Even though Columbia Financial (currently trading at $15.39 per share) has gained 12.7% over the last six months, it has lagged the S&P 500’s 24.4% return during that period. This might have investors contemplating their next move.

Is now the time to buy Columbia Financial, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Columbia Financial Not Exciting?

We don't have much confidence in Columbia Financial. Here are three reasons there are better opportunities than CLBK and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

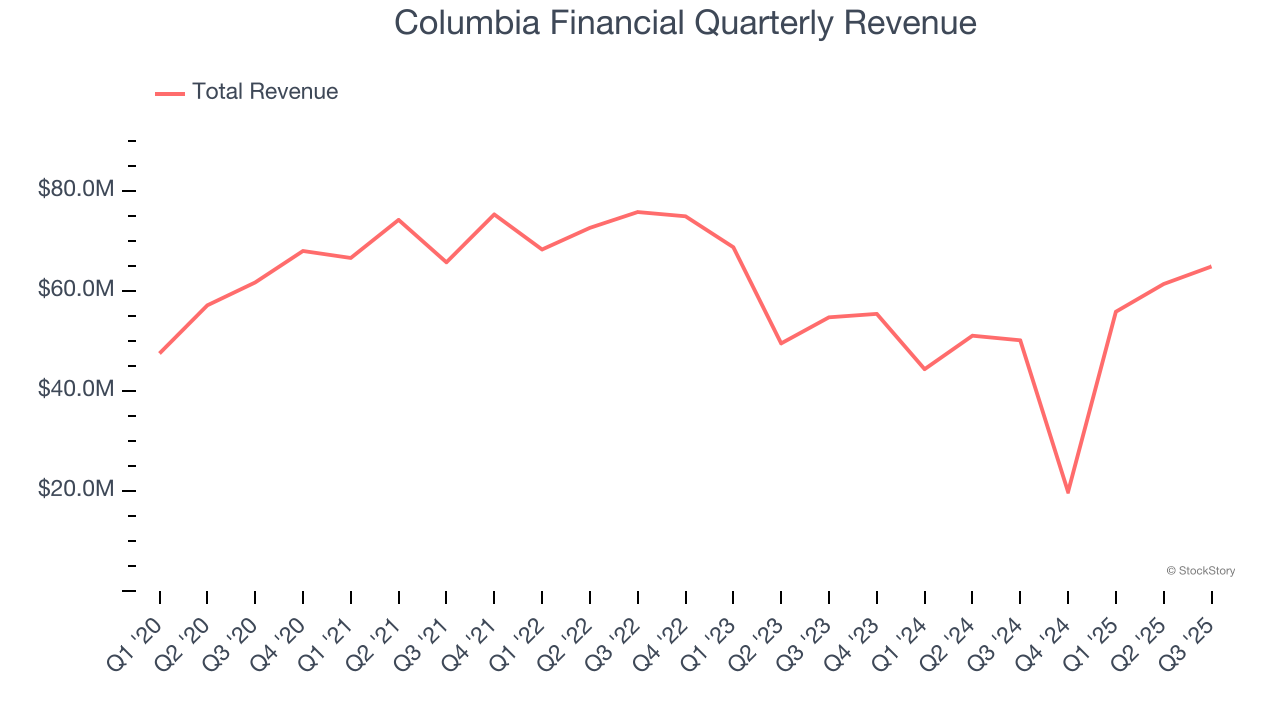

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Unfortunately, Columbia Financial’s 1.8% annualized revenue growth over the last five years was tepid. This fell short of our benchmarks.

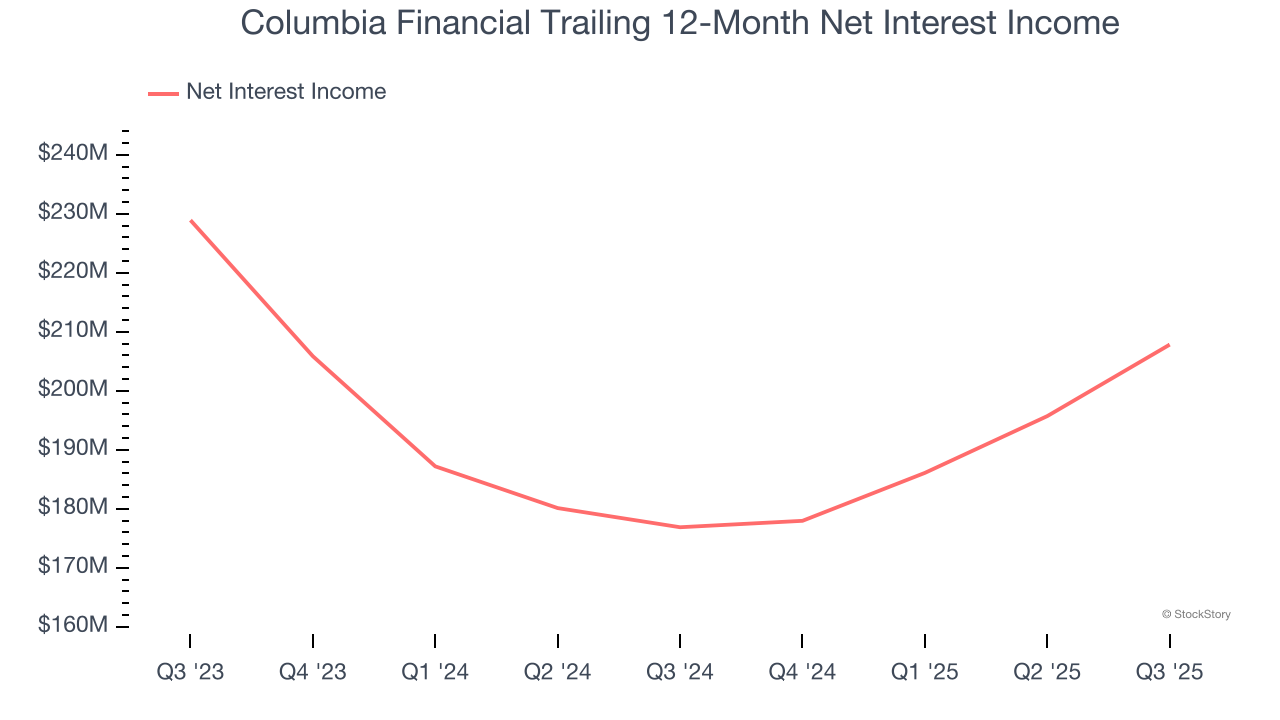

2. Net Interest Income Hits a Plateau

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Columbia Financial’s net interest income was flat over the last five years, much worse than the broader banking industry. This shows that lending underperformed its other business lines.

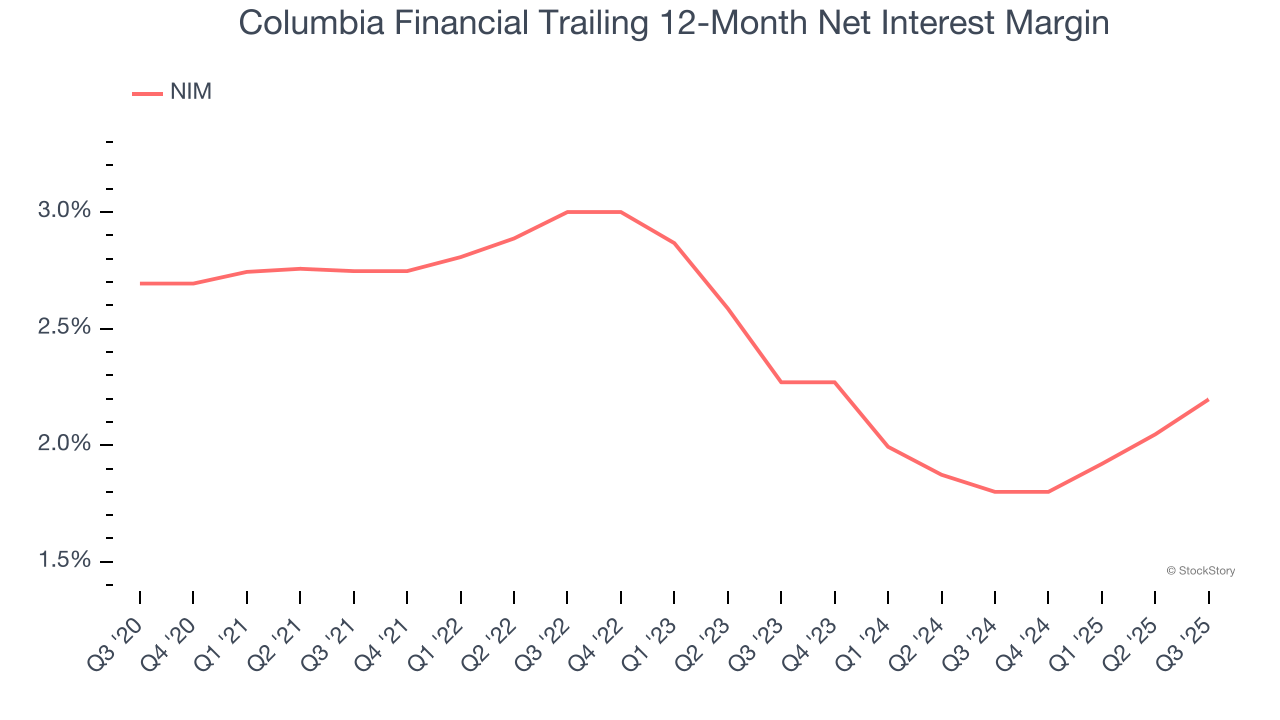

3. Low Net Interest Margin Reveals Weak Loan Book Profitability

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that Columbia Financial’s net interest margin averaged a poor 2%, indicating the company has weak loan book economics.

Final Judgment

Columbia Financial isn’t a terrible business, but it doesn’t pass our bar. With its shares trailing the market in recent months, the stock trades at 1.4× forward P/B (or $15.39 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Columbia Financial

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.