Over the last six months, Nature's Sunshine’s shares have sunk to $14.50, producing a disappointing 7.3% loss while the S&P 500 was flat. This might have investors contemplating their next move.

Is there a buying opportunity in Nature's Sunshine, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Nature's Sunshine Not Exciting?

Even though the stock has become cheaper, we're cautious about Nature's Sunshine. Here are three reasons why there are better opportunities than NATR and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

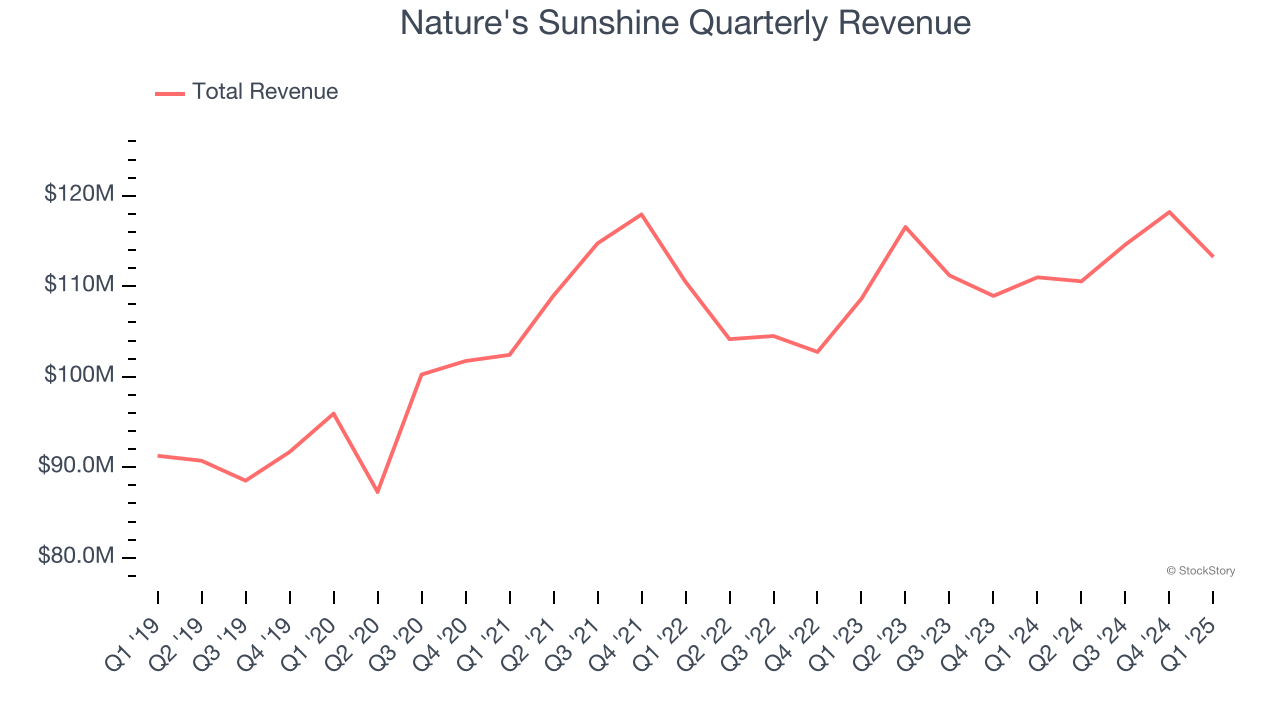

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Nature's Sunshine struggled to consistently increase demand as its $456.6 million of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and is a sign of lacking business quality.

2. Fewer Distribution Channels Limit its Ceiling

With $456.6 million in revenue over the past 12 months, Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Nature's Sunshine, its EPS declined by 20.6% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Nature's Sunshine isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 19.1× forward P/E (or $14.50 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.