Over the past six months, HNI’s shares (currently trading at $41.88) have posted a disappointing 11.4% loss, well below the S&P 500’s 14.1% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy HNI? Find out in our full research report, it’s free for active Edge members.

Why Do Investors Watch HNI?

With roots dating back to 1944 and a significant acquisition of Kimball International in 2023, HNI (NYSE: HNI) manufactures and sells office furniture systems, seating, and storage solutions, as well as residential fireplaces and heating products.

Three Positive Attributes:

1. Operating Margin Rising, Profits Up

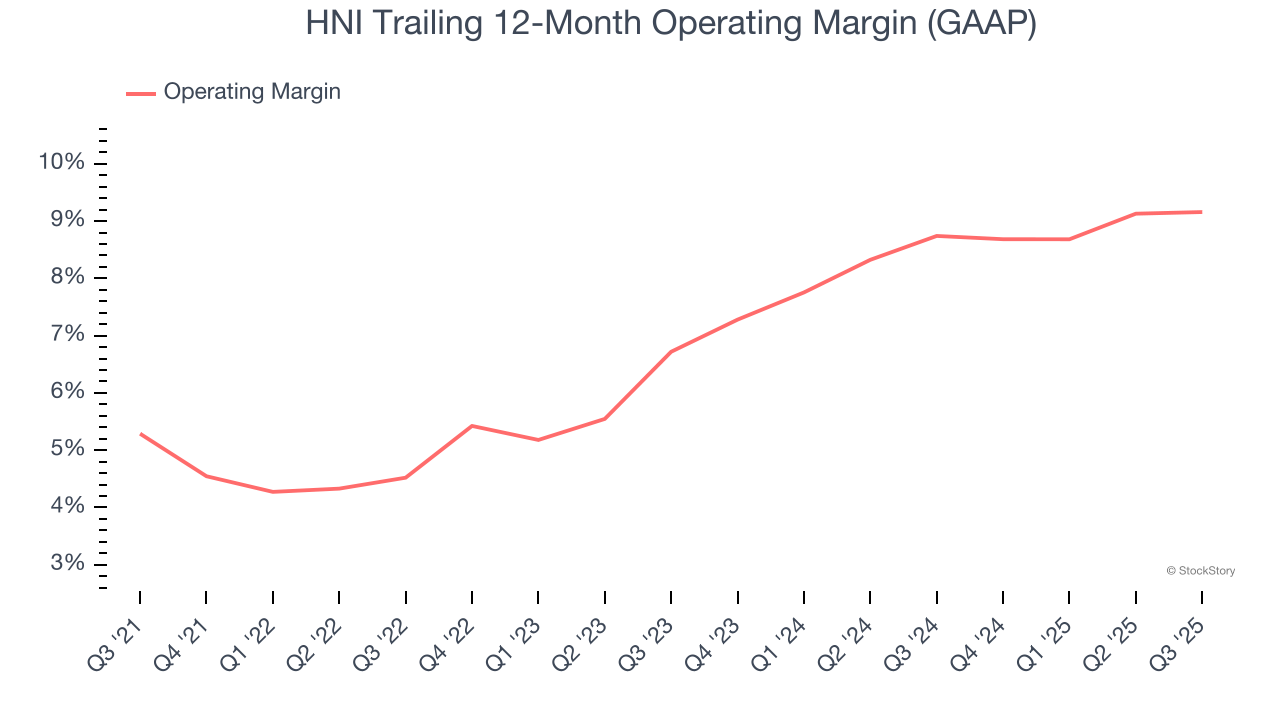

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

HNI’s operating margin rose by 3.9 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 9.2%.

2. EPS Increasing Steadily

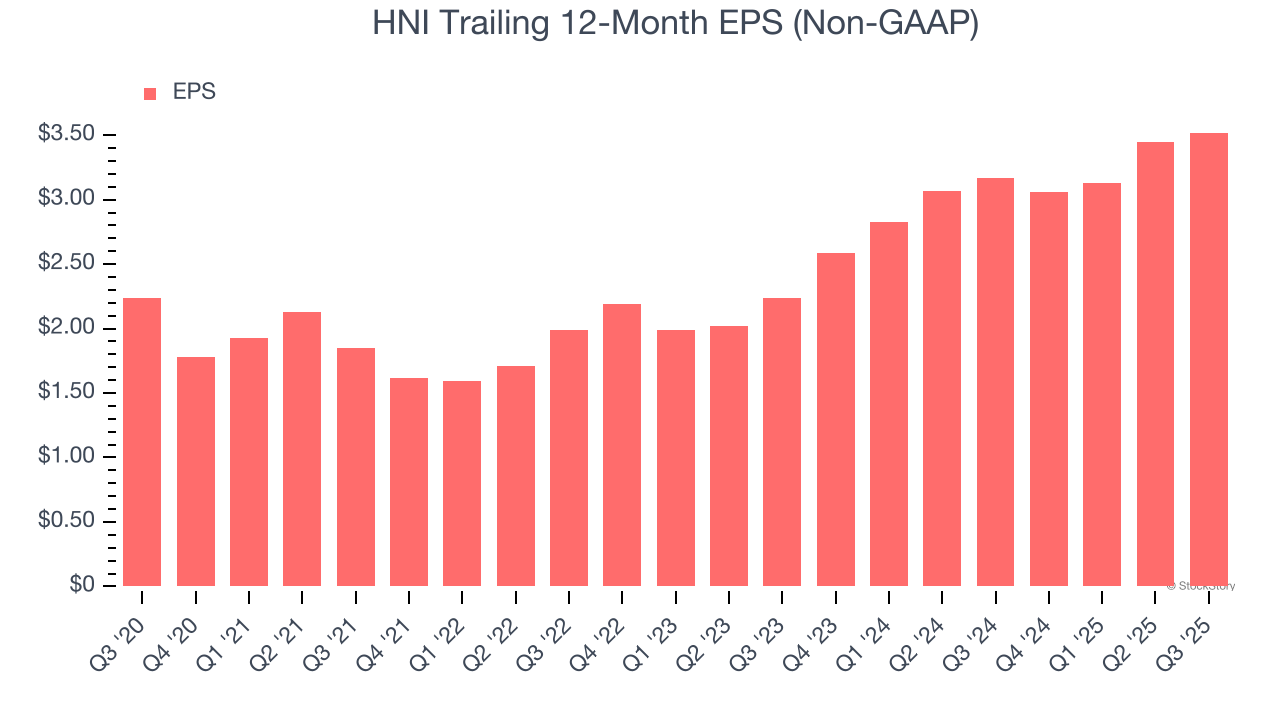

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

HNI’s EPS grew at a solid 9.5% compounded annual growth rate over the last five years, higher than its 5.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. New Investments Bear Fruit as ROIC Jumps

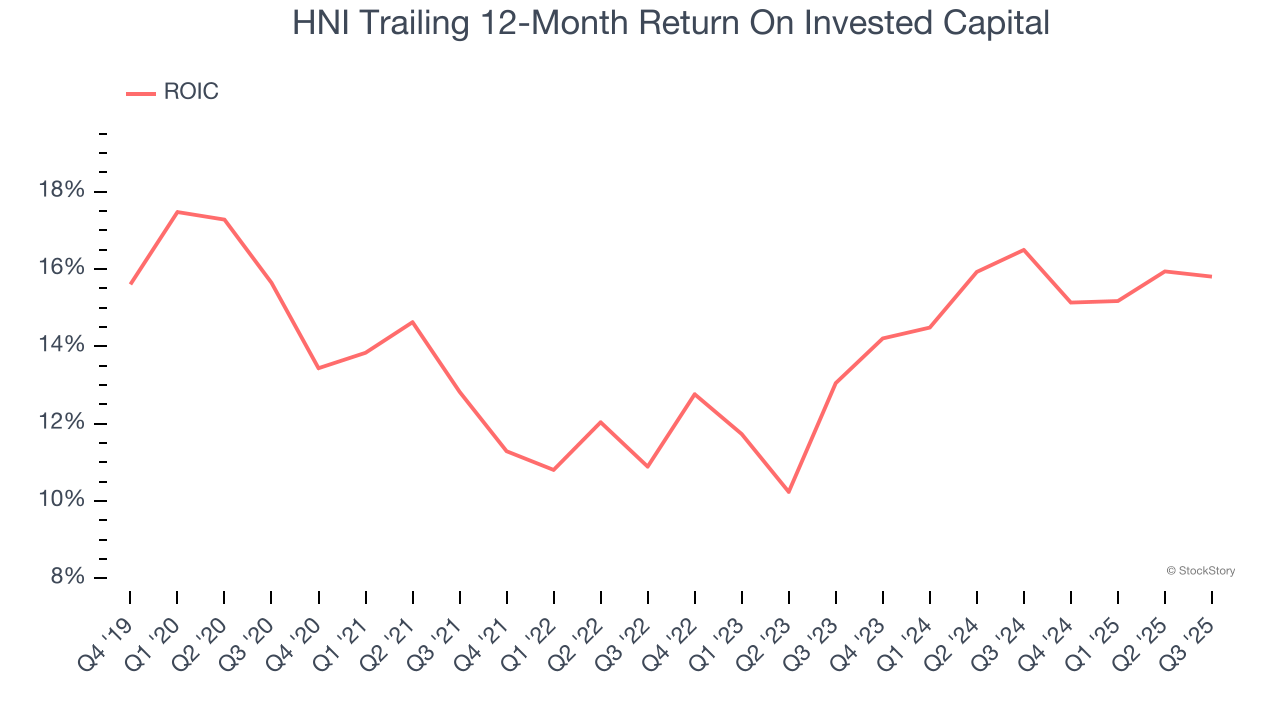

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, HNI’s ROIC increased by 4.3 percentage points annually over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

There are definitely things to like about HNI. After the recent drawdown, the stock trades at 10.8× forward P/E (or $41.88 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than HNI

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.