Artificial intelligence (AI) has driven some of the biggest growth stories of 2025. This earnings season revealed two things: AI is already boosting revenue at scale, and the race for compute, chips, and talent will reshape spending for years. This combination creates significant opportunities as well as short-term pain. Tech giants Amazon (AMZN), Microsoft (MSFT), Meta Platforms (META), and Alphabet (GOOGL) are investing heavily in AI, but each represents a very different kind of AI bet.

Let’s find out which is the better AI play for the long term.

Microsoft’s Q1 Results Show Surging Cloud Momentum and Massive AI Investment

Microsoft’s recent quarter reflected a company riding the strongest wave of AI demand in its history. Revenue for the fiscal 2026 first quarter reached $77.7 billion, rising 17% from a year earlier, while earnings climbed 21% to $4.13 per share. Despite significant investment in next-generation AI technology, Microsoft maintained a 69% profit margin, showing the robustness of its software and cloud ecosystem.

The company invested $34.9 billion to expand its AI and cloud footprint, including additional data centers, GPUs, CPUs, and engineering teams. Management stated that approximately half of this spending went to shorter-lived chips and hardware, while the remainder supported long-term infrastructure expected to yield profits for more than a decade. These efforts have already positioned Microsoft as the preferred platform for global AI workloads.

Microsoft also strengthened its strategic relationship with OpenAI by signing a new agreement that grants exclusive Azure privileges as well as extended model and IP access. Microsoft's financial position remains strong. The company ended the quarter with $102 billion in cash and short-term investments. With commercial AI demand growing and a record $392 billion backlog, Microsoft's growth trajectory is reshaping at a rapid pace.

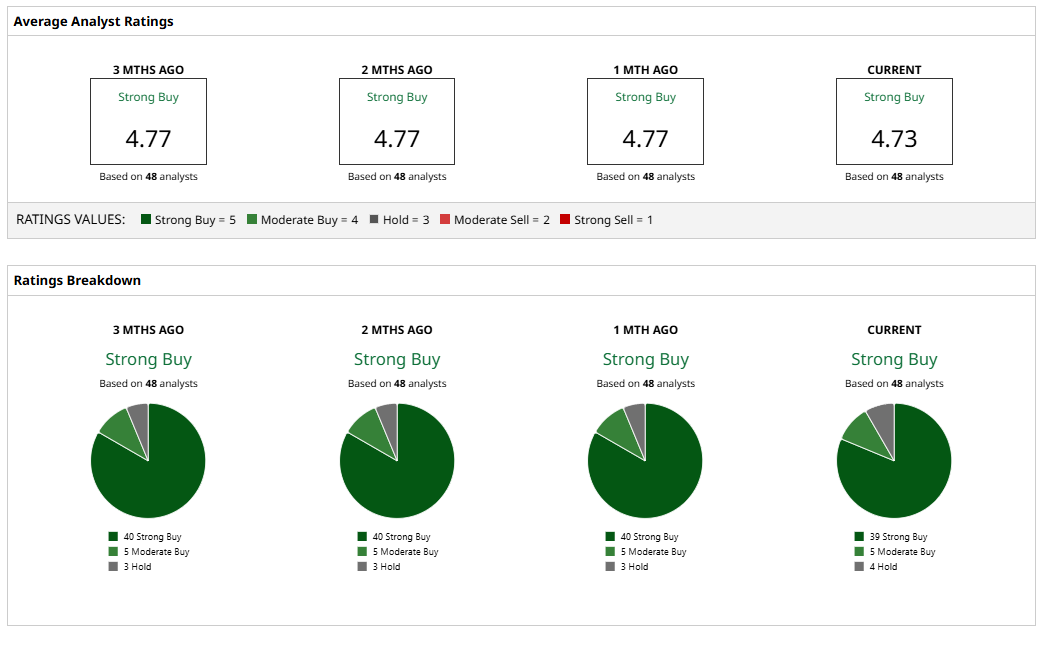

On Wall Street, MSFT stock is a “Strong Buy.” Of the 48 analysts covering the stock, 39 rate it a "Strong Buy,” five rate it a “Moderate Buy,” and four say it is a “Hold.” The average analyst target price of $630.59 suggests the stock has upside potential of 32.6% from current levels. Plus, its high target price of $700 implies that the stock could rise as much as 48% from current levels.

Amazon’s Q3 Earnings Show AI-Fueled Momentum Across Cloud and Retail

While e-commerce remains a massive revenue engine, the real story of Amazon's third quarter is the growing strength of Amazon Web Services (AWS), which continues to dictate the company's long-term trajectory.

AWS reported a 20% year-over-year revenue increase in Q3, its strongest growth in nearly three years. The cloud division currently has an annualized revenue run rate of $132 billion, supported by a huge $200 billion backlog that excludes major agreements signed after the quarter ended. Amazon is aggressively preparing for an AI-heavy future, investing more than $90 billion this year. Yet, Amazon maintained healthy profitability, with EPS rising 36% to $1.95. Analysts predict continued earnings growth, while the company sees AI as a significant, long-term accelerator for its whole business.

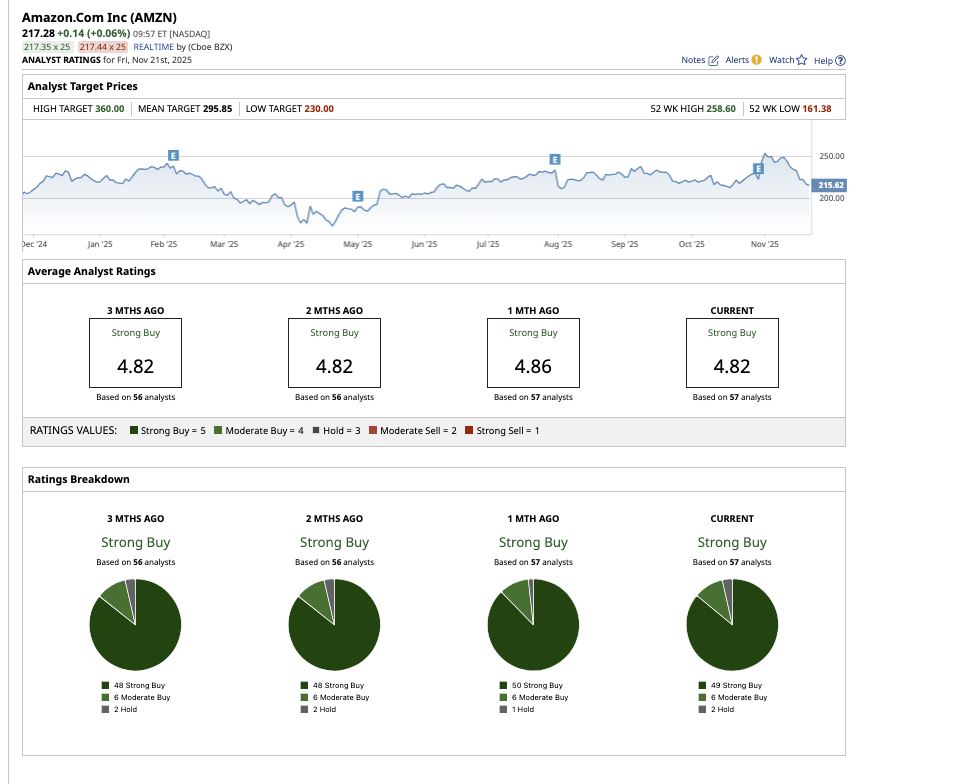

Overall, Amazon stock has earned a “Strong Buy” rating. Of the 57 analysts covering the stock, 49 have given it a “Strong Buy” rating, six recommend a “Moderate Buy,” and two rate it a “Hold.” The average target price is $295.85, indicating a potential upside of 36% from its current price. Additionally, the highest target price of $360 suggests the stock could rise by as much as 66% over the next 12 months.

Meta Platforms: Q3 Highlighted Explosive User Growth and Expanding AI Ambitions

Meta Platforms’ third quarter revealed the company’s powerful global reach and its growing commitment to AI-driven products and infrastructure. The Family of Apps segment performed well, generating $50.8 billion in revenue, a 26% increase over the previous year. Advertising remained the primary driver, increasing 26% on the strength of higher ad impressions and higher prices, indicating that demand from marketers remains strong even in a slowing economy.

Meta’s long-term bet on the metaverse also showed momentum. Reality Labs posted a 74% increase in revenue to $470 million, driven by interest in Quest headsets and its AI-enabled smart glasses.

With $44.4 billion in cash on hand, Meta is preparing for what CEO Mark Zuckerberg predicts will be its most revolutionary decade, with plans to integrate AI into its apps, boost computer capacity, and create new experiences that combine the digital and real worlds.

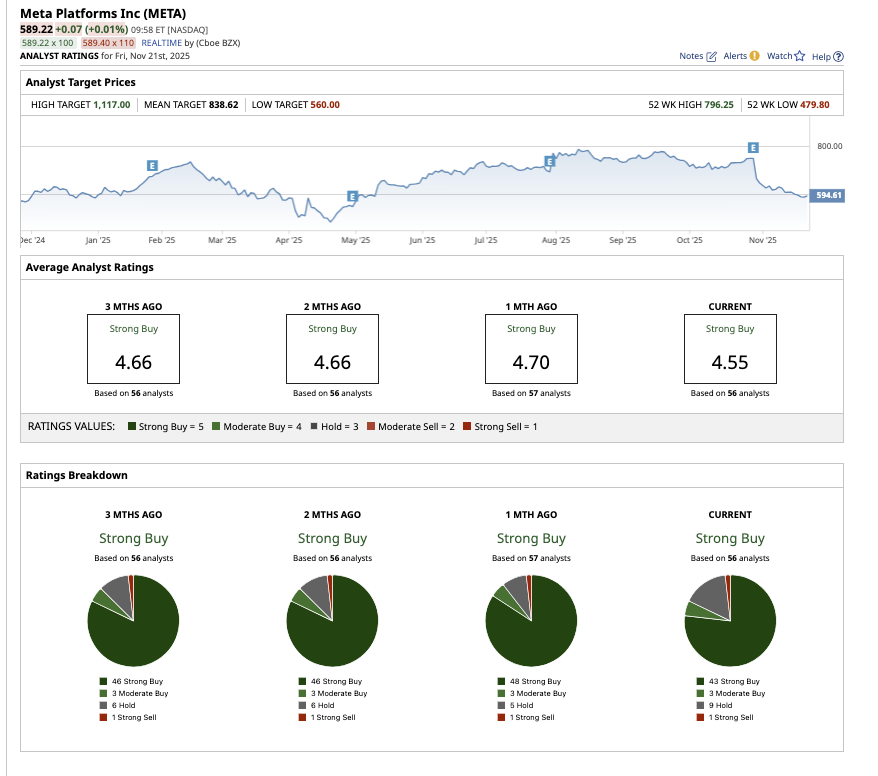

Overall, the consensus for META stock is a “Strong Buy.” Among the 56 analysts covering the company, 43 give it a “Strong Buy” rating, three recommend a “Moderate Buy,” nine suggest holding, and one rates it a “Strong Sell.” The average price target of $838.62 indicates a potential 42.3% upside from current levels. Meanwhile, the high price target of $1,117 implies the stock could surge by as much as 89.5% over the next year.

Alphabet’s $100 Billion Quarter Marks Its Rapid Evolution Into an AI Giant

Alphabet’s third-quarter results highlight just how quickly the company is transforming from a search leader into a diversified, AI-driven technology powerhouse. The company reported $102.3 billion in revenue, its first-ever $100 billion quarter, reflecting 16% year-over-year growth and nearly tripling revenue from five years ago. Net income increased by more than 35% to $2.87 per share, cementing Alphabet's place among the world’s most profitable companies.

AI is now reshaping every segment, including Search, Cloud, and Google Services. Revenue from Search and related ads rose 15% to $56.6 billion, powered by robust spending in retail and financial services. Google Cloud was another standout, posting 34% revenue growth to reach $15.2 billion. Enterprises are increasingly adopting Google’s AI-ready infrastructure and Gemini models, driving the cloud backlog to $155 billion, up 82% from last year and 46% from the previous quarter. Alphabet is investing aggressively to support this surge in demand with capital spending totaling $24 billion in Q3. Despite this massive buildout, Alphabet remains financially strong with nearly $100 billion in cash at the end of the quarter.

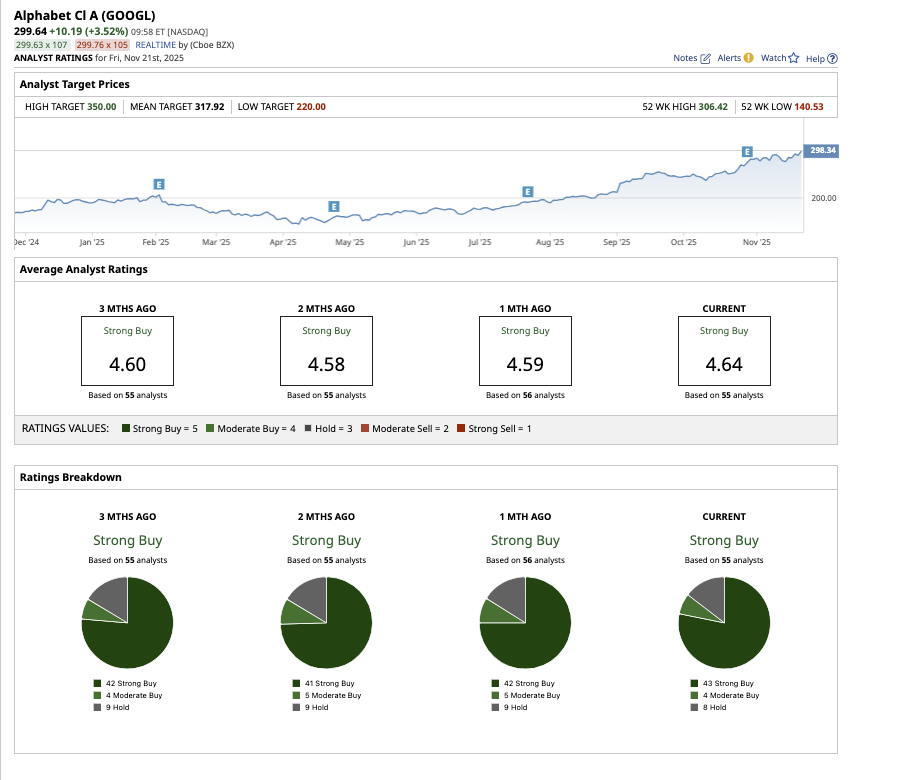

Overall, on Wall Street, GOOGL stock is a “Strong Buy.” Of the 55 analysts covering the stock, 43 rate it a “Strong Buy,” four say it is a “Moderate Buy,” and eight rate it a “Hold.” The stock’s average target price of $317.92 suggests an upside potential of 6% from current levels. However, its high price estimate of $350 suggests the stock has an upside potential of 16.8% over the next 12 months.

The Verdict: Which Is the Best AI Stock Now?

While all four are great long-term AI bets in their own right, Microsoft would be my pick for most investors who want balanced exposure to AI upside and reasonable downside protection. Microsoft has an unmatched global reach into enterprises, allowing it to monetize AI across many product layers. Additionally, its strong free cash flow and shareholder-friendly capital allocation enable the company to invest heavily without losing balance-sheet stability.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart