘top-tier’ gold project in a safe mining jurisdiction, the potential of the Project to be developed, the delivery of the PEA by mid-2023, the large-scale and robust nature of the Project PEA, the continued exploration and drilling initiatives and having the necessary funding required to complete these initiatives, the prospectivity of exploration targets, the potential economic viability of the assets, and the advancement of projects towards a development decision. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “add” or “additional”, “advancing”, “anticipates” or “does not anticipate”, “appears”, “believes”, “can be”, “conceptual”, “confidence”, “continue”, “convert” or “conversion”, “deliver”, “demonstrating”, “estimates”, “encouraging”, “expand” or “expanding” or “expansion”, “expect” or “expectations”, “forecasts”, “forward”, “goal”, “improves”, “increase”, “intends”, “justification”, “plans”, “potential” or “potentially”, “promise”, “prospective”, “prioritize”, “reflects”, “scheduled”, “suggesting”, “support”, “updating”, “upside”, “will be” or “will consider”, “work towards”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”.

Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Nighthawk to be materially different from those expressed or implied by such forward-looking information, including risks associated with required regulatory approvals, the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current exploration activities, government regulation, political or economic developments, the ongoing wars and their effect on supply chains, environmental risks, COVID-19 and other pandemic risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Nighthawk's annual information form for the year ended December 31, 2021, available on www.sedar.com. Although Nighthawk has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Nighthawk does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Cautionary Statement regarding Mineral Resource Estimates

Until mineral deposits are actually mined and processed, Mineral Resources must be considered as estimates only. Mineral Resource estimates that are not Mineral Reserves and have not demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the Company’s public disclosure available on SEDAR at www.sedar.com. The quantity and grade of reported “Inferred” Mineral Resource estimates are uncertain in nature and there has been insufficient exploration to define “Inferred” Mineral Resource estimates as an “Indicated” or “Measured” Mineral Resource and it is uncertain if further exploration will result in upgrading “Inferred” Mineral Resource estimates to an “Indicated” or “Measured” Mineral Resource category. The accuracy of any Mineral Resource estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of future test mining and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including block model design; (vi) proposed mining operations, including dilution; (vii) the evaluation of future mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. It cannot be assumed that all or any part of a “Inferred” or “Indicated” Mineral Resource estimate will ever be upgraded to a higher category. The Mineral Resource estimates disclosed in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Standards”) in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”).

Cautionary Statement to U.S. Readers

This news release uses the terms “Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” as defined in the CIM Standards in accordance with NI 43-101. While these terms are recognized and required by the Canadian Securities Administrators in accordance with Canadian securities laws, they may not be recognized by the United States Securities and Exchange Commission.

The Mineral Resource estimates and related information in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

____________________

1There is no certainty that the 2023 MRE will be converted to Proven and Probable Mineral Reserve categories or will be realized in the future. Mineral Resource estimates that are not Mineral Reserves do not have demonstrated economic viability. The 2023 MRE may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties and other factors, as more particularly described in the Cautionary Statements at the end of this news release.

2For further details refer to the 2022 Estimate effective as of March 8, 2022 reported in the Company’s NI 43-101 technical report entitled “NI 43-101 Technical Report and Update of the Mineral Resource Estimate for the Indin Lake Gold Property, Northwest Territories, Canada” and dated March 31, 2022 (the “2022 Technical Report”), which is available on SEDAR www.sedar.com and on the Company’s website at www.nighthawkgold.com. The 2022 Estimate is not current and should not be relied upon, it has been superseded by the 2023 MRE.

3See Nighthawk news release dated December 1, 2021 for more details on the Albatross drill results, which can be accessed in the Company’s profile on www.sedar.com or on the Company’s website www.nighthawkgold.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230209005475/en/

“Our 2023 MRE demonstrates a significant boost in estimated ounces in the Indicated and Inferred categories compared to last year. "

Contacts

FOR FURTHER INFORMATION:

NIGHTHAWK GOLD CORP.

Tel: 1-416-880-7090; Email: info@nighthawkgold.com

Website: www.nighthawkgold.com

Keyvan Salehi

President & CEO

Salvatore Curcio

CFO

Allan Candelario

VP, Investor Relations & Corporate Development