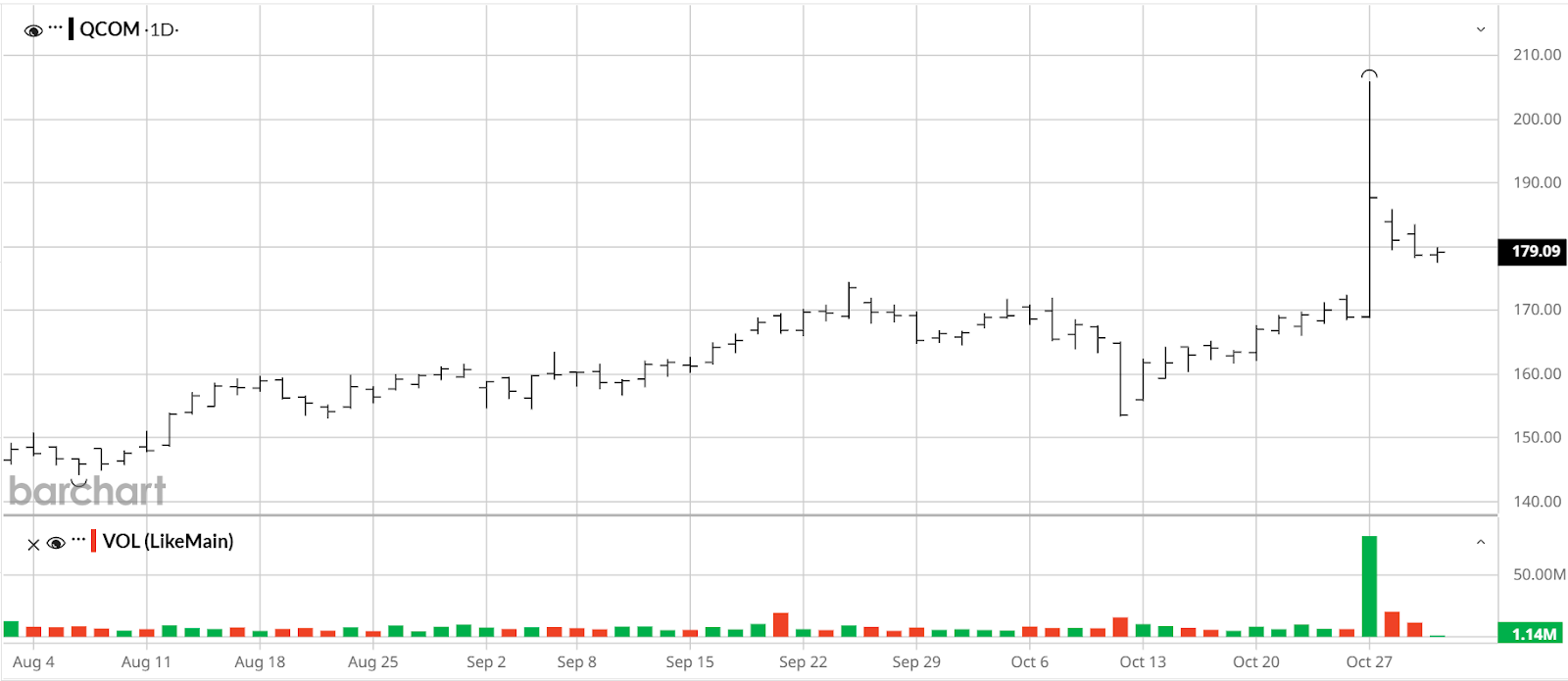

Qualcomm (QCOM) enters the final stretch of 2025 on strong footing. The stock is up roughly 18% year to date, giving the company a market capitalization of about $191 billion. While the upcoming Nov. 5 earnings report will offer the latest read on fundamentals, the larger story is Qualcomm’s ongoing pivot toward artificial intelligence, an evolution that’s quietly redefining its role in the semiconductor landscape.

From Mobile Powerhouse to AI Innovator

Qualcomm’s recent unveiling of the AI200 and AI250 accelerator systems marks a decisive step beyond mobile and into the broader AI computing race, one that finally puts Qualcomm in direct competition with Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) for the future of inference workloads.

Qualcomm’s AI accelerators are designed to prioritize inference over training, betting that the true scale of AI won’t come from model development, but from deployment, when billions of devices, cars, and applications start running AI locally. It’s a space where Qualcomm’s deep experience in low-power, high-efficiency design gives it a natural edge.

Both chips — the AI200 shipping in 2026 and the AI250 in 2027 — push that idea forward. They support up to 768 GB of memory per card and feature near-memory computing architectures that enable tenfold increases in bandwidth while cutting energy consumption. The result is a chip built for scale, one that enterprises can deploy at lower cost and with less power than traditional GPUs. It’s a logical extension of Qualcomm’s leadership in mobile and edge computing, and an entirely new frontier for the company. Early adopters, like Saudi Arabia’s Humain AI, have already committed to large-scale deployment, a promising validation for a business line that could eventually add billions in revenue.

In essence, Qualcomm is building a bridge, connecting its dominance at the edge to a larger presence in enterprise AI. The company’s heritage in system-on-chip (SoC) integration and power efficiency positions it uniquely for this transition. As the AI ecosystem matures, inference computing is expected to dwarf training in total demand and Qualcomm’s ability to deliver cost-efficient, high-performance inference may become a defining advantage. If Nvidia powers the data center’s brain, Qualcomm aims to energize its senses, extending AI from the cloud to every connected device and network node.

Strong Financial Base Fuels AI Ambitions

With Qualcomm’s next earnings report due on Nov. 5, expectations are cautiously optimistic. Wall Street is looking for the company to deliver roughly $2.86 in non-GAAP EPS on about $10.77 billion in revenue, which sits near the midpoint of Qualcomm’s official guidance range of $2.75-$2.95 EPS on $10.3 billion to $11.1 billion in revenue. Those figures imply solid year-over-year growth, with investors watching closely to see if Qualcomm can extend its streak of quarterly beats and keep momentum in its AI, automotive, and IoT segments heading into 2026.

Under the surface, the revenue mix continues to evolve. The IoT and automotive businesses are approaching a combined contribution that could soon rival Apple’s modem revenue. These verticals, tied directly to Qualcomm’s AI-enabled hardware strategy, have become the clearest indicators of diversification progress.

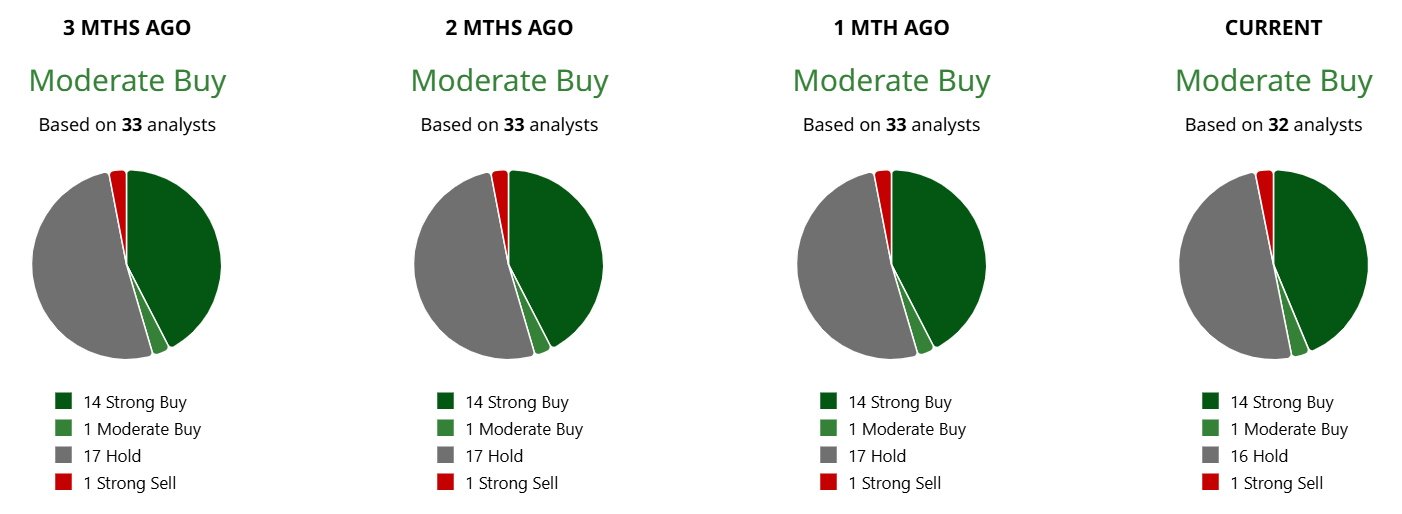

From a valuation standpoint, Qualcomm remains discounted relative to peers even after the rally observed in October. The company trades at about 18x GAAP trailing earnings, well below the semiconductor sector median of roughly 32x. On a price-sales basis, it sits at 4.6x versus a 3.6x sector median, and at 7.4x book value compared with 4x for peers. The latter metrics reflect the premium investors continue to assign to Qualcomm’s IP portfolio and balance-sheet strength. Among 32 analysts, sentiment remains evenly split between bullish and neutral: 15 “buy,” and 16 “hold,” with an average price target of roughly $182 per share.

Takeaways

Qualcomm’s transformation is no longer subtle, it’s structural. What began as gradual diversification beyond smartphones has evolved into a full-scale repositioning at the intersection of edge computing and artificial intelligence. The launch of the AI200 and AI250 systems cements that direction, giving Qualcomm a credible foothold in AI acceleration without abandoning its core advantage in efficiency and integration.

The market is beginning to take notice. At roughly 18x earnings, Qualcomm is still priced as a steady incumbent rather than an emerging AI leader. That perception could change quickly as its diversification story gains traction.

Assuming the Nov. 5 report doesn’t contain any major surprises, Qualcomm’s valuation could begin closing the gap with peers like Nvidia, AMD, and Broadcom. In a market where investors pay a premium for credible AI exposure, Qualcomm finally has both the narrative and the numbers to earn one.

On the date of publication, Andrew Prochnow did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Pair of New 2X ETFs Goes Double or Nothing on Big Tech. Should You Chase the Volatility in Apple, Nvidia, and Microsoft Now?

- Analysts Say You Should Ignore ‘Short-Term Blips’ and Keep Buying Microsoft Stock

- This Penny Stock Just Reported a 1,000% Increase in Revenue. Should You Buy It Here?

- Netflix Just Announced a 10-for-1 Stock Split. Should You Buy NFLX Stock Here?