Over the last six months, Pinterest’s shares have sunk to $26.96, producing a disappointing 18.6% loss - a stark contrast to the S&P 500’s 14.1% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy PINS? Find out in our full research report, it’s free for active Edge members.

Why Is Pinterest a Good Business?

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

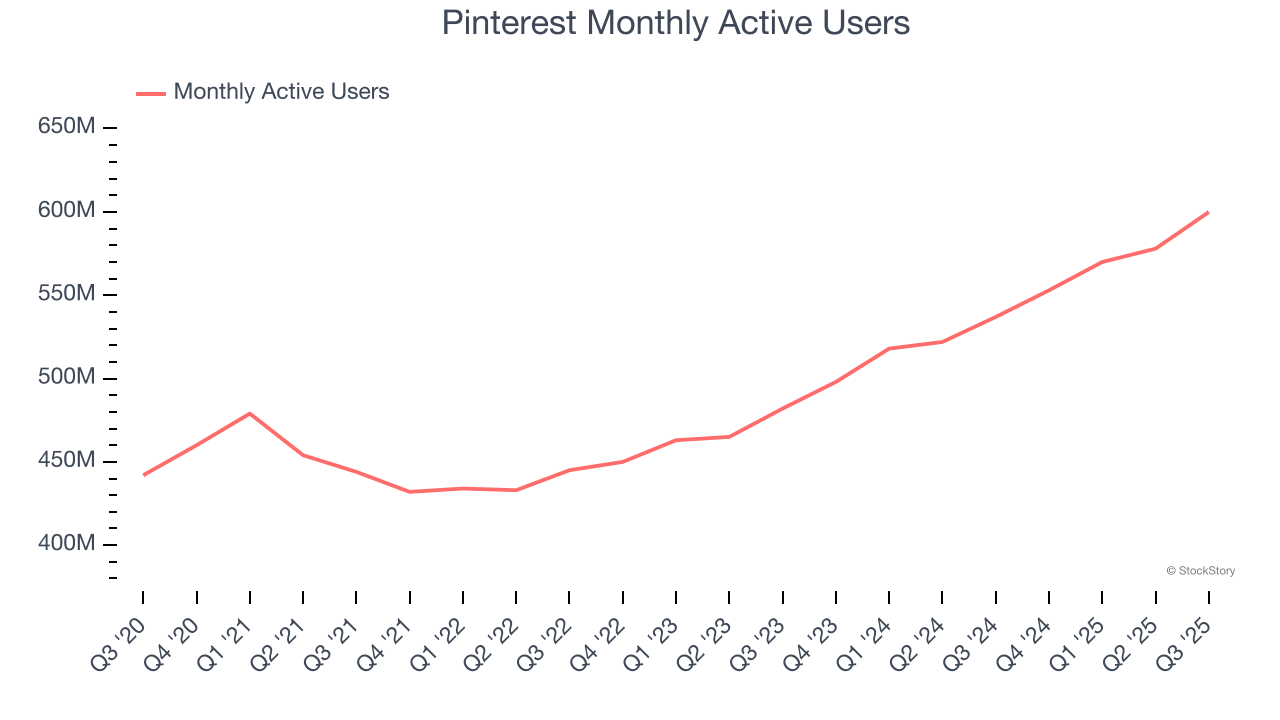

1. Monthly Active Users Skyrocket, Fueling Growth Opportunities

As a social network, Pinterest generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Pinterest’s monthly active users, a key performance metric for the company, increased by 11.2% annually to 600 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

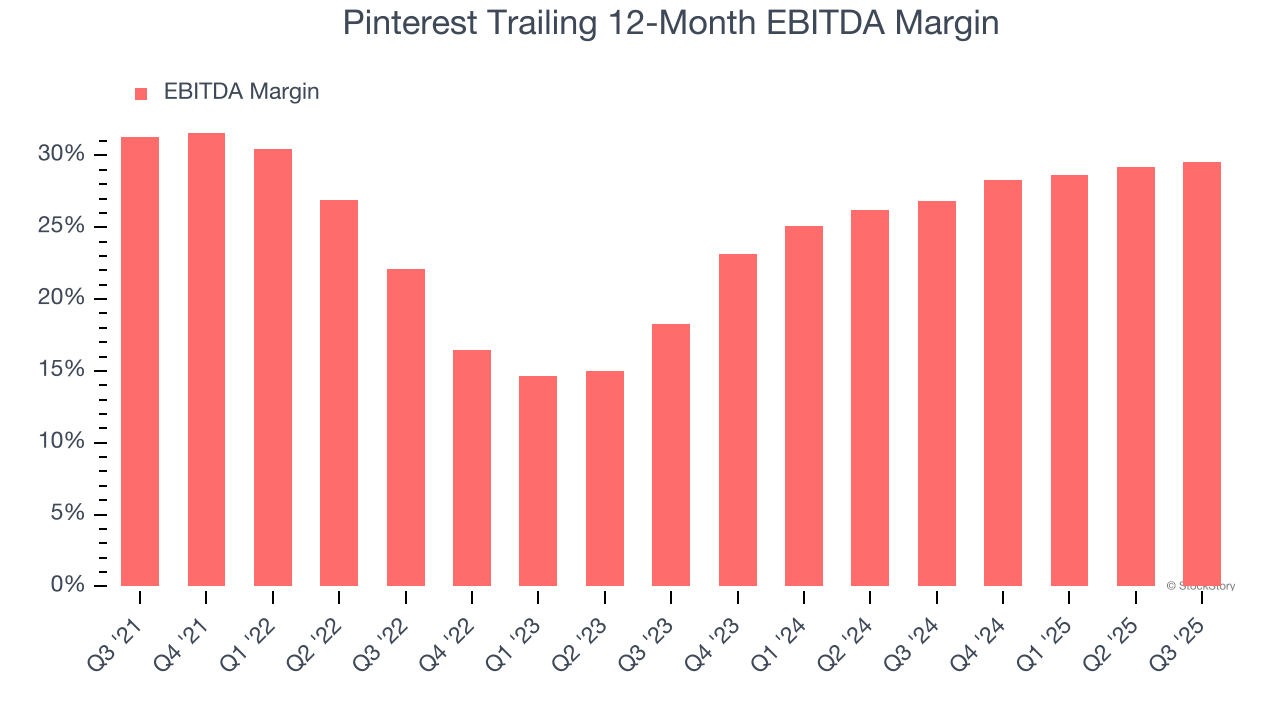

2. EBITDA Margin Reveals a Well-Run Organization

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Pinterest has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 28.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

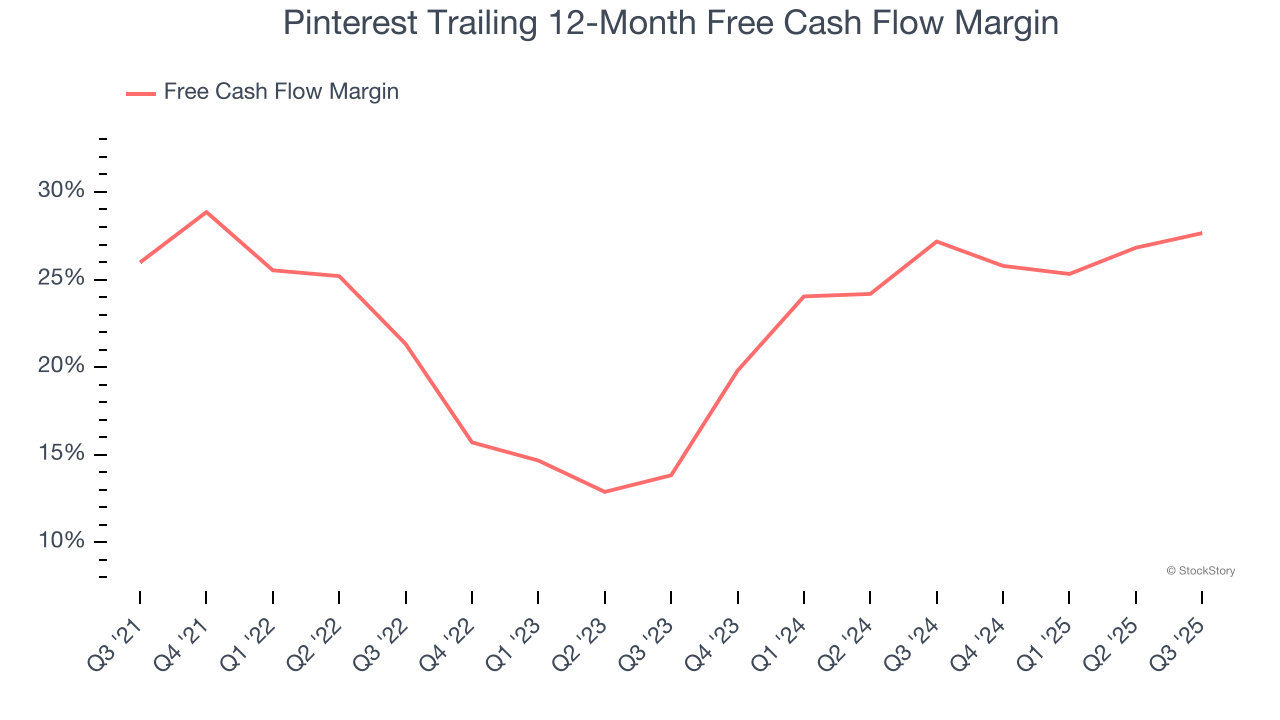

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Pinterest has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 27.4% over the last two years.

Final Judgment

These are just a few reasons Pinterest is a rock-solid business worth owning. With the recent decline, the stock trades at 13.4× forward EV/EBITDA (or $26.96 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.