Advanced Micro Devices (AMD) has emerged as the best-performing stock in the S&P 500 Index ($SPX) over the past month. Shares of the chipmaker have surged more than 56%, reaching new record highs. The rally comes as investor confidence in AMD’s role within the artificial intelligence (AI) market continues to strengthen. Moreover, the company’s recent partnerships and strategic deals have further driven optimism about its ability to compete with industry leaders and capture more market share.

AMD stock recently received a boost when International Business Machines (IBM) announced that it could run a quantum computing error correction algorithm on AMD chips. This news followed a multibillion-dollar partnership with OpenAI. The stock also received a significant boost after the company announced a multibillion-dollar partnership with OpenAI. This deal will reshape AMD’s product roadmap and accelerate its presence in the AI hardware space.

Adding to the momentum, AMD also deepened its long-standing relationship with Oracle (ORCL) in October. Oracle Cloud Infrastructure (OCI) will serve as the launch partner for the world’s first publicly available AI supercluster powered by AMD’s Instinct MI450 Series GPUs. The initial rollout is set for the third quarter of 2026, with broader expansion to follow in 2027 and beyond.

These strategic moves position AMD solidly to capitalize on the accelerating global investments in AI and cloud infrastructure. The company’s GPUs, EPYC CPUs, and networking technologies form a robust ecosystem designed to handle intensive AI workloads, which is likely to drive its financials and share price.

However, the stock’s meteoric rise has also elevated its valuation, raising concerns. While AMD’s prospects remain strong, other semiconductor players, such as Micron Technology (MU), are offering better value. Notably, Micron has outpaced AMD in terms of year-to-date performance, with its shares soaring roughly 177% compared to AMD’s 113% gain. Despite that impressive run, Micron’s valuation remains attractive relative to its earnings growth potential, offering a more compelling entry point for investors.

Micron Offers Better Value Than AMD Despite Impressive Rally

After a remarkable run, AMD stock now trades at a significantly higher forward price-earnings (P/E) ratio of about 81.1 times. Such a high multiple signals that investors are pricing in strong growth ahead. While AMD’s fundamentals remain solid and its growth story compelling, analysts expect the company’s earnings to rise by 68.2% in 2026. That growth outlook is strong, but when set against its premium valuation, it leaves little room for error.

Micron, by contrast, appears to be far more reasonably priced. MU stock trades at just 14.5 times forward earnings, a level that leaves room for further growth. Analysts forecast Micron’s earnings per share to jump by an impressive 101.5% in fiscal 2026, making MU undervalued.

The Bottom Line

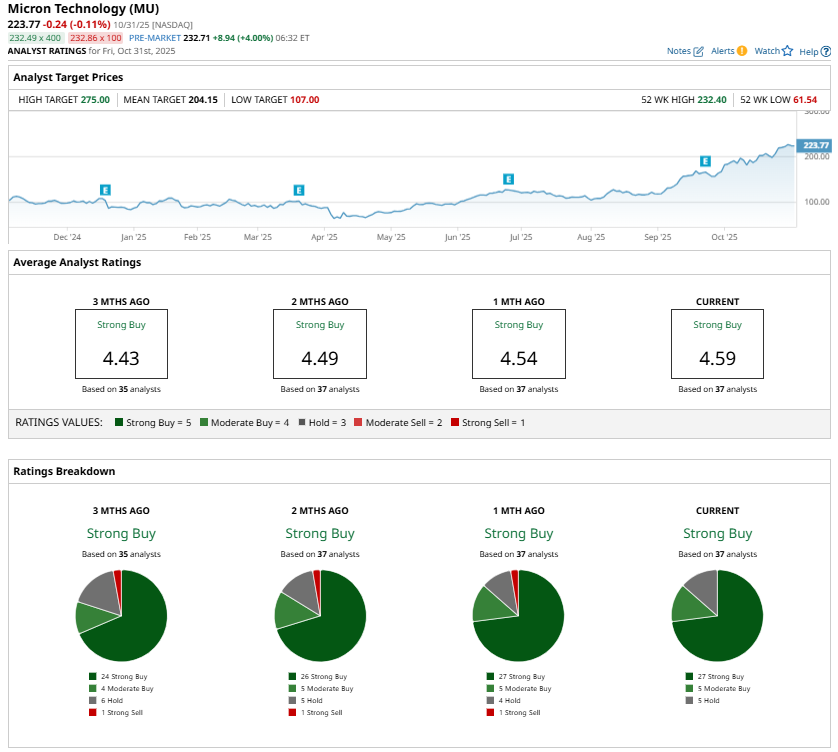

As AI-driven demand is reshaping the semiconductor landscape, both AMD and Micron are well-positioned to capture long-term growth. Further, Wall Street analysts are bullish about both stocks. However, when it comes to balancing value and opportunity, Micron appears to hold the upper hand.

Micron is benefiting from the growing global data center market. These centers demand faster and more efficient memory and storage, driving demand for Micron’s high-performance solutions.

A key growth catalyst for Micron is its High Bandwidth Memory (HBM) business. In the fourth quarter of fiscal 2025, Micron’s HBM revenue soared to nearly $2 billion, pointing to an annualized run rate close to $8 billion. This rapid growth stems largely from the ramp-up of its next-generation HBM3E products.

Micron’s growth potential is further strengthened by its diverse and expanding customer base. The company now partners with six major customers for its HBM portfolio and has already secured pricing agreements for most of its HBM3E supply through 2026. Negotiations for its HBM4 products are also underway, with early signs indicating that Micron’s 2026 capacity could soon be fully booked, reflecting surging demand and strong customer confidence.

In essence, while AMD may be the market’s current favorite, Micron appears to offer better value for investors. With a modest valuation and stronger projected earnings growth, Micron is an attractive semiconductor play.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart