Casual sandwich chain Potbelly (NASDAQ: PBPB) reported Q3 CY2024 results beating Wall Street’s revenue expectations, but sales fell 4.7% year on year to $115.1 million. Its non-GAAP profit of $0.08 per share was also 88.2% above analysts’ consensus estimates.

Is now the time to buy Potbelly? Find out by accessing our full research report, it’s free.

Potbelly (PBPB) Q3 CY2024 Highlights:

- Revenue: $115.1 million vs analyst estimates of $113.2 million (1.7% beat)

- Adjusted EPS: $0.08 vs analyst estimates of $0.04 ($0.04 beat)

- EBITDA: $8.66 million vs analyst estimates of $6.93 million (25.1% beat)

- Gross Margin (GAAP): 36.1%, up from 34% in the same quarter last year

- Operating Margin: 3.7%, up from 2.6% in the same quarter last year

- EBITDA Margin: 7.5%, up from 6% in the same quarter last year

- Free Cash Flow was $43,000, up from -$2.49 million in the same quarter last year

- Locations: 425 at quarter end, down from 430 in the same quarter last year

- Same-Store Sales rose 1.8% year on year (8% in the same quarter last year)

- Market Capitalization: $251.8 million

Bob Wright, President and Chief Executive Officer of Potbelly Corporation, commented, “During the third quarter, our team once again demonstrated the effectiveness of our five-pillar strategic plan amidst a dynamic consumer environment. Our app and Potbelly Perks program drove a positive shift in our comp trajectory and engagement with our brand, while our $7.99 everyday value platform supported sales and traffic; We achieved a 70-basis point year-over-year improvement in our shop profit margins; metered our G&A spend to deliver EBITDA growth; and opened eight new shops with our franchise partners as we further accelerate our unit growth. While I’m thrilled with what we’ve accomplished together to date, I believe the future for Potbelly is even brighter.”

Company Overview

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ: PBPB) today is a chain known for its toasty sandwiches.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

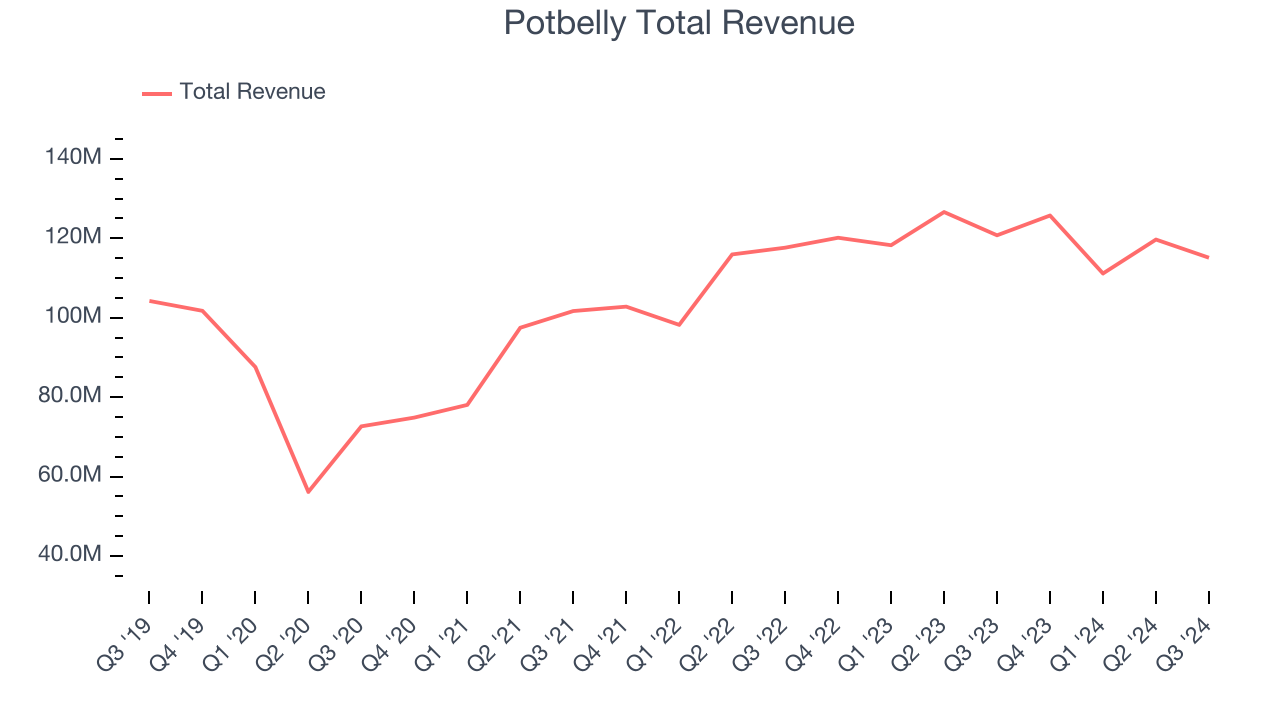

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Potbelly is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

As you can see below, Potbelly’s sales grew at a weak 2.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Potbelly’s revenue fell 4.7% year on year to $115.1 million but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last five years. This projection is underwhelming and indicates the market believes its offerings will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Restaurant Performance

Number of Restaurants

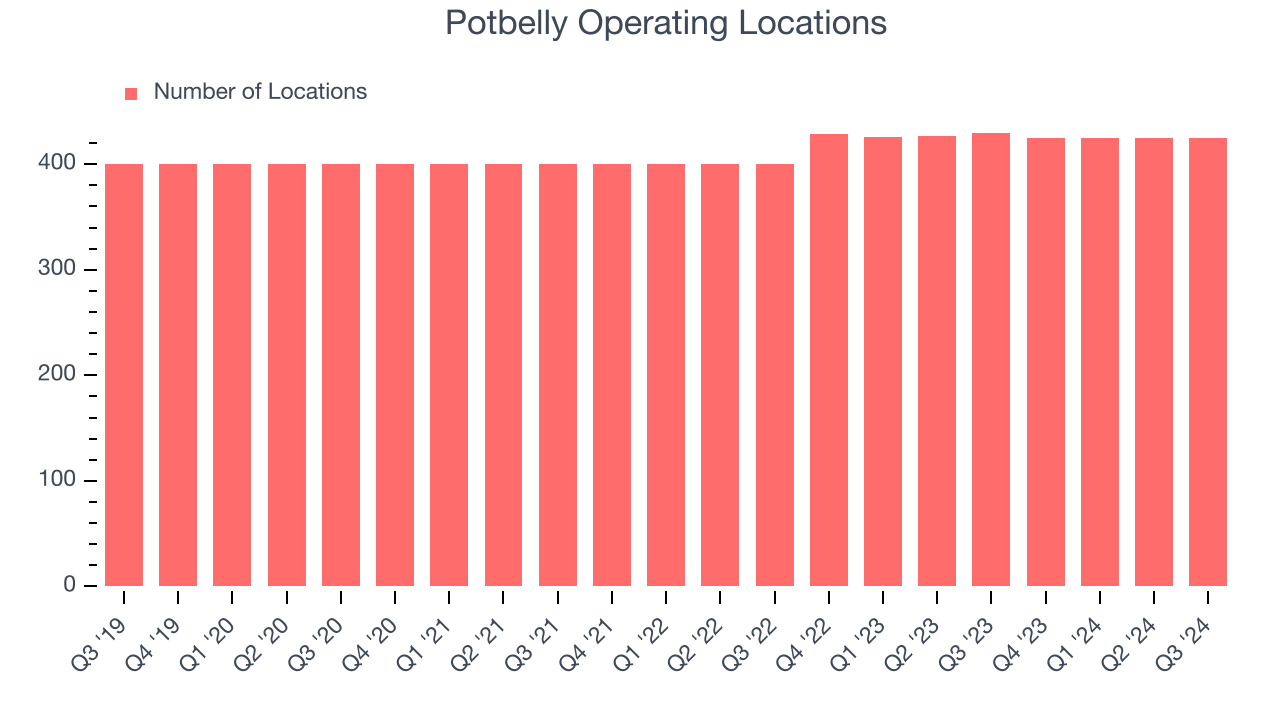

The number of dining locations a restaurant chain operates is a critical driver of how quickly company-level sales can grow.

Potbelly operated 425 locations in the latest quarter. It has opened new restaurants quickly over the last two years and averaged 3.2% annual growth, faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

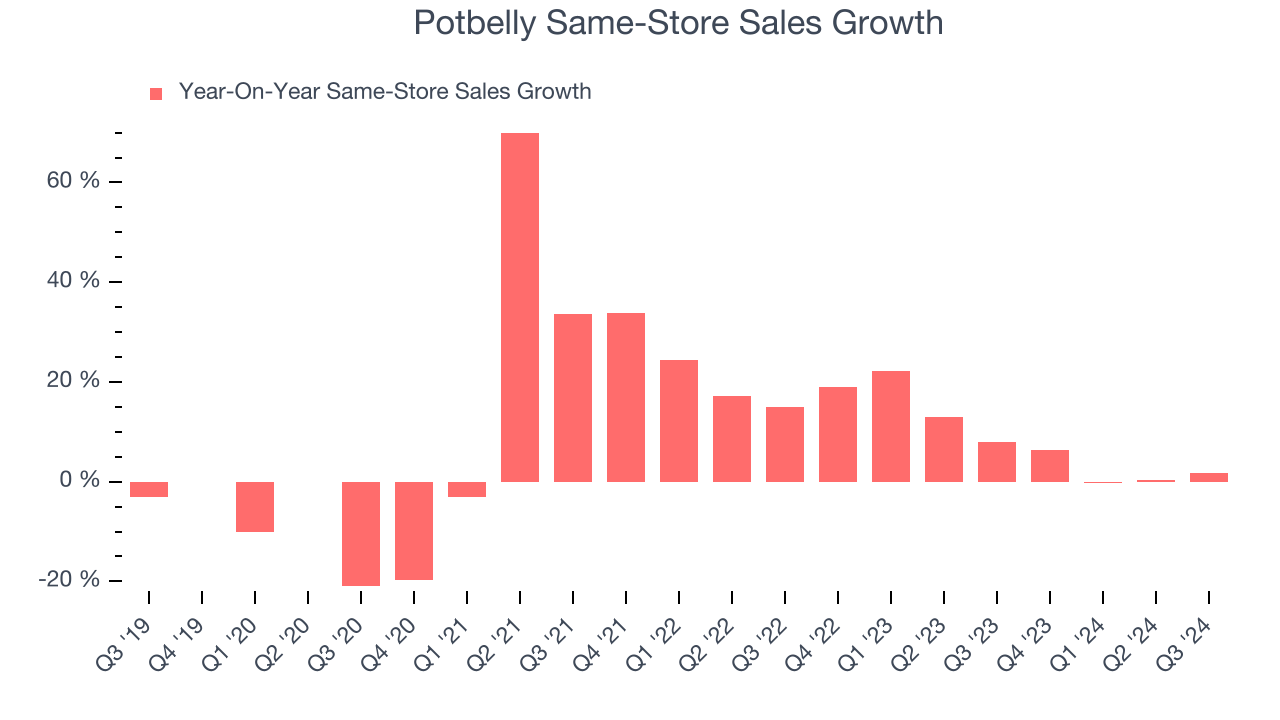

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Potbelly has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 8.8%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Potbelly multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Potbelly’s same-store sales rose 1.8% annually. By the company’s standards, this growth was a meaningful deceleration from the 8% year-on-year increase it posted 12 months ago. We’ll be watching Potbelly closely to see if it can reaccelerate growth.

Key Takeaways from Potbelly’s Q3 Results

We were impressed by how significantly Potbelly blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock remained flat at $8.27 immediately after reporting.

Potbelly may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.