Valued at $89.9 billion by market cap, Dell Technologies Inc. (DELL) operates as one of the largest laptop and PC companies in the world. The Round Rock, Texas-based PC designer operates through Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG) segments. Its operations span numerous countries across the Americas, Indo-Pacific, and EMEA.

Companies worth $10 billion or more are generally described as "large-cap stocks." Dell fits right into that category, reflecting its significant presence and influence in the computer hardware industry.

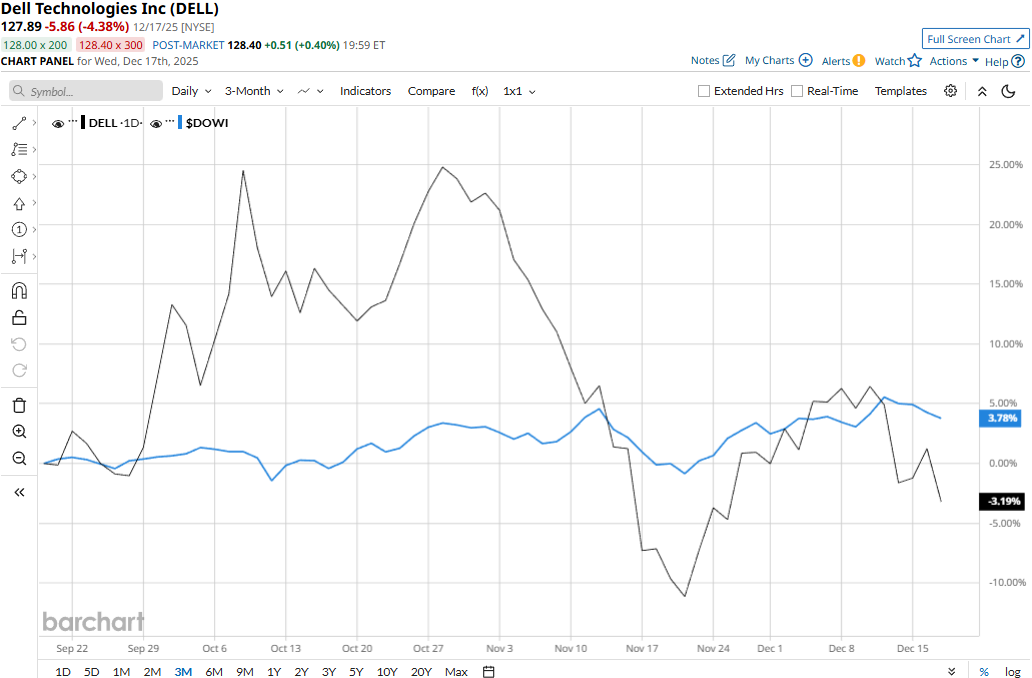

Dell touched its 52-week high of $168.08 on Nov. 3 and is currently trading 23.9% below that peak. Meanwhile, its stock prices have dipped 1.9% over the past three months, significantly underperforming the Dow Jones Industrial Average’s ($DOWI) 4.1% gains during the same time frame.

Dell has lagged behind the Dow over the longer term as well. Dell’s stock prices have gained 11% on a YTD basis and 8.1% over the past 52 weeks, underperforming the Dow’s 12.6% surge in 2025 and 10.2% returns over the past year.

Taking a dive from its 52-week high, Dell stock has plunged below its 50-day moving average in mid-November but traded mostly above its 200-day moving average since May, underscoring its previous bullish movement and recent downturn.

Dell Technologies’ stock prices surged 5.8% in the trading session following the release of its impressive Q3 results on Nov. 25. The company has continued to observe a surge in its infrastructure solutions revenues, which have pushed its overall net revenues to grow 10.8% year-over-year to a record $27 billion. Driven by record AI server orders of $12.3 billion during the quarter and an unprecedented $30 billion in orders year-to-date, the company’s prospects look bright.

Meanwhile, Dell observed a notable 17.2% growth in adjusted EPS to $2.59, beating Street expectations. Further, its adjusted free cash flows soared 133.2% year-over-year to $1.7 billion, boosting investor confidence.

Moreover, Dell has significantly outperformed its peer, HP Inc.’s (HPQ) 25.1% decline on a YTD basis and 27.8% plunge over the past 52 weeks.

Among the 22 analysts covering the Dell stock, the consensus rating is a “Moderate Buy.” As of writing, Dell’s mean price target of $164.70 suggests a 28.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $4.8 Million Reason to Buy AeroVironment Stock Today

- This Analyst Says IonQ Stock Can Gain Over 75% from Here. Should You Buy It Now?

- 3 Barchart Stock Screeners to Help You Find Better Call Option Trades

- ‘You Didn’t Want to Be in Jamestown’: Elon Musk Warns Mars Won’t Be A Billionaire Vacation Spot; It Will Be ‘Very Dangerous’ and ‘You Might Die’