As we approach 2026, investors are eyeing opportunities in high-growth stocks that stand to benefit from accelerating artificial intelligence (AI) adoption, robust earnings momentum, and expanding market demand. Here are three of the fastest-growing stocks poised to deliver significant upside in the year ahead.

Arm Holdings

Arm Holdings (ARM), best known for designing the chip architectures that power most of the world’s smartphones, is rapidly cementing its position at the center of the global AI buildout. While Arm does not manufacture chips, its licensing and royalty business model positions it to earn significantly as AI demand grows across devices, data centers, and future platforms.

Valued at roughly $120 billion, Arm stock has dipped 8.2% YTD, compared to the broader market index gain of 15.9%.

In the second quarter of fiscal 2026, Arm delivered the strongest quarter in its history. Revenue increased by 34% year-over-year to $1.14 billion, marking the company's third-consecutive billion-dollar quarter. Royalties reached a record $620 million, thanks to strong growth in smartphones, cloud infrastructure, automotive systems, and IoT. At the same time, Arm's license annualized contract value increased by 28%, indicating strong demand for its next-generation designs.

Data centers continue to be a primary growth engine. Arm's Neoverse platform has now surpassed 1 billion CPUs deployed worldwide. Hyperscalers and chip designers, such as Nvidia (NVDA), Amazon (AMZN) AWS, Alphabet's (GOOG) (GOOGL) Google, and Microsoft (MSFT) continue to develop custom processors based on Arm architecture, increasing Arm's royalty base as AI workloads grow.

During the quarter, licensing revenue increased 56% to $515 million, reflecting deeper relationships and growing interest in AI-optimized systems. Profitability also increased, with adjusted earnings per share (EPS) rising by 30% to $0.39. Beyond the data center, Arm is expanding its AI footprint into edge devices and automotive systems. Strategic collaborations with Meta (META) and Samsung aim to boost AI efficiency across wearables and flagship smartphones, while new platforms such as Lumex CSS provide powerful on-device AI capabilities to customers. Arm-based computers are also gaining popularity among developers, aided by a global community of over 22 million programmers.

Looking ahead, management expects to maintain progress, with third-quarter revenue of around $1.22 billion. With expanded collaborations, rising royalties, and increasing AI usage across all layers of computing, Arm appears to be well-positioned as a key participant in the AI era, as well as an increasingly attractive long-term investment option.

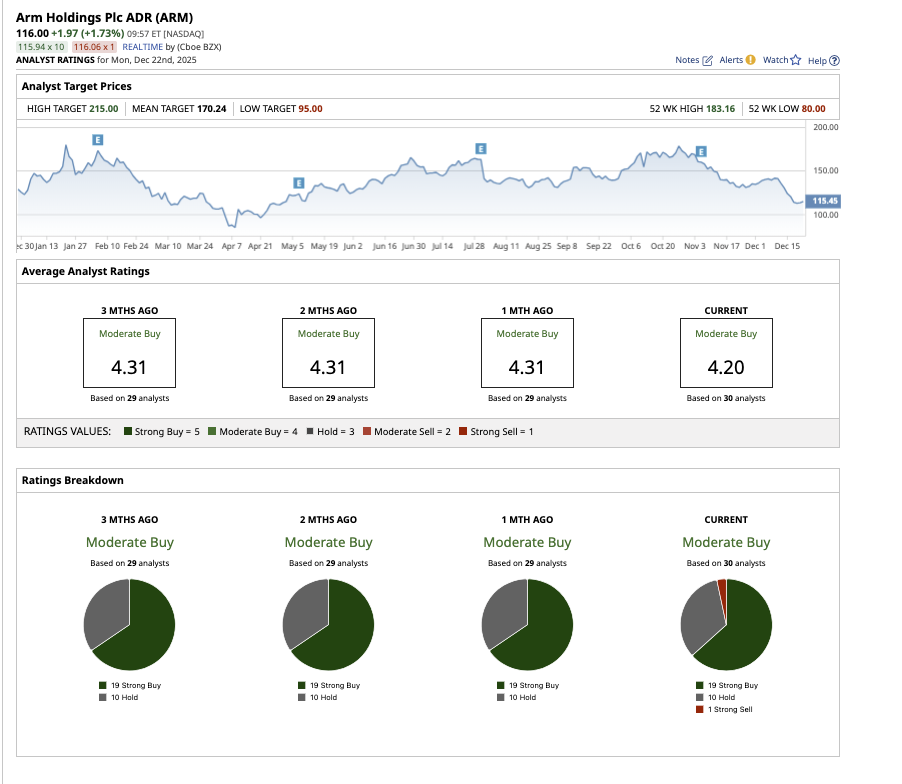

What Does Wall Street Say About ARM Stock?

On Wall Street, ARM stock holds an overall consensus rating of "Moderate Buy.” Among the 30 analysts covering the stock, 19 rate it as a “Strong Buy,” 10 recommend a “Hold,” and one rates it a “Strong Sell.” The stock’s average target price of $170.24 suggests potential upside of nearly 50% from current levels, while the highest price estimate of $215 indicates a possible 90% rally over the next 12 months.

SoundHound AI

SoundHound AI (SOUN) develops voice and conversational AI technology that lets people interact with devices and services using natural speech. Valued at $4.7 billion, SOUN stock has fallen 43.2% YTD, yet Wall Street expects significant upside.

In the first three quarters of 2025 alone, the company earned record revenue of $114 million, indicating 127% growth, causing management to revise its full-year forecast once more. The company's success stems from two decades of extensive AI research and early innovation. A major driver of recent growth is the Amelia 7 platform, one of the first fully agentic AI systems designed specifically for enterprise use. By combining deterministic workflows, machine learning, and human escalation, Amelia enables companies to move AI use cases from concept to deployment in weeks rather than months. The platform’s latest upgrades have further improved conversational speed and natural interaction, driving new customer wins globally.

Q3 revenue reached $42 million, up 68% year-over-year, with growth across enterprise, restaurants, IoT, healthcare, insurance, and financial services. Looking ahead, management expects full-year revenue between $165 million and $180 million, with a path toward near breakeven profitability as growth and scale continue into 2026.

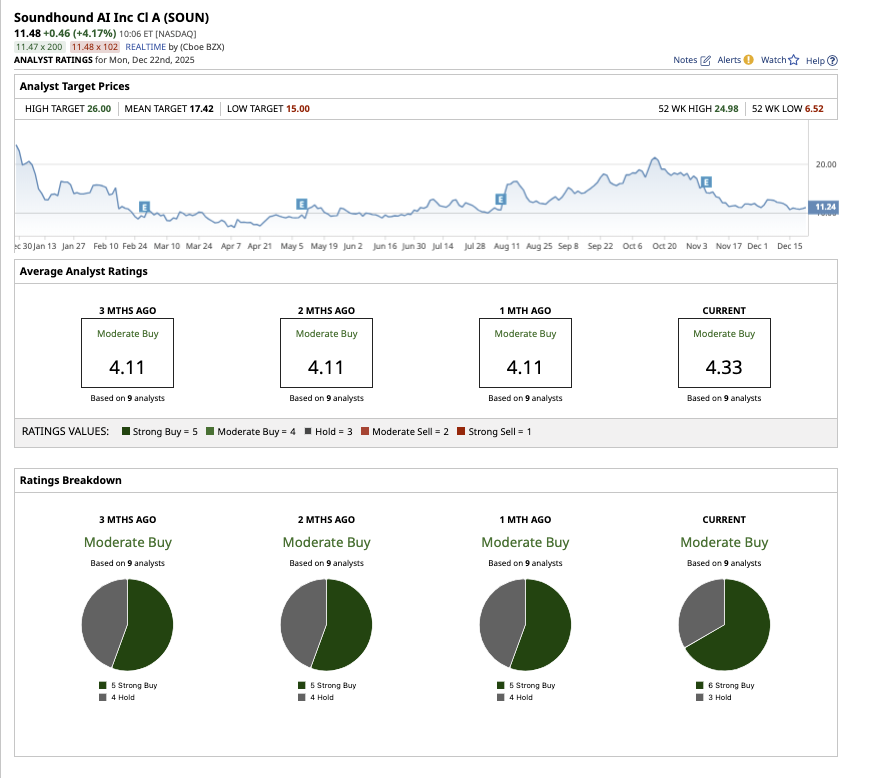

What Does Wall Street Say About SOUN Stock?

On Wall Street, SOUN stock holds an overall rating of “Moderate Buy.” Among the nine analysts covering the stock, six rate it as a “Strong Buy” and three rate it a “Hold.”

The stock’s average target price of $17.42 suggests potential upside of 54.5% from current levels, while the highest price estimate of $26 indicates a possible 130% rally over the next 12 months.

Snowflake

Snowflake (SNOW) is a cloud-based data and AI platform that enables businesses to store, manage, analyze, and share massive volumes of data while also developing and deploying AI and machine-learning applications on that data.

SNOW stock has gained 46.9% YTD, outperforming the broader market.

Snowflake delivered a standout third quarter as enterprise adoption of data and AI solutions continued to accelerate. The company reported product revenue of $1.16 billion, representing 29% year-over-year growth, supported by strong execution across its core data platform and expanding AI workloads. Remaining performance obligations increased to $7.88 billion, representing a 37% year-over-year growth, which highlights rising long-term customer commitments.

Customer demand remained robust, with Snowflake adding a record 615 new customers during the quarter and maintaining a healthy net revenue retention rate of 125%. AI adoption has emerged as a major growth driver. More than 7,300 customers now use Snowflake's AI capabilities on a weekly basis, and Snowflake Intelligence experienced the fastest product adoption ramp in company history, hitting 1,200 customers. AI-related products generated a $100 million revenue run rate one quarter ahead of projections, signaling real-world enterprise usage rather than experimentation.

Strategic partnerships further strengthened Snowflake’s ecosystem. Collaborations with companies such as SAP, Google Cloud, Anthropic, and major SaaS providers expanded data access, model choice, and enterprise-grade AI deployment.

Looking ahead, management raised full-year revenue guidance to approximately $4.45 billion, reinforcing confidence in sustained growth as Snowflake deepens its role at the center of enterprise data and AI strategies.

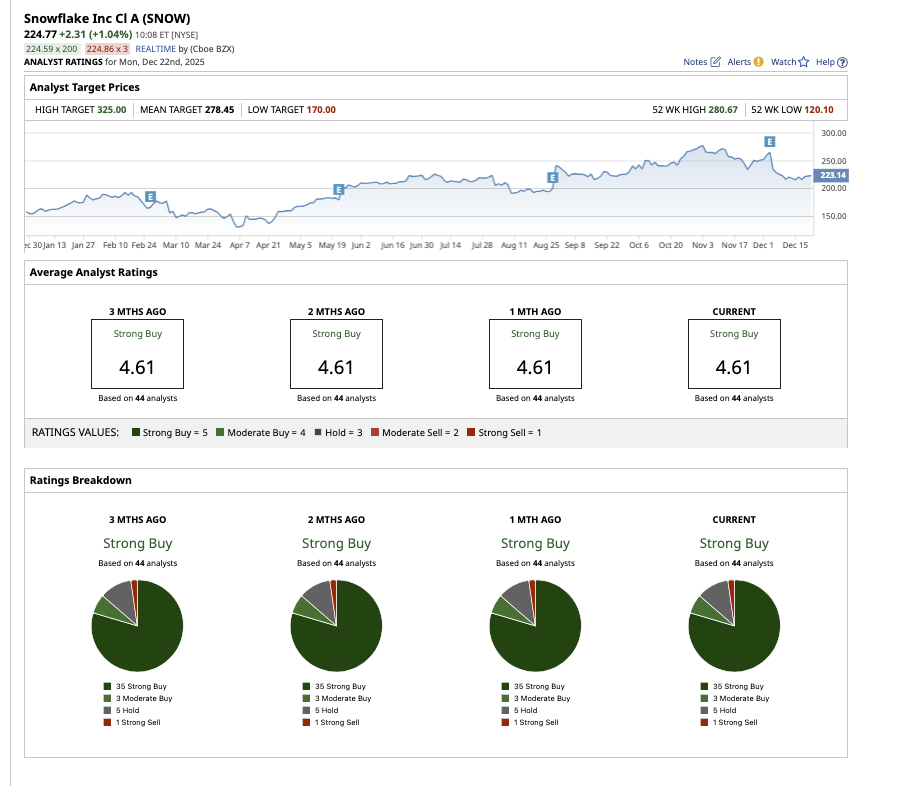

What Does Wall Street Say About SNOW Stock?

On Wall Street, SNOW stock holds an overall rating of “Strong Buy.” Among the 44 analysts covering the stock, 35 rate it as a “Strong Buy,” three say it is a “Moderate Buy,” five rate it a “Hold,” and one says it is a “Strong Sell.” The stock’s average target price of $278.45 suggests potential upside of 22.7% from current levels, while the highest price estimate of $325 indicates a possible 43.3% rally over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart