In a tech world where artificial intelligence (AI) has become the ultimate growth frontier, Amazon (AMZN) might be making one of its most audacious strategic moves yet. News is swirling that the e-commerce and cloud giant is in early talks to invest around $10 billion in OpenAI, the maker of ChatGPT and one of the industry’s most influential AI innovators. This deal could value OpenAI at over $500 billion and further cement AI’s role in reshaping global markets. Also, there is an agreement for OpenAI to use Amazon’s custom AI chips.

Meanwhile, Amazon has already invested at least $8 billion in OpenAI rival Anthropic and appears eager to deepen its exposure to generative AI.

The talks underscore the growing importance of AI infrastructure. Amazon Web Services (AWS) has developed its own AI chips for years, including Inferentia and the latest Trainium, aimed at meeting surging compute demand. On the other hand, OpenAI has made over $1.4 trillion in infrastructure commitments recently, partnering with chipmakers like Advanced Micro Devices (AMD) and Broadcom (AVGO), and signing its first AWS contract last month for $38 billion in cloud capacity.

This move could redefine Amazon’s competitive posture in the cloud wars, supercharge demand for its custom AI infrastructure, and reshape expectations for future earnings.

About Amazon Stock

Amazon.com is a global technology and e-commerce behemoth, headquartered in Seattle, Washington. Today, the company operates across a dazzling range of businesses, cloud services via AWS, digital streaming, subscription services, advertising, physical retail, consumer electronics, and more. Its diversified growth model has placed it among the world’s most valuable public companies, with a market cap of $2.4 trillion, and it has a secure position in the Magnificent Seven (MAGS).

Amazon’s stock has experienced a relatively muted performance compared with the broader market and many of its big-tech peers. Over the past 52 weeks, AMZN is up 1.82%, and year-to-date (YTD) it delivered 3.6% returns, reflecting its relatively weak performance compared with double-digit gains of the S&P 500 Index ($SPX).

Amazon’s stock underperformed in 2025 amid heightened investor concerns over its competitive position in the AI race and a perceived slowdown in the growth rate of its highly focused AWS division relative to rivals.

Specifically, while AWS continued to grow and secure large deals, its revenue growth rate was slower than that of competitors like Microsoft Azure and Google Cloud, leading some investors to fear Amazon was falling behind in the critical AI infrastructure push. These anxieties were compounded by the substantial capital expenditures and heavy spending Amazon committed to building out its AI infrastructure and data center capacity, which raised questions about near-term profit margins without immediately translating into faster revenue growth.

AMZN currently trades at a premium compared to the sector median but below its own historical average at 31.7 times forward earnings.

Q3 Results Beat Expectations

Amazon released its third-quarter 2025 earnings on Oct. 30, reporting results for the period ended Sept. 30. In the quarter, the company delivered net sales of $180.2 billion, up about 13% year-over-year (YOY), above analyst expectations. The company’s North America segment grew 11% YOY to $106.3 billion, while International sales rose 14% to $40.9 billion.

AWS continued to reaccelerate, growing 20% YOY to $33 billion, its fastest growth pace in several quarters and driven in part by strong demand for cloud and AI infrastructure.

On the profitability front, net income jumped to $21.2 billion, or $1.95 per share, up significantly from $15.3 billion, or $1.43 per share, in Q3 2024 and above the consensus estimate. Operating income remained flat at around $17.4 billion compared with the year-ago quarter. However, free cash flow decreased to $14.8 billion for the trailing twelve months, largely due to a substantial increase in capital expenditures tied to data center and infrastructure build-out.

For the important fourth quarter of 2025, Amazon guided net sales in a range of about $206 billion to $213 billion, implying 10% to 13% YOY growth versus Q4 2024, and projected operating income between roughly $21 billion and $26 billion, compared with $21.2 billion in Q4 2024. This guidance suggested continued expansion into the holiday season, albeit at a growth pace that is not spectacular relative to past periods.

What Do Analysts Expect for Amazon Stock?

Analysts remain upbeat, projecting EPS of $7.17 for fiscal 2025, up 30% YOY, and anticipating a further 9.5% annual increase to $7.85 in fiscal 2026.

This month, BMO Capital Markets raised its price target on Amazon to $304 from $300 while reiterating an “Outperform” rating, citing accelerating cloud commitments and strengthening demand trends at AWS. BMO also reaffirmed Amazon as a Top Pick, highlighting improving cloud momentum and longer-term enterprise AI adoption.

Also, TD Cowen reiterated its “Buy” rating and $300 price target on Amazon following the company’s AWS re:Invent conference, citing strong product momentum and long-term AI upside. The firm highlighted major announcements, including new Nova generative AI models, custom Trainium 3 UltraServers, and expanded agentic AI capabilities via AgentCore and QuickSuite. Updates on Zoox autonomous ride-sharing, which runs on AWS infrastructure, further reinforced confidence in Amazon’s AI ecosystem.

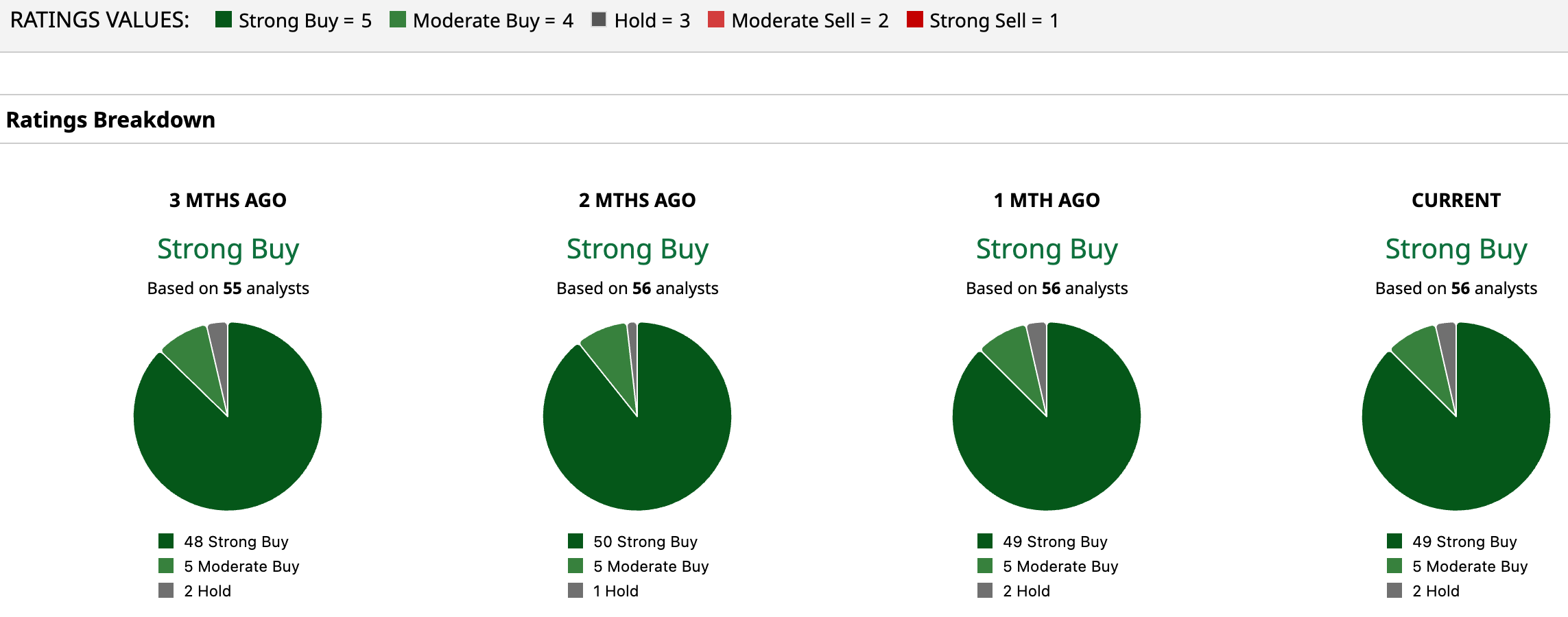

Wall Street is majorly bullish on AMZN. Overall, AMZN has a consensus “Strong Buy” rating. Of the 56 analysts covering the stock, 49 advise a “Strong Buy,” five suggest a “Moderate Buy,” and two analysts recommend a “Hold” rating.

The average analyst price target for AMZN is $295.80, indicating a potential upside of 29.8%. The Street-high target price of $360 suggests that the stock could rally as much as 58.4%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Amazon Could Invest $10 Billion in OpenAI. Should You Invest in AMZN Stock First?

- Holiday Trading, Inflation Data and Other Key Things to Watch this Week

- Analysts Are Hot on the Foldable iPhone. Should You Buy AAPL Stock Before Apple’s Next Big Product Launch?

- 25 Reasons to Buy Joby Aviation Stock for 2026