The institutional activity in the furniture industry stocks has been a little mixed over the past two quarters or so but one thing is clear. The institutions are comfortable with this group and there are many reasons why. Not only do they present value to investors but they offer high yields, and strong balance sheets and they are still outperforming the analyst's expectations.

In regards to which stocks are the most owned by the institutions, La-Z-Boy (NYSE: LZB) comes with the highest amount of institutional ownership at 95% and it's very widespread ownership at that. Names owning stocks within the group pop up over and over again including Comerica, Goldman Sachs (NYSE: GS), Truist, and no shortage of state and municipal pension funds. One name that stands out is Ritholz Wealth Management which is helmed by Josh Brown of The Reformed Broker fame.

Furniture Stocks Are Tightly Held Names

La-Z-Boy, Ethan Allen (NYSE: ETD), and Haverty Furniture Companies (NYSE: HVT) are the most tightly held names in a tightly held group and include high levels of insider and institutional ownership. La-Z-Boy has the lowest insider ownership but that is offset by the institutions, there just isn’t that much of the company left for the insiders to own. The others, including Basset Furniture, have insider ownership that runs in the range of 7.2% to 10.8% which is a telling sign for investors. Not only does management have skin in the game but there are large numbers of “major shareholders” to help reduce volatility in the respective markets.

In regards to activity, the activity in the more tightly-held names is more mixed while that in Basset, which has the lowest institutional ownership at only 59%, has seen an uptick in buying. Haverty and Ethan Allen are both running with institutional ownership in the mid-to-high 80% range. The takeaway here is that, while tightly held, there is a little rotation going on and Basset Furniture is the current beneficiary. In this light, it may outperform over the next quarter or so but all of these businesses (that have reported so far) are outperforming their expectations while offering safe yields and low entry prices.

Furniture Stocks Offer Value And Yield

The furniture stocks are, as a group, trading at very low levels relative to the broad market and there are deals to be found within the group as well. The range of value runs from a P/E of 6X earnings for Haverty Furniture Companies to a high of 8X earnings for Basset Furniture and they all pay above-average dividends. The lowest yield in the group belongs to La-Z-Boy which amounts to a 2.6% yield with shares trading near $25 while the highest, 5%, belongs to Ethan Allen. In all cases, there is a positive outlook for dividend growth and special dividends as well. The balance sheets in this industry are fortresses and cash flow is unimpeded. At last look, the average payout ratio was running in the mid-30% range which is very healthy indeed.

Furniture Stocks Outperform The Broad Market

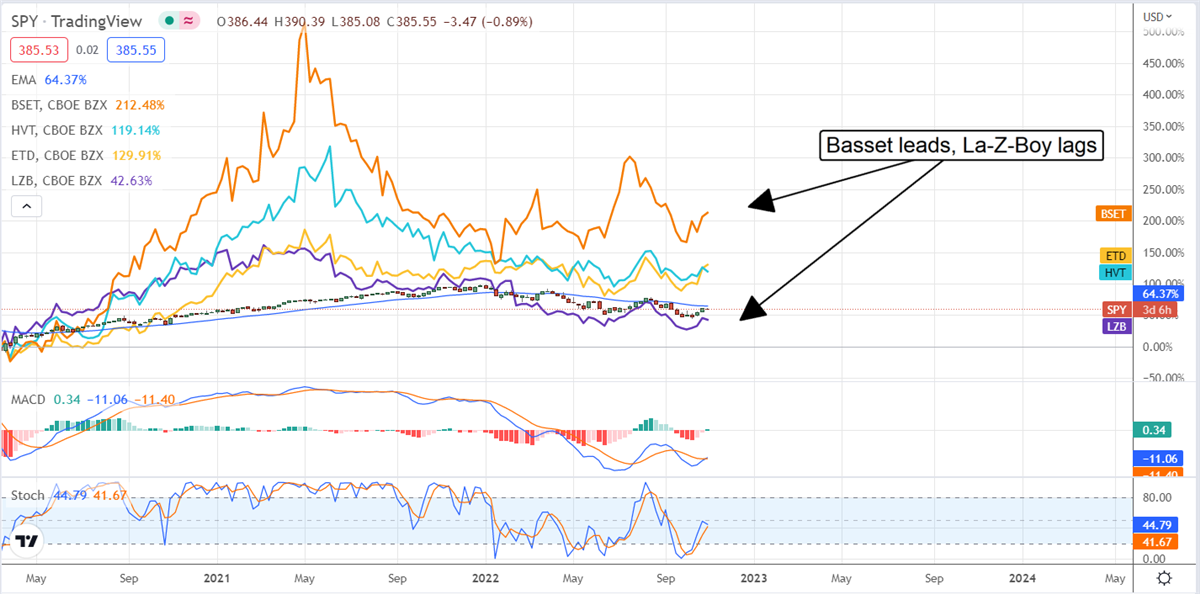

Furniture stocks have been outperforming the broad market since it hit the pandemic bottom in spring 2020. Basset Furniture is the winner with a gain of over 210% since the bottom was put in and only La-Z-Boy is lagging. Basset Furniture may be the best buy in the group but a blended approach may also be a good idea for investors looking to get into this market.