Netflix (NFLX) shares are inching up on Friday after the streaming giant announced plans of a 10-for-1 stock split. According to its press release, the split will take effect on Nov. 17.

A stock split does not fundamentally make a company more attractive, but the strategic move could still prove constructive for NFLX shares in the near term.

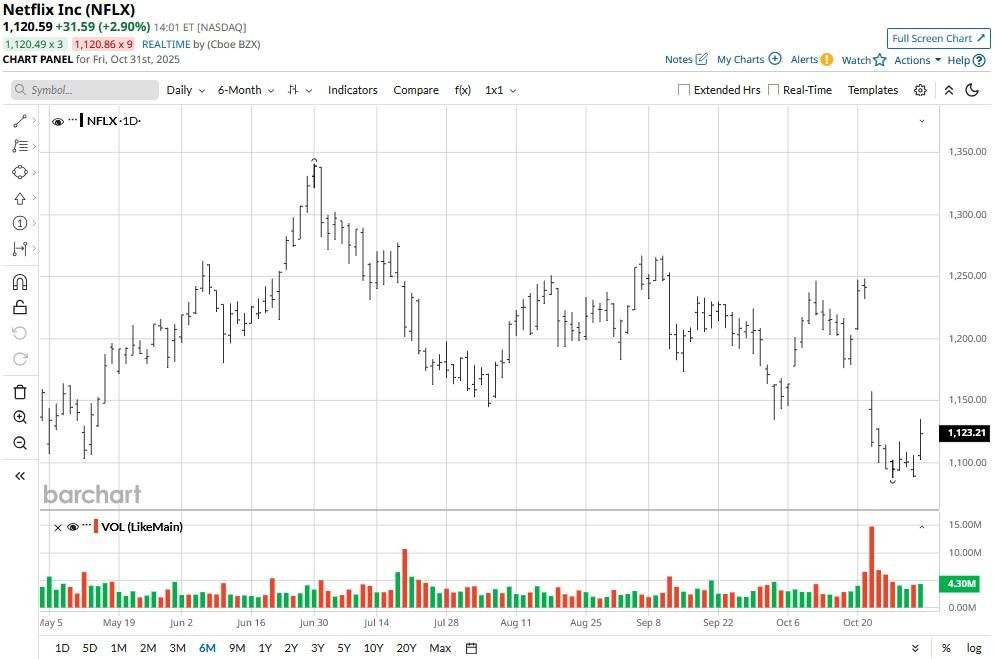

Despite today’s gains, Netflix stock remains down over 16% versus its year-to-date high in June.

Why Might the Stock Split Push Netflix Stock Higher

The announced stock split could drive NFLX shares higher through the remainder of 2025 because the reduced price post Nov. 17 will make them more accessible to individual traders.

At over $1,000 per share, Netflix may have deterred retail investors since late April, but they could choose to initiate positions in the mass media and entertainment conglomerate after the stock split.

This will boost the stock’s liquidity and broaden ownership, factors that often push prices higher.

Moreover, stock splits are often interpreted as signs of insider confidence, which makes for another reason to own Netflix in the build-up to its stock split on Nov. 17.

NFLX Shares Could Benefit From a Potential WBD Acquisition

NFLX stock is worth owning heading into 2026 also because latest media reports suggest the firm’s management is interested in buying for Warner Bros. Discovery’s (WBD) studio and streaming assets.

Bringing WBD’s renowned intellectual property like Harry Potter and DC, and HBO’s prestige programming under its umbrella, could help Netflix supercharge its content moat.

The potential acquisition would also expand Netflix’s production capabilities given WBD already produces several of its “originals.”

Strategically, it will allow the company to consolidate two of the most powerful streaming brands, reduce content licensing dependencies, and strengthen its competitive edge against Amazon Prime (AMZN) and Disney (DIS).

Most importantly, with Warner Bros. Discovery splitting its assets, NFLX has real shot at executing such a deal.

Wall Street Continues to See Significant Upside in Netflix

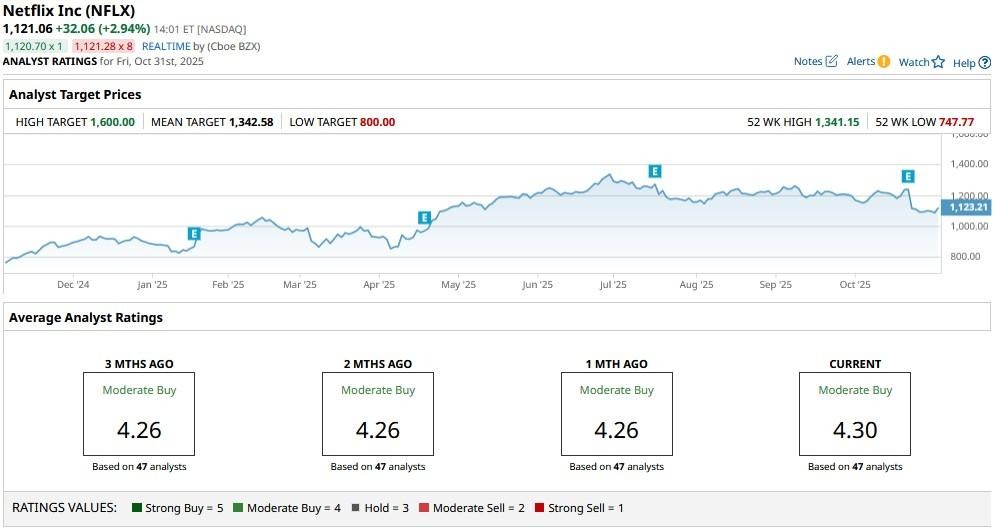

Despite recent earnings miss, Wall Street remains positive on Netflix shares for 2026.

The consensus rating on NFLX stock currently sits at “Moderate Buy” with the mean target of about $1,343 indicating potential upside of another 19% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?