Palantir Technologies Inc. (PLTR), headquartered in Denver, Colorado, develops and deploys software platforms to support the intelligence community in counterterrorism investigations and operations. Valued at $437.5 billion by market cap, the company manages software deployment across environments and offers access to large language models (LLMs) for analyzing both structured and unstructured data.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and PLTR definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the software - infrastructure industry. PLTR’s Foundry and Gotham platforms offer unique data analytics capabilities, supporting its strong government-sector foothold.

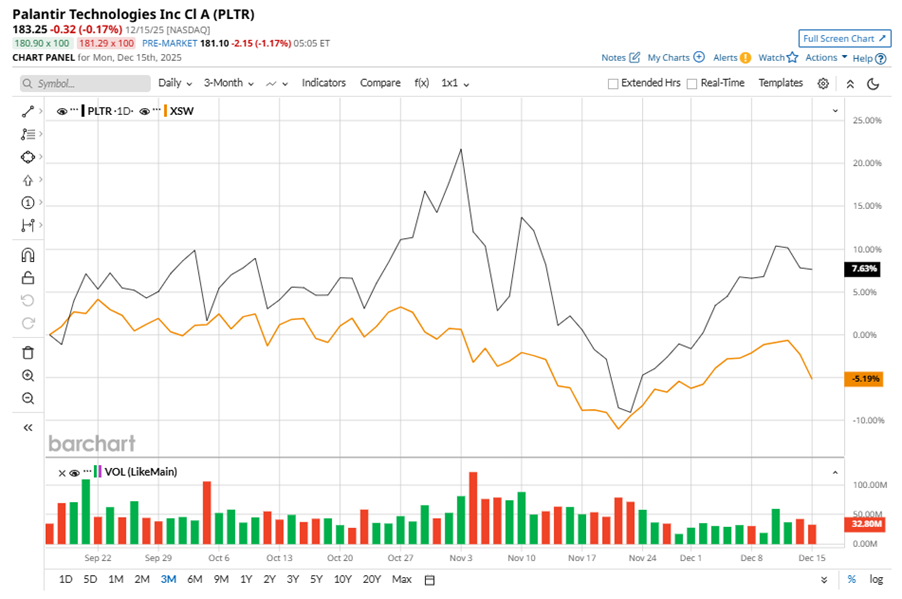

Despite its notable strength, PLTR shares slipped 11.7% from their 52-week high of $207.52, achieved on Nov. 3. Over the past three months, PLTR stock has gained 7%, outperforming the SPDR S&P Software & Services ETF’s (XSW) 4.5% losses during the same time frame.

In the longer term, shares of PLTR rose 33.4% on a six-month basis and climbed 140.9% over the past 52 weeks, considerably outperforming XSW’s six-month gains of 4.2% and 5.6% decline over the last year.

To confirm the bullish trend, PLTR has been trading above its 50-day and 200-day moving averages over the past year, with some fluctuations.

PLTR’s strong performance is driven by AI partnerships and government contracts, including a Navy shipbuilding deal cutting planning time from 160 hours to under 10 minutes. Its key deals encompass energy infrastructure, aviation maintenance, rodeo analytics, and government services, thereby expanding its recurring revenue base and reducing dependence on government contracts.

On Nov. 3, PLTR reported its Q3 results, and its shares closed down by 7.9% in the following trading session. Its revenue stood at $1.2 billion, up 62.8% year over year. The company’s adjusted EPS came in at $0.21, beating analyst estimates by 25.5%.

PLTR’s rival, CrowdStrike Holdings, Inc. (CRWD), has lagged behind the stock, with a 1.4% uptick over the past six months and 32.5% gains over the past 52 weeks.

Wall Street analysts are cautious on PLTR’s prospects. The stock has a consensus “Hold” rating from the 21 analysts covering it, and the mean price target of $192.67 suggests a potential upside of 5.1% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart