Healthcare technology company GE HealthCare Technologies (NASDAQ: GEHC) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 5.8% year on year to $5.14 billion. Its non-GAAP profit of $1.07 per share was 2.2% above analysts’ consensus estimates.

Is now the time to buy GE HealthCare? Find out by accessing our full research report, it’s free for active Edge members.

GE HealthCare (GEHC) Q3 CY2025 Highlights:

- Revenue: $5.14 billion vs analyst estimates of $5.07 billion (5.8% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.07 vs analyst estimates of $1.05 (2.2% beat)

- Adjusted EBITDA: $766 million vs analyst estimates of $847.8 million (14.9% margin, 9.7% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $4.57 at the midpoint

- Operating Margin: 12.7%, down from 13.9% in the same quarter last year

- Free Cash Flow Margin: 9.4%, down from 13.4% in the same quarter last year

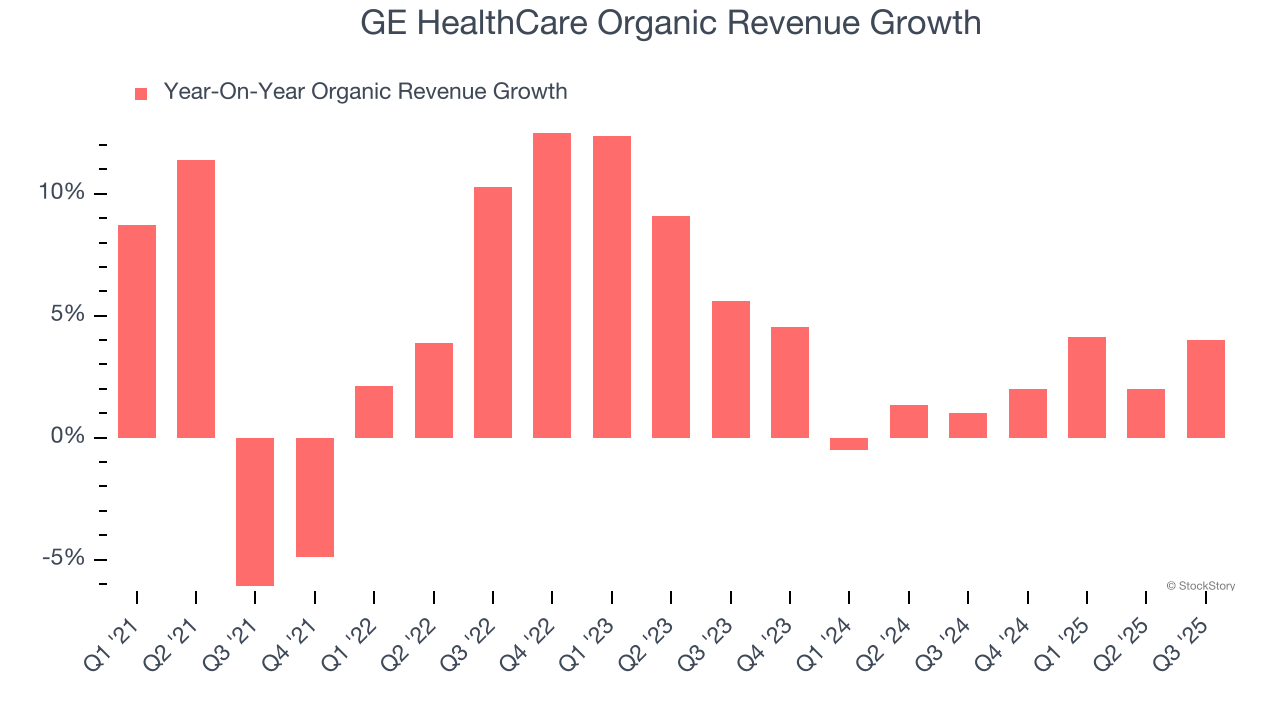

- Organic Revenue rose 4% year on year vs analyst estimates of 2.6% growth (141.8 basis point beat)

- Market Capitalization: $36.25 billion

GE HealthCare President and CEO Peter Arduini said, “We delivered robust orders with growth across all segments in the third quarter. This was led by customer demand for our differentiated solutions and a healthy capital equipment environment. Revenue performance was driven by Imaging, Advanced Visualization Solutions, and Pharmaceutical Diagnostics, and was ahead of our expectations. We continue to see momentum with commercial execution, where our teams leverage our broad portfolio and services, creating sustainable revenue and strengthening customer relationships. As a result of our increased R&D investments, we are entering a new wave of innovation and, coupled with our focus on lean, we expect to accelerate top and bottom line growth.”

Company Overview

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ: GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

Revenue Growth

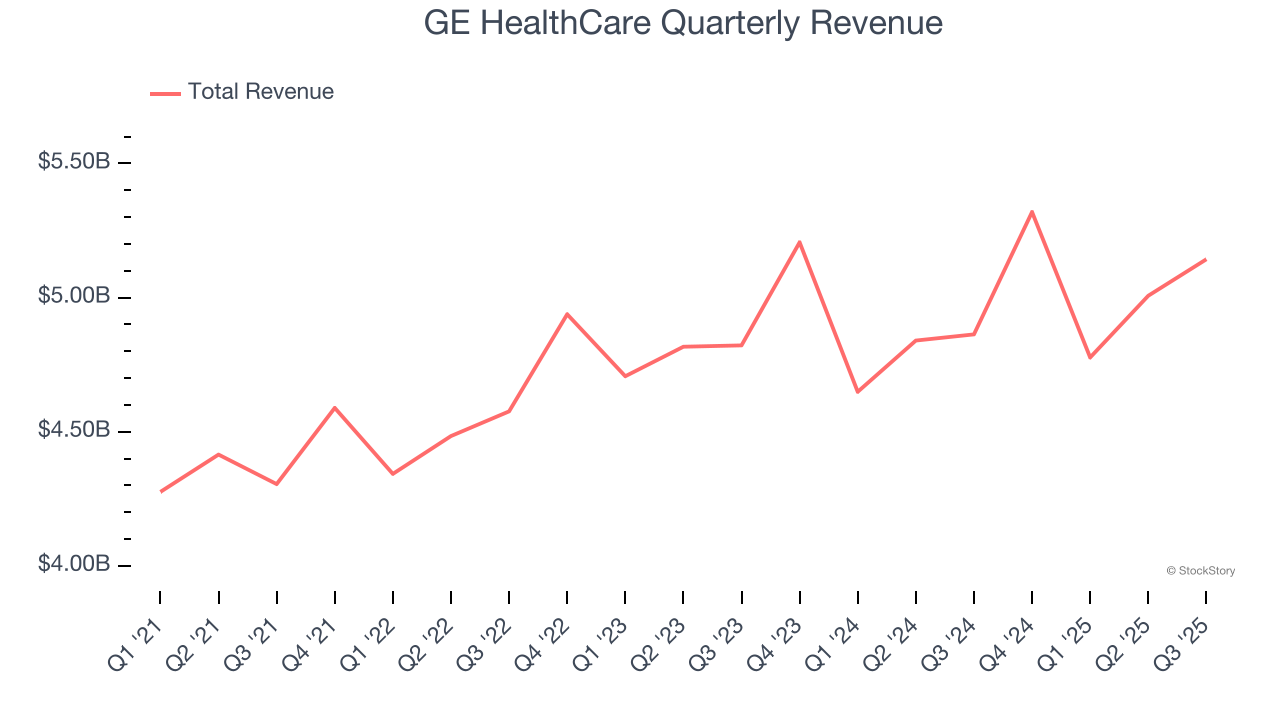

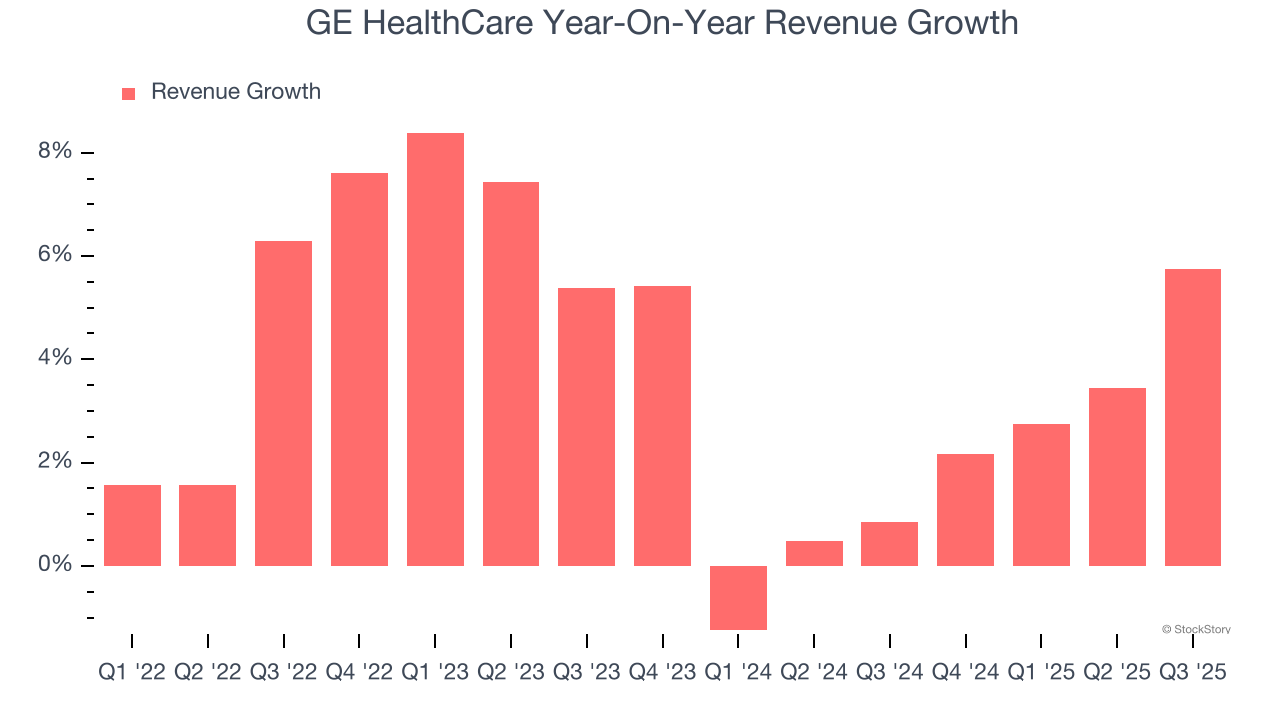

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, GE HealthCare’s sales grew at a tepid 3.5% compounded annual growth rate over the last four years. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. GE HealthCare’s recent performance shows its demand has slowed as its annualized revenue growth of 2.5% over the last two years was below its four-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, GE HealthCare’s organic revenue averaged 2.3% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, GE HealthCare reported year-on-year revenue growth of 5.8%, and its $5.14 billion of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

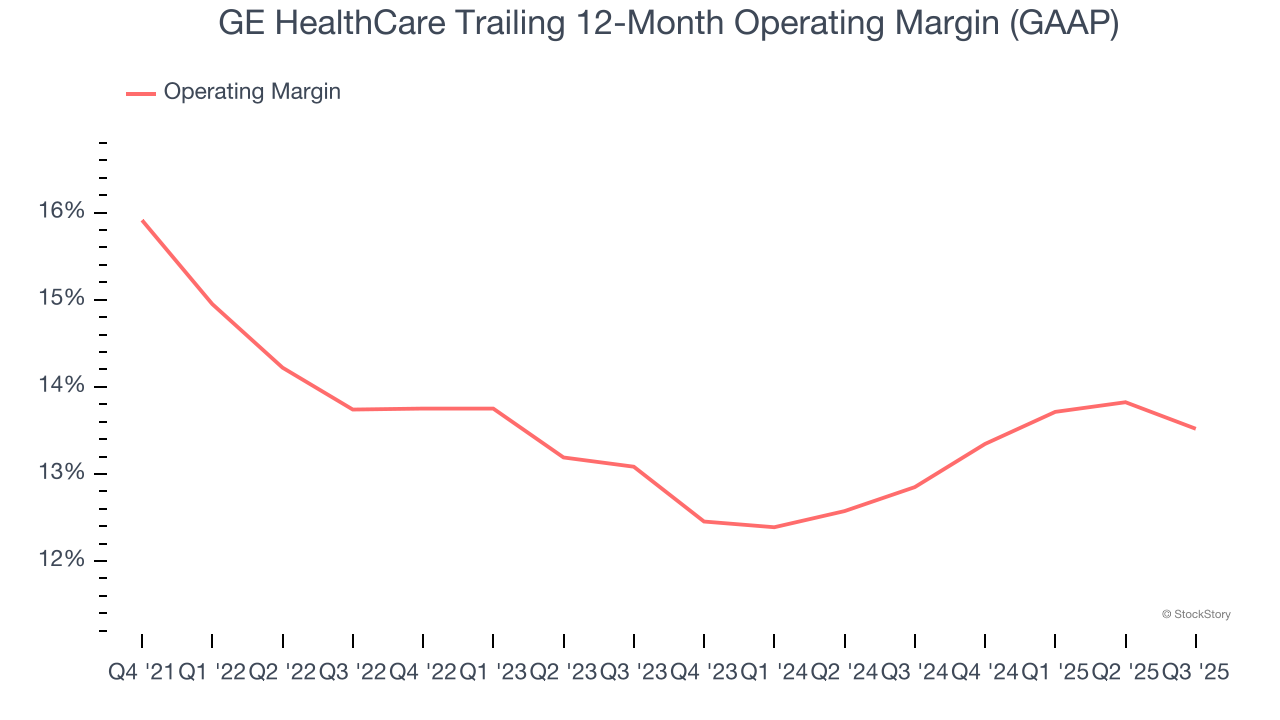

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

GE HealthCare has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.7%, higher than the broader healthcare sector.

Looking at the trend in its profitability, GE HealthCare’s operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, GE HealthCare generated an operating margin profit margin of 12.7%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

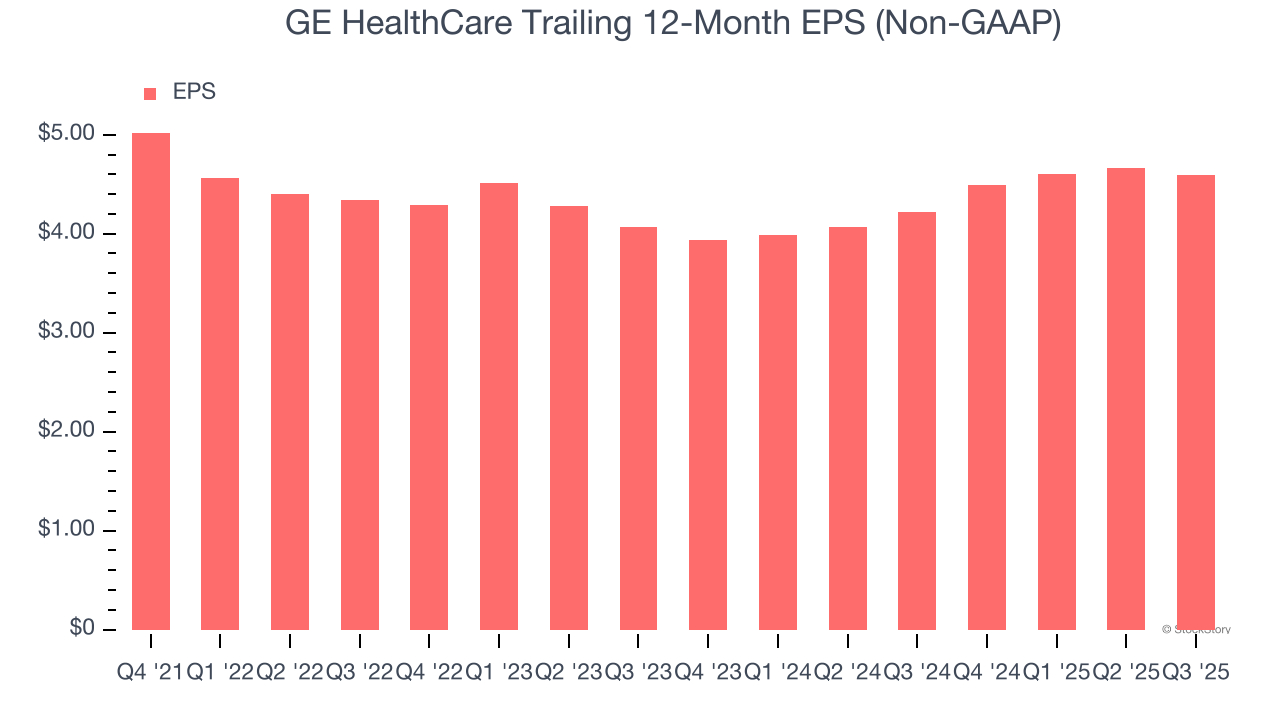

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for GE HealthCare, its EPS declined by 3.8% annually over the last four years while its revenue grew by 3.5%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, GE HealthCare reported adjusted EPS of $1.07, down from $1.14 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 2.2%. Over the next 12 months, Wall Street expects GE HealthCare’s full-year EPS of $4.59 to grow 4.4%.

Key Takeaways from GE HealthCare’s Q3 Results

It was good to see GE HealthCare narrowly top analysts’ organic revenue expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $79 immediately after reporting.

Is GE HealthCare an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.