Shares of CoreWeave (CRWV) are jumping 19% in morning trading today following the announcement that the company has joined the Energy Deptartment’s Genesis Mission. This initiative aims to harness advanced AI computing to accelerate scientific breakthroughs, enhance national security, and promote energy innovation.

For CoreWeave, an AI-focused cloud infrastructure provider, participation in this high-profile government-led effort marks a significant validation of its specialized GPU cloud platform and opens doors to potential collaborations with national labs and supercomputing centers.

This surge provides a welcome respite for investors in the AI infrastructure stock, which has endured a brutal decline of more than 60% from its 52-week high of $187 reached in June. The drop has been fueled by persistent negative coverage highlighting execution risks, mounting debt, and broader skepticism about the sustainability of explosive AI spending.

While the Genesis Mission news highlights CoreWeave’s growing role in mission-critical applications, is that enough to make CRWV stock a buy?

About CoreWeave Stock

CoreWeave is a specialized cloud computing provider focused on delivering high-performance GPU infrastructure tailored for artificial intelligence and machine learning workloads headquartered in Livingston, New Jersey. The company operates a fleet of data centers across the U.S. and Europe, offering bare-metal servers, managed services, and tools optimized for AI training, inference, and rendering. CoreWeave has a market capitalization of approximately $26 billion.

Over the past 52 weeks, CRWV shares have experienced extreme volatility, having peaked at $187 before plunging due to market doubts about AI infrastructure economics. Year-to-date since its March 2025 IPO at $40, the stock remains up 95% from its debut but down sharply from those earlier highs. It is handily outperforming the Nasdaq Composite ($NASX), however, which is still up 30% since the IPO despite broader tech sector rotations.

CoreWeave remains unprofitable, with ongoing net losses despite rapid revenue growth. Forward price-sales ratios are elevated compared to traditional cloud peers but reflect the company’s hypergrowth trajectory in the AI sector. Analysts view the current valuation as reflecting high expectations for future scale, though risks around capital intensity could pressure multiples if growth moderates. Overall, the stock appears priced for perfection in a high-interest-rate environment, suggesting it may be fairly valued to slightly overvalued relative to near-term fundamentals but undervalued if long-term AI demand proves resilient.

CoreWeave does not pay a dividend, consistent with its focus on reinvesting heavily in infrastructure expansion.

How CoreWeave Benefits

The Genesis Mission represents a strategic win for CoreWeave, as it positions the company to contribute its high-performance AI cloud resources to vital national priorities, including advanced simulations for energy research and secure computing for defense applications. This involvement could diversify revenue streams beyond commercial clients, enhance credibility with government and enterprise customers, and potentially unlock new contracts in regulated sectors where reliability and U.S.-based operations are paramount.

However, the stock’s severe downturn in recent months stems from mounting investor worries about the broader AI ecosystem’s viability. Escalating power consumption and environmental impacts from massive data centers have raised questions about long-term operational feasibility, with critics pointing to potential regulatory hurdles and resource constraints that could cap expansion.

Additionally, CoreWeave has faced company-specific challenges, including delays in data center buildouts due to supply chain issues and weather-related setbacks, heavy reliance on a concentrated customer base, and substantial leverage from financing aggressive growth. These factors have amplified fears of cash burn outpacing revenue ramps, contributing to the sharp sell-off despite a robust order backlog.

What Do Analysts Expect for CoreWeave Stock?

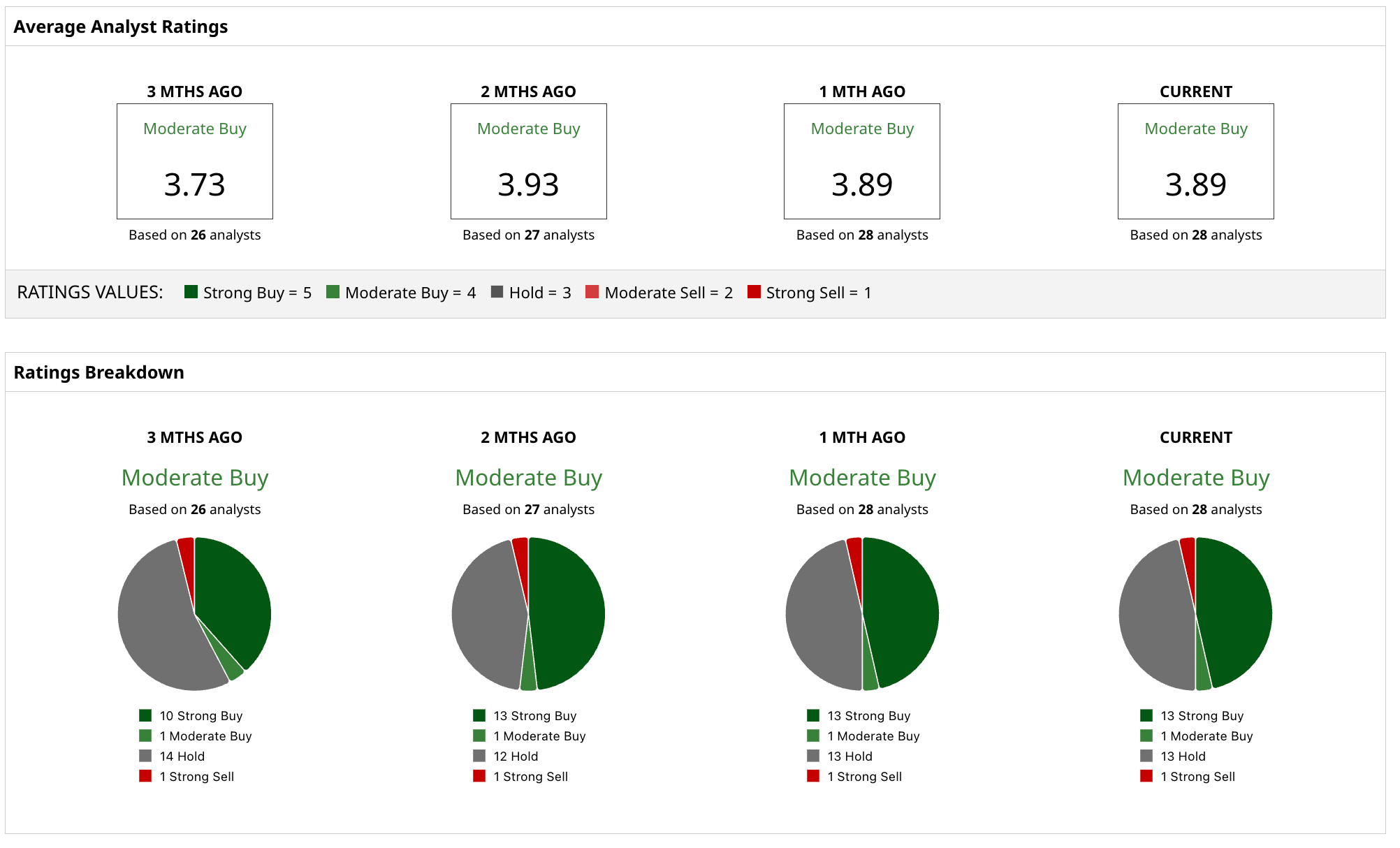

Analysts maintain a generally positive stance on CoreWeave, with a consensus leaning toward “Moderate Buy” ratings across approximately 28 firms covering the stock. While 13 analysts rate it a “Strong Buy,” just as many have a “Hold” rating, reflecting near-term risks, though recent adjustments have incorporated more caution as the stock has gone into decline. Notably, there is only one “Sell” rating and 1 “Buy” rating. Wall Street either loves CoreWeave or is uncertain about its future.

CoreWeave’s mean target of $129.77 represents potential upside of 62.6% from recent trading levels just below $80 per share.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?

- Nike, Tilray, and Palantir: Their Unusually Active Put Options Will Boost Your Wallet After Christmas

- Micron Says ‘We Are More Than Sold Out.’ Should You Buy MU Stock After Earnings?

- IonQ Is Down More Than 30% Since September. What Happened to the Quantum Computing Leader?