Aflac currently trades at $107.18 per share and has shown little upside over the past six months, posting a small loss of 1.2%. The stock also fell short of the S&P 500’s 22.9% gain during that period.

Is there a buying opportunity in Aflac, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Aflac Will Underperform?

We're sitting this one out for now. Here are three reasons why AFL doesn't excite us and a stock we'd rather own.

1. Declining Net Premiums Earned Reflect Weakness

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Aflac’s net premiums earned has declined by 7.8% annually over the last four years, much worse than the broader insurance industry.

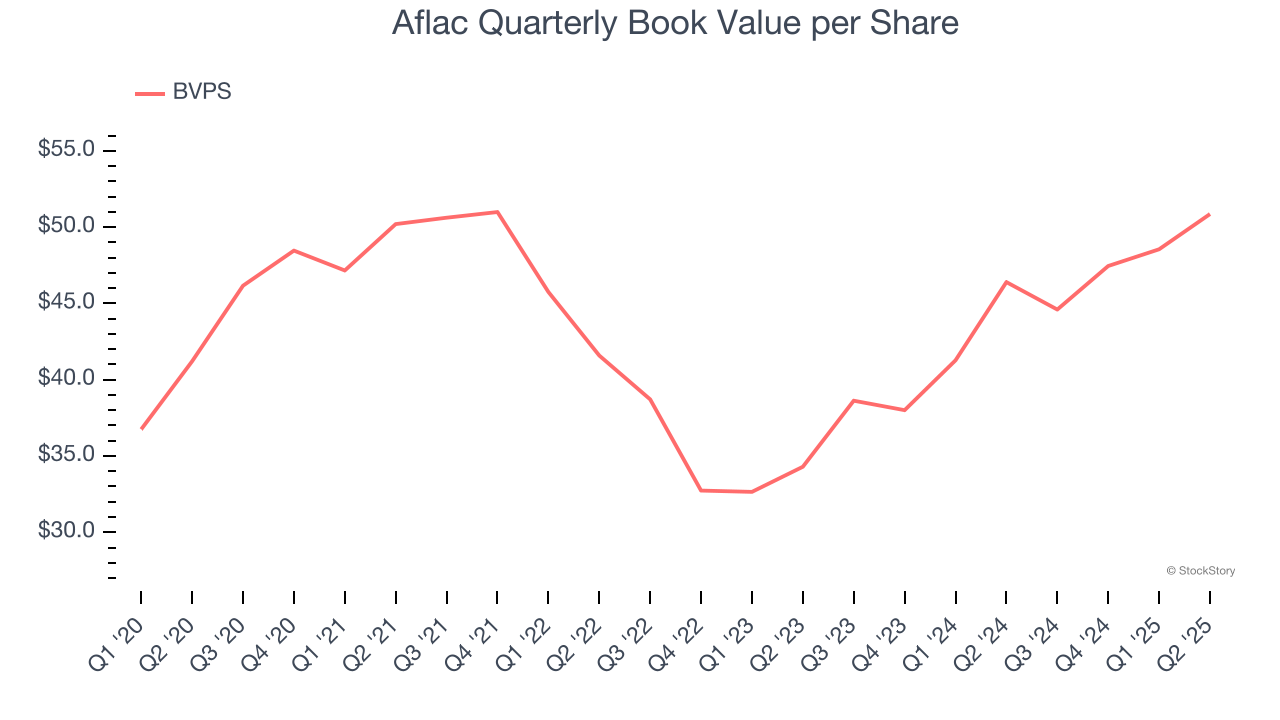

3. Projected BVPS Growth Is Slim

An insurer’s book value per share (BVPS) increases when it maintains a profitable pre-tax profit margin and effectively manages its investment portfolio.

Over the next 12 months, Consensus estimates call for Aflac’s BVPS to grow by 4.6% to $52.33, lousy growth rate.

Final Judgment

Aflac doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 2.1× forward P/B (or $107.18 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Aflac

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.