Over the past six months, Stock Yards Bank’s shares (currently trading at $66.08) have posted a disappointing 10.8% loss, well below the S&P 500’s 14.1% gain. This might have investors contemplating their next move.

Following the pullback, is this a buying opportunity for SYBT? Find out in our full research report, it’s free for active Edge members.

Why Does Stock Yards Bank Spark Debate?

Founded in 1904 in Louisville and named after the city's historic livestock market district, Stock Yards Bancorp (NASDAQ: SYBT) operates a regional bank providing commercial banking, wealth management, and trust services across Kentucky, Indiana, and Ohio.

Two Positive Attributes:

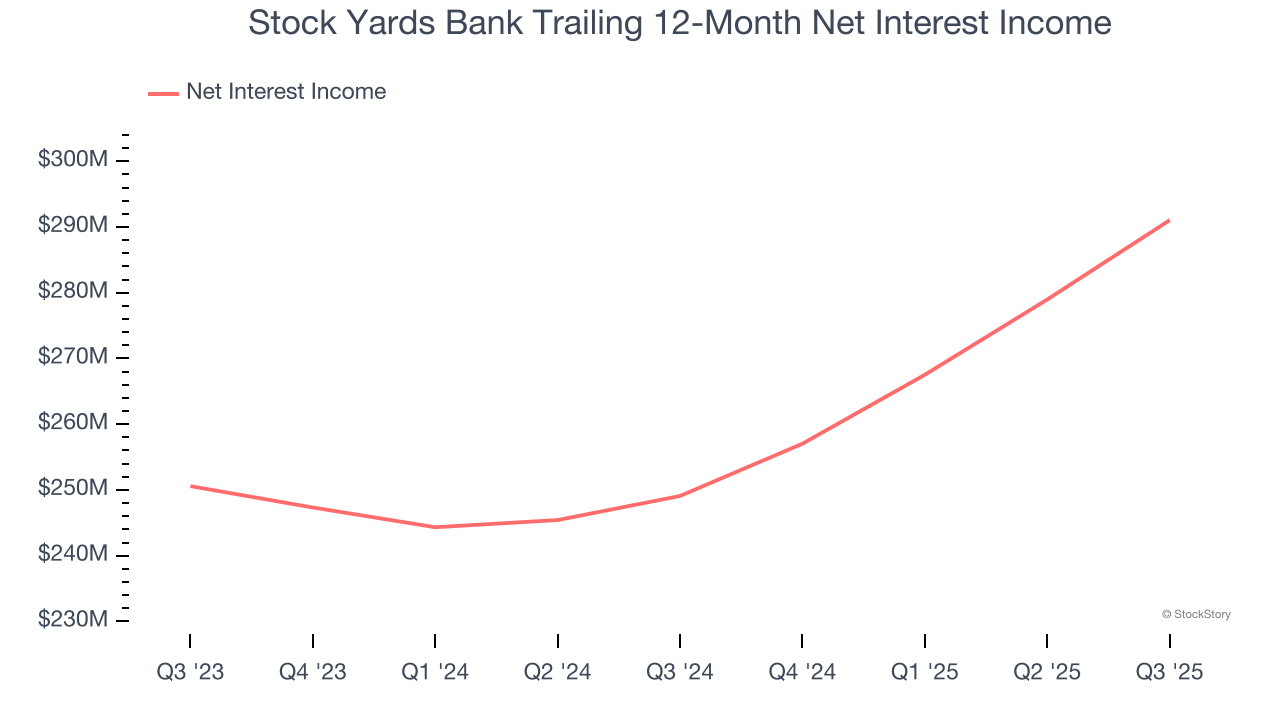

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Stock Yards Bank’s net interest income has grown at a 17.1% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

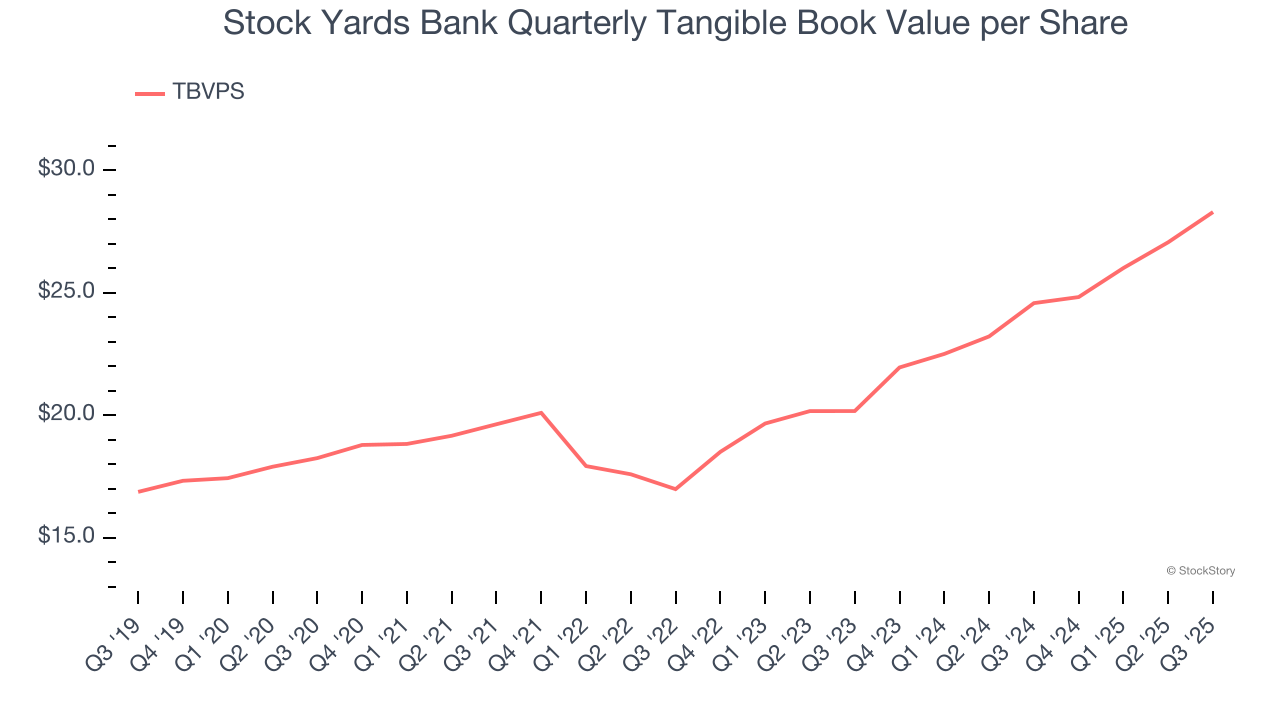

2. Growing TBVPS Reflects Strong Asset Base

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Stock Yards Bank’s TBVPS increased by 9.2% annually over the last five years, and growth has recently accelerated as TBVPS grew at an exceptional 18.5% annual clip over the past two years (from $20.17 to $28.30 per share).

One Reason to be Careful:

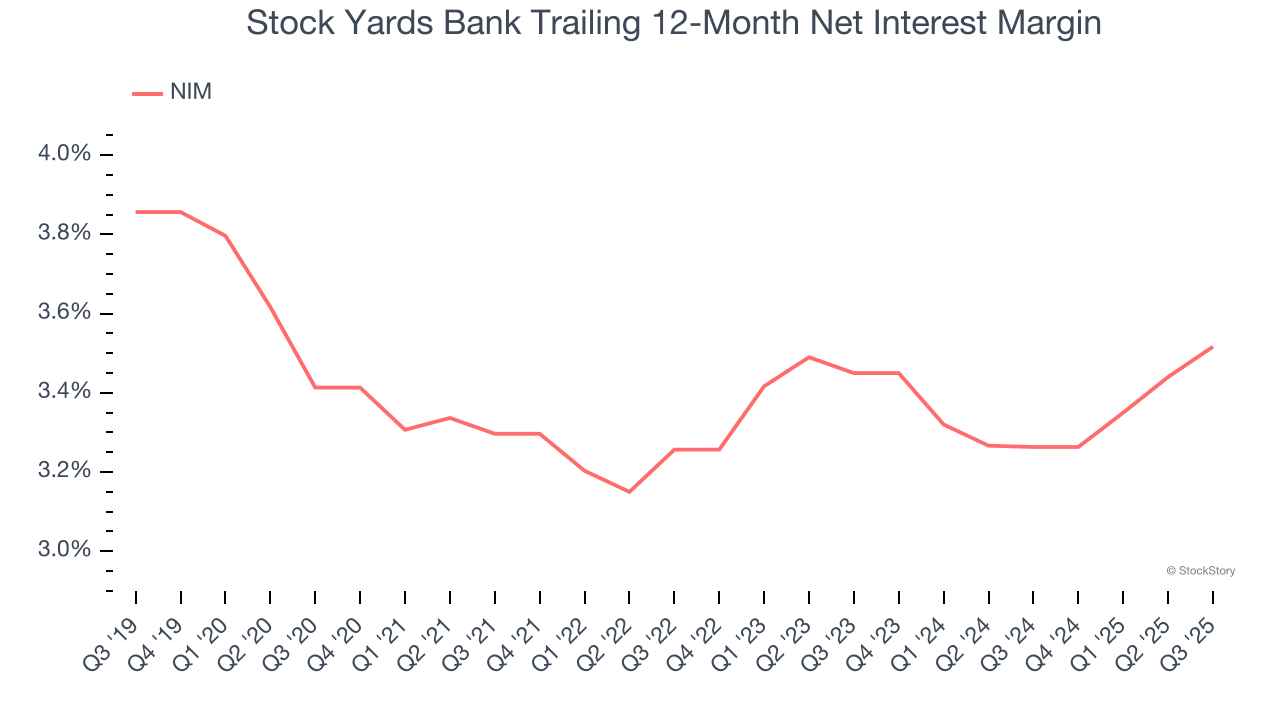

Low Net Interest Margin Hinders Flexibility

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that Stock Yards Bank’s net interest margin averaged a subpar 3.4%, meaning it must compensate for lower profitability through increased loan originations.

Final Judgment

Stock Yards Bank’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 1.8× forward P/B (or $66.08 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Stock Yards Bank

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.