Nordstrom has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 7.3% and now trades at $24.55. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Nordstrom, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think Nordstrom Will Underperform?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Nordstrom. Here are three reasons why JWN doesn't excite us and a stock we'd rather own.

1. Flat Same-Store Sales Indicate Weak Demand

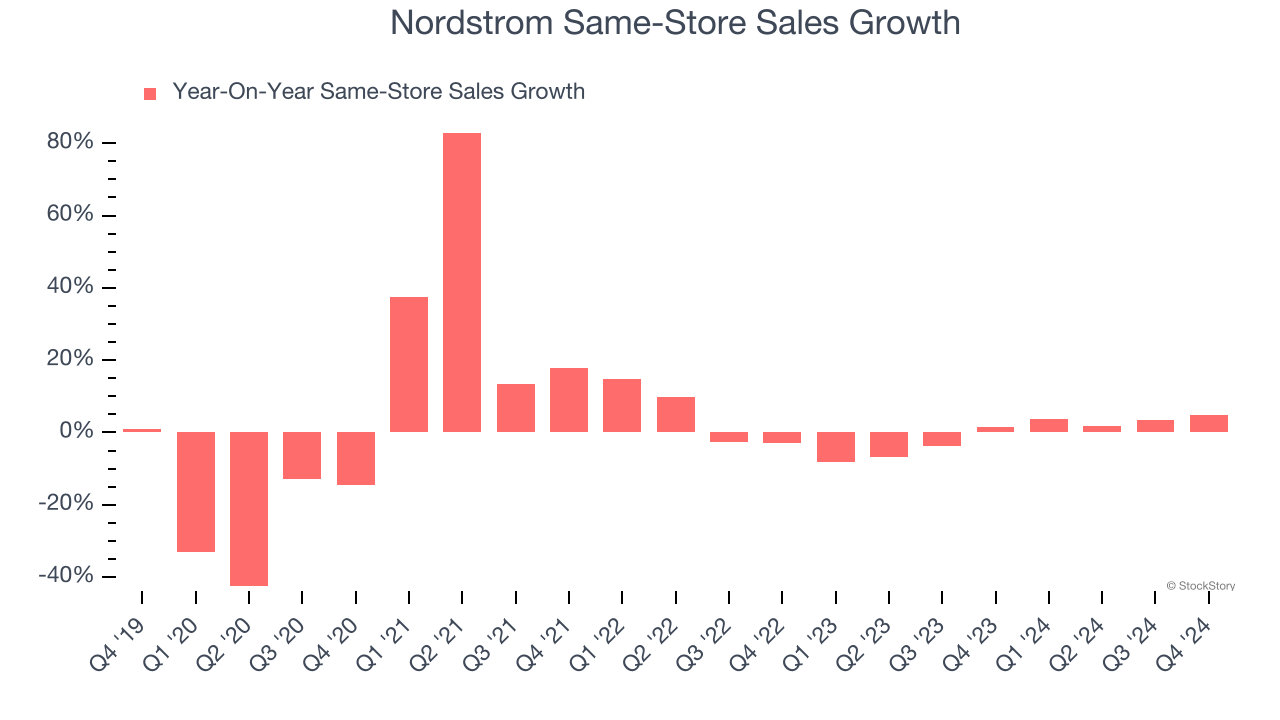

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Nordstrom’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat.

2. Weak Operating Margin Could Cause Trouble

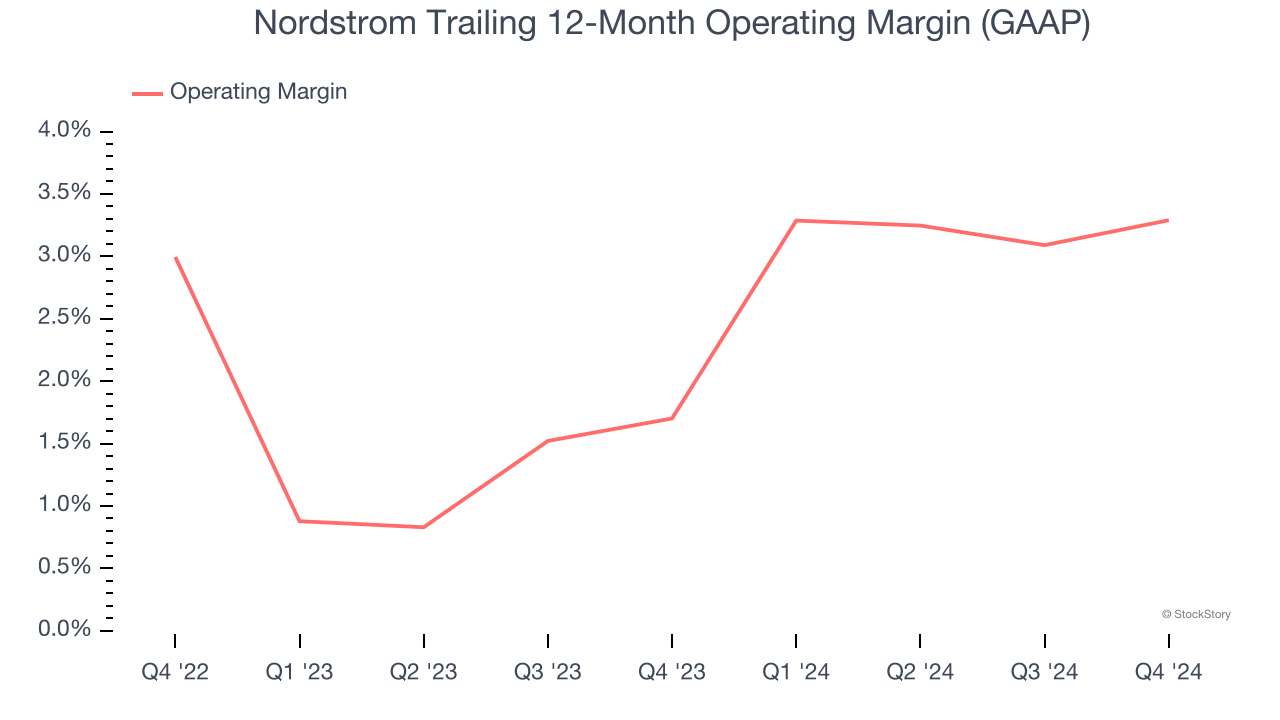

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Nordstrom was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.5% was weak for a consumer retail business.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Nordstrom historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.3%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Nordstrom, we’ll be cheering from the sidelines. With its shares topping the market in recent months, the stock trades at 11.8× forward P/E (or $24.55 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Like More Than Nordstrom

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.