Consumer products behemoth Proctor & Gamble (NYSE: PG) will be reporting results this Friday morning. Here’s what you need to know.

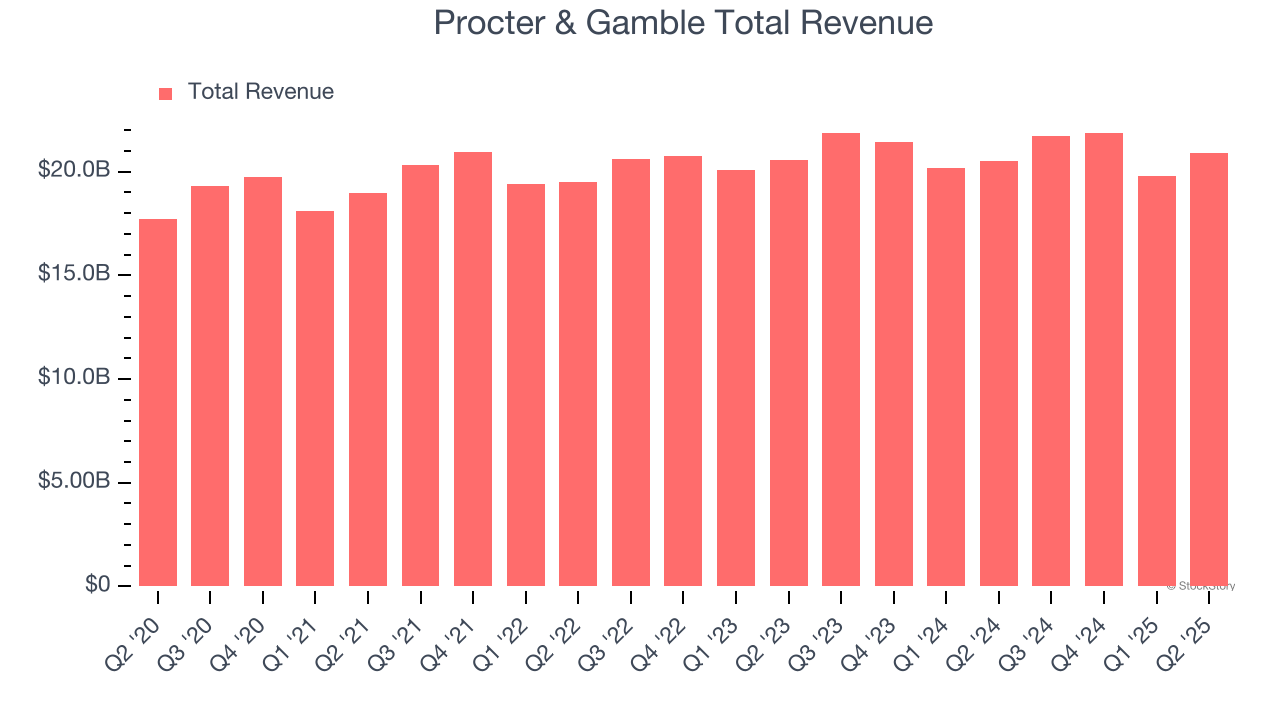

Procter & Gamble met analysts’ revenue expectations last quarter, reporting revenues of $20.89 billion, up 1.7% year on year. It was a satisfactory quarter for the company, with an impressive beat of analysts’ EBITDA estimates but a slight miss of analysts’ gross margin estimates.

Is Procter & Gamble a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Procter & Gamble’s revenue to grow 2% year on year to $22.17 billion, improving from its flat revenue in the same quarter last year. Adjusted earnings are expected to come in at $1.90 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Procter & Gamble has missed Wall Street’s revenue estimates twice since going public.

Looking at Procter & Gamble’s peers in the consumer staples segment, some have already reported their Q3 results, giving us a hint as to what we can expect. WD-40 delivered year-on-year revenue growth of 4.8%, beating analysts’ expectations by 6.2%, and Lamb Weston reported flat revenue, topping estimates by 2.6%. Lamb Weston traded up 11.4% following the results.

Read our full analysis of WD-40’s results here and Lamb Weston’s results here.

Investors in the consumer staples segment have had steady hands going into earnings, with share prices flat over the last month. Procter & Gamble’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $168.64 (compared to the current share price of $152.20).

P.S. While everyone's chasing Nvidia, we found a hidden AI semiconductor winner trading at a fraction of the price. See our #1 pick before Wall Street catches on.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.