All News about Invesco DB Agriculture Fund

How To Trade Agricultural Commodities Without Trading Futures

January 09, 2022

Via Talk Markets

Something Stinks B4 Thanksgiving

November 21, 2021

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

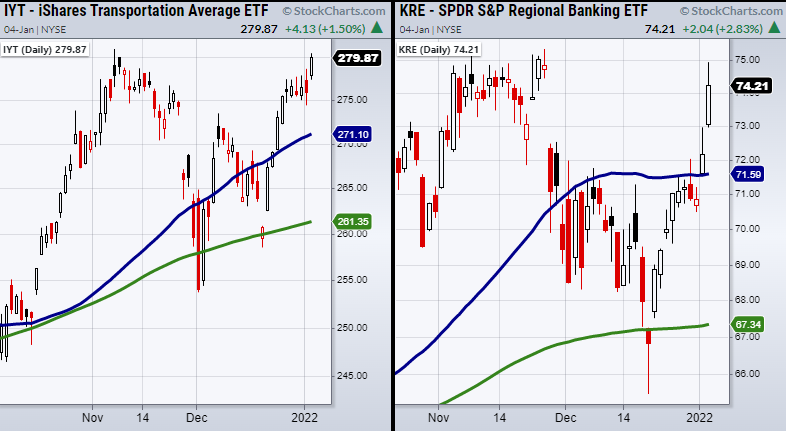

The Major Stock Indices Must Hold these Key Support Levels

October 31, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

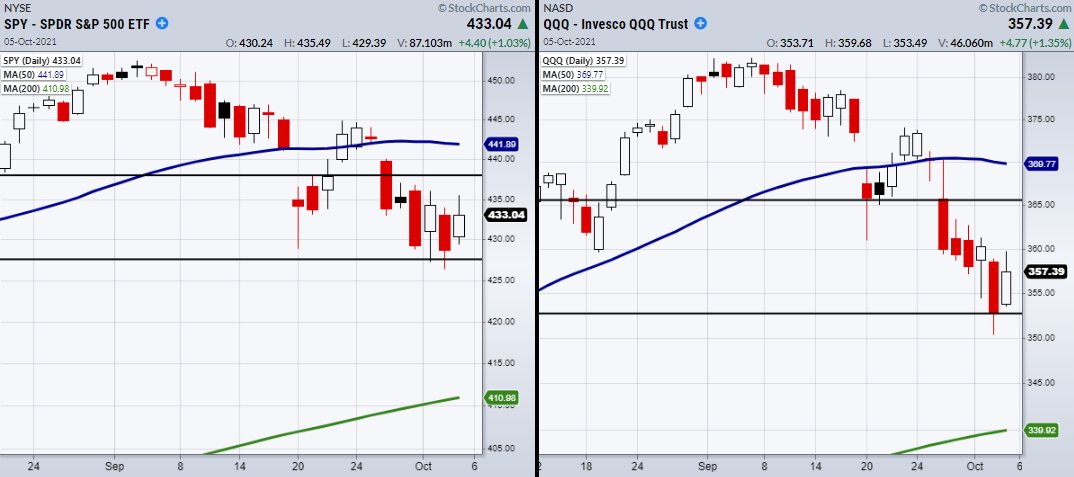

Did Jerome Powell Jump Scare the Major Stock Indices?

October 24, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

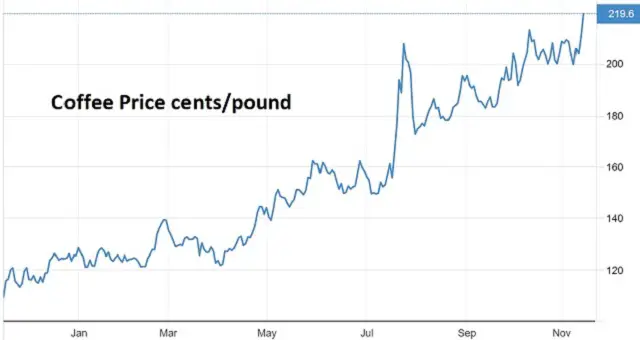

Soft Commodities: Firming And Becoming Potentially Explosive

October 03, 2021

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.