Net Interest Income increased $1.5 million, or 6.7%, to $24.1 million for the quarter ended June 30, 2024 from $22.6 million for the quarter ended June 30, 2023

Net Interest Margin grew 29 basis points, or 7.6%, to 4.10% for the quarter ended June 30, 2024, as compared to 3.81% for the quarter ended June 30, 2023

Total Deposits rose $160.5 million, or 7.9%, to $2.2 billion at June 30, 2024 from $2.0 billion at year-end 2023

Book value per share increased $2.09, or 7.1%, to $31.35 at June 30, 2024 from $29.26 at December 31, 2023

Trust and investment advisory income rose 15.9%, to approximately $3.0 million for the quarter ended June 30, 2024, from $2.6 million for Q2 2023

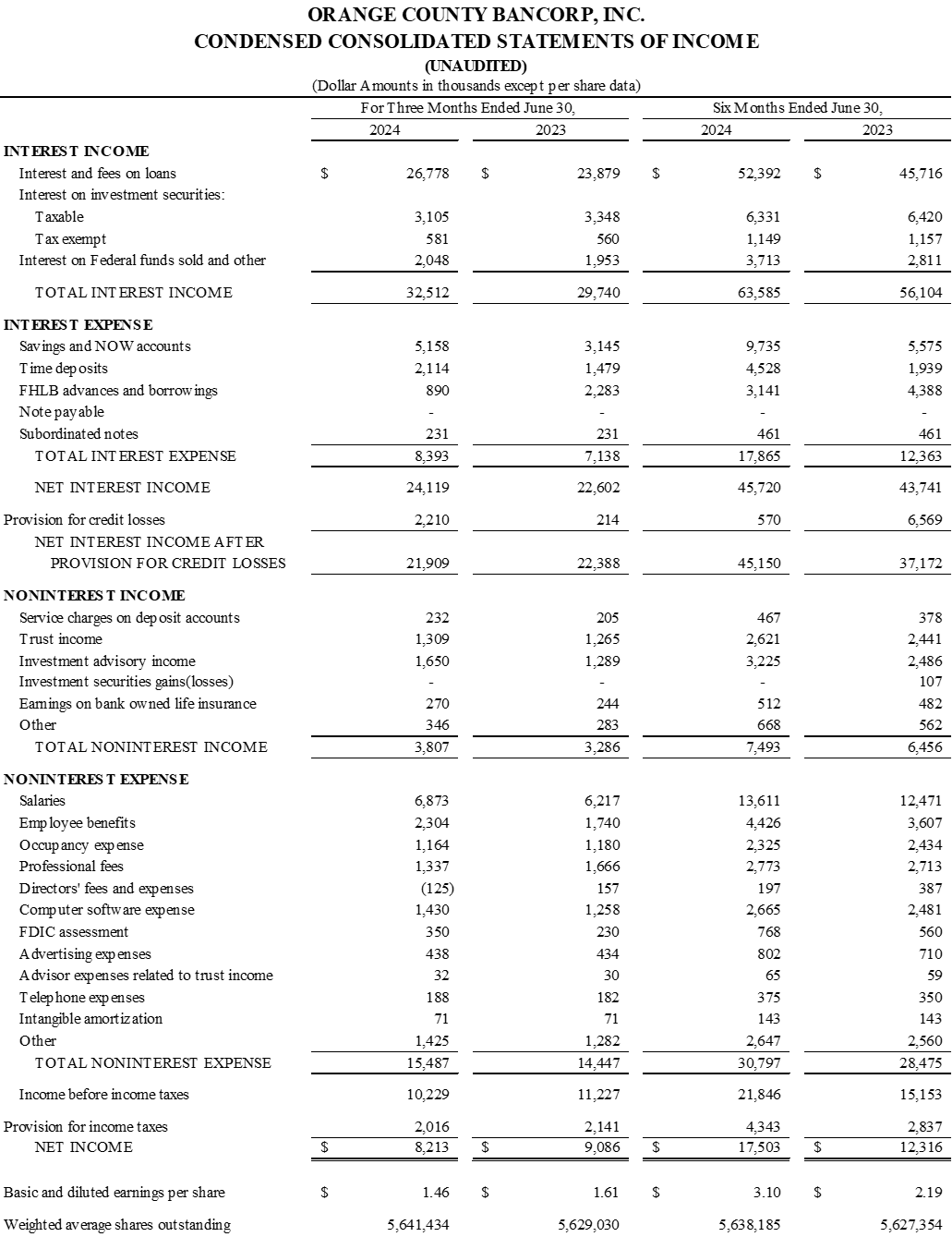

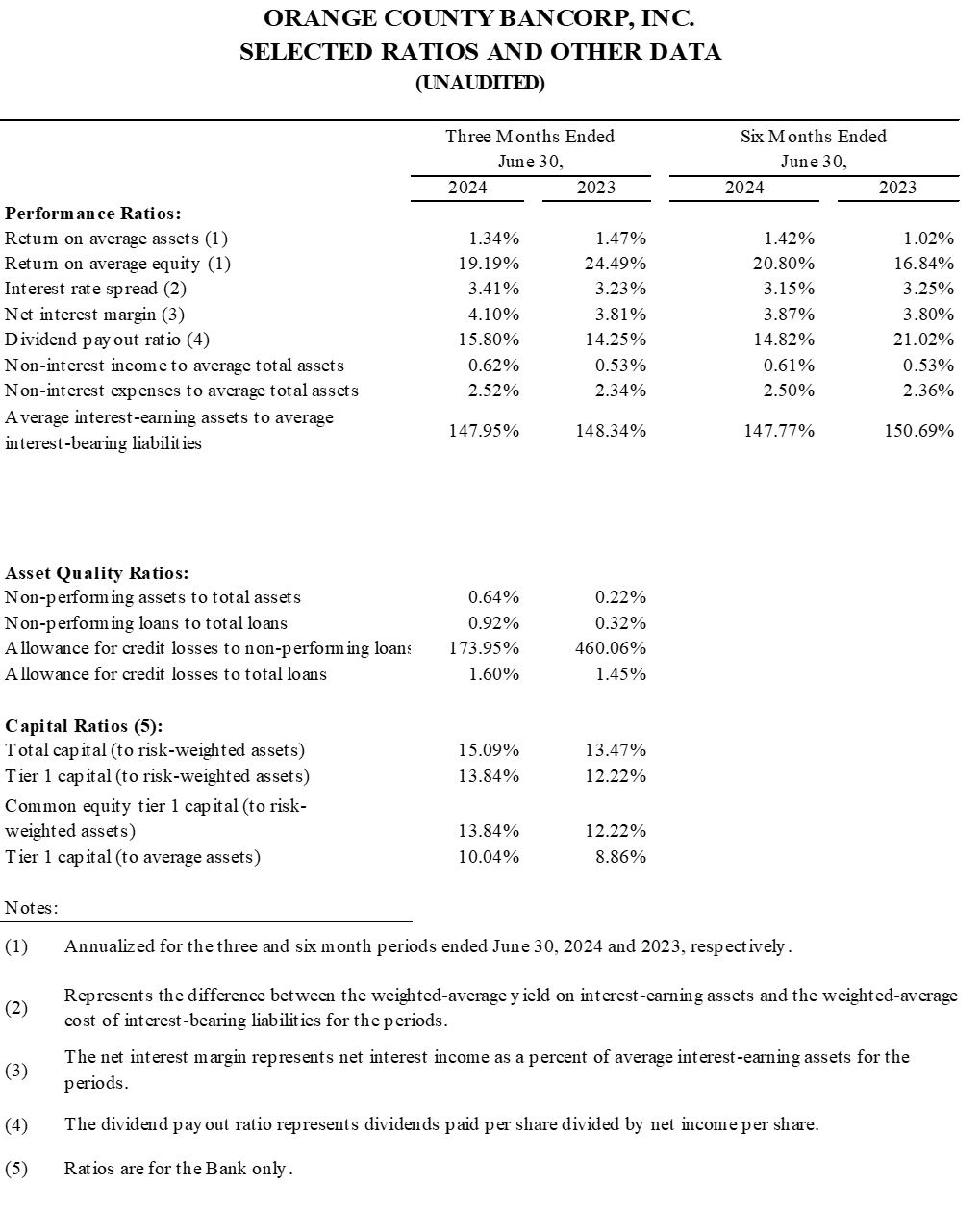

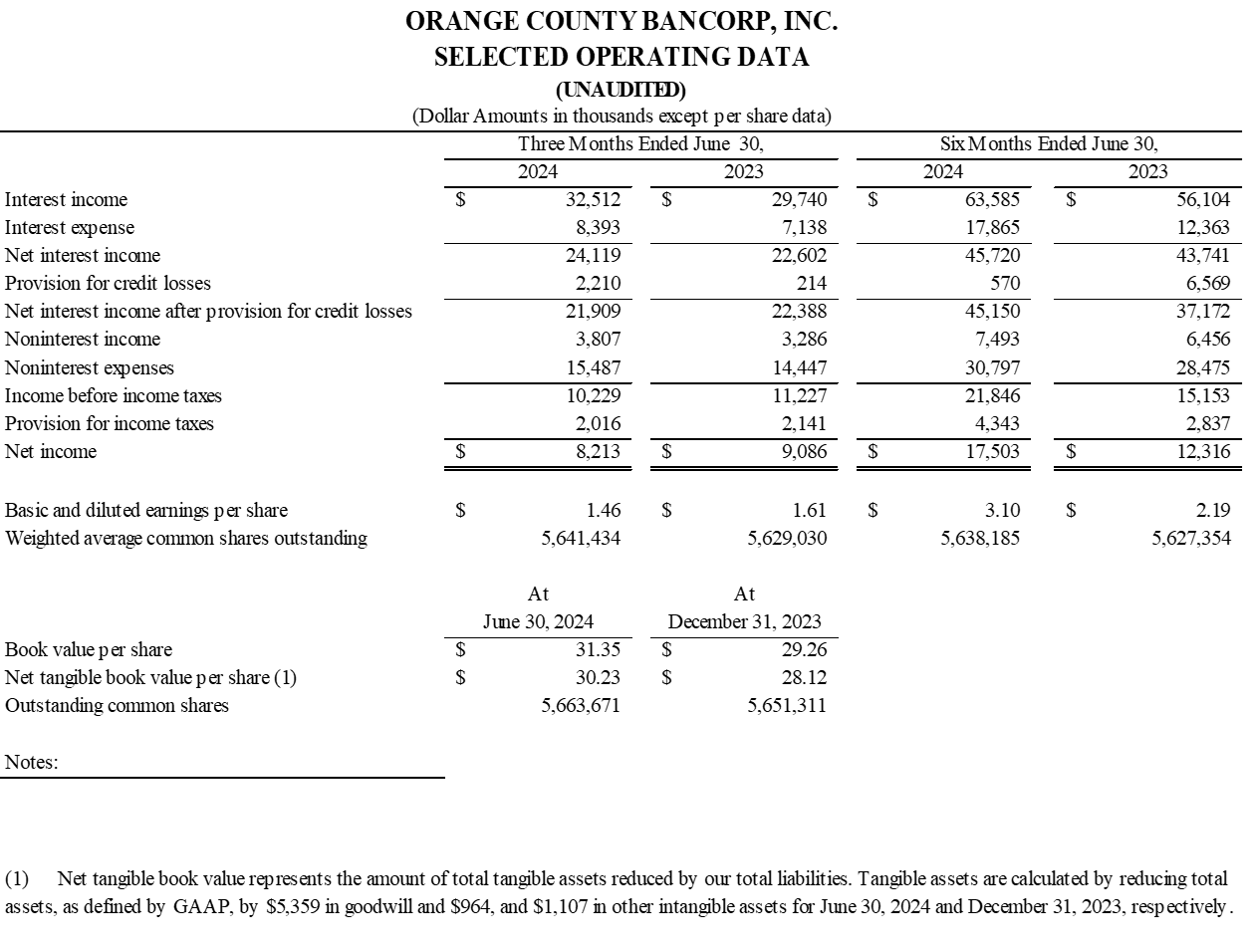

MIDDLETOWN, KY / ACCESSWIRE / July 31, 2024 / Orange County Bancorp, Inc. (the "Company") (Nasdaq:OBT), parent company of Orange Bank & Trust Co. (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of $8.2 million, or $1.46 per basic and diluted share, for the three months ended June 30, 2024. This compares with net income of $9.1 million, or $1.61 per basic and diluted share, for the three months ended June 30, 2023. The decrease in earnings per share, basic and diluted, was due primarily to increases in the provision for credit losses and non-interest expense offset by increases in net interest income and non-interest income during the current period. For the six months ended June 30, 2024, net income reached $17.5 million, or $3.10 per basic and diluted share, as compared to $12.3 million, or $2.19 per basic and diluted share, for the six months ended June 30, 2023.

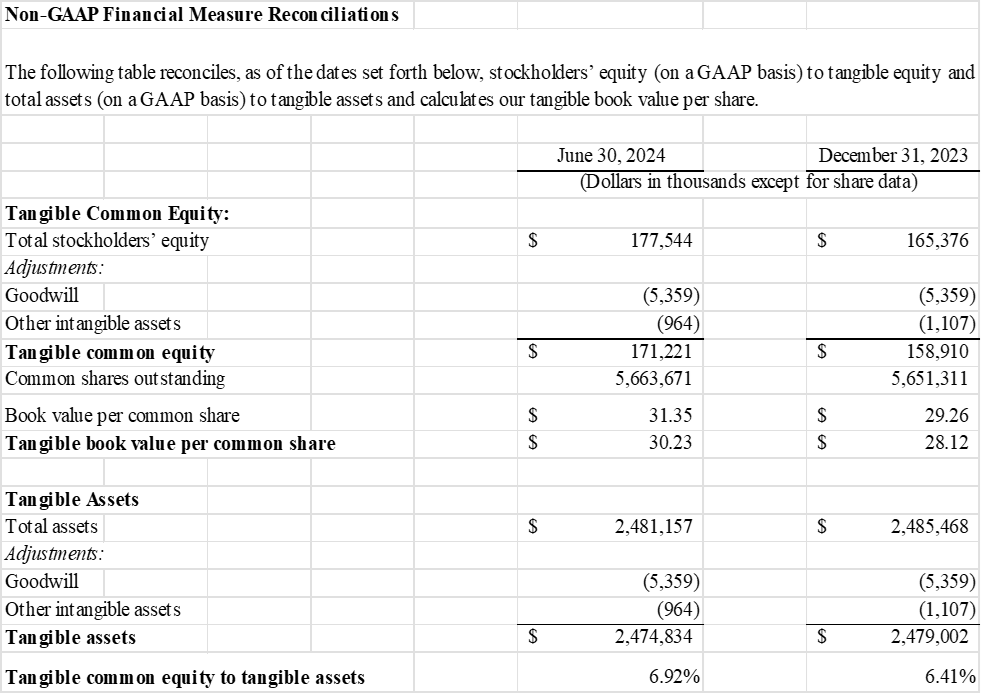

Book value per share rose $2.09, or 7.1%, from $29.26 at December 31, 2023 to $31.35 at June 30, 2024. Tangible book value per share increased $2.11, or 7.5%, from $28.12 at December 31, 2023 to $30.23 at June 30, 2024 (see "Non-GAAP Financial Measure Reconciliation" below for additional detail). These increases were due primarily to increased earnings during the six months ended June 30, 2024.

"Though it wasn't without challenges, I am pleased to report another excellent quarter of financial performance," announced Company President and CEO Mike Gilfeather, "For the second quarter of 2024 we recorded net income of $8.2 million versus $9.1 million the same period last year. Strong earnings during the quarter were negatively impacted by a credit impairment charge on one of our participation loans, which resulted in a net increase in our provision for credit losses.

Our total loan portfolio at quarter end stood at $1.7 billion. The Bank funded $29.2 million in new loans during the quarter, which were offset by loan repayment. As I've mentioned previously, regional loan demand remains strong, but uncertainty surrounding the Federal Reserve rate policy and overall industry volatility have caused us to slow loan origination in favor of maintaining and modestly improving rates in our loan portfolio. These actions helped push the average yield on our loan portfolio to 6.21% during Q2 2024 from 5.91% for Q1 2024.

This quarter also saw the results of our ongoing effort to increase deposits, despite today's challenging rate environment. Total deposits rose $160.5 million, or 7.9%, during the quarter to $2.2 billion at June 30, 2024, from $2.0 billion at year-end 2023. The bulk of these were relationship driven and, as such, carry a lower cost than broker originated deposits. The average cost of deposits stood at 1.34% for the second quarter, which is flat from last quarter, and up 46 basis points from 0.88% a year ago. While I am confident in the Bank's ability to gather deposits across rate environments, this result was particularly noteworthy.

This quarter also saw a continuation of our efforts to pay down external borrowings, which we secured last year in response to broad industry concerns stemming from the rapid rise in interest rates. We are fortunate our financial results continue to provide the opportunity to replace these expensive liquidity sources with more reasonably priced ones generated through deposit gathering. This year alone, we have reduced these borrowings from $234.5 million at year end 2023 to just $60 million at the end of Q2 2024.

The increased yield on our loan portfolio, growth in low cost deposits, and significant reduction of high-cost borrowings have all led to healthy expansion of our net interest margin. During the quarter, NIM rose 29 basis points, or 7.6%, to 4.10%, as compared to 3.81% for the quarter ended June 30, 2023.

Our Wealth Management division also remained a strong performer during the quarter. Trust and investment advisory income rose $405 thousand, or 15.9%, to $3.0 million for Q2 2024 from $2.6 million for the same period last year. Additionally, while year-over-year performance has been strong, HVIA's continued growth in the context of more volatile and uncertain fixed-income market performance is all the more impressive. I would add that these results aren't dependent upon or correlated with our traditional banking business, making Wealth Management an increasingly important source of diversified revenue for the Bank

In many ways, this quarter highlights the results of our very focused business strategy. Our performance resulted from an intentional effort to moderate loan growth in favor of higher rates, a bank wide, multi-year effort to grow core deposits, and a specific plan to replace expensive borrowings with lower cost funding. And though we executed on all of these to great effect, we remain subject to the traditional risks of lending which, unfortunately, resulted in the recognition of a participation loan impairment which impacted an otherwise outstanding quarter. I want to thank our employees once again for their tireless effort, flexibility and commitment to our work. Their ability to respond to challenges and consistently deliver these types of results reflects the knowledge and experience that makes our approach to business banking successful. Thanks as well to our shareholders for their continued support."

Second Quarter 2024 Financial Review

Net Income

Net income for the second quarter of 2024 was $8.2 million, a decrease of $873 thousand, or 9.6%, from net income of $9.1 million for the second quarter of 2023. The decrease represents a combination of an increased provision for credit losses and increased interest and non-interest expense over the same quarter last year. Net income for the six months ended June 30, 2024 was $17.5 million, as compared to $12.3 million for the same period in 2023. The increase reflects the effect of net interest income growth combined with reduced provision for credit losses during the first six months of 2024 as compared to the prior period. The reduced provision includes the positive impact of a recovery in 2024 associated with the write-off of Signature Bank subordinated debt during the first quarter of 2023.

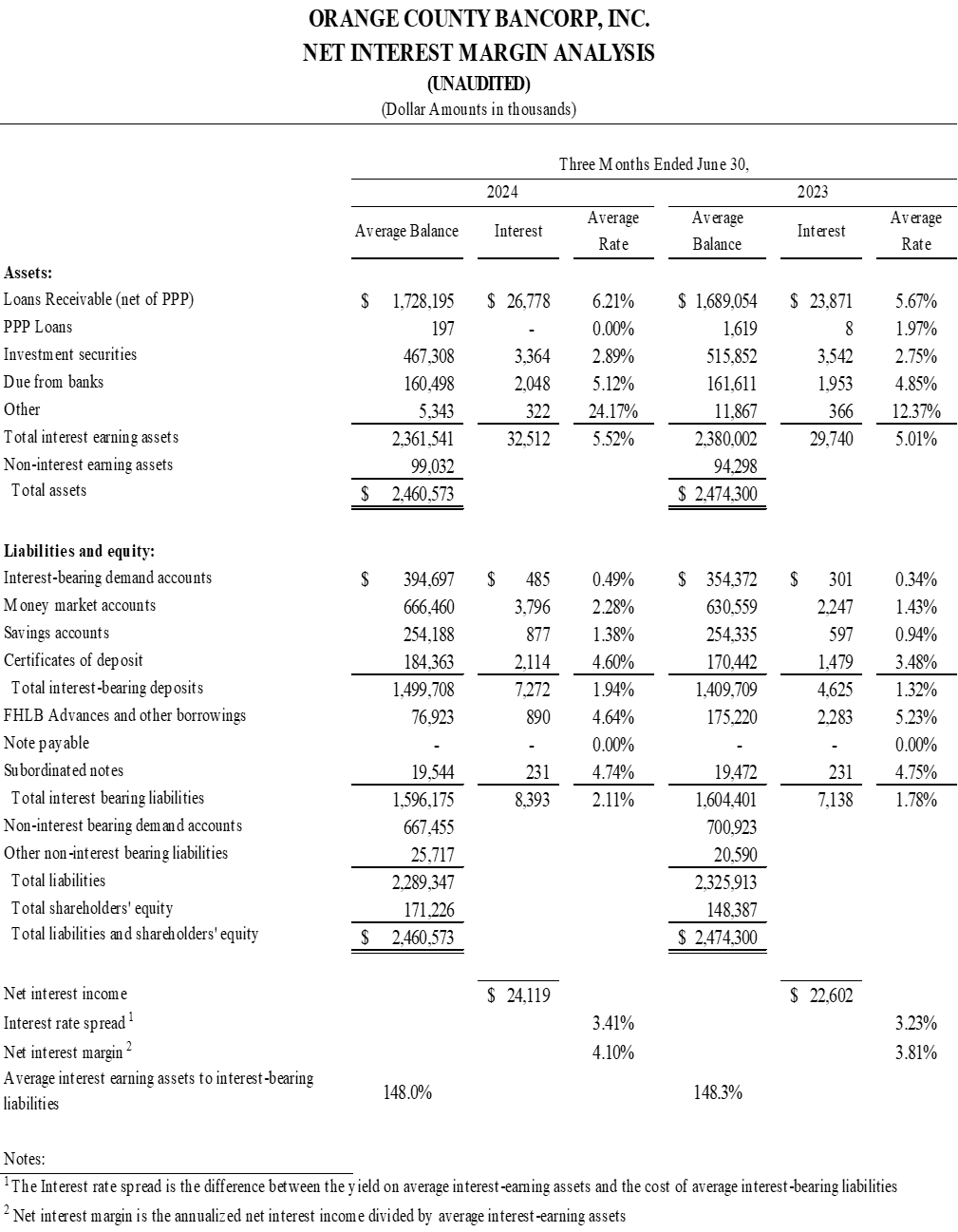

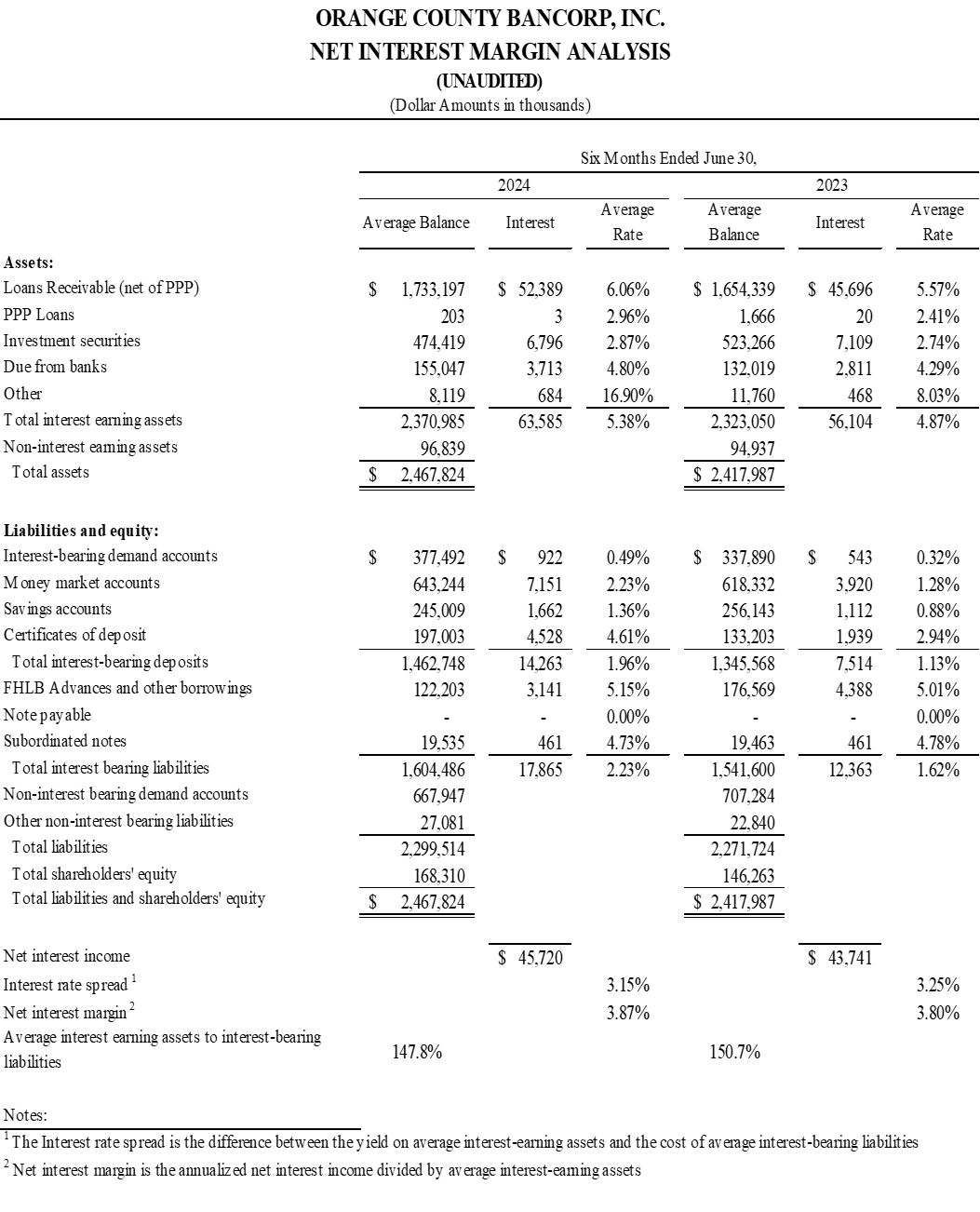

Net Interest Income

For the three months ended June 30, 2024, net interest income rose $1.5 million, or 6.7%, to $24.1 million, versus $22.6 million during the same period last year. The increase was driven primarily by a $2.9 million increase in interest and fees on loans during the current period. For the six months ended June 30, 2024, net interest income reached $45.7 million representing an increase of $2.0 million, or 4.5%, over the first half of 2023.

Total interest income rose $2.8 million, or 9.3%, to $32.5 million for the three months ended June 30, 2024, compared to $29.7 million for the three months ended June 30, 2023. The increase reflected 12.1% growth in interest and fees associated with loans, a 3.8% increase in interest income from tax-exempt investment securities, and a 4.9% increase in interest income related to fed funds interest and balances held at correspondent banks. For the six months ended June 30, 2024, total interest income rose $7.5 million, or 13.3%, to $63.6 million as compared to $56.1 million for the six months ended June 30, 2023.

Total interest expense increased $1.3 million during the second quarter of 2024, to $8.4 million, as compared to $7.1 million in the second quarter of 2023. The increase represented the continued combined effect of rising interest rates on customer deposits as well as higher costs associated with brokered deposits as alternate sources of funding. Interest expense associated with savings and NOW accounts totaled $5.2 million during the second quarter of 2024 as compared to $3.2 million during the second quarter of 2023. Interest expense associated with FHLB advances drawn and other borrowings during the current quarter totaled $890 thousand as compared to $2.3 million during the second quarter of 2023. During the six months ended June 30, 2024, total interest expense rose $5.5 million, to $17.9 million, as compared to $12.4 million for the same period last year.

Provision for Credit Losses

As of January 1, 2023, the Company adopted the current expected credit losses methodology ("CECL") accounting standard, which includes loans individually evaluated, as well as loans evaluated on a pooled basis to assess the adequacy of the allowance for credit losses. The Bank seeks to estimate lifetime losses in its loan and investment portfolio by using expected discounted cash flows and supplemental qualitative considerations, including relevant economic considerations, portfolio concentrations, and other external factors, as well as evaluating investment securities held by the Bank.

The Company recognized a provision for credit losses of $2.2 million for the three months ended June 30, 2024, as compared to $214 thousand for the three months ended June 30, 2023. This increase was primarily driven by a reserve associated with a specific non-accrual loan as well as the impact of the methodology associated with estimated lifetime losses and the types of loans closed during the quarter. The allowance for credit losses to total loans was 1.60% as of June 30, 2024 versus 1.44% as of December 31, 2023. For the six months ended June 30, 2024, the provision for credit losses totaled $570 thousand as compared to $6.6 million for the six months ended June 30, 2023. No reserves for investment securities were recorded during 2024.

Non-Interest Income

Non-interest income rose $521 thousand, or 15.9%, to $3.8 million for the three months ended June 30, 2024 as compared to $3.3 million for the three months ended June 30, 2023. This growth was related to continued increased fee income within each of the Company's fee income categories, including investment advisory income, trust income, and service charges on deposit accounts. For the six months ended June 30, 2024, non-interest income increased approximately $1.0 million, to $7.5 million, as compared to $6.5 million for the six months ended June 30, 2023.

Non-Interest Expense

Non-interest expense was $15.5 million for the second quarter of 2024, reflecting an increase of $1.0 million, or 7.2%, as compared to $14.5 million for the same period in 2023. The increase in non-interest expense for the three-month period continues to reflect the Company's commitment to growth. This investment consists primarily of increases in compensation, information technology, and deposit insurance costs. Our efficiency ratio improved to 55.5% for the three months ended June 30, 2024, from 55.8% for the same period in 2023. For the six months ended June 30, 2024, our efficiency ratio increased to 57.9% from 56.7% for the same period in 2023. Non-interest expense for the six months ended June 30, 2024 reached $30.8 million, reflecting a $2.3 million increase over non-interest expense of $28.5 million for the six months ended June 30, 2023.

Income Tax Expense

Provision for income taxes for the three months ended June 30, 2024 was $2.0 million, compared to $2.1 million for the same period in 2023. The decrease was directly related to lower income before income taxes. For the six months ended June 30, 2024, the provision for income taxes was $4.3 million as compared to $2.8 million for the six months ended June 30, 2023. Our effective tax rate for the three-month period ended June 30, 2024 was 19.7% as compared to 19.1% for the same period in 2023. Our effective tax rate for the six-month period ended June 30, 2024 was 19.9% as compared to 18.7% for the same period in 2023.

Financial Condition

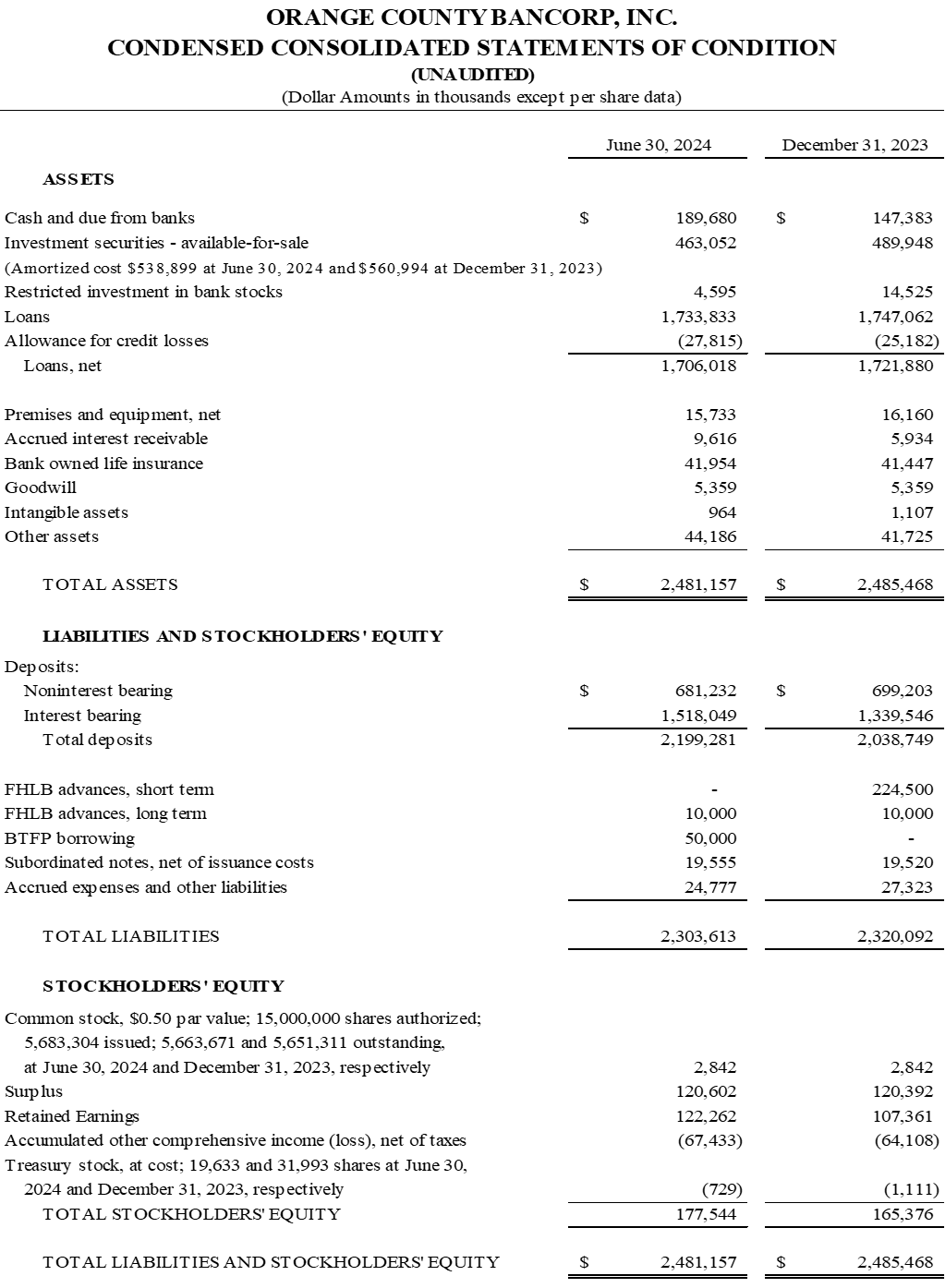

Total consolidated assets decreased $4.3 million, or 0.2%, and remained relatively level at $2.5 billion at June 30, 2024 and December 31, 2023, respectively. The stability of the balance sheet included increases and continued growth in deposits and cash as well as paydowns of borrowings during the current six-month period.

Total cash and due from banks increased from $147.4 million at December 31, 2023, to $189.7 million at June 30, 2024, an increase of approximately $42.3 million, or 28.7%. This increase resulted primarily from increases in deposit balances and slower loan growth which increased cash levels while reducing short-term borrowings.

Total investment securities fell $36.8 million, or 7.3%, from $504.5 million at December 31, 2023 to $467.7 million at June 30, 2024. The decrease continues to be driven primarily by investment maturities during the first six months of 2024.

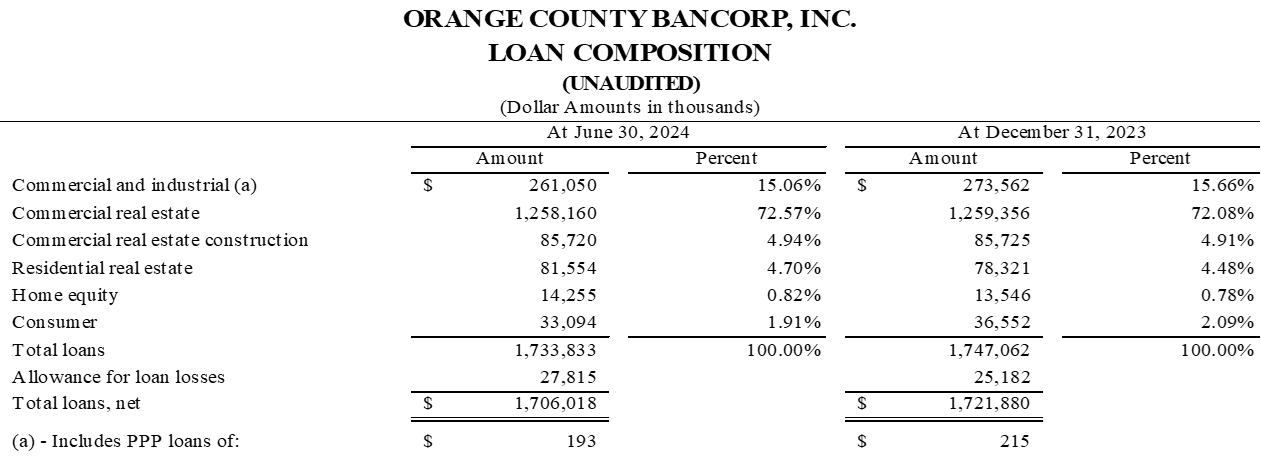

Total loans decreased $13.2 million, or 0.8%, from $1.7 billion at December 31, 2023 to $1.7 billion at June 30, 2024. The decrease was primarily driven by a decrease of $12.5 million related to commercial and industrial loans as well as a $3.5 million decrease in consumer loans offset by an increase of $3.2 million in residential real estate. All other loan categories were relatively stable during 2024.

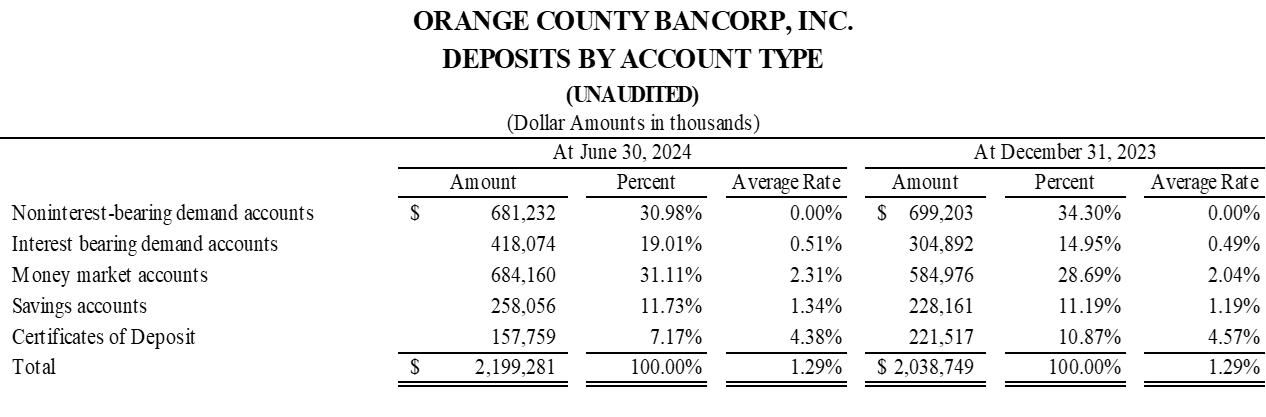

Total deposits increased $160.5 million, to $2.2 billion at June 30, 2024, from $2.0 billion at December 31, 2023. This increase was due primarily to $113.2 million of growth in interest bearing demand accounts; $99.2 million of growth in money market accounts; and $29.9 million of growth in savings accounts. The increases in deposit accounts were offset by an $18.0 million decrease in noninterest-bearing demand accounts and a $63.8 million decrease in certificates of deposit, mainly associated with brokered deposits utilized by the Bank for short term funding purposes. Deposit composition at June 30, 2024 included 50.0% in demand deposit accounts (including NOW accounts) as a percentage of total deposits. Uninsured deposits, net of fully collateralized municipal relationships, remain stable and represent approximately 40% of total deposits at June 30, 2024 as compared to 37% of total deposits at December 31, 2023.

FHLBNY short-term borrowings were paid off and there was no amount outstanding as of June 30, 2024 as compared to $224.5 million at December 31, 2023. The decrease in borrowings continues to be driven by increased deposits which outpaced loan growth during the first half of 2024 and allowed for paydowns of borrowings while maintaining consistent levels of cash at June 30, 2024. The decrease in borrowings reflects a strategic decision to manage liquidity sources and take advantage of opportunities to reduce funding costs.

Stockholders' equity experienced an increase of approximately $12.2 million during the first half of 2024, reaching $177.5 million at June 30, 2024 from $165.4 million at December 31, 2023. The increase was due primarily to $17.5 million of net income during the first half of 2024 partially offset by an increase in unrealized losses of approximately $3.3 million on the market value of investment securities within the Company's equity as accumulated other comprehensive income (loss) ("AOCI"), net of taxes.

At June 30, 2024, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital to average assets ratio was 10.04%, both common equity and Tier 1 capital to risk weighted assets were 13.84%, and total capital to risk weighted assets was 15.09%.

Wealth Management

At June 30, 2024, our Wealth Management Division, which includes trust and investment advisory, totaled $1.7 billion in assets under management or advisory as compared to $1.6 billion at December 31, 2023, reflecting an increase of 8.6%. Trust and investment advisory income for the quarter ended June 30, 2024 reached $3.0 million and represented an increase of 15.9%, or $405 thousand, as compared to $2.6 million for the quarter ended June 30, 2023.

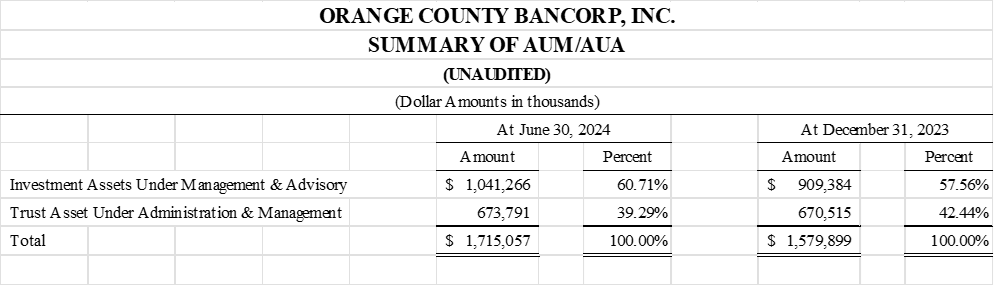

The breakdown of trust and investment advisory assets as of June 30, 2024 and December 31, 2023, respectively, is as follows:

Loan Quality

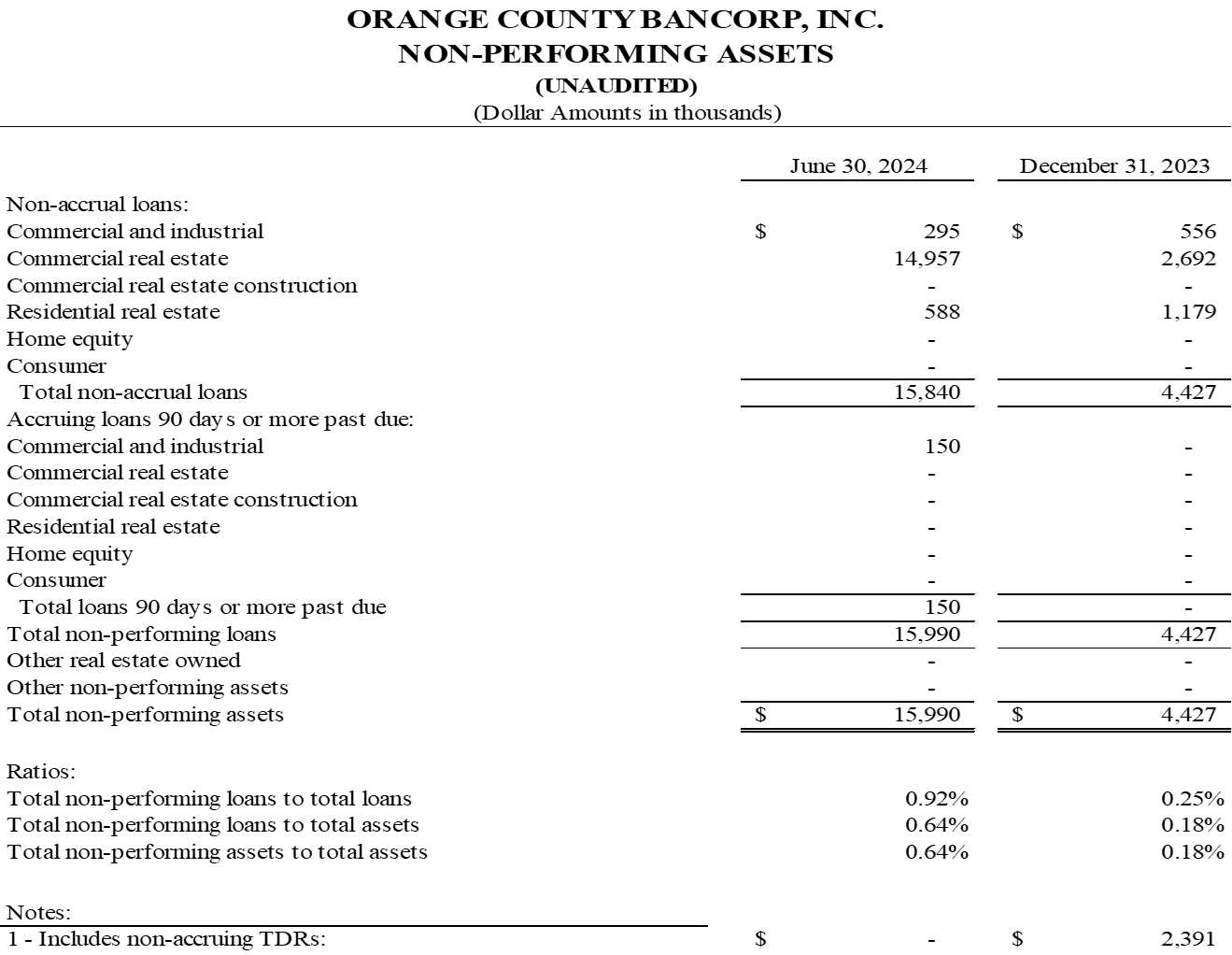

At June 30, 2024, the Bank had total non-performing loans of $16.0 million, or 0.92% of total loans. Total non-accrual loans represented approximately $15.8 million of loans as of June 30, 2024 compared to $4.4 million at December 31, 2023. The increase in non-accrual loans was primarily the result of one commercial real estate participation which has experienced payment slowdowns and required classification as non-accrual at quarter end.

Liquidity

Management believes the Bank has the necessary liquidity to meet normal business needs. The Bank uses a variety of resources to manage its liquidity position. These include short term investments, cash from lending and investing activities, core-deposit growth, and non-core funding sources, such as time deposits exceeding $250,000, brokered deposits, FHLBNY advances, and other borrowings. As of June 30, 2024, the Bank's cash and due from banks totaled $189.7 million. The Bank maintains an investment portfolio of securities available for sale, comprised mainly of US Government agency and treasury securities, Small Business Administration loan pools, mortgage-backed securities, and municipal bonds. Although the portfolio generates interest income for the Bank, it also serves as an available source of liquidity and funding. As of June 30, 2024, the Bank's investment in securities available for sale was $463.1 million, of which $59.9 million was not pledged as collateral and additional $45.2 million with the Federal Reserve which is not specifically designated to any borrowings. Additionally, as of June 30, 2024, the Bank's overnight advance line capacity at the Federal Home Loan Bank of New York was $611.0 million, of which $90.0 million was used to collateralize municipal deposits and $10.0 million was utilized for long term advances. As of June 30, 2024, the Bank's unused borrowing capacity at the FHLBNY was $511.0 million. The Bank also maintains additional borrowing capacity of $20 million with other correspondent banks. Additional funding is available to the Bank through the discount window lending by the Federal Reserve. At June 30, 2024, the Bank was utilizing $50 million of funding through the Bank Term Funding Program from the Federal Reserve under a one-year facility.

The Bank also considers brokered deposits an element of its deposit strategy. As of June 30, 2024, the Bank had brokered deposit arrangements with various terms totaling $122.5 million.

About Orange County Bancorp, Inc

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to approximately $2.5 billion in total assets. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and acquired by the Company in 2012.

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, inflation, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, increased levels of loan delinquencies, problem assets and foreclosures, credit risk management, asset-liability management, cybersecurity risks, geopolitical conflicts, public health issues, the financial and securities markets and the availability of and costs associated with sources of liquidity.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Michael Lesler

EVP & Chief Financial Officer

mlesler@orangebanktrust.com

Phone: (845) 341-5111

View the original press release on accesswire.com