Even though MSCI (currently trading at $567.88 per share) has gained 12.1% over the last six months, it has lagged the S&P 500’s 32.7% return during that period. This may have investors wondering how to approach the situation.

Is there a buying opportunity in MSCI, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is MSCI Not Exciting?

We're cautious about MSCI. Here is one reason we avoid MSCI and a stock we'd rather own.

Previous Growth Initiatives Have Lost Money

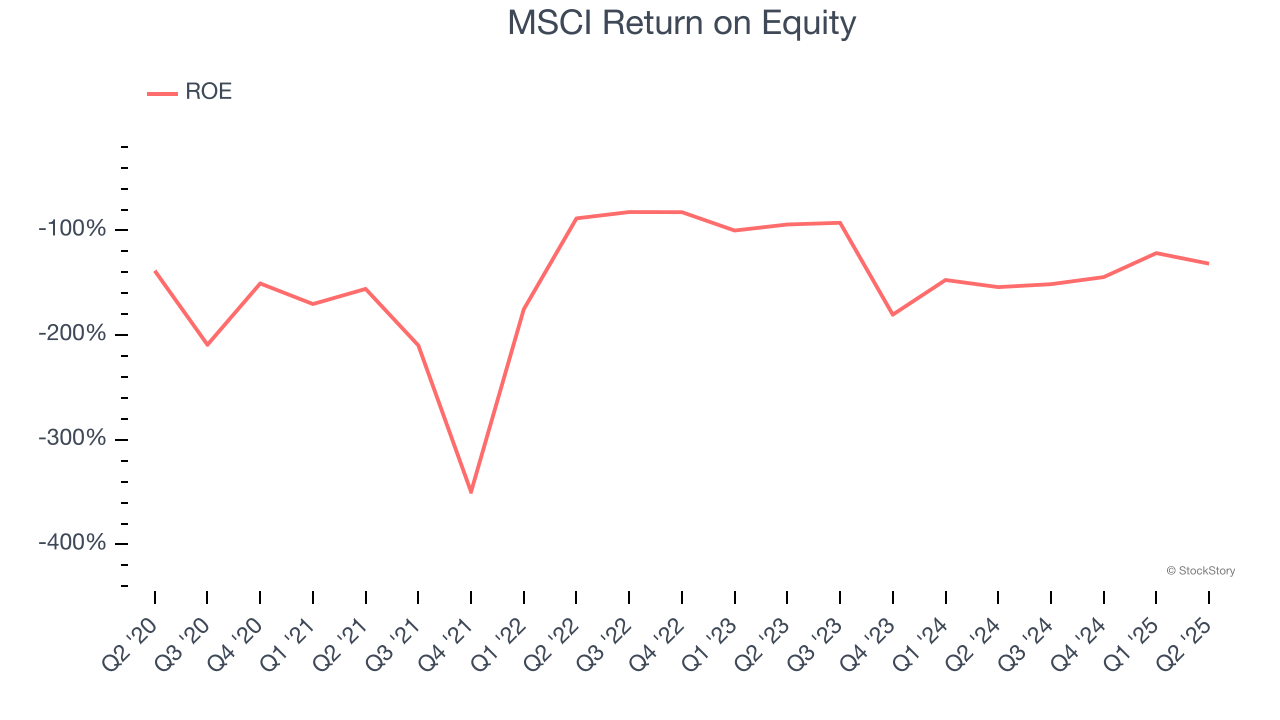

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, MSCI has averaged an ROE of negative 150%, a bad result not only in absolute terms but also relative to the majority of firms putting up 25%+. It also shows that MSCI has little to no competitive moat.

Final Judgment

MSCI isn’t a terrible business, but it doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 31.1× forward P/E (or $567.88 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than MSCI

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.