First Citizens BancShares trades at $2,067 and has moved in lockstep with the market. Its shares have returned 13.8% over the last six months while the S&P 500 has gained 13.1%.

Is now the time to buy First Citizens BancShares, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is First Citizens BancShares Not Exciting?

We're swiping left on First Citizens BancShares for now. Here are three reasons you should be careful with FCNCA and a stock we'd rather own.

1. Projected Net Interest Income Growth Shows Limited Upside

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect First Citizens BancShares’s net interest income to stall, a deceleration versus its 10.2% annualized growth for the past two years. This projection is below its 10.2% annualized growth rate for the past two years.

2. Net Interest Margin Dropping

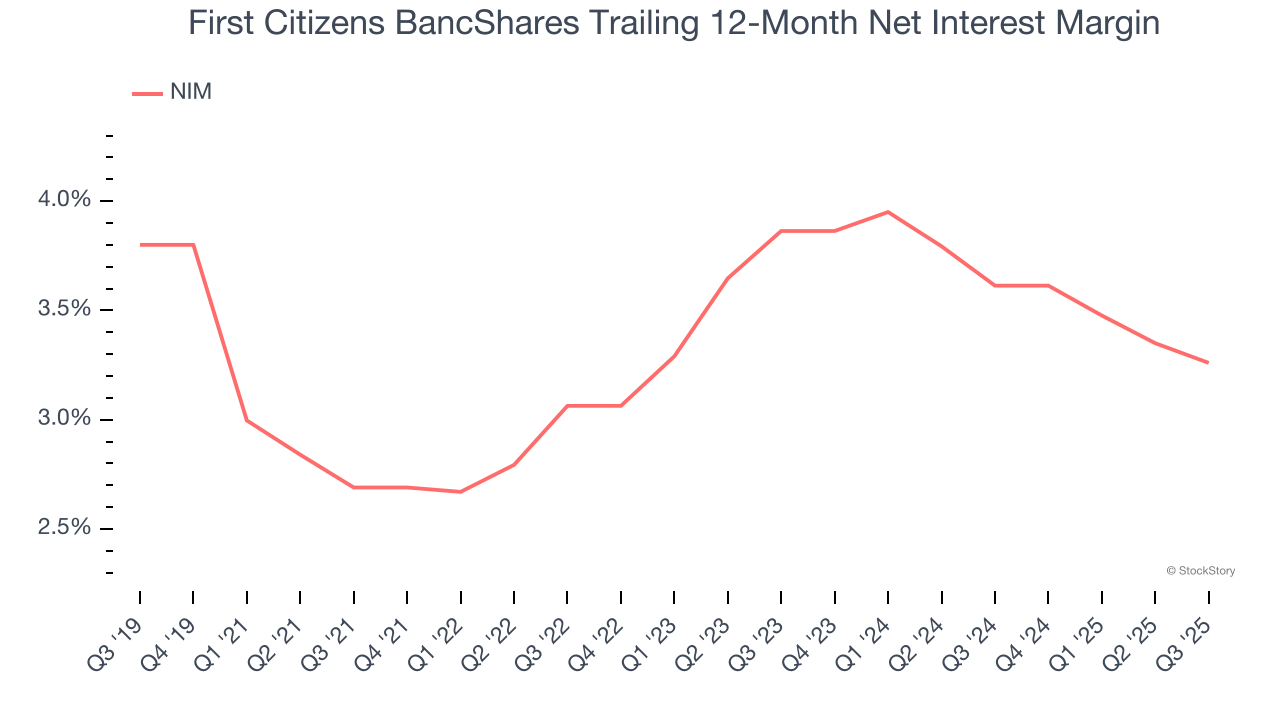

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, First Citizens BancShares’s net interest margin averaged 3.4%. Its margin also contracted by 60.3 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean that First Citizens BancShares either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

First Citizens BancShares’s EPS grew at an unimpressive 7.3% compounded annual growth rate over the last two years, lower than its 11.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

First Citizens BancShares’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.2× forward P/B (or $2,067 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.