Civil infrastructure construction company Sterling Infrastructure (NASDAQ: STRL) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 6% year on year to $593.7 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.16 billion at the midpoint. Its GAAP profit of $1.97 per share was 17.6% above analysts’ consensus estimates.

Is now the time to buy Sterling? Find out by accessing our full research report, it’s free.

Sterling (STRL) Q3 CY2024 Highlights:

- Revenue: $593.7 million vs analyst estimates of $608 million (2.3% miss)

- EPS: $1.97 vs analyst estimates of $1.68 (17.6% beat)

- EBITDA: $100.9 million vs analyst estimates of $89.68 million (12.5% beat)

- The company dropped its revenue guidance for the full year to $2.16 billion at the midpoint from $2.19 billion, a 1.1% decrease

- EPS (GAAP) guidance for the full year is $5.93 at the midpoint, beating analyst estimates by 4.8%

- EBITDA guidance for the full year is $312.5 million at the midpoint, above analyst estimates of $307 million

- Gross Margin (GAAP): 21.9%, up from 16.4% in the same quarter last year

- Operating Margin: 14.7%, up from 10.2% in the same quarter last year

- EBITDA Margin: 17%

- Market Capitalization: $4.83 billion

"In the third quarter we delivered 6% revenue growth and a remarkable 56% increase in diluted EPS. Our focus on margin expansion continues to drive profitability growth well in excess of revenue growth. Gross profit margins of 21.9% marked a new record, and we continue to look for opportunities to drive further expansion," stated Joe Cutillo, Sterling's Chief Executive Officer.

Company Overview

Involved in the construction of a major highway, the Grand Parkway in Houston, TX, Sterling Infrastructure (NASDAQ: STRL) provides civil infrastructure construction.

Engineering and Design Services

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Sales Growth

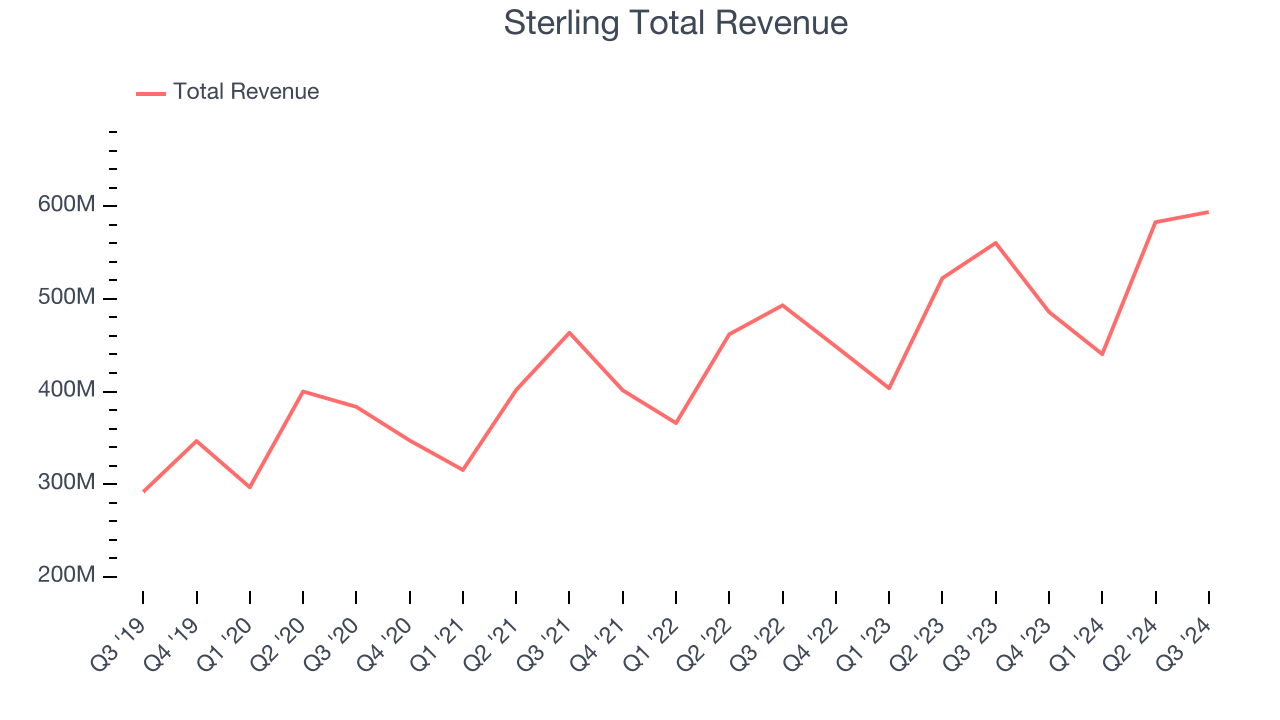

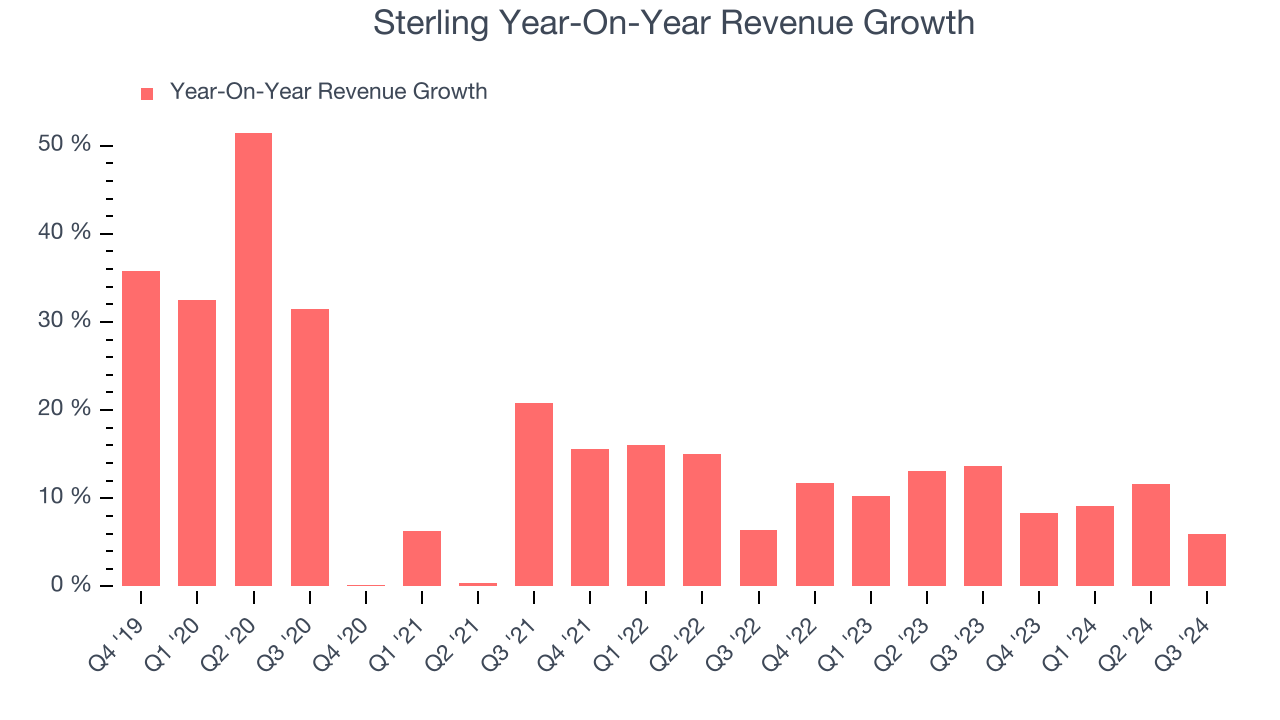

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Sterling’s 15.2% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows Sterling’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Sterling’s annualized revenue growth of 10.5% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Sterling’s revenue grew 6% year on year to $593.7 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is above the sector average and illustrates the market is baking in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

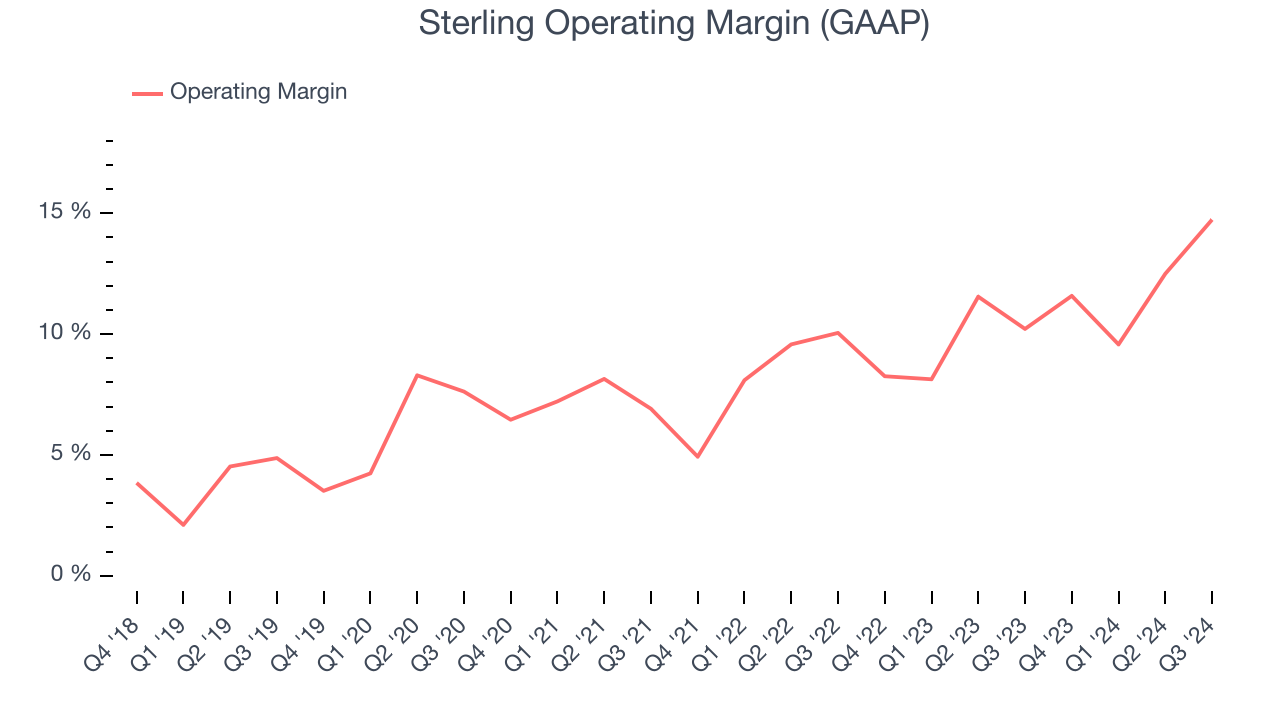

Sterling has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9%, higher than the broader industrials sector.

Looking at the trend in its profitability, Sterling’s annual operating margin rose by 6.2 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Sterling generated an operating profit margin of 14.7%, up 4.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

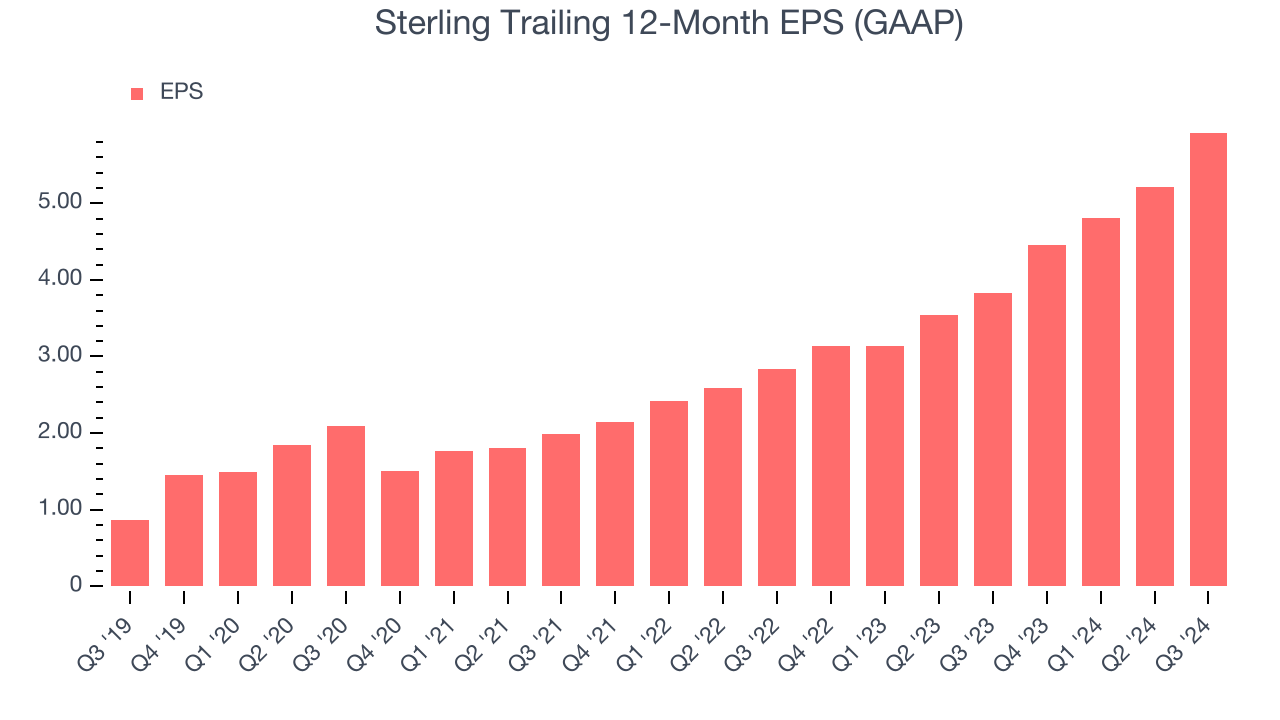

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sterling’s EPS grew at an astounding 46.8% compounded annual growth rate over the last five years, higher than its 15.2% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Sterling’s earnings can give us a better understanding of its performance. As we mentioned earlier, Sterling’s operating margin expanded by 6.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Sterling, its two-year annual EPS growth of 44.3% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Sterling reported EPS at $1.97, up from $1.26 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Sterling’s full-year EPS of $5.92 to shrink by 2%.

Key Takeaways from Sterling’s Q3 Results

This quarter showcased better-than-expected profits but underwhelming sales - its EBITDA and EBITDA guidance exceeded Wall Street's estimates while its revenue and revenue guidance fell short. Overall, this quarter was mixed. The areas below expectations seem to be driving the move, and shares traded down 3.2% to $170 immediately following the results.

Is Sterling an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.