Dividend income hunters tend to seek the highest yield, and the more intelligent investment is a company with a steadily increasing payout ratio as time progresses. Firms that make consistent growth in dividends and also have robust support of free cash flow would have an increased chance of producing an accruing increase when compared to single-period high-yield stocks.

Two large-cap names that fit that profile were recently highlighted by Wolfe Research, which include Merck & Co. (MRK) and Qualcomm (QCOM). Both posted considerable dividend growth over the last several years and maintained a moderate level of payout along with a substantial amount of cash, which is the financial position that allows further increases to be possible. They might not be the best in the yield tables, but a mix of current and future earnings, along with the prospects of increasing rewards, is what income investors should value.

Here’s a closer look at why Wolfe sees MRK and QCOM as candidates for “big payout growth ahead.”

Dividend Stock #1: Merck & Co. (MRK)

Founded in 1891, Merck & Co. makes medicines and vaccines for people and animals. Its best-known products include the cancer drug Keytruda and the HPV vaccine Gardasil. The company also partners with other big drugmakers and keeps a busy pipeline in oncology and immunology while expanding its animal-health portfolio. The company currently boasts a large market cap of around $235 billion.

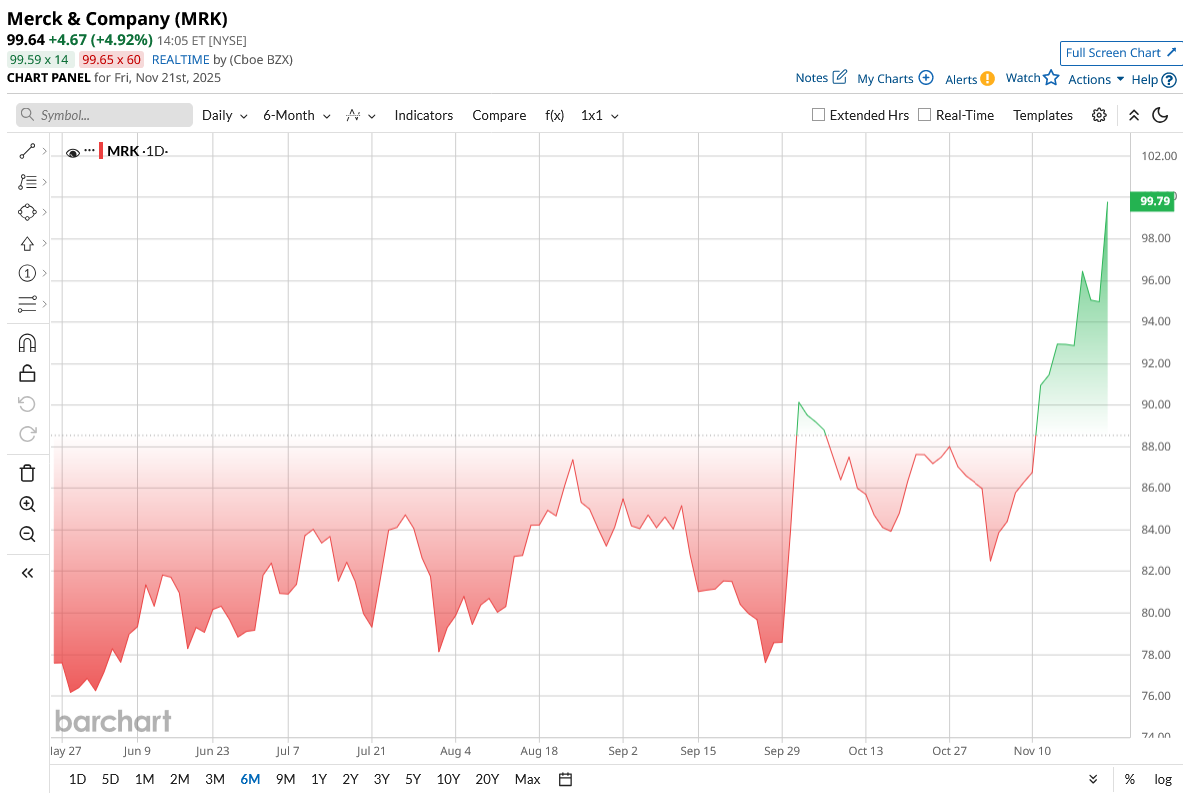

After facing a tough period in the first half of 2025, the stock bounced back, rising about 29% over the past six months versus the sector’s 14% median, driven largely by strong Keytruda sales and improving earnings momentum.

From a valuation perspective, Merck looks appealing. Its forward price-to-earnings ratio sits near 10, well below the sector median of 19, suggesting the stock may be undervalued. The company also yields roughly 3.4%, more than double the sector median, making it attractive for income-focused investors.

Merck’s dividend profile supports future raises. The company pays out only about 42% of earnings in dividends and has increased its payout each year since 2021. The board recently approved a $0.85 quarterly dividend for Q1 2026, up from $0.81, and dividends have climbed roughly 38% over the past five years, a sign of steady income growth backed by healthy cash flow.

Analysts expect meaningful earnings expansion, with forward EPS growth projected at 20%, well above sector norms. Merck’s free cash generation and improving profitability give it room to support these growth expectations and continued shareholder returns.

On the strategic front, Merck has moved to bolster its pipeline and offset patent risks. For example, its acquisition of Cidara Therapeutics at a value of $9.2 billion adds the antiviral candidate CD388. Recent results also show demand strength for newer products, like in Q3 2025 sales for Winrevair, which increased significantly year over year, demonstrating Merck’s ability to grow beyond its legacy franchises.

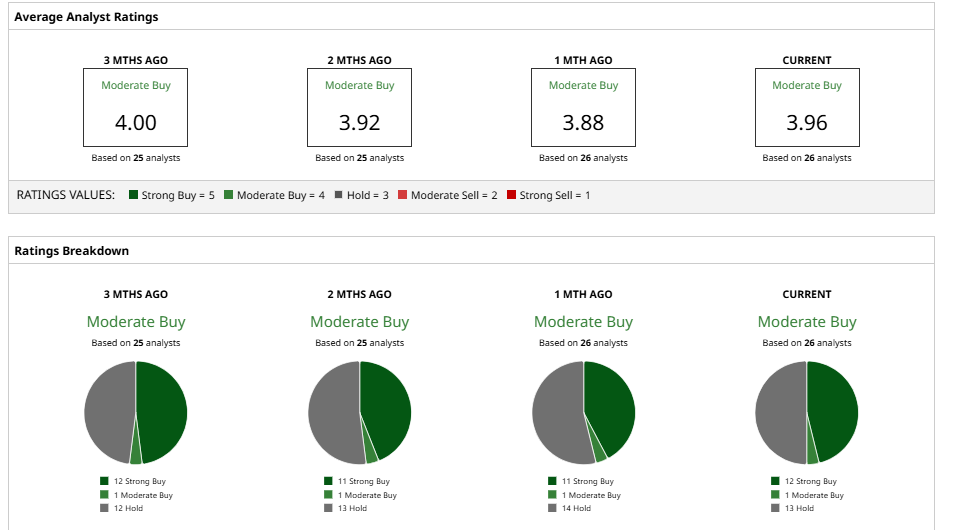

Analysts have a cautiously optimistic view on MRK, rating it as a consensus "Moderate Buy" overall. The average 12-month price target of $103.09 indicates an expected 4% upside potential from current levels.

Dividend Stock #2. Qualcomm (QCOM)

Founded in 1985, Qualcomm makes the wireless chips that power smartphones, cars, and IoT devices. Its Snapdragon platforms and deep 5G patent portfolio put it at the center of mobile connectivity, on-device AI, and next-generation computing.

Valued at about $178 billion, Qualcomm’s shares experienced a choppy ride in 2025. The stock hit a 52-week high in late October but then pulled back sharply with the broader semiconductor market amid AI-bubble worries, surrendering some gains. It’s now roughly up 5% year-to-date (YTD).

Qualcomm’s dividend yield is modest at about 2.18%, but the company has been an active payer. Management raised the quarterly payout from $0.80 to $0.85 in 2024 and to $0.89 in 2025, roughly a 37% increase over five years. At a payout ratio near 34%, Qualcomm keeps plenty of earnings available for reinvestment.

That capacity to pay comes from strong cash generation. Fiscal 2025 produced record free cash flow of about $12.8 billion. In Q3, the company returned $3.8 billion to shareholders, including $967 million in dividends, while using the rest for buybacks. In effect, Qualcomm recycled nearly all of its free cash to investors, which supports continued dividend growth.

That is not all; Qualcomm is doing great in its business, also with expanding into AI data center chips with its AI200 and AI250 families. That move could open a sizable new revenue stream by FY 2027 and reduce reliance on a few large customers.

From a valuation standpoint, Qualcomm looks attractive too. The stock trades at just 15x forward earnings, well below many tech peers, and analysts see room to run. For example, J.P. Morgan recently boosted its price target to $210, citing an improving earnings outlook.

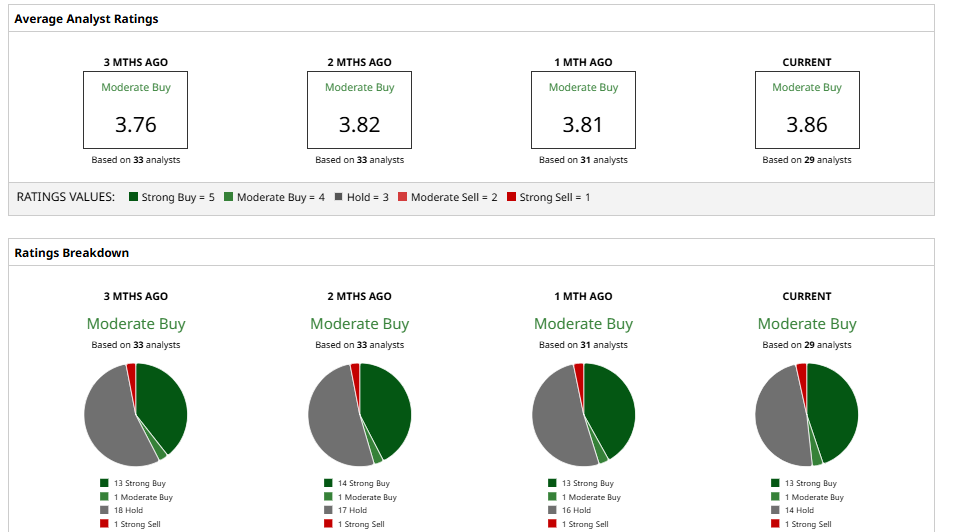

Overall, analysts rate QCOM as a consensus “Moderate Buy,” noting catalysts in the 5G and automotive sectors. The average 12-month price target of $191.09 implies an expected 16% upside potential over current levels.

So, for dividend investors, Qualcomm’s 2% yield may seem modest, but the combination of high dividend growth, low payout ratio, and massive free cash suggests the yield can grow meaningfully over time. As Wolfe points out, Qualcomm’s strong cash position “anchors” its dividend policy, so shareholders can expect regular hikes.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart