US Fed Chairman Jerome Powell is expected to announce an unchanged Fed fund rate Wednesday afternoon.

This will be followed by the usual histrionics from the US president/self-proclaimed Venezuelan president/wannabe high potentate of Greenland.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.Gold and silver both posted explosive rallies overnight, while the US dollar continued to weaken, reflecting what the rest of the world thinks of the situation in the United States.

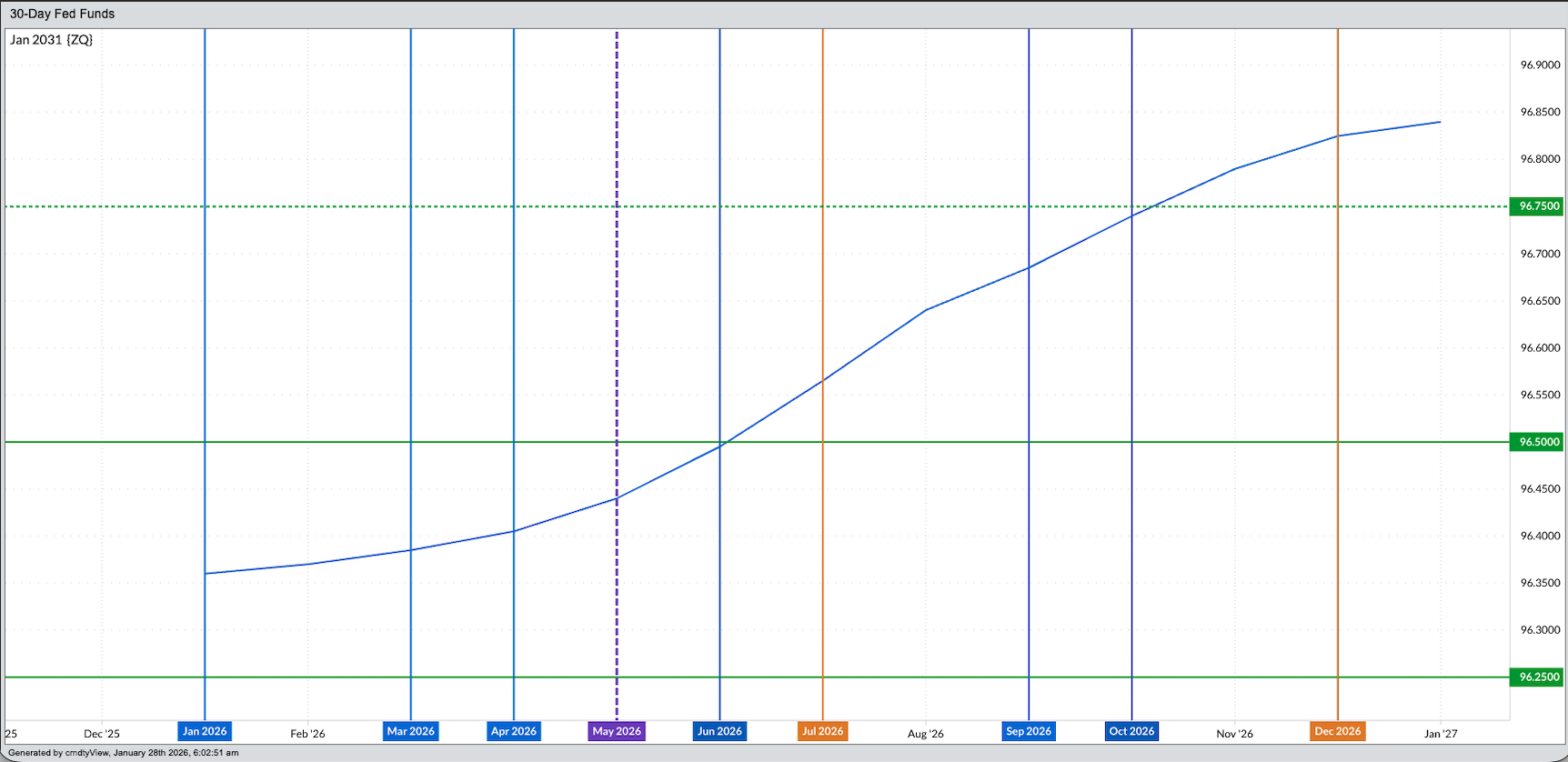

Morning Summary: Later today, 14:00 (ET), US Fed Chairman Powell will announce the latest Federal Open Market Committee decision on the Fed fund rate. As I talked about earlier this week, the Fed fund futures forward curve continues to show the range will be left unchanged this month, holding between 3.5% and 3.75%, with the next cut expected at the conclusion of the July meeting. If Wednesday plays out as expected, then there are three things we know will happen: 1) The wannabe high potentate of Greenland will be unhappy and make angry threats toward Chairman Powell. 2) The self-proclaimed President of Venezuela will do and/or say something to take the spotlight away from the US Fed and put it back on himself. 3) In the end, none of it will matter as the US government heads toward the next shutdown at the end of this month. With that as a backdrop, overnight through early Wednesday morning saw the US dollar index ($DXY) extend its break to below 96.00, hitting a low of 95.86, closing in on the February 2022 low of 95.14. Meanwhile, February gold (GCG26) climbed to a new high of $5,306, up $223.40 (4.4%) and March silver (SIH26) rocketed to a high of $116.165, a gain of $10.20 (9.6%).

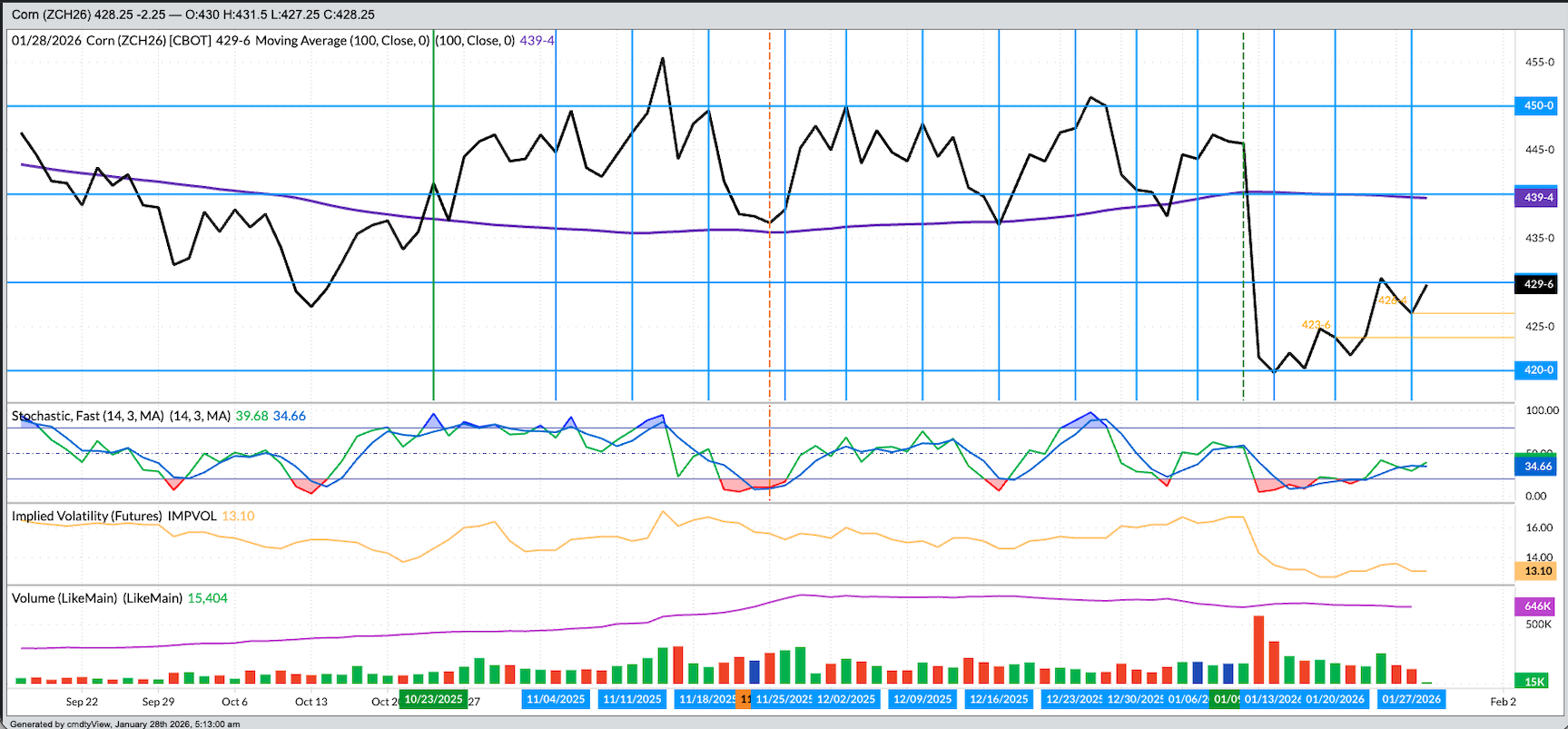

Corn: The corn market was quietly higher pre-dawn. The March issue (ZCH26) posted a 3.0-cent trading range, all of it above unchanged from Tuesday’s close on trade volume of 15,000 contracts and was sitting 3.0 cents higher at this writing. This being Wednesday, it’s the first day of the new noncommercial positioning week. A look back at the previous week, Tuesday to Tuesday, and we see March closed 2.75 cents higher while the carry in the March-May futures spread firmed by 0.75 cent. This tells us Watson likely decreased its net-short futures position, last reported at 51,700 contracts while the commercial side continued to hold a neutral view of short-term supply and demand. Speaking of fundamentals, the National Corn Index came in Tuesday night at $3.9225, down 1.5 cents for the day after March futures finished the session 2.25 cents in the red. This tells us merchandisers were willing to provide support to the cash market in order to source supplies to meet immediate-term demand. National average basis was calculated at 34.25 cents under March futures as compared to last Friday’s final figure of 34.75 cents under with the previous 5-year and 10-year low weekly closes for this week at 32.25 cents under and 33.75 cents under March respectively.

Soybeans: The soybean market was interesting as it posted a solid rally overnight on an uptick in trade volume. Activity was predominantly in the nearby March issue (ZSH26) as it rallied as much as 11.0 cents while registering 20,500 contracts changing hands and was sitting on its session high at this writing. My Blink reaction is the world’s largest buyer was covering some secondary supply needs again overnight, all while the early stage of Brazil’s harvest continues to progress. Why would China be showing interest, particularly with US soybeans’ port price at New Orleans running well above Brazil’s port price? There has been more talk lately of dryness across southern Brazil and Argentina possibly decreasing production potential for both countries. Regarding the latter, Argentina remains the world leader in soybean meal exports, and while the US bean meal market has shown an uptick of late, it hasn’t been anything dramatic. However, total sales (total shipments plus unshipped sales) of US soybean meal were running 11% ahead of the same week last marketing year as of Thursday, January 15. As for soybeans, the CME is showing open interest in March did decrease during Tuesday’s rally, albeit by only 170 contracts, after increasing during Monday’s selloff.

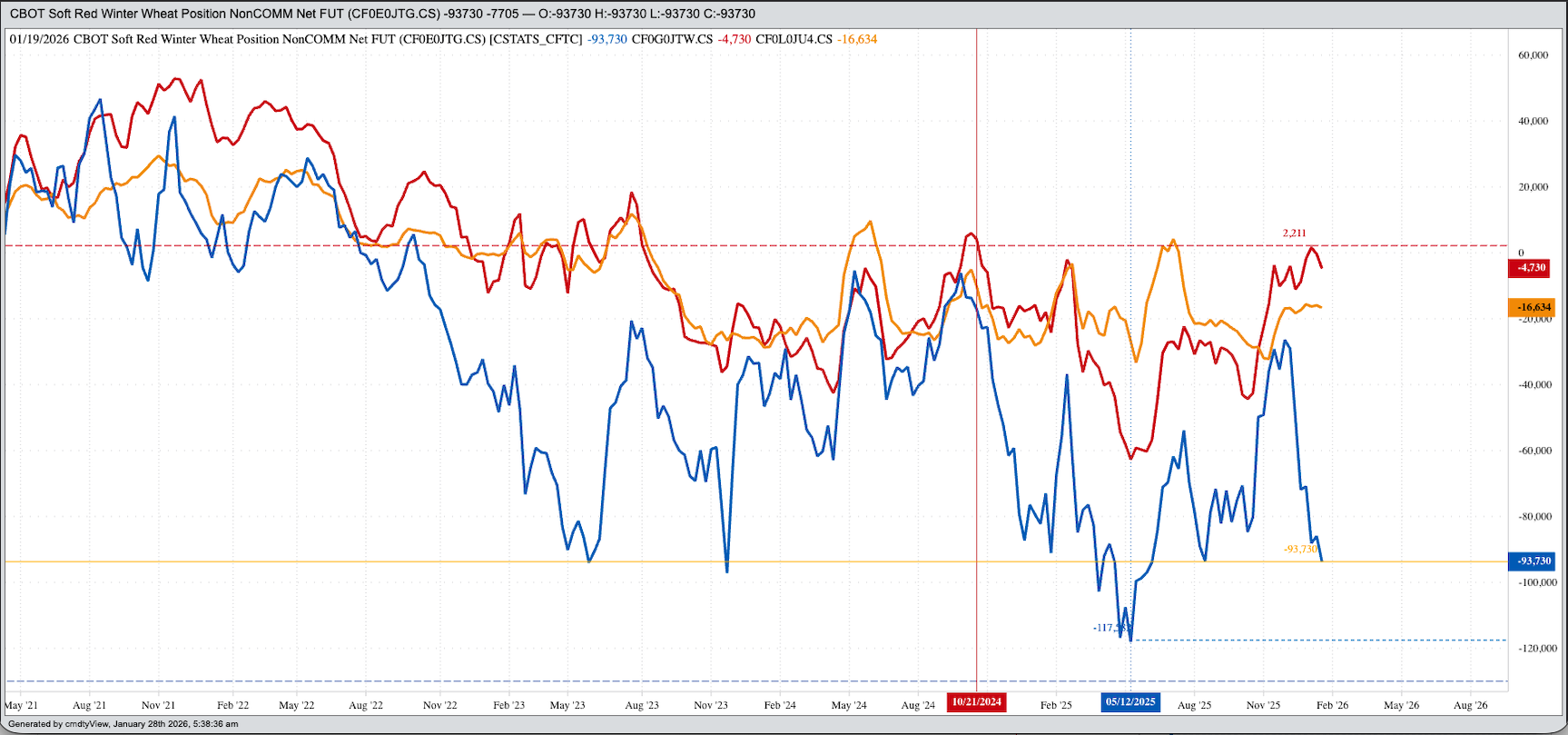

Wheat: The wheat sub-sector was also in the green pre-dawn Wednesday, also on an uptick in overnight trade volume. The March SRW issue (ZWH26) was sitting 7.0 cents higher at this writing after rallying as much as 9.75 cents on trade volume of 12,800 contracts. In other words, nearly as many contracts changed hands as what we saw in March corn. I still see recent activity as dominated by noncommercial short-covering given the latest Commitments of Traders update showed Watson held a net-short futures position of 93,730 contracts as of Tuesday, January 20, an increase of 7,705 contracts from the previous week and the largest SRW net-short futures position since 93,860 contracts reported for June 10, 2025. The National SRW Index was priced last night at $4.67, still running well below the previous 5-year low and 10-year average end of January figures of $5.04 and $5.2175 respectively. This tells us supplies are ample in relation to demand. Meanwhile, my latest national average basis calculation came in at 56.25 cents under March SRW futures as compared to last week’s 54.25 cents under with the previous 5-year low weekly close for this week at 58.0 cents under March. New-crop July SRW was up 6.0 cents to start the day.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart