While classical computing is still what’s used by the masses, the next wave appears to be quantum computing. Quantum computing uses quantum bits, or qubits, that can perform calculations much faster because of how they’re designed.

In short, classical computing works on a simple binary code of zeros and ones. But in quantum mechanics, zeros and ones can exist at the same time and in various stages. That’s why quantum computing has incredible potential and can be exponentially more powerful than classical computing for some problems.

And that’s why analysts are paying more attention to quantum computing stocks. Jefferies recently initiated coverage on IonQ (IONQ), putting a high price target of $100 on the stock. Will 2026 be the year that IonQ takes off?

About IonQ Stock

IonQ is a Maryland-based company developing quantum computing technology that operates through cloud services and direct access. The company, which was founded in 2015, develops general-purpose trapped ion quantum computers, as well as accompanying software. It has a market capitalization of $17 billion.

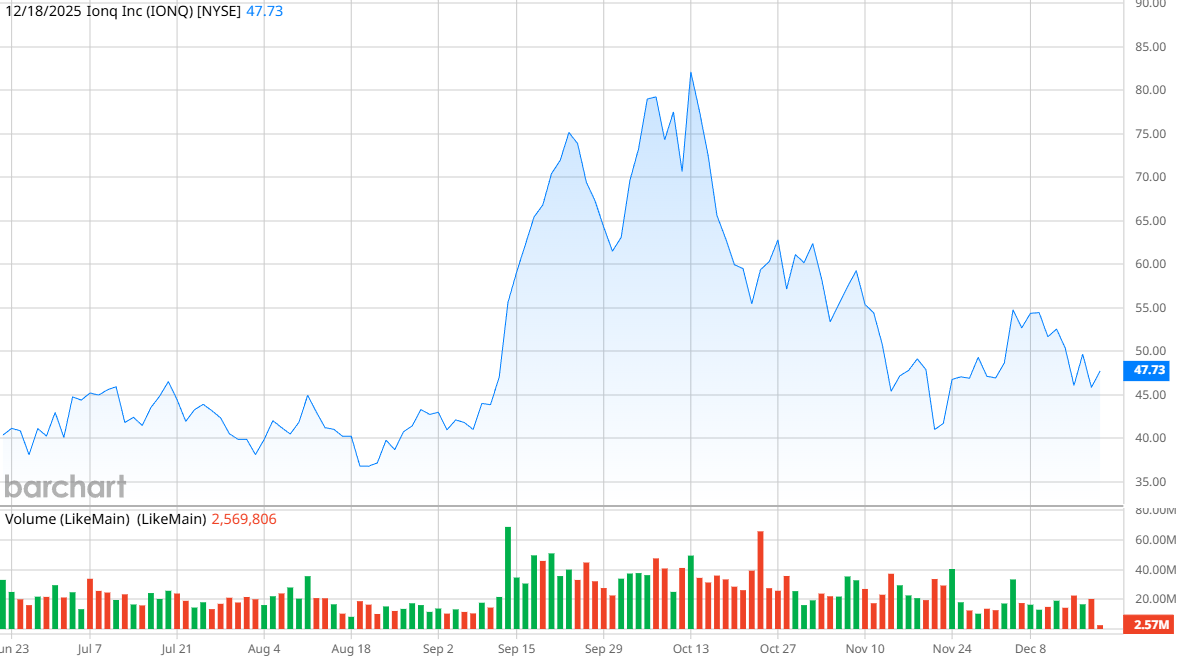

Shares this year are up nearly 13%, which not only trails the S&P 500’s ($SPX) gain of 16% but also its competitors. Rigetti Computing (RGTI) is up 50% in 2025, and D-Wave Quantum (QBTS) is up a whopping 201%. That’s not necessarily a red flag, though—IonQ has a market cap roughly the same size as Rigetti and D-Wave combined. The latter two companies appear to be catching up to IonQ, which was an early leader in the space.

IonQ isn’t generating a profit yet, so the best valuation metric is the price-to-sales ratio. IONQ stock has a hefty ratio of 150.5, but that’s much better than Rigetti (917) or D-Wave (304.9). The market is pricing in a lot of optimism for each of these companies, but IonQ can at least be considered the cheapest of the three.

IonQ Misses on Earnings

IonQ’s third-quarter earnings report showed a massive loss on paper, but if you dig into the earnings report, you see it wasn’t nearly as bad as it first appears. In fact, there are plenty of positives to take from the report.

For instance, revenue of $39.9 million beat the company’s previously announced guidance by 37% and was up 222% from a year ago.

The company posted a massive net loss of $1.1 billion, however, versus a loss of $52.5 million a year ago. That caused an earnings per share loss of $3.58 when analysts were expecting a loss of only $0.44. However, nearly $882 million of that net loss was because of accounting rules that require IonQ to mark certain warrants to market.

The adjusted loss of $0.17 appears much better, as well as the bottom-line adjusted loss of $48.9 million. The company also completed a $2 billion equity offering in October, which raised its cash, cash equivalents, and investments to $3.5 billion.

The company also completed two acquisitions in the quarter, Oxford Ionics and Vector Atomic, which together will help the company scale and strengthen its full-stack quantum platform.

“We are on a clear trajectory to deliver critical quantum cybersecurity infrastructure, ultra-precise quantum navigation, quantum timing solutions, and large-scale networked quantum systems,” CEO Niccolo de Masi said. “Now with $3.5 billion of pro-forma net cash, we are continuing to reap the compounding benefits of our scale and momentum advantages, entrenching our position as the dominant force in quantum and the only complete platform solution. I am confident in our ability to deliver growth and value creation for IonQ shareholders in 2026.”

What Do Analysts Expect for IONQ Stock?

Jeffries analyst Keven Garrigan is the most bullish on IONQ stock, with his newly instituted price target of $100. “We see upside as IonQ executes, expands partnerships/system sales, and builds the quantum ecosystem,” he wrote in a research note.

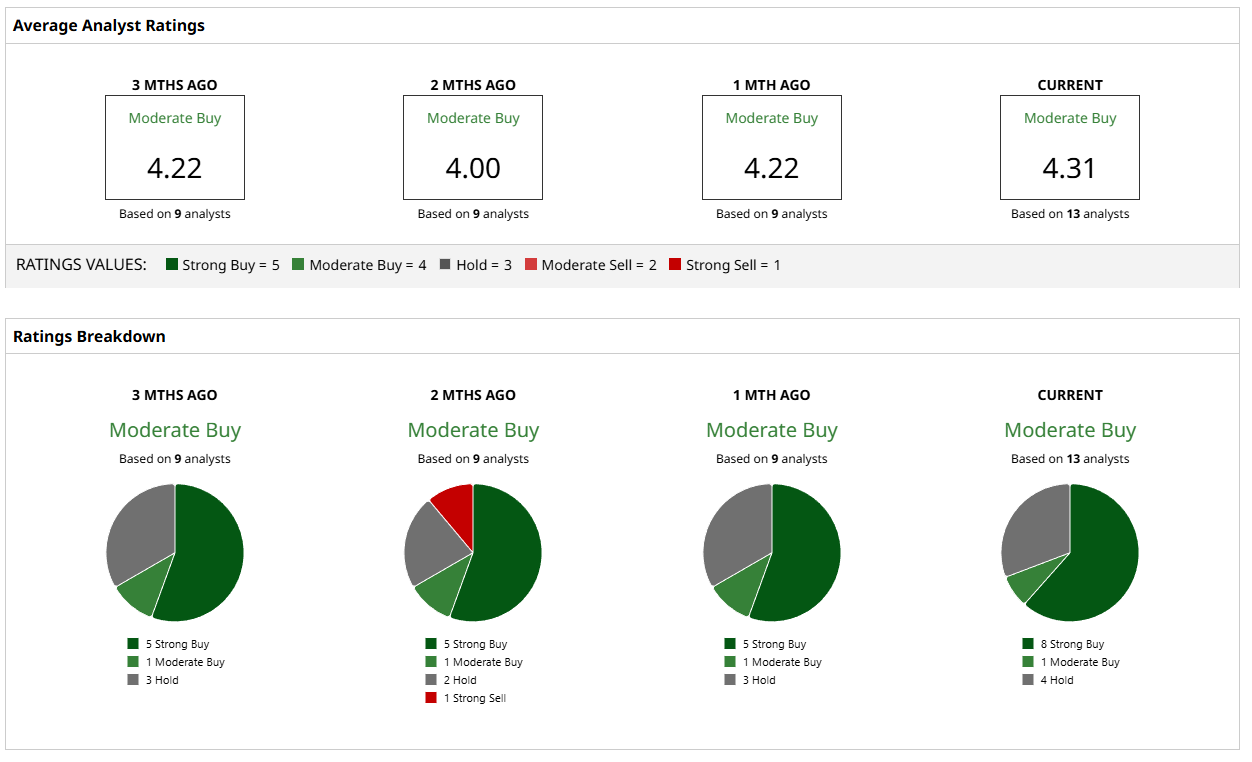

Of 13 analysts who cover the stock, eight of them have a “Strong Buy” rating on IonQ, with one giving it a slightly less glowing “Moderate Buy” rating. The other four analysts suggest holding, but nobody has a sell rating.

The mean price target of $75.50 represents a potential 59% increase in stock price in the coming months, while Garrigan’s target hints at a 111% jump.

For investors who are looking to invest in quantum computing stocks, IonQ looks to be an appealing opportunity. Just be patient, as this is an emerging space—losses will likely continue for several more quarters, and there may be some volatility ahead.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Raised Their Micron Stock Price Target by 50%. Should You Buy Shares Here?

- iRobot Just Filed for Bankruptcy. What Does That Mean for IRBT Stock? And Why Have Investors Been Chasing Shares Higher?

- Chip Stocks Are No Longer an Automatic Path to Profits. What the Numbers Say About This Key Semi ETF Now.

- As Robinhood Moves Into Sports Betting, Should You Buy, Sell, or Hold HOOD Stock?